DeFi Rate - This Week In DeFi – Aug 4

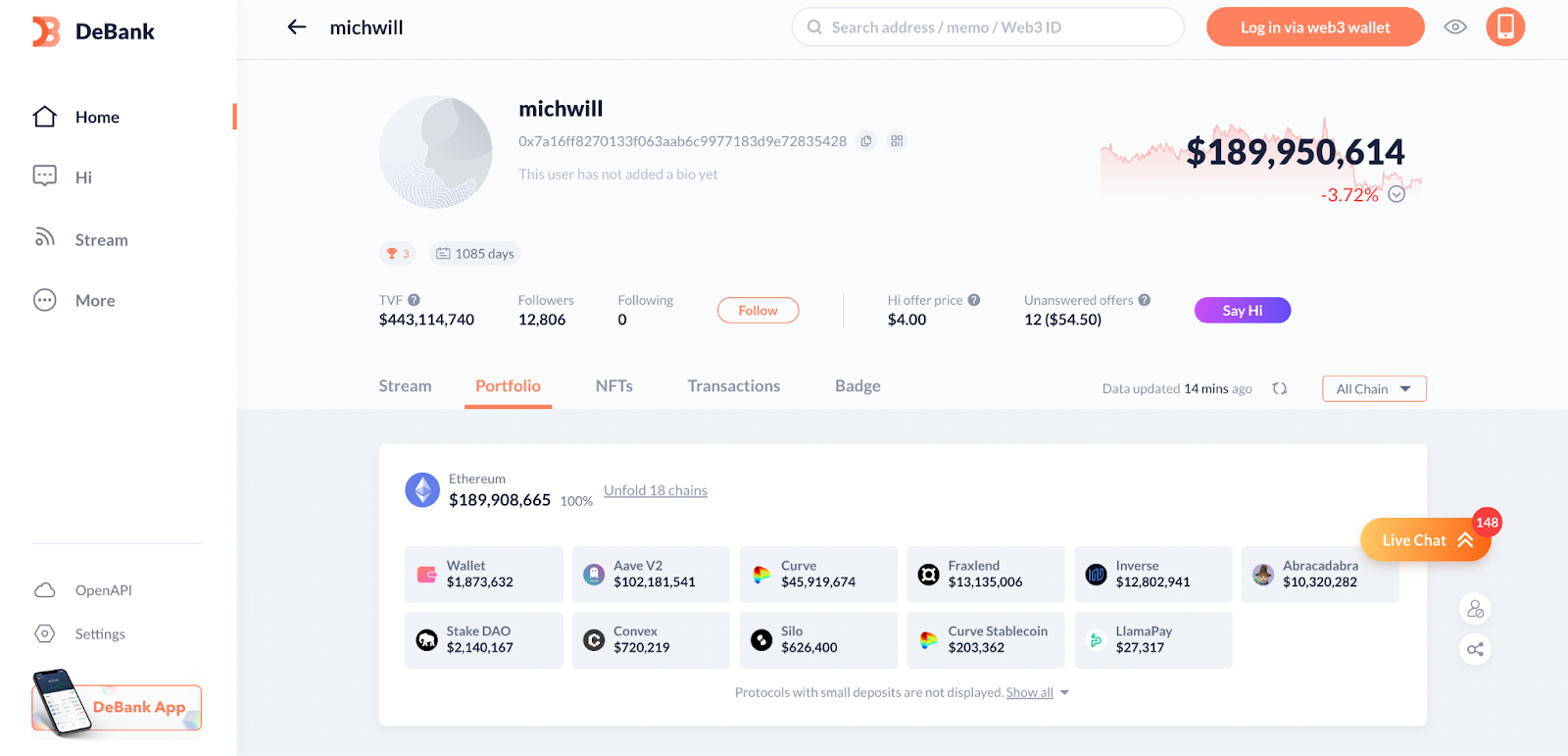

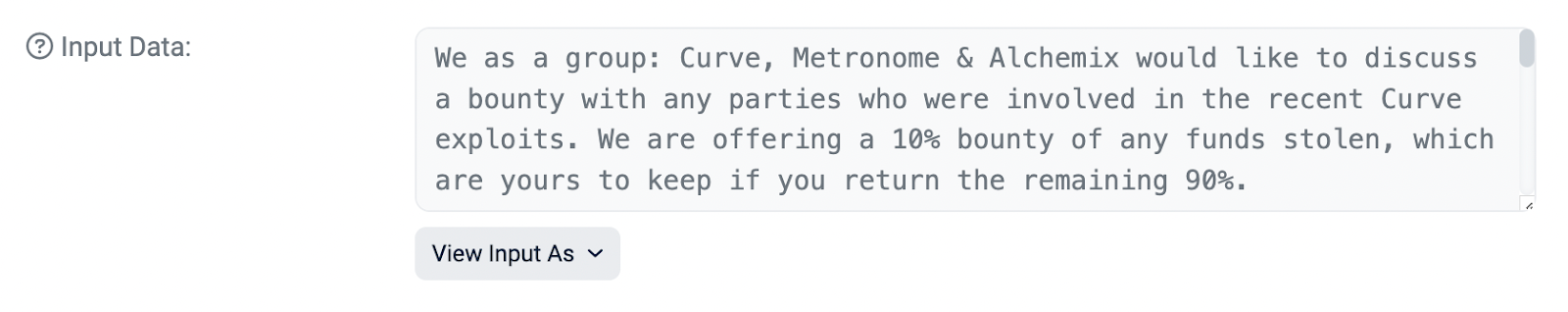

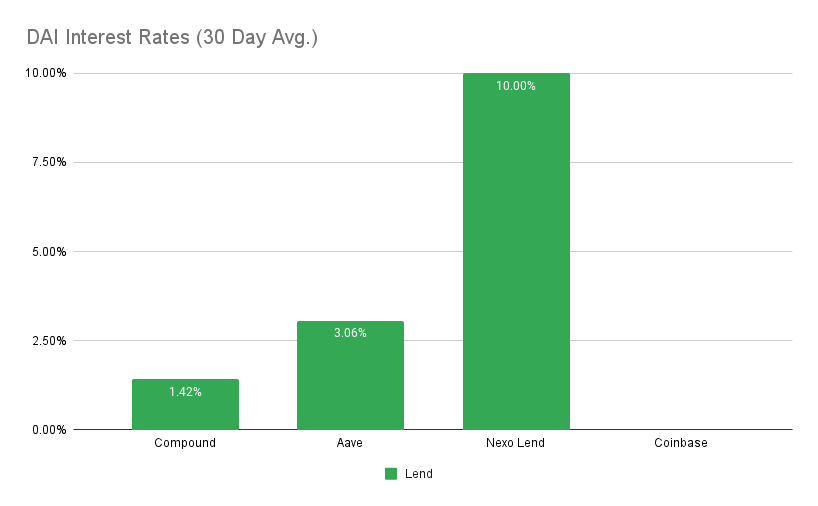

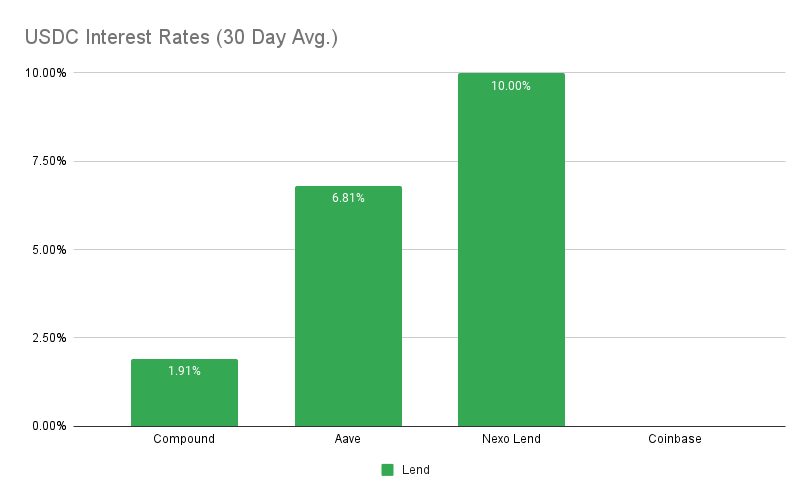

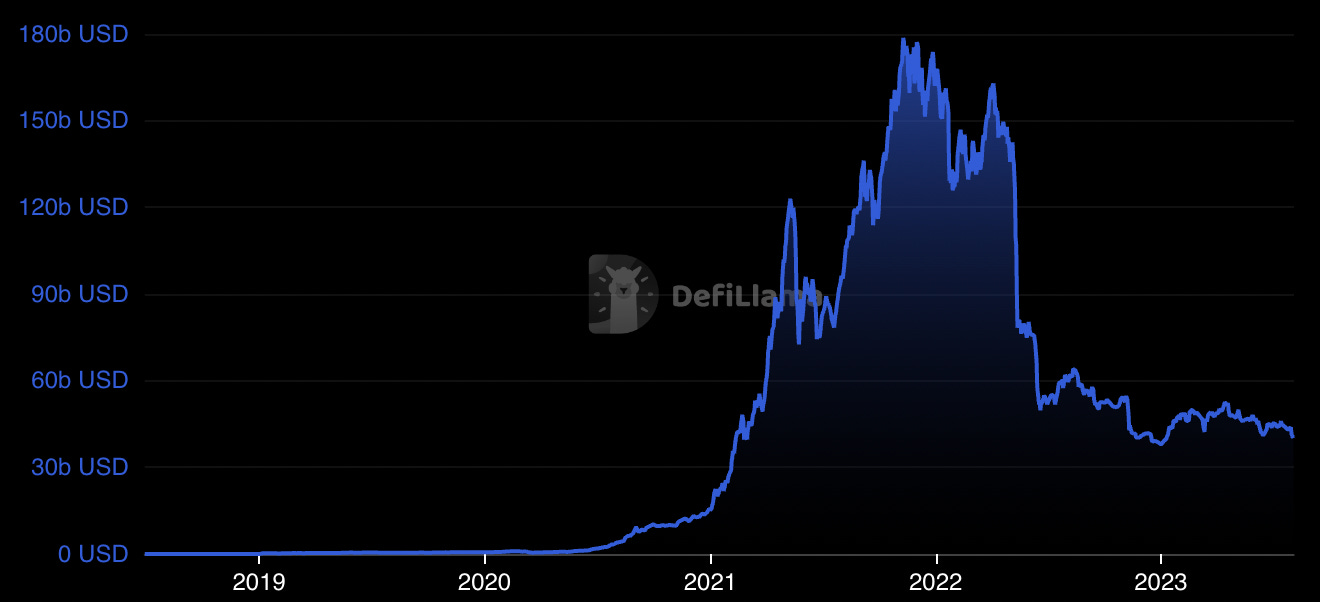

This Week In DeFi – Aug 4This week, drama surrounds Curve's CRV, Coinbase's Base mainnet becomes a roller coaster and the IRS says staking rewards are taxable as soon as they're received.To the DeFi Community, This week, Curve has become the center of attention, as a new exploit places founder Michael Egorov’s massive loans under stress once again, as the price of $CRV wavers. The exploit at hand was not specific to Curve, however it was of course the largest affected protocol. Vulnerabilities in the Vyper smart contract language enabled “reentrancy” attacks by the exploiters, leading to a total of $70 million in losses across the affected platforms. Egorov has $168 million worth of CRV – 34% of the total market cap – posted as collateral backing loans across several DeFi protocols, putting a large contingent of the DeFi community on-edge as his liquidation price drew nearer. CRV plummeted as much as 86% on decentralized exchanges after the exploit, however liquidation of Egorov’s positions was avoided due to Chainlink oracles using centralized exchange prices. Agorov has sold almost 72 million CRV tokens over-the-counter in order to reduce his liquidation risk since the exploit, including 10 million CRV to Huobi co-founder Jun Du, 5 million to Justin Sun, 4.25 million to trader DCFGod,, and more. It has been reported