Not Boring by Packy McCormick - Tech is Going to Get Much Bigger

Welcome to the 620 newly Not Boring people who have joined us since last Tuesday! If you haven’t subscribed, join 215,222 smart, curious folks by subscribing here: Our new podcast, Age of Miracles is three episodes in, with a fourth coming Friday. Today’s essay is about what happens when we get cheap energy, intelligence, and labor. This season of Age of Miracles is about how we get that energy. Listen on Apple, Spotify, or YouTube. Today’s Not Boring is brought to you by… Create If you read Not Boring, you likely already known that my brother Dan writes the Weekly Dose of Optimism. What you might not know is that he also runs Create — a creatine gummy brand thats sold nearly 15 million gummies in its first year of business. Creatine?! That bodybuilder supplement? Yes, creatine. It turns out that most people can benefit from creatine supplementation — whether you want to gain lean muscle, improve muscle recovery, or increase cognitive performance. Yeah, that’s right…it turns out creatine can improve brain health, everything from cognition to memory to mood. And of course, when matched with resistance training, it’s gonna help safely build muscle. Create is giving Not Boring readers early access to its Black Friday Sale (up to 40% off + Free Gift With Purchases) here. Give them a shot — even though I’m a biased older brother, the gummies are delicious, convenient, and have actually worked for me. Hi friends 👋, Happy Wednesday! Sorry for the late email – I was ready to send yesterday, but I didn’t like the draft and I want this one to be good, so I started rewriting it at 8:30 am yesterday. I could be wrong – I often am – and I certainly don’t have a good enough crystal ball to predict the timing or the specifics, but it’s my best distillation of the way things are moving and what that might mean for tech companies. Think of it as half-prediction, half-thought exercise. Let’s get to it. Tech is Going to Get Much BiggerTech is going to get so much bigger in the next decade or two that it will make everything up until now look quaint by comparison. We’re standing on that part of the curve that looks steep in the present but will look prairie flat looking back from the future. I’ve been writing around various parts of this thesis for a while. The simple version comes from Working Harder and Smarter, which I wrote last September:

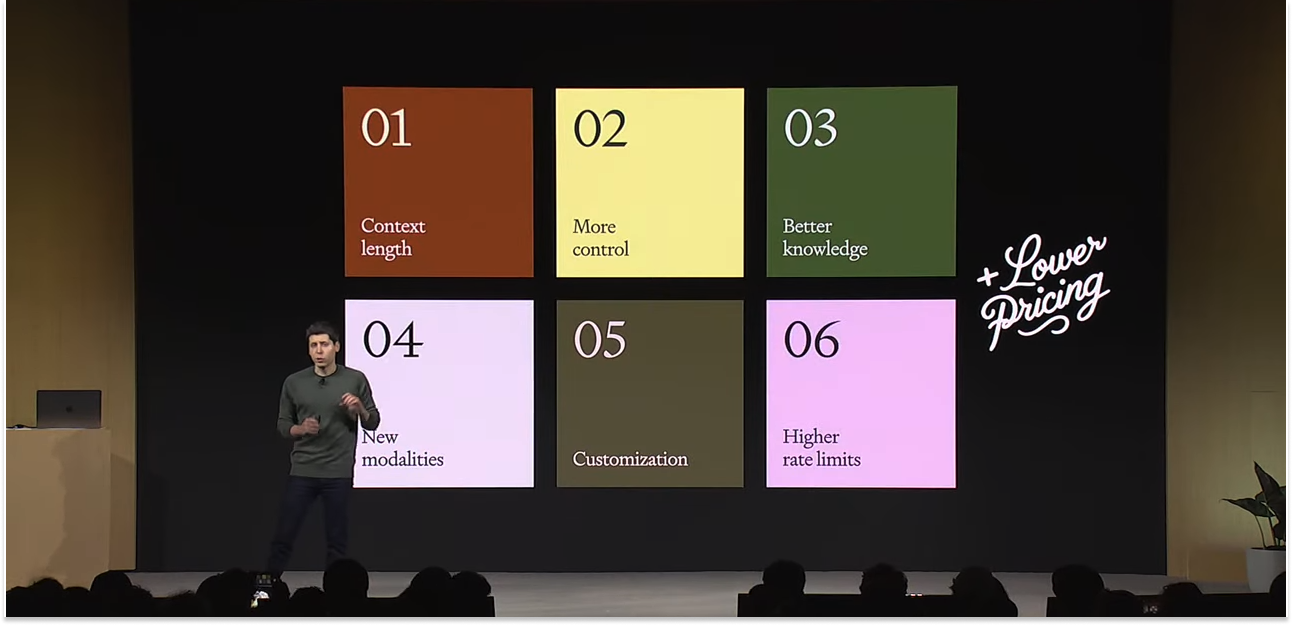

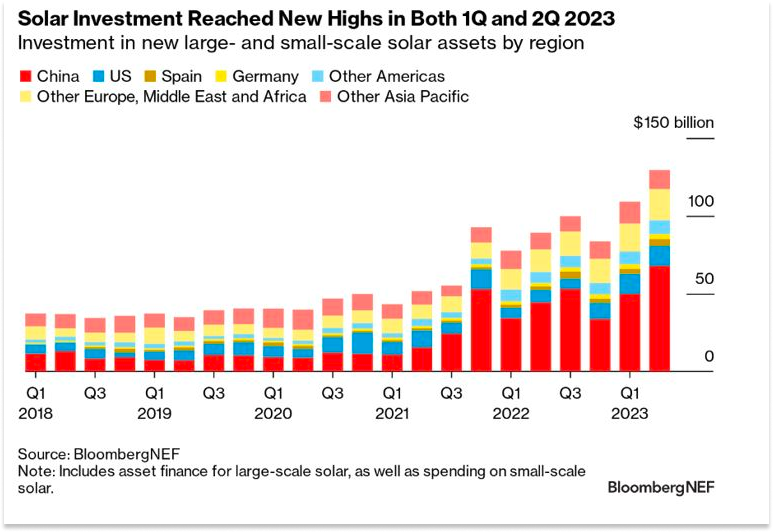

That was 14 months ago, and already so much has changed. The Tesla AI Day at which they unveiled Optimus was still three weeks away. Now Optimus can do this:  Figure was still in stealth. Not its 01 humanoid robot can do this:  ChatGPT wasn’t around then. Yesterday, OpenAI announced all of this: Millions of people and businesses are going to have armies of agents that just keep getting smarter and more capable with every model upgrade. Long, long ago, when I wrote that piece, the National Ignition Facility hadn’t achieved fusion ignition, half of the nuclear fission startups we’ve spoken to for Age of Miracles didn’t exist, and solar hadn’t yet crossed the $100 billion in quarterly investment mark. That’s head-spinning progress, all made in a supposedly bad economy with higher interest rates. The pace of change is important, but more important is what’s changing. At the end of all of the interviews we do for Age of Miracles, we ask each guest what the world will look like when we have abundant energy. Isaiah Taylor, the founder of Valar Atomics, gave an answer that frames the situation perfectly:

