DeFi Rate - This Week In DeFi – July 28

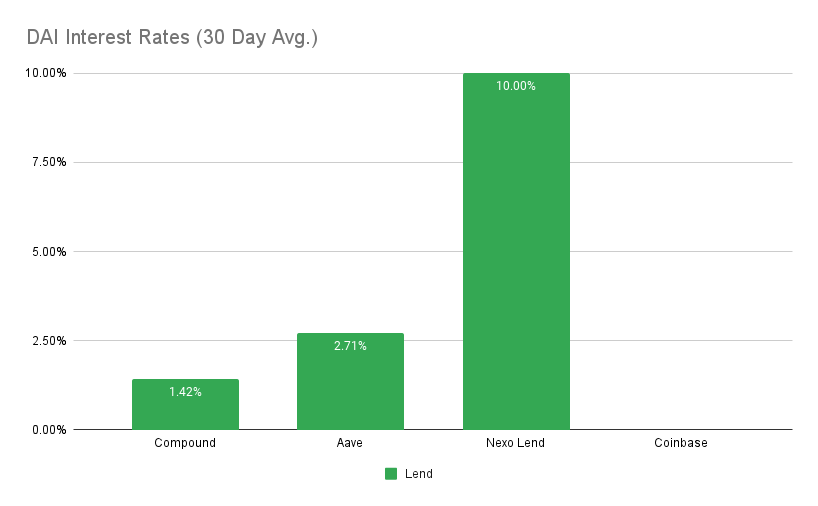

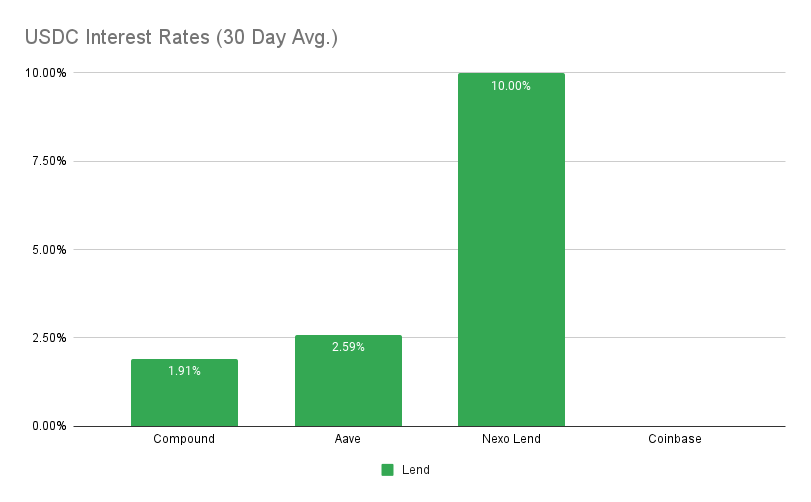

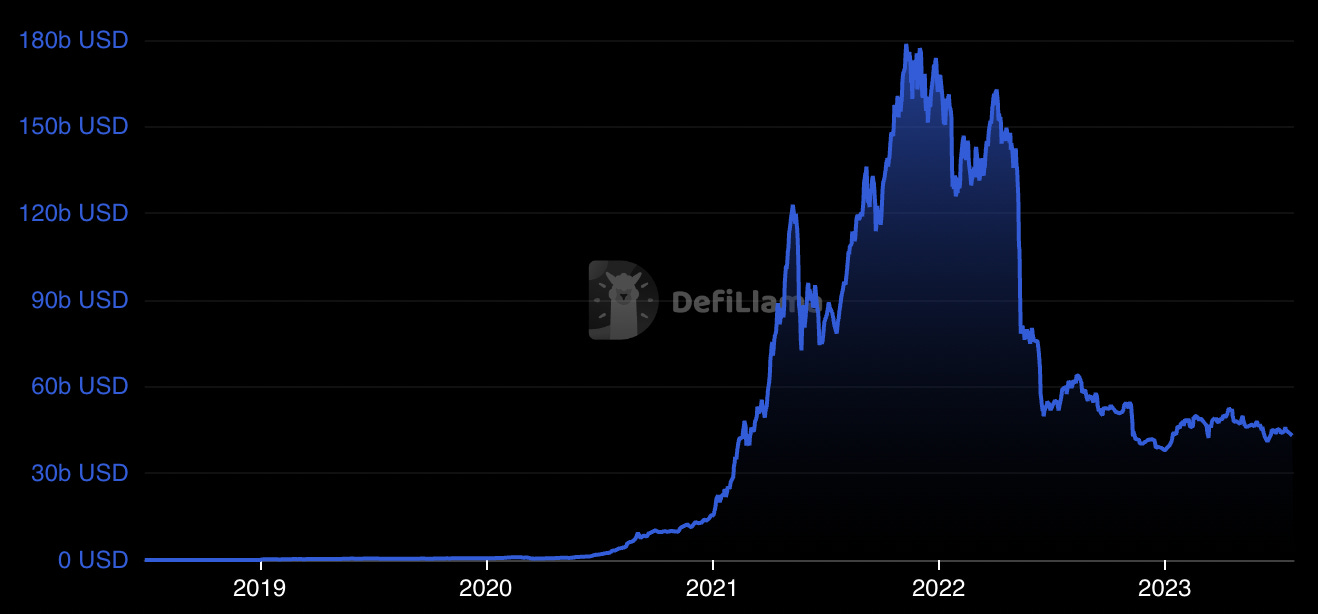

This Week In DeFi – July 28This week, Eco launches its Beam wallet with "cash-like" payments, Flashbots obtains unicorn status, Binance lists the new FDUSD stablecoin with zero fees, and MakerDAO votes for an 8% DSR.To the DeFi Community, This week, Beam, a new crypto wallet backed by investors like Coinbase Ventures and Andreessen Horowitz, has been launched by fintech firm Eco. Unlike typical wallets, Beam allows users to send payments using QR codes, resembling a cash-like experience for crypto transactions. The wallet operates on Ethereum layer-2 blockchains Optimism and Coinbase's Base, benefiting from Ethereum's ERC-4337 implementation for easy crypto recovery and Optimism's "Superchain" initiative for faster transactions and lower fees. With mainstream adoption in mind, Beam aims to simplify crypto usage and provide a more accessible solution for everyday transactions. https://twitter.com/AnnikaSays/status/1684604997986811904 Ethereum infrastructure service Flashbots has successfully raised $60 million in a Series B funding round, valuing the company at $1 billion. The funds will primarily be used to develop the Suave platform, aimed at enabling cheaper and more private blockchain transactions. The investors involved in the round include prominent venture capital firms, Layer-2 networks, angel investors, decentralized exchanges, apps, and MEV supply chain actors. Flashbots' service focuses on proposing blocks for Ethereum blockchain validators and aims to address MEV, a technique that exploits transaction sequencing for profitable on-chain trades. https://twitter.com/EnneZeta/status/1683928677023903746 Binance has listed the First Digital USD stablecoin and is offering zero trading fees for select FDUSD pairs for a limited time. The exchange will not charge maker fees for specific FDUSD trading pairs and also waives taker fees on others. However, shortly after listing FDUSD, Binance suspended trading due to technical issues faced by the stablecoin's liquidity providers and plans to resume trading later. The move comes amid controversy surrounding Binance's recent TrueUSD promotion and the phasing away of their own BUSD stablecoin. FDUSD is issued by First Digital Labs and is part of the larger First Digital Group, with plans to support more blockchains in the future. https://twitter.com/binance/status/1684051409199857664 The MakerDAO community approved a proposal on July 27 to temporarily increase the interest rate for stablecoin Dai, allowing tokenholders to earn yields as high as 8%. This proposal introduced the “Enhanced Dai Savings Rate” (EDSR), which adjusts the effective Dai Savings Rate (DSR) based on DSR utilization, gradually reducing it as utilization increases. Despite raising the DSR to 3.49% in