that these tokens were sold at $0.40, a significant discount from current market prices. Curve, Metronome and Alchemix have offered the hacker a 10% bounty and no legal pursuit, in exchange for returning the entirety of the stolen funds. https://twitter.com/CurveFinance/status/1687180381714358272 In response to lender risks, lending protocol Abracadabra has seen a pair of proposals to raise the interest rate on loans against CRV in order to prompt earlier repayment. The newer proposal of the two seeks to increase the interest rate on Egorov’s positions to 80%, but variable depending on the outstanding loan balance and the health of the borrowing position. As for Aave, security firm Gauntlet has proposed that the protocol pause all borrowing activity against CRV to mitigate any additional risk of bad debt, by setting the CRV loan-to-value ratio to 0. Both proposals detailed above appear to be on track to pass within the next several days. In Layer-2 news, Coinbase’s scaling platform Base has experienced a rollercoaster of early activity, despite its mainnet still being in a “developer access period”. Users bridged hastily over to the chain, without a bridge UI, to speculate on a flurry of new meme tokens including $BALD. In the space of just a few days, $BALD saw its market cap rise from zero to well over $90 million, before dumping 90% after an apparent “rug pull” by its anonymous developer, who some claim had ties to Alameda Research. But the drama didn’t stop there – LeetSwap, the chain’s leading DEX at the beginning of the frenzy, experienced its own exploit that