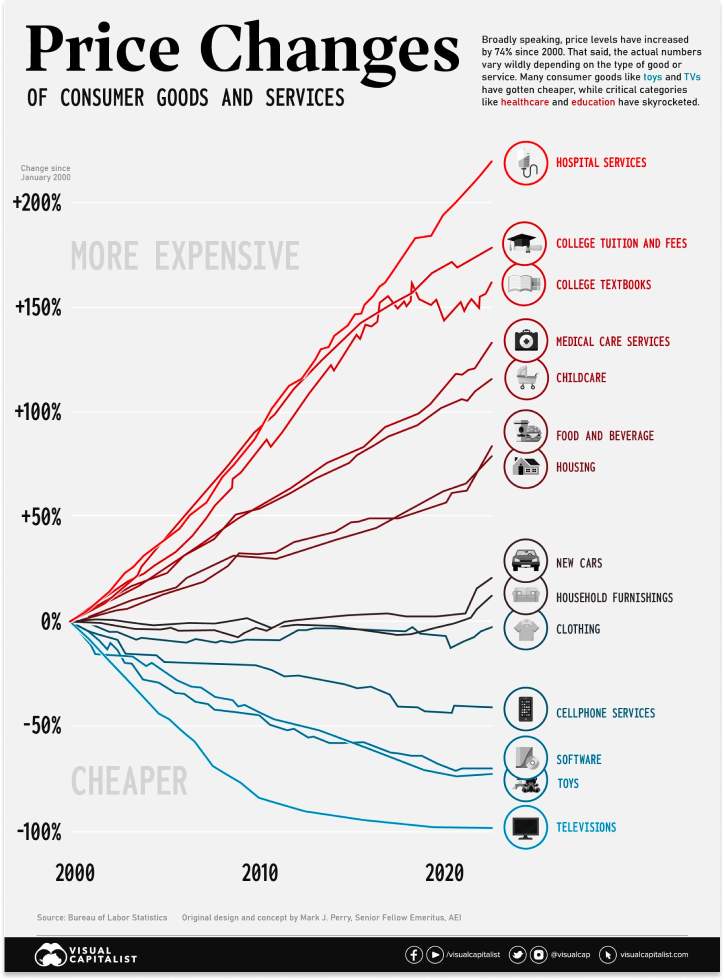

Labor is becoming a scalable utility – plug in, power up, and produce. This will certainly mean change for workers – I’m in the camp that believes we’ll do more fulfilling work and non-work with our time – and it will certainly mean surplus for consumers. If the cost of everything decreases, everyone can have more of what they need. We’ve talked about abundance here a bunch. I’ve seen a lot of tweets and read a lot of essays about what AI might mean for humanity. And those are the most important things, for sure. But my god, just putting on my tech investor hat for a minute, cheaper energy, intelligence, and dexterity are going to be an absolute boon for tech companies. The biggest tech companies of the next decade will be much, much bigger than the biggest tech companies today. Technology is Eating EverythingA little over a decade ago, in a similar in-between kind of market to the one we’re in today, Marc Andreessen wrote Why Software is Eating the World. He wrote about Amazon eating books and Netflix eating entertainment and Google eating direct marketing. He wrote about software enabling the truly big markets, like oil & gas, defense, and retail. The piece was prescient. When he wrote it in the third quarter of 2011, Apple was the largest company by market cap, and Microsoft was the fifth largest, but the top 10 was largely dominated by oil companies, and the market caps were much, much smaller. Today, the top 10 looks like this: Saudi Aramco should be in there at number three, but look at that. The top companies are all tech companies, and the market caps are almost an order of magnitude larger. Tech won. How are we going to top that? Software ate the world, but like the Very Hungry Caterpillar, it is still very hungry. In the incredible Acquired conversation with NVIDIA CEO Jensen Huang, David Rosenthal tells a story from the early days of Sequoia to highlight that venture returns can always get bigger as technology’s market grows:

That’s just compute. What happens when energy, intelligence, and dexterity get cheaper? Later in the conversation, Jensen gives his answer, focusing only on intelligence:

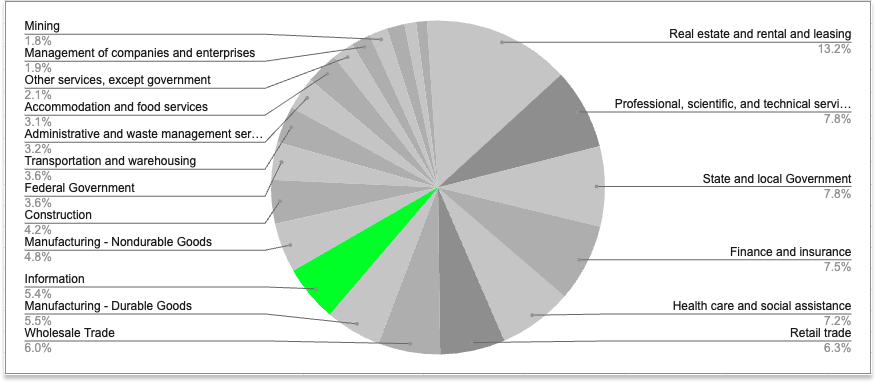

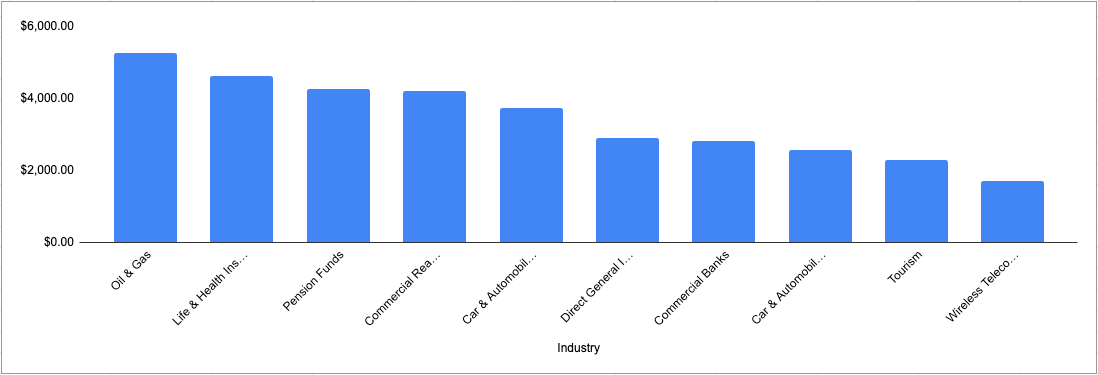

The size of the opportunity is growing as tech – software and hardware – accesses more areas of the economy, and eats more areas of the economy. What’s notable about tech’s dominance of the top companies by market cap list is that it doesn’t map very cleanly to the list of top companies by revenue. Apple, Microsoft, Amazon, and Alphabet come in ninth, thirty-first, fourth, and eighteenth, respectively. Meta, Tesla, and NVIDIA don’t make the top 50. Their market caps are so high because they’re insanely profitable, fast-growing, or dominant within their categories. But other than Amazon in retail and now Tesla in automobiles, they haven’t made a dent in the world’s largest pools of money. There are a few ways to slice what those pools are. The US Bureau of Economic Analysis breaks down GDP by Industry: Tech doesn’t fit fully into any one category – it’s eating the world! – but its best fit is “Information,” which includes activities like software publishing, data processing, and telecommunications. Amazon has certainly penetrated “Retail Trade,” tech workers are included in “Professional, Scientific, and Technical Services,” and computers and iPhones sit in “Manufacturing - Durable Goods,” but there’s a lot left to eat. IBISWorld, which, caveat fontem (for example, they have Telecommunications at the top of the list because of a formatting error), lists the top 10 global industries by revenue: Good data on this is surprisingly hard to find, and I was going to bang my head against the wall to pull it, but this is directionally current and you get the point. Whichever way you slice it, tech companies haven’t won the biggest spend categories. That’s beginning to change. Tech companies are going to get much bigger for two separate reasons, which will converge:

Tech Startups in Hard TechThe first reason tech companies are going to be bigger this decade than last decade is simply that they’re going after bigger buckets of spend, energy, intelligence, and dexterity or not. SpaceX and Tesla kicked this off and showed that it could be done. I think SpaceX in particular is the 4-minute mile of hard tech, because it showed that a tech company could break into an incumbent and government-dominated industry and win by offering a better product at a better price. While the launch market itself isn’t massive today, SpaceX is entering the trillion-dollar communications market with Starlink. And if the Space Economy flourishes, SpaceX is positioned to be the its infrastructure layer. SpaceX is currently the most valuable private tech company at $150 billion, and many of its alums have gone on to start and work for the next generation of hard tech companies. Anduril is a spiritual descendent of SpaceX with a key evolution: it’s betting that by launching hardware products on top of its AI-powered software operating system, Lattice, it will be able to “deliver more capable hardware products for less money, and that its advantages will compound with each new product it plugs in.” The company is putting its money where its mouth is, funding its own R&D and acquisitions and bidding on fixed-price contracts instead of the Department of Defense’s traditional cost-plus contracts, where the winner gets paid for all of their costs, original budget be damned, plus a fixed margin. If it keeps costs low and product quality high enough to win contracts, it reaps the rewards in the form of higher margins. The mega bull case for Anduril is that it will be able to eat into the more than $100 billion the US DoD spends with the five Defense Primes each year, but at much higher margins, in the 50% range instead of the 10% range. Higher margins mean a few things:

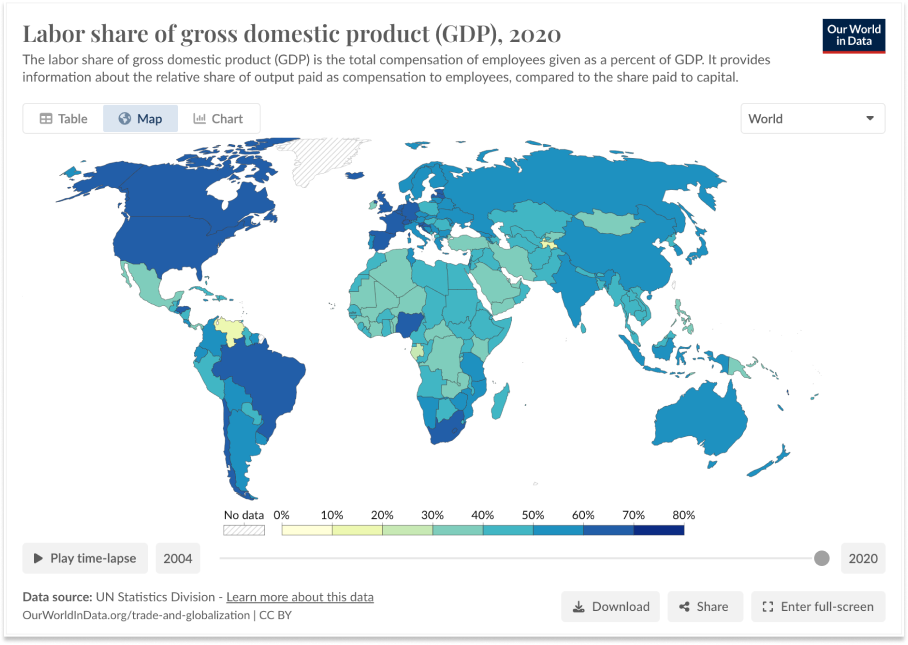

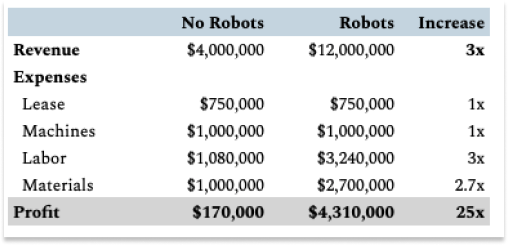

With Anduril, we’re starting to see the early glimpses of what the world might look like when tech companies eat large, established markets. Anduril’s revenue is nowhere close to Lockheed Martin’s $66 billion today, but if everything goes just right, if the market comes to it over the next decade, the company could find itself in a position where it is earning tens of billions of dollars in revenue at something like 50% margins, for a market cap that’s multiples higher than Lockheed’s on the same revenue. Lower costs, better margins, and faster growth unlock value. The same revenue in the hands of a well-run tech company is worth multiples of what it would be in the hands of an incumbent. What’s particularly interesting in the context of this conversation is that the traditional Defense Primes seem to struggle to do the same. Last month, when Boeing reported its third quarter earnings, it blamed the $1.7 billion in losses in its Defense, Space, and Security Division on fixed-price contracts. “Rest assured,” the company’s CFO Brian West assured analysts, “We haven't signed any fixed-price development contracts, nor intend to.” That’s one of the reasons tech companies will be bigger in the next decade: if the thesis that good software combined with cheaper hardware is better than more expensive hardware alone, the financial picture of companies in big spend categories begins to shift towards looking more like software companies. Not all the way there, but more like them. The success of companies like SpaceX and Anduril has inspired a wave of newer startups to tackle huge, established, challenging industries. Of course, there are aerospace and defense startups, companies I’ve written about like Varda and Array Labs, plus dozens more credible and well-backed teams, many of which hail from SpaceX and Anduril themselves. But it extends beyond the obvious ones into anything hard in the physical world, including two legs of the energy, intelligence, and dexterity stool. Like energy. As we’ve been interviewing founders in nuclear fission and fusion for Age of Miracles, for example, it’s incredible how often SpaceX in particular has come up. My co-host, Julia DeWahl, is a SpaceX alum who recently co-founded a company, Antares, that’s working to bring nuclear power to the DoD. And dexterity. Tesla itself is using its resources, including its Dojo Supercomputer and AI team, to develop the Optimus Robot. Figure is developing the 01. And it’s not just America. China claims to have a plan to mass-produce humanoid robots that can “reshape the world” in the next two years. The race is on. Increasingly, tech startups will steal market share in the largest industries on earth, changing the financial dynamics of those industries and unlocking value in the process. But I think the bigger opportunities might be in converting large, non-addressable markets into addressable markets. Expanding Tech’s TAMIn Intelligence Superabundance, I argued that AI wouldn’t replace the need for human workers, but that thanks to concepts like induced demand and Jevons Paradox, more intelligence would create demand for even more intelligence. Extending that argument, cheaper labor – intelligence and dexterity – will create demand for more labor. Importantly, it will make an increasing share of that labor – mental and physical – addressable. Humans earn for themselves; AI and robots earn for whoever sells them. According to the International Labour Organization’s 2020-2021 Global Wage Report, people around the globe earn roughly $44 trillion. Sense checking that against labor’s share of GDP, it checks out. In 2020, Global GDP was $85.2 trillion. The worldwide labor share of GDP was 53.8%. That gives us $45.8 trillion in global compensation. So we’re looking at $45 trillion in annual spend that is not currently addressable by any tech company that can be addressed only by tech companies. (Note: This piece is not about the ethical implications or the potential dislocation that might occur. For what it’s worth, I believe that, after a transition period, people will do more fulfilling work than work that robots can replace, or find more fulfilling non-economic things to do with their time, but I also think that there will be a gap between those who adapt quickly and those who don’t. But this piece is just about the economic implications). I know that this sounds insane and hyperbolic. And for a while, it will be. Optimus can move some blocks around, like a baby. Figure 01 can walk, like my 1-year-old. And I need to tell ChatGPT exactly what I want done, and keep pushing it to get a result I’m happy with, like an intern. But AI keeps getting smarter, more capable, and cheaper. As OpenAI rolled out an ocean of new features at Dev Day, it also cut prices for those features by 2-3x. Intelligence is getting more powerful and cheaper at the same time. Why cut prices? In a prescient 2009 blog post, Y Combinator founder Paul Graham wrote a post on the five most interesting startup founders of the past 30 years. He included a young Sam Altman, writing, “On questions of strategy or ambition I ask ‘What would Sama do?’” Sama likely isn’t being charitable by cutting prices; he believes the increase in demand for intelligence will outweigh the impact of lower prices. Jevons Paradox. Suddenly, lawyers, accountants, and any manner of professional services providers become part of tech’s addressable market. Not in a “we can sell these big industries software” way, but in a “we can make and sell you lawyers as-a-service” way. OpenAI’s GPTs – “custom versions of ChatGPT that combine instructions, extra knowledge, and any combination of skills” – are a little preview of this world. Robots, too, will get cheaper and more capable, especially as they’re infused with AI that’s cheaper and more capable. They’ll take time to scale, and it will be a while before they come down the experience curve to the point that they’re cheaper than human labor. Today, they don’t need to be. As I wrote about in my piece on Formic, America faces a huge labor shortage, with 10.1 million unfilled jobs at the time, 1.5 million of which were in manufacturing. Robots – whether they look and walk like humans or do one task really well – can fill open roles, and work round the clock, dramatically increasing the profits of the factories that employ them. In manufacturing, because so much of a facility’s costs are fixed:

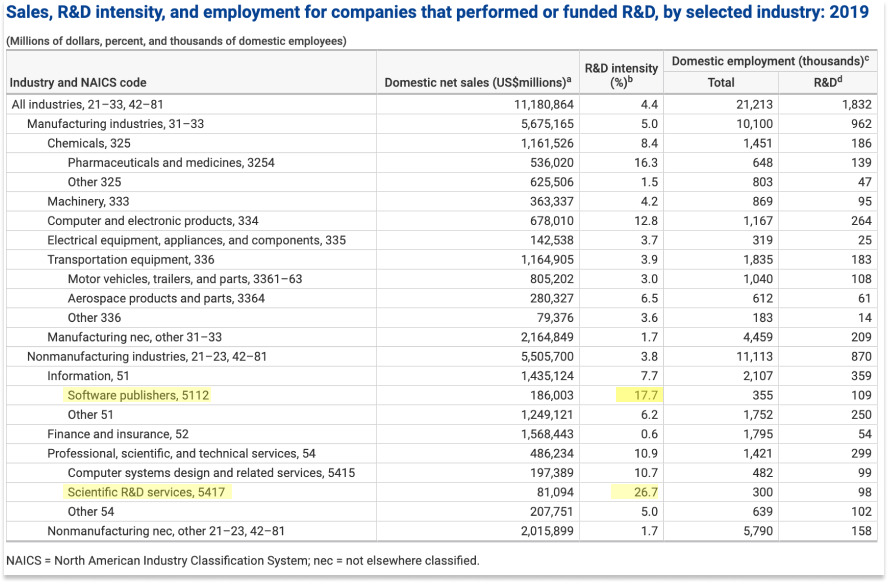

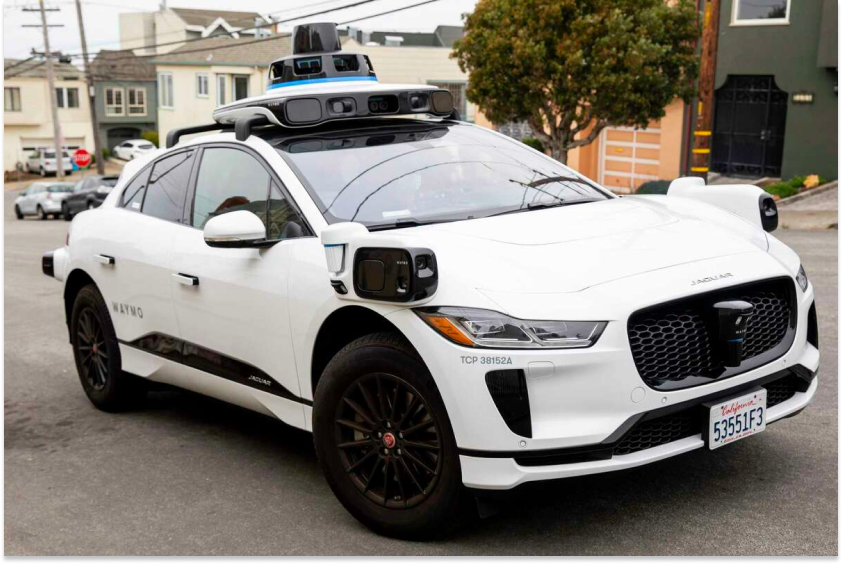

With those profits, manufacturers can pay higher wages, hire more people, buy more robots, and make products more cheaply. That will increase demand, and keep the flywheel spinning. Dexterity is an important step towards material abundance. Intelligence and dexterity, by becoming cheaper, will increase their market size and make the market addressable to the tech companies that make the intelligence and dexterity. Again, I don’t know if this will play out over five years, ten years, or twenty. Regulators may try to stop it in a misguided attempt to protect workers (who typically, counterintuitively, benefit from automation). A million things can and will stand between what the plan looks like on paper and how it gets implemented in reality. All of this stuff will be messy and complex. But it will happen. And as it does, one final thing will happen: every market will trend towards behaving like a software market. Every Market Will Look More Like SoftwareAs the costs of energy, intelligence, and dexterity approach zero, the cost and speed of manipulating and distributing atoms will approach the cost and speed of manipulating and distributing bits. I said approach, not match, because the laws of physics stand in the way. Bits can move at the speed of light; atoms cannot. Bits can cost practically zero; atoms cannot. The cost and speed of physical things will asymptote somewhere above zero, but they’ll get much cheaper and faster than they are today. Turning labor into CapEx will change cost structures. It will require more upfront investment and enable lower marginal costs. As that happens, every industry will come to look more like the software industry. Faster growth, higher margins, more R&D. Here’s a relevant table from the National Scientific Board. It looks at R&D intensity – R&D spend as a percentage of net sales – by industry. It once again shows how small software is compared to other industries, but it also shows how much more the industry spends on R&D. Software companies have an R&D intensity of 17.7%, meaning that they spend 17.7% of net sales on R&D. The only category that’s higher – Scientific R&D services at 26.3% – is the category that includes biotech, nanotechnology, advanced materials, and renewable energy, and literally has R&D in its industry name. Compare that to manufacturing broadly, at 5%, or a particular laggard in Finance and Insurance, at 0.6%. Those seem ripe. It makes sense when you think about it. Industries whose main product is intellectual property spend more money on researching and developing that intellectual property. They spend a lot of money on research and development upfront, and reap the benefits of high marginal costs over time. Because their products are information-based and not physical, they can grow more quickly. But what happens when the marginal costs of almost everything approach zero? I think the majority of SaaS companies are going to have a hard time, but SaaS is a great business model if you can protect it. I understand why investors like it so much and want to hold on. The real big opportunity here, though, is that large swaths of the economy might come to look like SaaS models, but with deeper moats – higher switching costs, meaningful economies of scale, and even network effects as the most used AI and robots get smarter and more skilled with more usage of any member of their fleet. This is kind of happening already, in a very early form, with robotaxis. While they’re still money-burning endeavors, the model is beginning to emerge. Instead of every driver having a car that they operate for eight, maybe 12 hours a day, burning their own time for money, robotaxis will be able to run practically non-stop, save for charging time, running on near-free and ever-cheaper machine labor. Waymos are electric vehicles powered by renewables, which can be super, super cheap if you charge at the right time. So Waymo invests in cars, the models needed to run them, and the data needed to train them, then powers up with cheap renewables, and can run practically non-stop. Currently, it needs to burn a lot of car time on data collection, but that might change, too. The end result is that they’ve pushed as much driving OpEx as possible into CapEx. At scale, each ride will be so cheap – approaching the same cost for the rider as a ride on public transport – that companies like Waymo might charge a subscription instead of per-ride to lock in customers and generate predictable cashflows. Plus, according to a study Waymo did with reinsurance giant Swiss Re, their cars are already 4x safer than human drivers, and getting safer as the cars get smarter. You’d imagine that will show up in lower insurance rates, making the model even more profitable at scale, giving the company more money to invest in R&D and fleet expansion, and accelerating tech’s devouring of a big portion of transportation demand. As energy, intelligence, and dexterity get cheaper, more abundant, and more on-demand, we’ll see this same thing play out in other sectors of the economy. More and more industries will come to look like software. Of course, this will not be a smooth transition and it will not happen overnight in any industry, as the pushback against robotaxis shows. A bunch of chatbots and robots won’t be able to replicate everything that large manufacturers can do overnight. There are huge CapEx investments and know-how that would be difficult to replicate. Energy startups will take decades to displace the fossil fuel giants, if the fossil fuel giants don’t leverage their scale and regulatory skill to make the investment in clean energy first. The whole point of Age of Miracles is that these big industry transitions are much harder and more complex than they look on paper. And in some cases, large incumbents will be the ones to invest in AI and robots, to lower their costs, increase their output, increase demand, and improve margins. In those cases, the companies