DeFi Rate - This Week In DeFi – July 14

This Week In DeFi – July 14This week, Linea launches on mainnet in alpha, Aave votes to launch GHO, more funds go missing from Multichain, and Eclipse hires former Uniswap and dYdX business head Vijay Chetty.To the DeFi Community, This week, Blockchain development firm ConsenSys has launched its Layer 2 network, Linea, on mainnet in alpha. The ZK-rollup based network is compatible with Ethereum dApps and will be open to the public. The release follows a testnet phase that was deemed highly successful, as the platform received participation from 5.2 million unique addresses, conducting over 41 million transactions over three months. Linea offers transaction costs 15 times cheaper than Ethereum itself. ConsenSys is well-known for creating and running the popular MetaMask Web3 wallet, as well as blockchain infrastructure provider Infura. https://twitter.com/LineaBuild/status/1678738006646177793

Aave’s community is currently voting on the launch of its long-anticipated GHO stablecoin, with certain initial parameters. The proposal looks to introduce the stablecoin through “facilitators”, allowing Aave v3 users to mint GHO against their collateral. Aave Companies expects the launch to increase competition for stablecoin borrowing on the platform, as well as boost revenue generated for the DAO. The Aave V3 Ethereum Pool Facilitator will enable users to borrow GHO against collateral in the V3 Ethereum mainnet pool, while the FlashMinter Facilitator will allow users to flash-mint GHO without collateral, if it is repaid within a single transaction. The interest rate on GHO will be adjustable via DAO governance. Voting will end today, July 14. https://twitter.com/0xboka/status/1678557988070768641