led to developers having to halt activity on the exchange. The initial exploit saw around 340 ETH (about $630,000) worth of liquidity drained from the platform. Base has announced that the chain will be officially open to the public August 9, with Coinbase running an “Onchain Summer” campaign to promote the platform. https://twitter.com/coinbase/status/1687087501507469312 Although much controversy has taken the limelight in this week’s DeFi headlines, don’t let that fool you – there has also been a wealth of new integrations and development! One interesting new thing out of this week is EIP-6968, which proposes a new token type that allows developers to claim a portion of transaction fees generated from use of their smart contracts. These revenues could be used to fund further development, public goods, or simply provide developers with incentives. We also had THORSwap introduce “Streaming Swaps,” a feature which automatically breaks large trades down internally to minimize slippage and maximize efficiency, without the need to manually execute multiple smaller trades. This also works well to minimize gas fees, since the trade is treated as a single transaction. Yet another interesting innovation has been Ribbon Finance (now Aevo) creating and settling the first “Autocallable” product on Ethereum – a popular financial instrument in traditional finance. Over in regulatory news, the IRS has made a statement saying that staking rewards should be counted as income at market value as soon they are received – perhaps leading to some interesting and/or unfavorable implications for large stakers. Interest RatesDAIHighest Yields: Nexo Lend at 10% APY, Aave at 3.1% APY MakerDAO Updates DAI Savings Rate: 3.49% Base Fee: 0.00% ETH Stability Fee: 3.49% WBTC Stability Fee: 5.55% USDCHighest Yields: Nexo Lend at 10% APY, Compound at 6.8% APY Top StoriesIRS: Crypto Staking Rewards Taxable Once Investor Gets Hands on TokensProposed Ethereum Upgrade Could Allow Layer 2 Developers To Share Fee RevenueEthereum futures become latest ETF craze as applications tumble inCoinbase Looks to Add Bitcoin Lightning for PaymentsStat BoxTotal Value Locked: $40.50B (down 6.2% since last week) DeFi Market Cap: $47.91B (down 3.0%) DEX Weekly Volume: $11.50B (up 23%) Bonus Reads[Sage D. Young – CoinDesk] – Decentralized Exchange THORSwap Introduces New Feature Aimed at Better Price Execution for Large Trades [Sage D. Young – CoinDesk] – DYdX Proposal to Slash Token Issuance Wins Early Support [Yogita Khatri – The Block] – PancakeSwap to share trading-fee revenue with CAKE token stakers [Omkar Godbole – CoinDesk] – Ribbon Finance Settles First On-Chain Ether 'Autocallable' With Marex and MEV Capital This Week in DeFi is free today. But if you enjoyed this post, you can tell This Week in DeFi that their writing is valuable by pledging a future subscription. You won't be charged unless they enable payments. |

Older messages

This Week In DeFi – July 28

Friday, July 28, 2023

This week, Eco launches its Beam wallet with "cash-like" payments, Flashbots obtains unicorn status, Binance lists the new FDUSD stablecoin with zero fees, and MakerDAO votes for an 8% DSR.