that make the AI and the robots – or whichever flavor of intelligent machine they need for the task at hand, just as humans do some things and machines do others today – will become very valuable indeed. Those will be tech companies, and they will be big. And as they scale production to meet demand, they’ll bring their products down the learning curve, making the machines that make the things cheaper and cheaper, which will make them more widely accessible, and make all of the things cheaper and cheaper. Then, when you can, for all intents and purposes, speak a product into existence, what becomes valuable is the IP. Reggie James put it well: More spend will shift from production to R&D, across all industries. Everything, even things that deal in atoms, will look more like software companies. Lower prices, more demand, higher margins. In bigger markets than technology touches deeply today, with, I think, benefits to scale that come from having swarms of smart machines that can learn and teach each other the more they experience. Hardware experience curves at near-software speeds. While you can still paint a strong bull case for tech even if its AI and robots simply power incumbents to improve their performance, my suspicion is that companies built from the ground up for this new paradigm will ultimately win, as Anduril and SpaceX are showing. If every company behaves more like a software company, then startups should be able to leverage modern technology and tech company nimbleness to build structurally better businesses than incumbents in very large categories. And that’s before the costs of energy, intelligence, and dexterity get close to zero. What’s It All Mean?So: The economy will get larger and structurally more profitable as the prices of energy, intelligence, and dexterity trend to zero. If incumbents maintain their position, there will be massive opportunities for tech companies to sell plug-and-play labor and intelligence to them, essentially productizing, centralizing, on-demanding, and SaaSifying what is now a distributed, inconsistent product in human labor. Early evidence in industries as varied as auto and defense suggest that many incumbents will not maintain their position in a sufficiently dramatic shakeup. I think the transition could be akin to what Spotify did to the music industry - growing the market, but killing CDs. If that’s the case, tech companies will both provide the infrastructure – intelligence and dexterity, and potentially energy – and build the products that serve end customers in massive markets that have been largely impervious to startups, like manufacturing and defense. There’s always the major risk – certainty, actually – that regulatory capture staves off some of the benefits – and the disruption – for longer than we’d imagine in certain industries. But when people start heading to Mexico for cheaper robot medical services in droves, that will start to break down. The long and short of it is, tech companies will tap into larger and growing pools of revenue at lower costs and higher margins than they’ve been able to to date. Everything will be cheaper, and they’ll sell much more of it. They’ll reinvest profits into R&D, and turn the fruits of that R&D into newer, cheaper, better products at an accelerating rate. The economy will become much bigger and structurally more profitable. Companies will be able to hire more people and machines, and consumers will be able to acquire most anything more cheaply, maybe as-a-service. There are some big pools we haven’t touched on. Real estate will be tough thanks to zoning, regulation, NIMBYs, and the industry’s capital structure (writing this piece has made me want to buy land). Finance and insurance spend the least on R&D – 0.9% – but they have large customer deposits and cost of capital advantages. I do think crypto becomes an even more formidable challenger in a world where intelligent machines play a larger and larger role. Anyway, tech companies will get much, much bigger than they are today. I think this framing can help explain a lot of what we’re seeing out there. NASDAQ is heading back in the direction of all-time highs and crypto is coming back even as rates remain high and software companies’ forward estimates come down. In venture, there’s a bifurcation: a lot of software companies with good numbers are struggling to raise while foundation model companies, hard tech companies, and even nuclear companies are hoovering up investor dollars. One way of framing this is that any company that is convex to this trend we’re discussing will be able to raise at what seem like crazy valuations, and any company that isn’t, or worse, is at risk from it, will struggle to find investor interest at any price. There’s an intense battle being waged between those who want to regulate AI in a way that would benefit its current leaders and those who want to keep it open, as exemplified by President Biden’s Executive Order and the open letter from technologists and investors fighting for open source. This debate has been shrouded in language around safety and extinction risk, but when you think about the opportunity to make a $45 trillion market addressable by a small number of companies, safetyists begin to look like useful idiots in a bigger game. Tech companies as a group will get much, much bigger than they are today. Take that to the bank. The question is: how many tech companies? Will it be a small handful of 10-trillion-plus-dollar companies, or a larger number of mere trillion-dollar companies? That’s to be determined. The trend is clear, but the details are up to how everyone plays it. Whatever the case, you need to think way bigger to win in a world where intelligence and labor are being commoditized. Take your ambition and multiply it by 100. Craft a Grand Strategy. We’ll talk about that next time. Thanks to Dan and the new ChatGPT with 128k context window for editing! That’s all for today. We’ll be back in your inbox with the Weekly Dose on Friday! Thanks for reading, Packy |

