DeFi Rate - This Week In DeFi – July 22

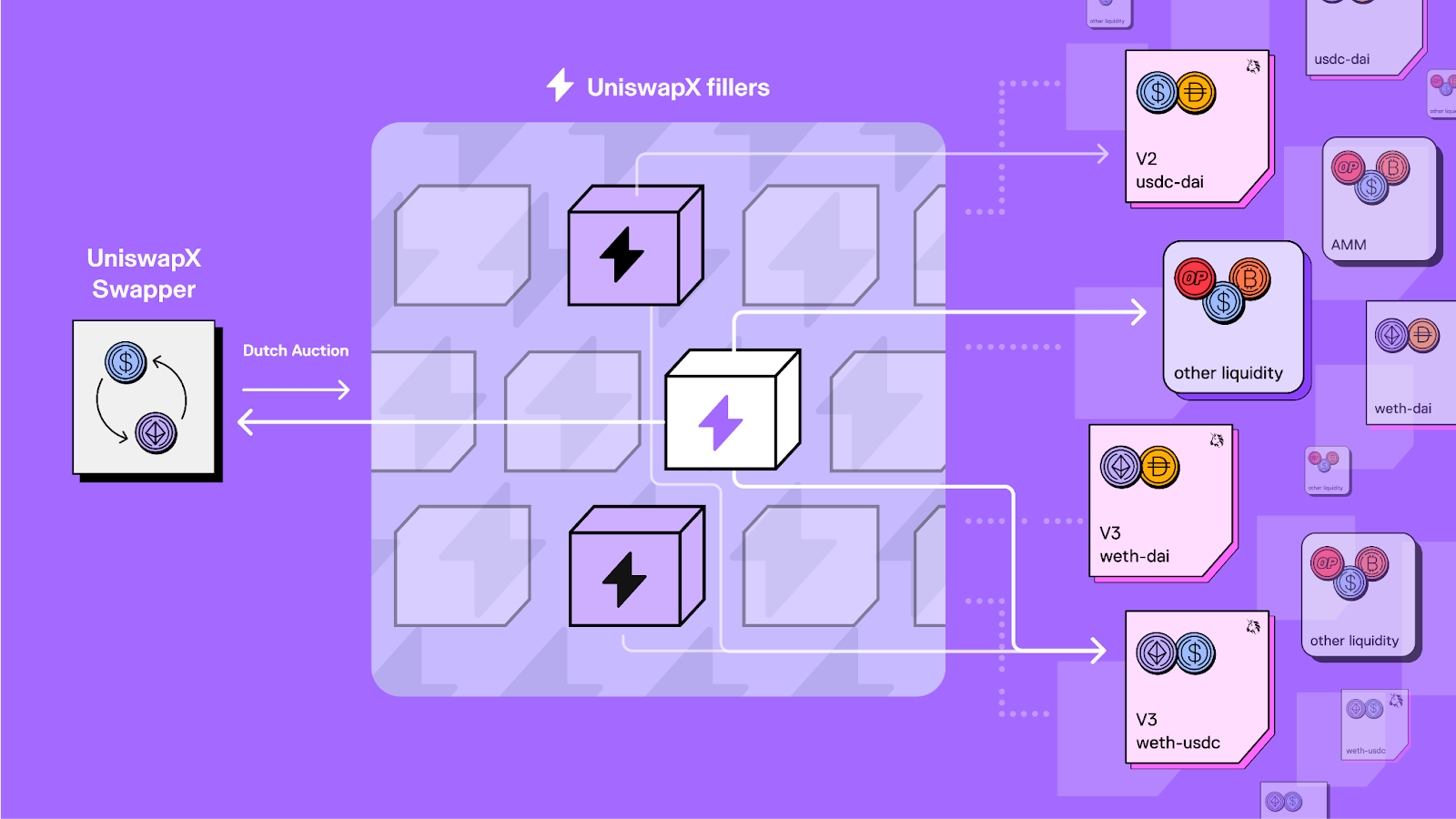

This Week In DeFi – July 22This week, Uniswap announces its own DeFi aggregator, Synthetix dives into perpetuals contracts, Chainlink launches its interoperability protocol, and Aave finally launches its GHO stablecoin.To the DeFi Community, This week, Uniswap founder Hayden Adams has announced UniswapX, a new open-source aggregator protocol. UniswapX looks to become an open network of “fillers” that compete to fill swaps with on-chain liquidity, including pools across all versions of Uniswap, or private inventory. The protocol will also feature gas-free execution, which would authorize fillers to pay gas fees on behalf of the swapper. This enables users to trade without the need for a chain’s native network token. UniswapX has been launched as an opt-in beta feature on the official Uniswap front-end. https://twitter.com/Uniswap/status/1680955621343129600 Synthetix has decided to dive into perpetual futures contracts, with plans for a new platform called Infinex. The protocol will run on the Layer-2 scaling network, Optimism, and is designed to run in tandem with Synthetix itself. Infinex seeks to address some of the challenges associated with centralized exchanges, however is likely to compete directly with established decentralized perpetual exchanges such as dYdX. The platform will be governed by the Synthetix token, and users will require only a username, password and email address to sign up. https://twitter.com/DefiantNews/status/1679838219201028097

Chainlink has rolled out an early-access version of its cross-chain interoperability protocol (CCIP), which is designed to seamlessly link apps across both public and private blockchains. The protocol is supposed to differ from traditional bridges with wrapping mechanisms, instead using smart contract-enabled mechanisms between audited token pools on different chains. The Chainlink team says that CCIP will enable users to deposit collateral on one blockchain and borrow assets on another, as well as providing various other benefits. https://twitter.com/chainlink/status/1682012600182226944