This Week In DeFi – July 22

Friday, July 21, 2023

This week, Uniswap announces its own DeFi aggregator, Synthetix dives into perpetuals contracts, Chainlink launches its interoperability protocol, and Aave finally launches its GHO stablecoin.

This Week In DeFi – July 14

Sunday, July 16, 2023

This week, Linea launches on mainnet in alpha, Aave votes to launch GHO, more funds go missing from Multichain, and Eclipse hires former Uniswap and dYdX business head Vijay Chetty.

This Week In DeFi – July 7

Friday, July 7, 2023

This week, IDEX announces it's going to L2, Ethereum considers an anti-exploit standard ERC-7265, Abracadabra DAO looks at a centralized legal structure, and Balancer proposes a new staking system.

This Week In DeFi – June 30

Friday, June 30, 2023

This week, TUSD briefly loses its peg, Maple Finance launches a direct lending arm, ZKSync developers launch the ZK Stack, and dYdX announces a date for its Cosmos testnet.

You Might Also Like

Trump’s crypto reserve faces backlash over ADA and XRP inclusion

Monday, March 3, 2025

Ripple and Cardano leaders embrace Trump's multichain approach despite criticism for altcoin inclusion. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

📈 Bitcoin dominance reached a 4-year high of 62%; Trump announced a strategic crypto reserve with BTC, ETH, XRP, …

Monday, March 3, 2025

Bitcoin dominance reached a 4-year high of 62%; Cronos becomes the first blockchain to power crypto-to-debit transfers; Trump announced a strategic crypto reserve with BTC, ETH, XRP, SOL, and ADA ͏ ͏ ͏

White House Schedules First Ever Crypto Summit

Monday, March 3, 2025

March 3rd, 2025 Sign Up Your Weekly Update On All Things Crypto TL;DR White House Schedules First Ever Crypto Summit SEC Declares Meme Coins Are Not Securities Consensys Secures Victory In MetaMask

VC Monthly Report, February Sees 14% Growth in Funding Amount and Deal Count, Stablecoins and Payments Dominate In…

Monday, March 3, 2025

According to RootData statistics, there were 98 publicly disclosed crypto VC investment projects in February 2025, a 14% increase month-over-month (compared to 86 projects in January 2025) but a 35.1%

Bitcoin’s steep decline fueled by short-term holders

Sunday, March 2, 2025

High-frequency traders and day traders rile Bitcoin market as prices plummet. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Asia's weekly TOP10 crypto news (Feb 24 to Mar 2)

Sunday, March 2, 2025

According to Coindesk, citing local news outlet Dawn, Pakistan is planning to establish a National Crypto Committee to formulate cryptocurrency policies. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

On ICOs, NFTs, and Memecoins

Sunday, March 2, 2025

CRYPTODAY 143 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

StanChart warns of further downside for Bitcoin over the weekend akin to August 2024

Saturday, March 1, 2025

Standard Chartered sees parallels to past Bitcoin sell-offs amid volatile weekend projections. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Weekly Project Updates: Babylon Launches Airdrop Registration, Berachain Initiates Phase One of Governance, and Me…

Saturday, March 1, 2025

In the recent theft incident of Bybit, hackers laundered money by exchanging ETH for BTC through THORChain, bringing huge trading volume and fees to THORChain. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin pullback could be set up for $370k bull run price target

Friday, February 28, 2025

Bitcoin's 27% slide raises prospects for rebound, aligns with historical cycle patterns. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