DeFi Rate - This Week In DeFi – June 30

This Week In DeFi – June 30This week, TUSD briefly loses its peg, Maple Finance launches a direct lending arm, ZKSync developers launch the ZK Stack, and dYdX announces a date for its Cosmos testnet.To the DeFi Community, This week, stablecoin TrueUSD (TUSD) had a small de-pegging incident this week, as its price dropped to as low as 80 cents per token on Binance.US. The extent of the drop was not replicated across other exchanges, however, indicating that the problem may have been somewhat isolated to just the singular market. The volatility followed shortly after reports that the project held a very small portion ($26,000) of its reserve assets at Prime Trust, a bank ordered to shut off all deposits and withdrawals. Skepticism has arisen around TUSD after it paused minting of its token earlier this month, as well as the recent revelation that its attestation reports come from the same auditors that worked for the now-defunct exchange giant, FTX. Rather than acknowledge the price discrepancy, the official TrueUSD Twtitter account interestingly chose to celebrate the increase in trading volume: https://twitter.com/tusdio/status/1673896178071601152 Lending protocol Maple Finance has launched a new direct-lending arm, called Maple Direct. The service aims to fill the gap in the market left by the collapse of Celsius, BlockFi and Genesis, focusing on bespoke deals to Web3-native entities. The company believes that it has an advantage in the fact that traditional lenders do not have the expertise to underwrite within the sector. Maple Direct will start to offer its first lending product in July, with all lenders required to pass KYC verification. https://twitter.com/maplefinance/status/1674049021810229256 Layer-2 platform ZKSync has launched the ZK Stack, a customizable tech stack for creating ZK-powered scaling networks on Ethereum. The open-source framework will be free to use, with each chain being composable via native bridges – designed to function together as a “trustless network with low latency and shared liquidity.” The stack appears to be ZKSync’s response to the highly-popular OP Stack from Optimism, which uses optimistic fraud proofs rather than zero-knowledge validity proofs. ZKSync Era has become the space’s third-largest Layer-2, crossing $600 million in total value locked (TVL) this week. https://twitter.com/zksync/status/1673317167628967936