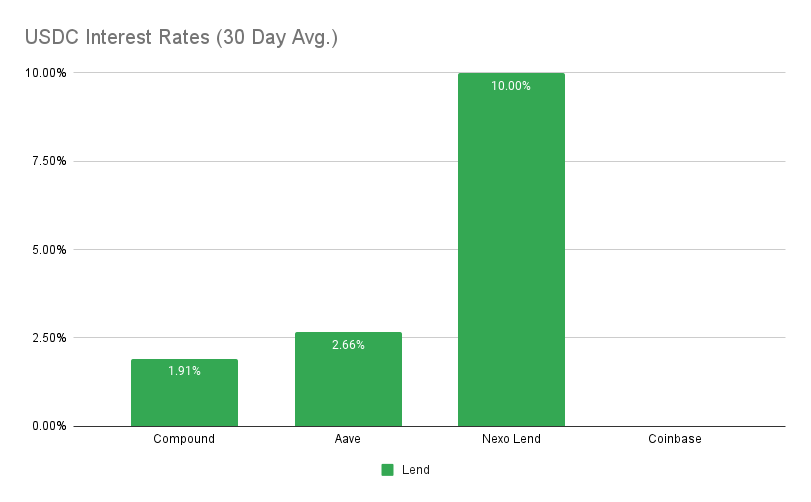

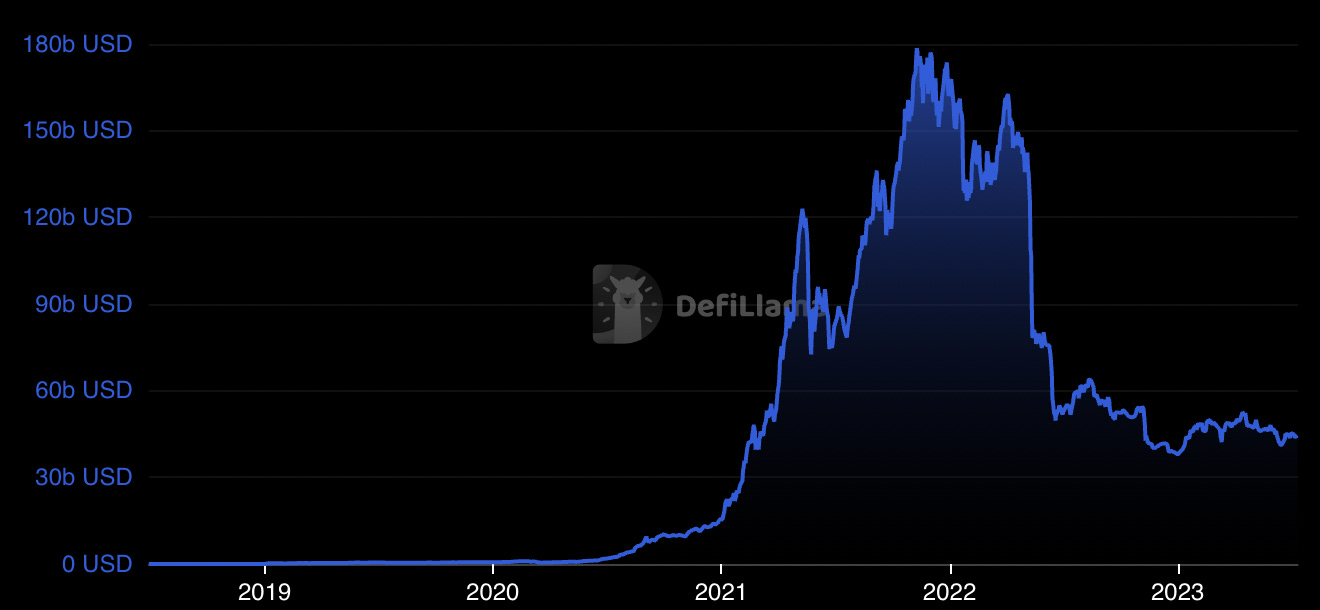

An additional $103 million in assets have mysteriously flowed out of the Multichain bridge this week, following a potentially malicious transfer of $126 million last week. According to blockchain security firm Beosin, this week’s figure was transferred to new addresses and brings the total value of the strange outflows to around $230 million. Stablecoin issuers Circle and Tether have each frozen some of the affected assets, including $63 million in USDC and $2.5 million in USDT. https://twitter.com/spreekaway/status/1678445945548152847 Web3 rollup provider Eclipse has hired Vijay Chetty as Chief Business Officer, adding significant experience to its team. Chetty was formerly Head of Business Development at decentralized exchanges Uniswap and dYdX – both billion-dollar market cap protocols. Cheety plans to launch self-service support for one-click deployments of Eclipse rollups, with support for further blockchain virtual machines within the next six months. He plans for Ecplise to become fully open-source within one year at the company. https://twitter.com/vijay_chetty/status/1678796209186832384 Layer-2 networks continue to trend this week, as ConsenSys takes the next steps for the launch of its zk-rollup platform, Linea. Airdrop farming appears to be in full effect at the moment, as I have my doubts about how many of the 5.2 million unique addresses active on the network are genuine individual users – especially in a bear market. If bots are attempting to farm an airdrop, it may be prudent to take some measures to boost your own chances of obtaining a reasonable allocation, perhaps with an emphasis on genuine network usage. and aiming for making larger, more meaningful transactions rather than going for high-volumes of small ones. Eclipse may also become a notable rollup platform in the near future, following the notable recruitment of its new Chief Business Officer Vijay Chetty. Yet another budding Layer-2 platform is Mantle Network, which has allocated a significant $200 million to develop its ecosystem over the next few years. Mantle’s treasury currently stands at a whopping $2 billion. It appears to be a tough year for total funding in the Web3 sector, as Q1 figures reveal an 80% decline in venture investment from Q1 2022. Certain niches in particular appear to have captured most of last year’s investor interest, however, including competing Layer-1 network such as Avalanche, Cardano and Solana, as well as NFTs. Interest RatesDAIHighest Yields: Nexo Lend at 10% APY, Aave at 2.1% APY MakerDAO Updates DAI Savings Rate: 3.49% Base Fee: 0.00% ETH Stability Fee: 3.49% WBTC Stability Fee: 5.55% USDCHighest Yields: Nexo Lend at 10% APY, Compound at 2.7% APY Top StoriesGrayscale makes Lido the second-heaviest component in its DeFi FundWeb3 venture funding dropped 80% in first quarterMantle Network is voting to form a $200 million ecosystem fundThree Arrows Capital Liquidator May Try to Claw Back About $1.2B From DCG, BlockFiStat BoxTotal Value Locked: $44.48B (up 0.5% since last week) DeFi Market Cap: $48.24B (up 0.4%) DEX Weekly Volume: $11.42B (down 19%) Bonus Reads[Danny Nelson – CoinDesk] – Aptos Voting to Enable Fungible Assets With Network Upgrade [Oliver Knight – CoinDesk] – MATIC Surges 10% as Polygon's 2.0 Upgrade Draws Closer [Oliver Knight – CoinDesk] – DeFi Protocol Holding 55% of Algorand Value to Shut Down [Jeremy Nation – The Defiant] – Security Engineer Arrested Over $9M DEX Hack This Week in DeFi is free today. But if you enjoyed this post, you can tell This Week in DeFi that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

This Week In DeFi – July 7

Friday, July 7, 2023

This week, IDEX announces it's going to L2, Ethereum considers an anti-exploit standard ERC-7265, Abracadabra DAO looks at a centralized legal structure, and Balancer proposes a new staking system.

This Week In DeFi – June 30

Friday, June 30, 2023

This week, TUSD briefly loses its peg, Maple Finance launches a direct lending arm, ZKSync developers launch the ZK Stack, and dYdX announces a date for its Cosmos testnet.

This Week In DeFi – June 23

Friday, June 23, 2023

This week, BNB Chain launches an OP-based L2, Polygon proposes transitioning from PoS to zkEVM, Ethereum looks at increasing validator ETH limits, and Curve Finance votes to add WETH as collateral.

This Week In DeFi – June 16

Tuesday, June 20, 2023

This week, Tether encounters a mild de-pegging situation, Uniswap teases v4, Frax announces its own Layer-2 and a large CRV-collateralized loan scares the market.

This Week In DeFi – June 9

Monday, June 12, 2023

This week, the SEC takes action against Coinbase's staking service, Curve adds stETH as collateral for crvUSD, ENS announces .box domains, and Atomic Wallet is hacked for $35M+.

You Might Also Like

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Babylon Launches Airdrop Registration, Berachain Initiates Phase One of Governance, and Me…

Saturday, March 1, 2025

In the recent theft incident of Bybit, hackers laundered money by exchanging ETH for BTC through THORChain, bringing huge trading volume and fees to THORChain. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin pullback could be set up for $370k bull run price target

Friday, February 28, 2025

Bitcoin's 27% slide raises prospects for rebound, aligns with historical cycle patterns. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