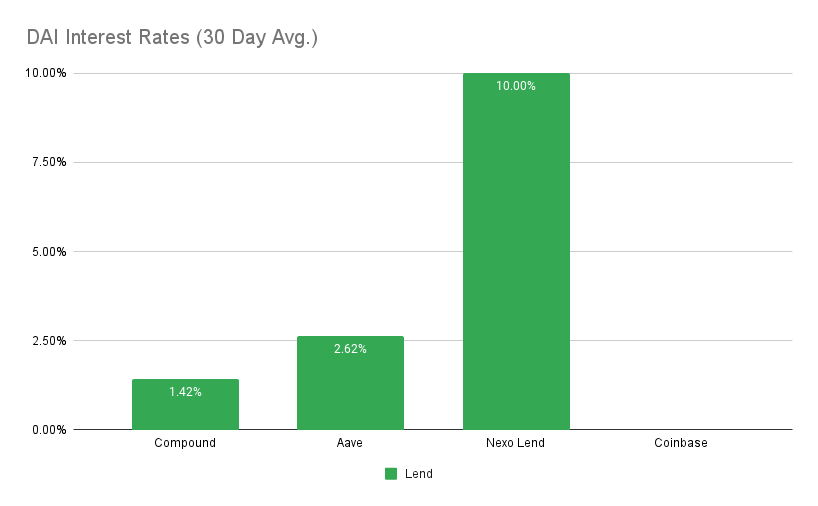

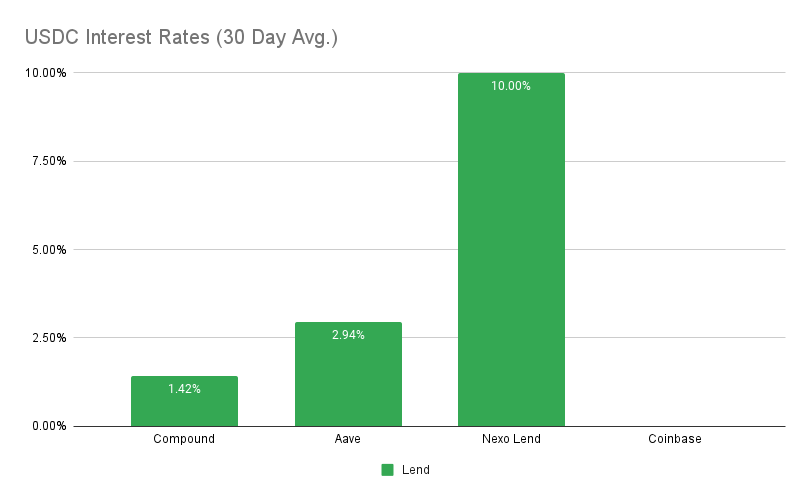

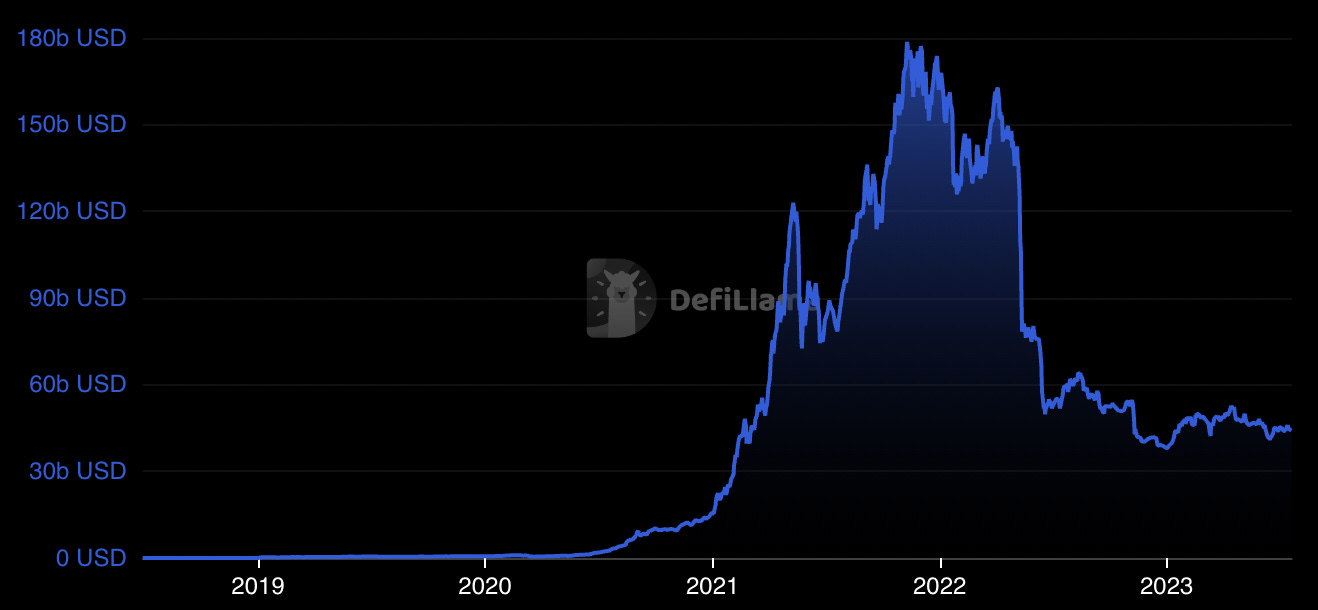

Aave has finally launched its GHO stablecoin on Ethereum mainnet, enabling users to mint the token against assets deposited in its v3 protocol. GHO will be offered at a fixed interest rate of 1.5%, and AAVE stakers will receive a 30% discount. Borrowers will continue to earn yield on their assets while borrowing GHO, and the Aave DAO treasury will receive all fees generated by the stablecoin. The launch comes after a near-unanimous passing of a governance proposal on July 14. https://twitter.com/0xMughal/status/1681388943617716224 The big-guns in DeFi have been busy at work this week – and it shows. With several high-profile releases and launches, development in the sector is anything but dead. Uniswap, Synthetix, Chainlink and Aave have all made significant announcements, despite the market remaining extremely quiet in terms of price action. Centralized finance continues to lose market share as Coinbase is forced to sunset its crypto-backed loans feature, while customers in four states will no longer be able to stake additional assets on the Coinbase platform. On the other hand, Compound Finance has seen an uptick in activity – perhaps showing a migration to DeFi as interest rates and accessibility become more attractive to users. A further tightening of stablecoin and crypto regulations is on the horizon, as the G20’s Financial Stability Board (FSB) makes new recommendations, and US politicians look to improve clarity and definitions around the crypto industry. The Layer-2 trend also