June, only a small portion (less than 7%) of the total DAI supply was deposited in the DSR. The proposal aims to address this issue by making better use of the protocol's earnings and surplus. https://twitter.com/StableLab/status/1684663590257844224 Ease-of-use has been a theme in DeFi and DeFi trading this week, as Telegram trading bots begin to trend. Bots such as Unibot, Swipe and others have become popular both as an automation tool for trading on decentralized exchanges, as well as being an investment themselves (with their own tokens). However, the trend has drawn some concern from more critical eyes as those community members observe potential for exploits related to what they consider poor security of the protocols – especially associated with surrendering tokens or private keys. Also in the ease-of-use department, we have the Coinbase and a16z-backed company Eco releasing the Beam wallet, with a specific focus of facilitating everyday payments in crypto – specifically, USDC. Although payment rails such as lightning network have provided the ability for quick and easy crypto payments, they have failed to gather meaningful mainstream adoption. If done correctly, Beam may provide us with a glimpse of what is possible when “crypto” (in this case, a centralized stablecoin), can be used far and wide for everyday purchases. Other headlines this week appear to revolve around state and corporate-level interest in crypto and DeFi. Italy’s central bank is creating a DeFi pilot program in partnership with Polygon, A&G Bank in Spain is launching a crypto hedge fund for accredited investors, and the US may finally get some much-needed regulatory clarity on crypto assets via their latest bill. Interest RatesDAIHighest Yields: Nexo Lend at 10% APY, Aave at 2.7% APY MakerDAO Updates DAI Savings Rate: 3.49% Base Fee: 0.00% ETH Stability Fee: 3.49% WBTC Stability Fee: 5.55% USDCHighest Yields: Nexo Lend at 10% APY, Compound at 2.6% APY Top StoriesCelsius Network reaches settlements that could clear path to return customer funds: WSJBank of Italy Taps Polygon for Institutional DeFi PilotPrivate Banking Firm With $14B Assets Starts First Crypto Fund of SpainHistoric crypto market bill approved to advance to full US HouseStat BoxTotal Value Locked: $43.18B (down 2.1% since last week) DeFi Market Cap: $49.41B (down 3.8%) DEX Weekly Volume: $9.37B (down 22%) Bonus Reads[Vishal Chawla – The Block] – Telegram crypto trading bots spark fears over security vulnerabilities [Vishal Chawla – The Block] – Alphapo’s hack now estimated at $60 million: ZachXBT [Jeremy Nation – The Defiant] – MetaMask To Support Cross-Chain Interactions With 'Snaps' By 2024 [Vishal Chawla – The Block] – Gitcoin's Layer 2 'Public Goods Network' goes live on mainnet This Week in DeFi is free today. But if you enjoyed this post, you can tell This Week in DeFi that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