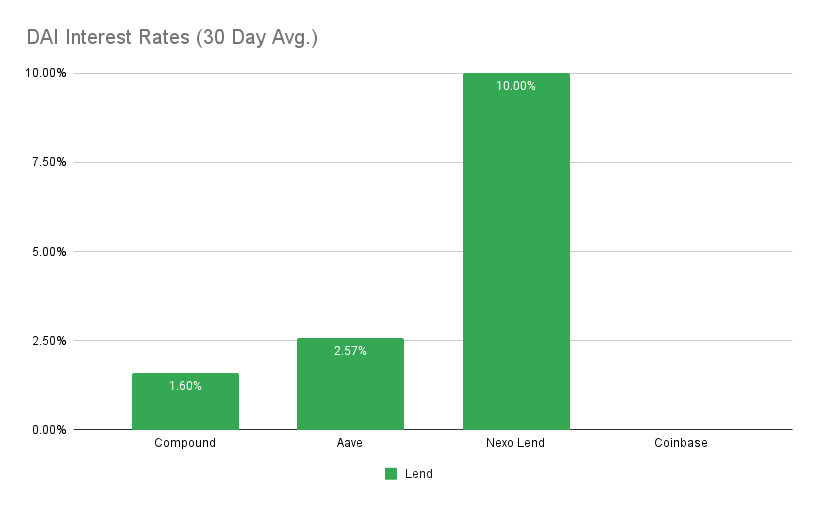

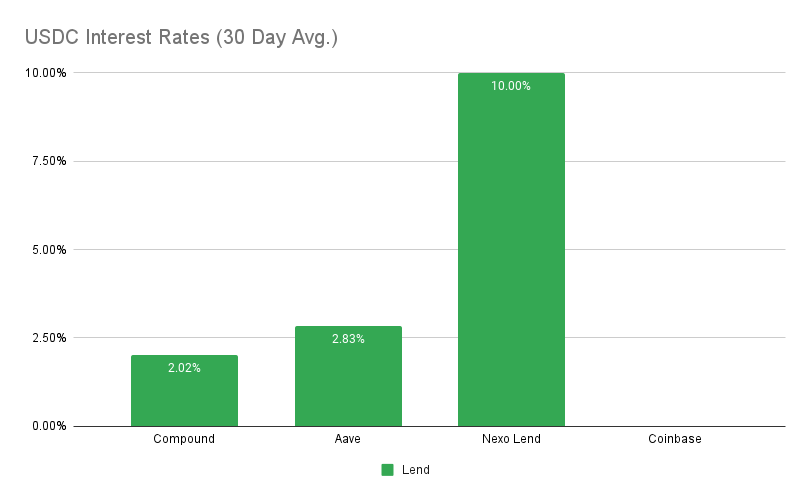

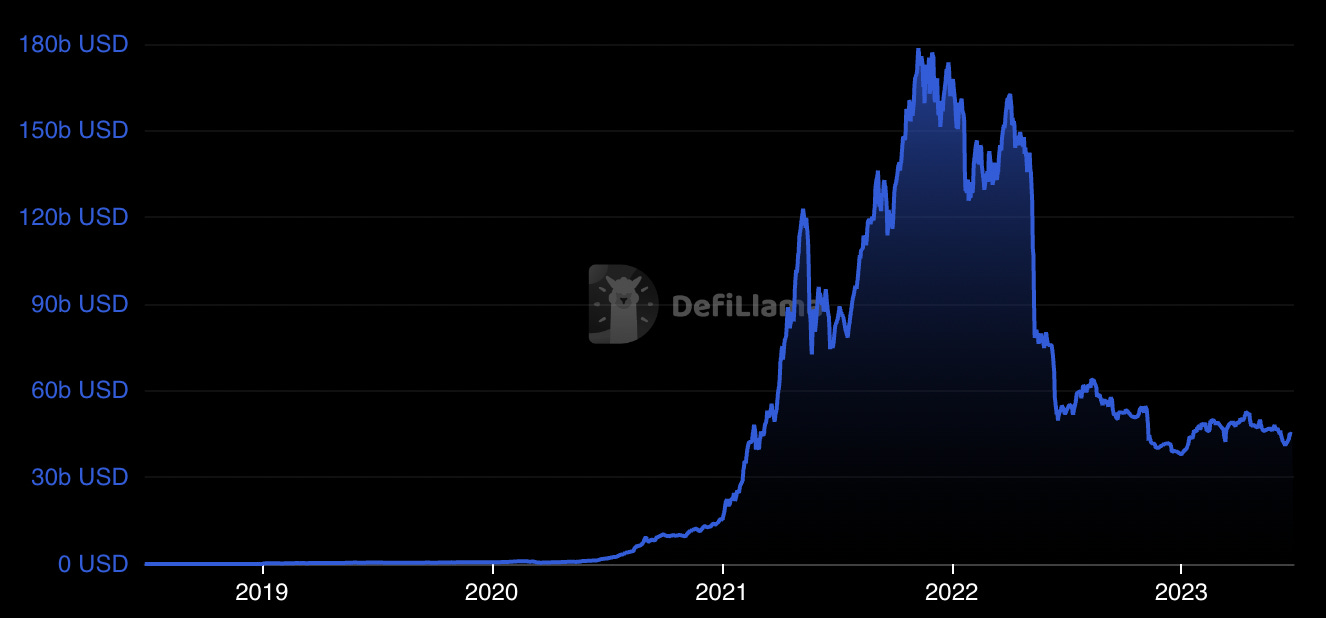

Decentralized futures exchange dYdX has announced that it will launch the public testnet of its Cosmos-based chain on July 5 – reportedly ahead of schedule. The testnet will have 40 or more validators running the project’s software, and will test functions such as connecting wallets, viewing the order books, placing orders and viewing account information. Only Bitcoin and Ethereum markets will be available at launch, however 30+ markets are expected to be added via future upgrades. dYdX is targeting a mainnet launch for the chain in September of this year, as part of its “Milestone 5” for the project. https://twitter.com/dYdX/status/1674124130462109699?t=h8ct6PeStyP_r78q50SXzg&s=19 Once again we have observed new stablecoin drama this week, as trust in TrueUSD (TUSDT) wavers. Coincidentally, the stablecoin has recently been thrown into the limelight by Binance, being part of multiple promotions and new trading pairs. With a market cap of just $3 billion, TUSD does not appear to be a major threat to the ecosystem regardless of what happens to it – however the activity currently surrounding it should be observed. Governments around the world have also made headlines in crypto this week, as the UK passes a bill giving regulators to oversee crypto and stablecoins. Regulators in the UK will now be able to introduce and enforce rules in the sector more easily. The EU has settled on new rules for their “Data Act,” that may rattle the Web3 community once finally passed. The rules, which are not to be confused with the controversial MiCA framework, may drastically affect smart contracts due to a “kill switch” requirement. Finally, over in the United States, the CFTC tech advisory board will convene to discuss DeFi, DAOs and more July 18, following up on the regulator’s enforcement action against Ooki DAO. The case set a precedent that DAOs may be held liable for legal violations as a “person.” Interest RatesDAIHighest Yields: Nexo Lend at 10% APY, Aave at 2.6% APY MakerDAO Updates DAI Savings Rate: 3.49% Base Fee: 0.00% ETH Stability Fee: 3.49% WBTC Stability Fee: 5.55% USDCHighest Yields: Nexo Lend at 10% APY, Compound at 2.8% APY Top StoriesUK Crypto, Stablecoin Rules Receive Royal Assent, Passing Into LawEU’s Controversial Smart Contract Kill-Switch Rules Finalized by NegotiatorsMastercard is Piloting Tokenized Bank Deposits in New UK TestbedCFTC technology advisory board to discuss DeFi, DAOs and more