continues, as projects appear to be giving up on competing with Ethereum as a Layer-1 chain. This time, Celo bites the bullet, opting instead to facilitate a scaling network for Ethereum and transition to a Layer-2 using the OP Stack. Interest RatesDAIHighest Yields: Nexo Lend at 10% APY, Aave at 2.6% APY MakerDAO Updates DAI Savings Rate: 3.49% Base Fee: 0.00% ETH Stability Fee: 3.49% WBTC Stability Fee: 5.55% USDCHighest Yields: Nexo Lend at 10% APY, Compound at 2.7% APY Top StoriesG20 body sets out recommendations for regulating crypto-assets and stablecoinsHouse Republicans introduce much-awaited US crypto market overhaulCoinbase to fully sunset bitcoin-backed loan program for retail customersCompound's outstanding debt on Ethereum hits $1 billionStat BoxTotal Value Locked: $44.09B (down 0.9% since last week) DeFi Market Cap: $51.34B (up 6.4%) DEX Weekly Volume: $12.05B (up 5.5%) Bonus Reads[Brian McGleenon – The Block] – Neon EVM launches to support Ethereum apps on Solana [James Hunt – The Block] – Ethereum Layer 2 Mantle Network unveils mainnet alpha at EthCC [Lyllah Ledesma – CoinDesk] – Celo Proposes to Ditch Own Standalone Blockchain for Layer-2 Network on Ethereum [Frank Chaparro – The Block] – Coinbase users in four states will no longer be able to stake additional assets This Week in DeFi is free today. But if you enjoyed this post, you can tell This Week in DeFi that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

This Week In DeFi – July 14

Sunday, July 16, 2023

This week, Linea launches on mainnet in alpha, Aave votes to launch GHO, more funds go missing from Multichain, and Eclipse hires former Uniswap and dYdX business head Vijay Chetty.

