DeFi Rate - This Week In DeFi – July 7

This Week In DeFi – July 7This week, IDEX announces it's going to L2, Ethereum considers an anti-exploit standard ERC-7265, Abracadabra DAO looks at a centralized legal structure, and Balancer proposes a new staking system.To the DeFi Community, This week, IDEX, one of the original decentralized exchanges on Ethereum, has announced plans to build a Layer-2 chain based on Polygon zkEVM. The chain, dubbed Xchain, will use Polygon’s Supernets stack and aim to provide a decentralized perpetual trading platform. Supernets allow developers to build completely customized chains tailored to decentralized apps’ requirements. Immutable and Aavegotchi have both been constructed using the technology. https://twitter.com/idexio/status/1676984357326651393

Ethereum developers have proposed a new “circuit breaker” standard, that is designed to minimize hacking losses in DeFi protocols. ERC-7265 would enable developers to choose a limit on withdrawals from a protocol, which would halt token outflows if exceeded, as a security measure. If implemented, the standard has the potential to prevent the immediate draining of assets in future exploits. Smart contract auditor Enbang Wu has suggested adding a timelock function to protect users against administrators using the standard, providing a grace period to withdraw assets if the circuit breaker limit is changed. https://twitter.com/MeirBank/status/1675851684386570240 Abracadabra DAO, which governs the tokens Magic Internet Money (MIM) and Spell (SPELL), has put forward a proposal to introduce a centralized legal structure to the DAO. The move seeks to protect intellectual property rights and manage server expenses, countering the current need to rely on community members privately funding essential services. Abracadabra has emphasized that it stays committed to decentralization, and will retain governance via the DAO’s traditional voting mechanisms. https://twitter.com/TheBlock__/status/1676891108310151168