Older messages

Weekly Dose of Optimism

Friday, November 3, 2023

Mini Lasers, Giant Reactors, DNA Origami, AoM e3, AI EO, Palmer

Medicine's Endgame

Tuesday, October 31, 2023

The past, present, and future of cell-based therapy

Age of Miracles

Friday, October 27, 2023

Launching Season 1: Nuclear Energy

Weekly Dose of Optimism #64

Tuesday, October 24, 2023

Age of Miracles, Solar Resolution, Sturgeon, Purple Cloth, Charles Feeney, Loom

Weekly Dose of Optimism #65

Friday, October 20, 2023

Peace in the Middle East, Techno-Optimism, Scaling Nuclear, Collisons, Direct File

You Might Also Like

🔮 $320B investments by Meta, Amazon, & Google!

Friday, February 14, 2025

🧠 AI is exploding already!

✍🏼 Why founders are using Playbookz

Friday, February 14, 2025

Busy founders are using Playbookz build ultra profitable personal brands

Is AI going to help or hurt your SEO?

Friday, February 14, 2025

Everyone is talking about how AI is changing SEO, but what you should be asking is how you can change your SEO game with AI. Join me and my team on Tuesday, February 18, for a live webinar where we

Our marketing playbook revealed

Friday, February 14, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Cribbage Day, Reader... Don't get skunked! In today's

Connect one-on-one with programmatic marketing leaders

Friday, February 14, 2025

Enhanced networking at Digiday events

Outsmart Your SaaS Competitors with These SEO Strategies 🚀

Friday, February 14, 2025

SEO Tip #76

Temu and Shein's Dominance Is Over [Roundup]

Friday, February 14, 2025

Hey Reader, Is the removal of the de minimis threshold a win for e-commerce sellers? With Chinese marketplaces like Shein and Temu taking advantage of this threshold, does the removal mean consumers

"Agencies are dying."

Friday, February 14, 2025

What this means for your agency and how to navigate the shift ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Is GEO replacing SEO?

Friday, February 14, 2025

Generative Engine Optimization (GEO) is here, and Search Engine Optimization (SEO) is under threat. But what is GEO? What does it involve? And what is in store for businesses that rely on SEO to drive

🌁#87: Why DeepResearch Should Be Your New Hire

Friday, February 14, 2025

– this new agent from OpenAI is mind blowing and – I can't believe I say that – worth $200/month