This Week In DeFi – July 7

Friday, July 7, 2023

This week, IDEX announces it's going to L2, Ethereum considers an anti-exploit standard ERC-7265, Abracadabra DAO looks at a centralized legal structure, and Balancer proposes a new staking system.

This Week In DeFi – June 30

Friday, June 30, 2023

This week, TUSD briefly loses its peg, Maple Finance launches a direct lending arm, ZKSync developers launch the ZK Stack, and dYdX announces a date for its Cosmos testnet.

This Week In DeFi – June 23

Friday, June 23, 2023

This week, BNB Chain launches an OP-based L2, Polygon proposes transitioning from PoS to zkEVM, Ethereum looks at increasing validator ETH limits, and Curve Finance votes to add WETH as collateral.

This Week In DeFi – June 16

Tuesday, June 20, 2023

This week, Tether encounters a mild de-pegging situation, Uniswap teases v4, Frax announces its own Layer-2 and a large CRV-collateralized loan scares the market.

You Might Also Like

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Babylon Launches Airdrop Registration, Berachain Initiates Phase One of Governance, and Me…

Saturday, March 1, 2025

In the recent theft incident of Bybit, hackers laundered money by exchanging ETH for BTC through THORChain, bringing huge trading volume and fees to THORChain. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin pullback could be set up for $370k bull run price target

Friday, February 28, 2025

Bitcoin's 27% slide raises prospects for rebound, aligns with historical cycle patterns. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