at July meetingStat BoxTotal Value Locked: $44.24B (down 1.1% since last week) DeFi Market Cap: $46.28B (up 0.5%) DEX Weekly Volume: $13.12B (down 3.2%) Bonus Reads[Bradley Keoun – CoinDesk] – Syscoin Developer Launches Ethereum-Compatible Layer 2 Network Secured by Bitcoin Miners [Samuel Haig – The Defiant] – DAI’s Reliance On USDC Drops Below 10% As MakerDAO Expands Bond Holdings [James Hunt – The Block] – PayPal veterans launch SWIFT-like cross-border payments network on Sui [Jamie Crawley – CoinDesk] – Three Arrows Capital Liquidators Seek $1.3B From Bankrupt Hedge Fund's Founders: Bloomberg This Week in DeFi is free today. But if you enjoyed this post, you can tell This Week in DeFi that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

This Week In DeFi – June 23

Friday, June 23, 2023

This week, BNB Chain launches an OP-based L2, Polygon proposes transitioning from PoS to zkEVM, Ethereum looks at increasing validator ETH limits, and Curve Finance votes to add WETH as collateral.

This Week In DeFi – June 16

Tuesday, June 20, 2023

This week, Tether encounters a mild de-pegging situation, Uniswap teases v4, Frax announces its own Layer-2 and a large CRV-collateralized loan scares the market.

This Week In DeFi – June 9

Monday, June 12, 2023

This week, the SEC takes action against Coinbase's staking service, Curve adds stETH as collateral for crvUSD, ENS announces .box domains, and Atomic Wallet is hacked for $35M+.

This Week In DeFi – June 1

Friday, June 2, 2023

This week, MakerDAO looks to raise the DSR to 3.3%, the Tornado Cash hacker returns control of the protocol, Magic raises $52M for its wallet infrastructure and Multichain's CEO goes missing 👀

This Week In DeFi – May 26

Friday, May 26, 2023

This week, Multichain experiences unexplained disruptions, Coinbase's Base outlines its path to Mainnet, Tornado Cash governance is exploited, and tokenized securities are trending.

You Might Also Like

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Babylon Launches Airdrop Registration, Berachain Initiates Phase One of Governance, and Me…

Saturday, March 1, 2025

In the recent theft incident of Bybit, hackers laundered money by exchanging ETH for BTC through THORChain, bringing huge trading volume and fees to THORChain. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin pullback could be set up for $370k bull run price target

Friday, February 28, 2025

Bitcoin's 27% slide raises prospects for rebound, aligns with historical cycle patterns. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