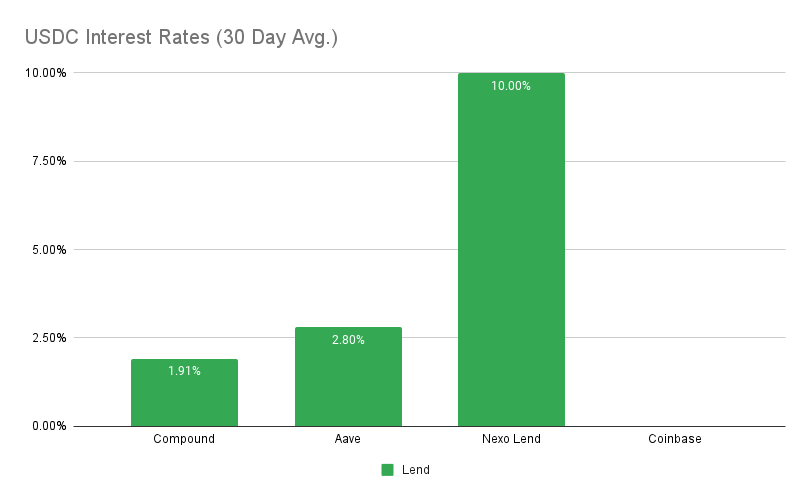

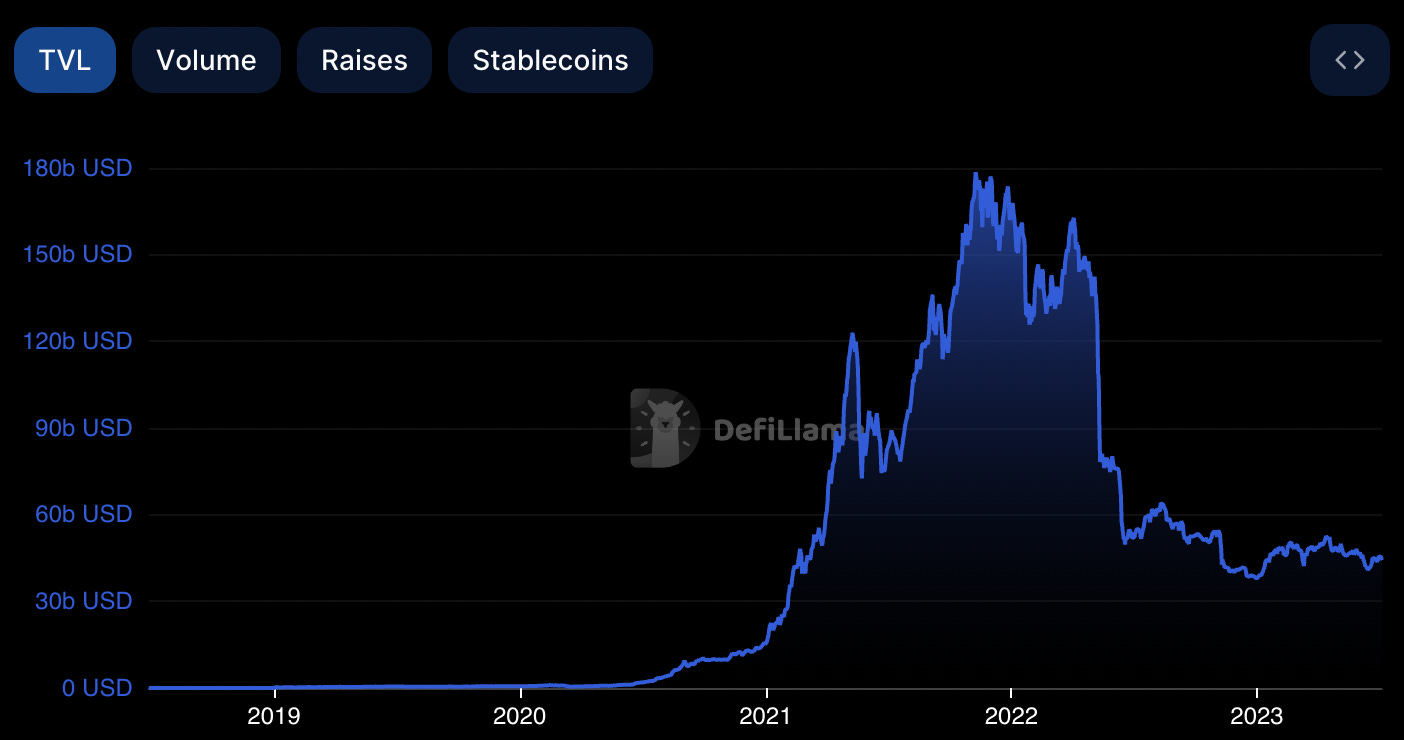

Balancer protocol has proposed a mechanism to address the lack of liquidity in DeFi, by replacing the single-asset staking model with a two-token staking system. The mechanism will allow users to participate in protocol governance while also providing liquidity to decentralized exchanges – rather than adversely affecting liquidity and slippage with single-asset staking. Dubbed the “8020 Initiative”, several protocols have joined the movement, including Radiant Capital, Alchemix, Paraswap, Y2K Finance and Oath Finance. https://twitter.com/Balancer/status/1676954525603860481 Several interesting developments and proposals have arisen in DeFi this week, as the sector continues to learn and make necessary improvements. The prospect of a circuit-breaker standard could very well save protocols from substantial losses from future hacks, if implemented correctly with ERC-7265. Balancer’s 8020 Initiative is equally exciting, with the potential to thoroughly improve the liquidity and resilience of multiple protocols, throughout the entire ecosystem. Abracadabra DAO is stepping into uncharted waters with its proposal to formulate a centralized legal component of its DAO, which will set a very interesting precedent for DAOs, depending on the result of its experiment. Could all DAOs look to form a legal focal point to interface with the CeFi world? Looking to older issues, Gemini has issued a “final offer” to Genesis, as the debtor seems to be pushing away responsibilities for its liabilities as long as possible. It is hopeful that customers are made as whole as possible from an eventual resolution. Overall, the DeFi world appears to be finding feet in terms of development and progress, despite continued stress in asset prices. The new advances will certainly add to the long-term viability of the ecosystem – now it’s just time for attention and money to come back. Interest RatesDAIHighest Yields: Nexo Lend at 10% APY, Aave at 2.3% APY MakerDAO Updates DAI Savings Rate: 3.49% Base Fee: 0.00% ETH Stability Fee: 3.49% WBTC Stability Fee: 5.55% USDCHighest Yields: Nexo Lend at 10% APY, Compound at 2.8% APY Top StoriesGemini's Cameron Winklevoss Tweets $1.5B 'Final Offer' in Debt Talks Over Crypto Firm GenesisCircle quietly launches wallet-as-a-service developer platformCompound Token Surges After CEO Steps Down And Unveils New VentureBlockFi Bankruptcy Plans Opposed by FTX, Three Arrows, and SECStat BoxTotal Value Locked: $44.25B (up 0.0% since last week) DeFi Market Cap: $48.03B (up 3.8%) DEX Weekly Volume: $14.11B (down 7.6%) Bonus Reads[Vishal Chawla – The Block] – Uniswap v4 expected to go live after Ethereum’s Cancun upgrade and security audit [Vishal Chawla – The Block] – Ethereum Layer 2 network Starknet plans 'Quantum Leap' upgrade on July 13 [Owen Fernau – The Defiant] – Pendle Attracts Over $125M In TVL With ‘Discounted Assets’ [Martin Young – Cointelegraph] – Poly Network Hacker Mints Billions Of Tokens From Thin Air This Week in DeFi is free today. But if you enjoyed this post, you can tell This Week in DeFi that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

This Week In DeFi – June 30

Friday, June 30, 2023

This week, TUSD briefly loses its peg, Maple Finance launches a direct lending arm, ZKSync developers launch the ZK Stack, and dYdX announces a date for its Cosmos testnet.

This Week In DeFi – June 23

Friday, June 23, 2023

This week, BNB Chain launches an OP-based L2, Polygon proposes transitioning from PoS to zkEVM, Ethereum looks at increasing validator ETH limits, and Curve Finance votes to add WETH as collateral.

This Week In DeFi – June 16

Tuesday, June 20, 2023

This week, Tether encounters a mild de-pegging situation, Uniswap teases v4, Frax announces its own Layer-2 and a large CRV-collateralized loan scares the market.

This Week In DeFi – June 9

Monday, June 12, 2023

This week, the SEC takes action against Coinbase's staking service, Curve adds stETH as collateral for crvUSD, ENS announces .box domains, and Atomic Wallet is hacked for $35M+.

This Week In DeFi – June 1

Friday, June 2, 2023

This week, MakerDAO looks to raise the DSR to 3.3%, the Tornado Cash hacker returns control of the protocol, Magic raises $52M for its wallet infrastructure and Multichain's CEO goes missing 👀

You Might Also Like

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Babylon Launches Airdrop Registration, Berachain Initiates Phase One of Governance, and Me…

Saturday, March 1, 2025

In the recent theft incident of Bybit, hackers laundered money by exchanging ETH for BTC through THORChain, bringing huge trading volume and fees to THORChain. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin pullback could be set up for $370k bull run price target

Friday, February 28, 2025

Bitcoin's 27% slide raises prospects for rebound, aligns with historical cycle patterns. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