This Week In DeFi – July 22

Friday, July 21, 2023

This week, Uniswap announces its own DeFi aggregator, Synthetix dives into perpetuals contracts, Chainlink launches its interoperability protocol, and Aave finally launches its GHO stablecoin.

This Week In DeFi – July 14

Sunday, July 16, 2023

This week, Linea launches on mainnet in alpha, Aave votes to launch GHO, more funds go missing from Multichain, and Eclipse hires former Uniswap and dYdX business head Vijay Chetty.

This Week In DeFi – July 7

Friday, July 7, 2023

This week, IDEX announces it's going to L2, Ethereum considers an anti-exploit standard ERC-7265, Abracadabra DAO looks at a centralized legal structure, and Balancer proposes a new staking system.

This Week In DeFi – June 30

Friday, June 30, 2023

This week, TUSD briefly loses its peg, Maple Finance launches a direct lending arm, ZKSync developers launch the ZK Stack, and dYdX announces a date for its Cosmos testnet.

This Week In DeFi – June 23

Friday, June 23, 2023

This week, BNB Chain launches an OP-based L2, Polygon proposes transitioning from PoS to zkEVM, Ethereum looks at increasing validator ETH limits, and Curve Finance votes to add WETH as collateral.

You Might Also Like

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Babylon Launches Airdrop Registration, Berachain Initiates Phase One of Governance, and Me…

Saturday, March 1, 2025

In the recent theft incident of Bybit, hackers laundered money by exchanging ETH for BTC through THORChain, bringing huge trading volume and fees to THORChain. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin pullback could be set up for $370k bull run price target

Friday, February 28, 2025

Bitcoin's 27% slide raises prospects for rebound, aligns with historical cycle patterns. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