Checking On-Chain Indicators for Green Shoots in the Digital Assets Market

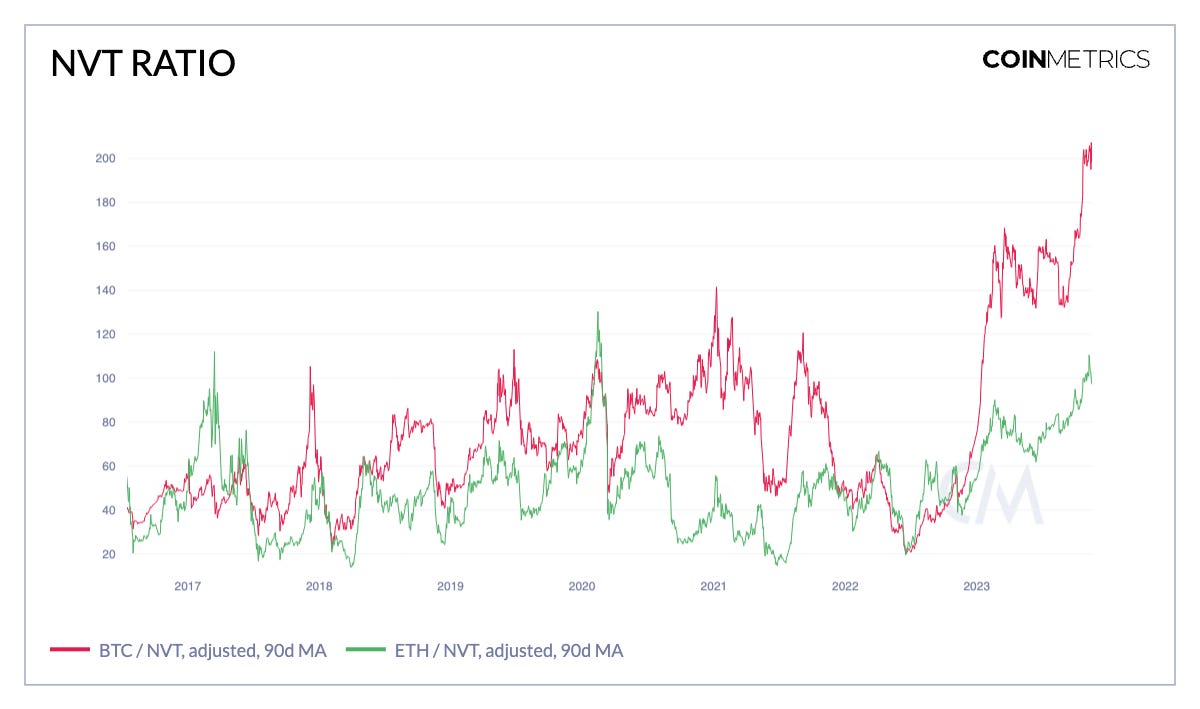

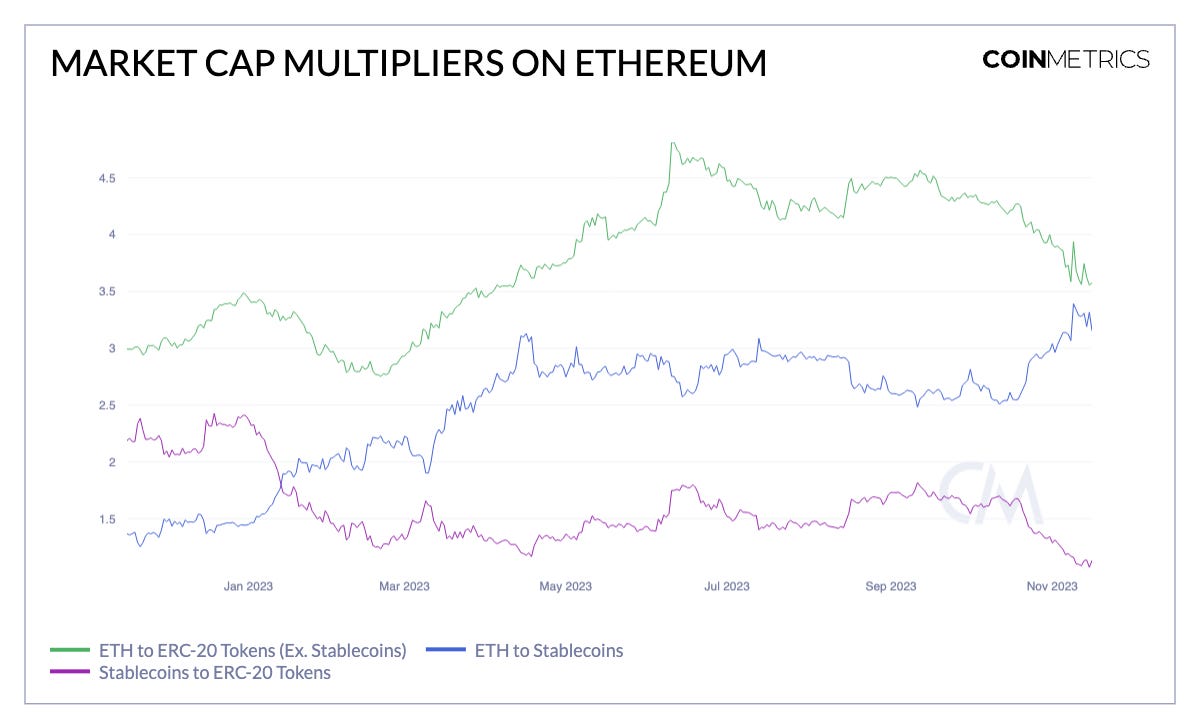

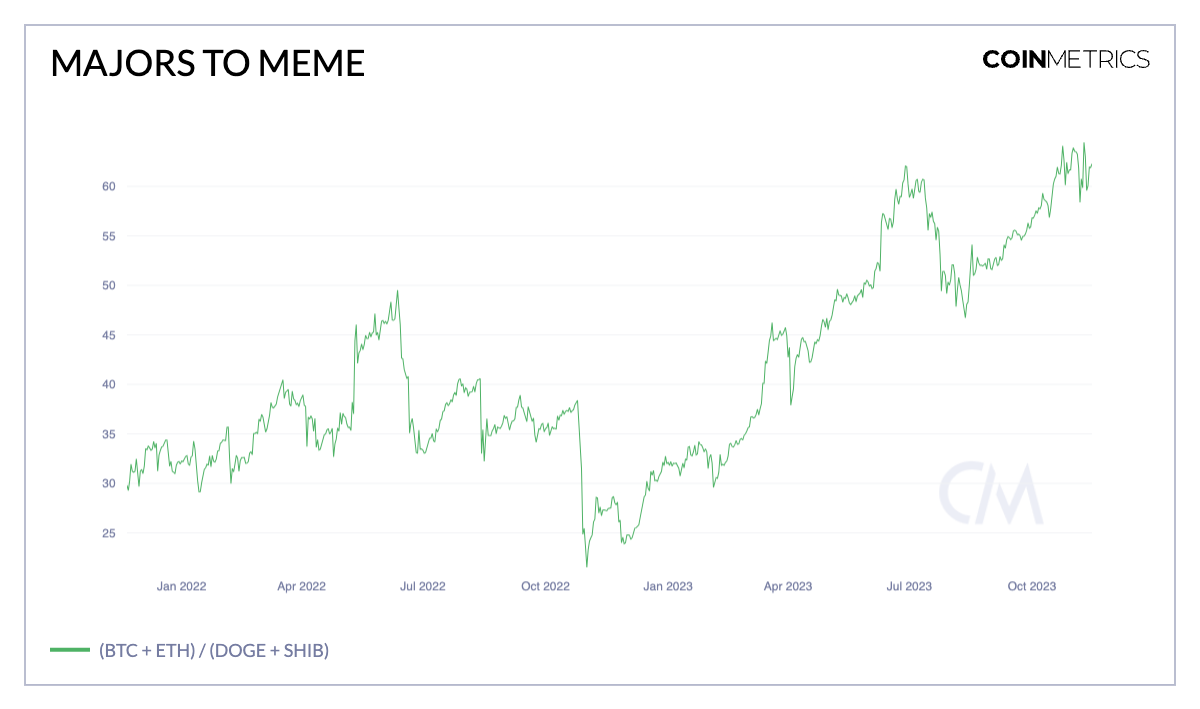

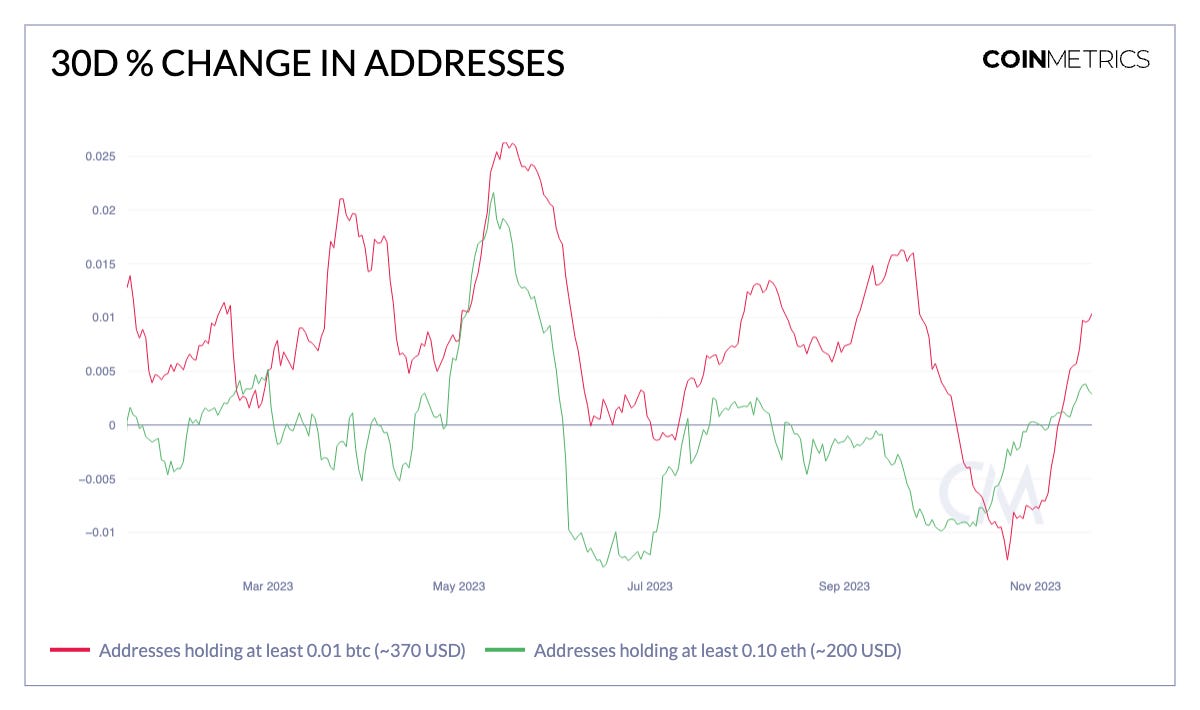

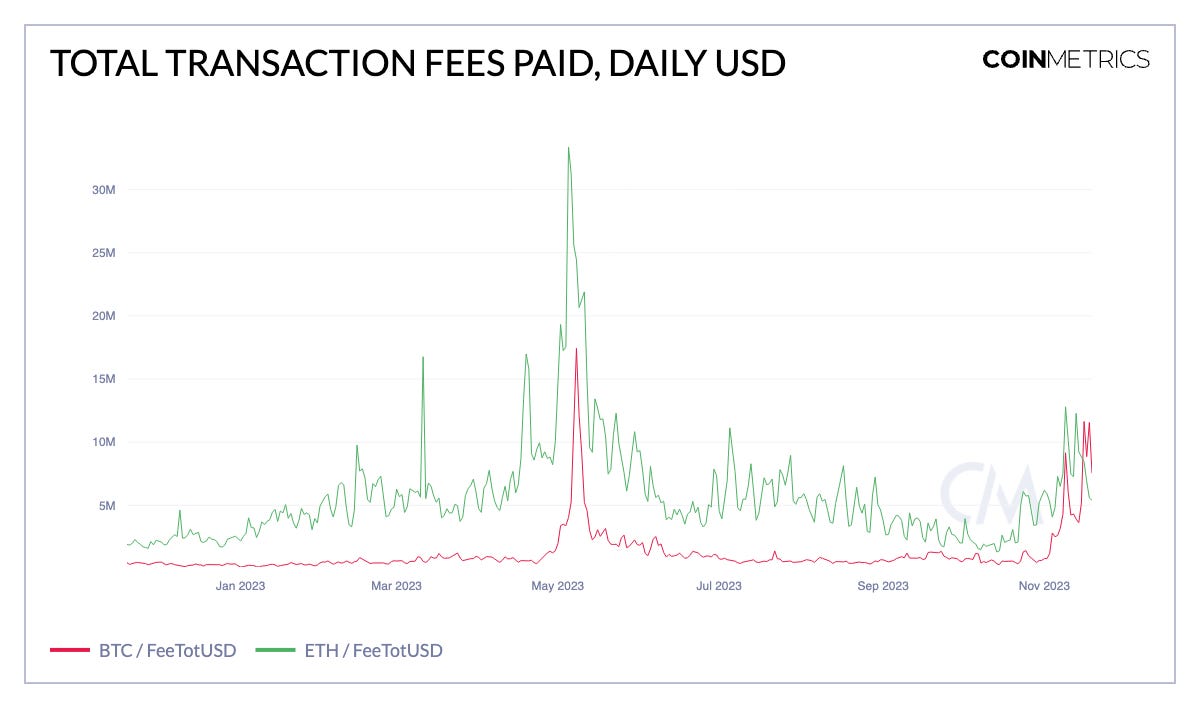

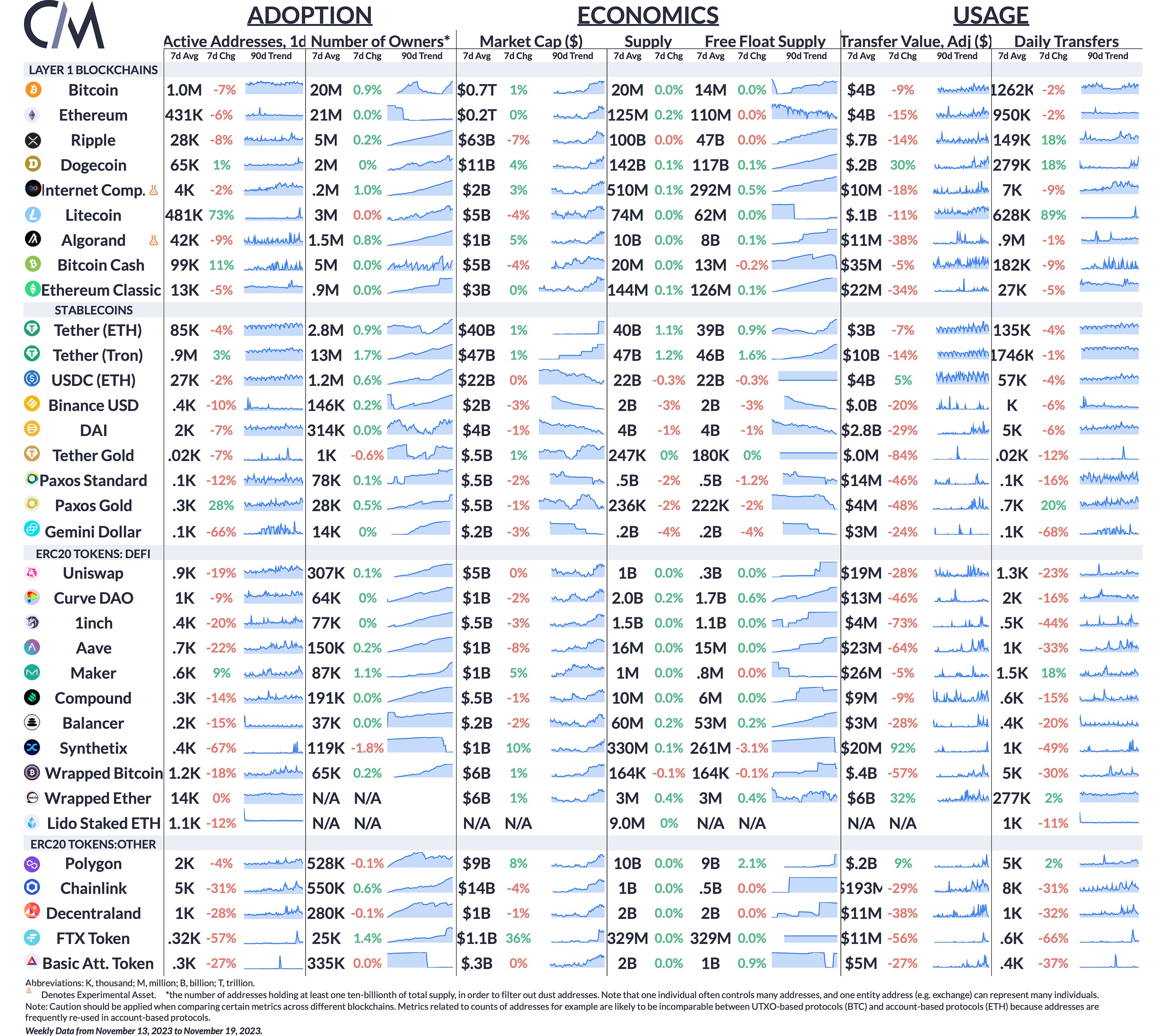

Checking On-Chain Indicators for Green Shoots in the Digital Assets MarketCoin Metrics’ State of the Network: Issue 234Get the best data-driven crypto insights and analysis every week: Checking On-Chain Indicators for Green Shoots in the Digital Assets MarketBy: Kyle Waters & Matías Andrade IntroductionIn macroeconomics, analysts have long relied upon a set of established indicators to pinpoint the health and trajectory of the economy. The study of macroeconomics is a well-trodden path, rich in historical precedent. In contrast, the crypto-economy, still in its nascent stages, requires creativity and domain expertise to find appropriate indicators. But as the availability of crypto data and our understanding of it has grown, so has the available set of indicators. While caution must be exercised in over-relying on any single metric in dynamic and unpredictable markets, certain indicators can provide valuable insights. In this week’s edition of State of the Network, we present a selection of indicators that offer us insights against the backdrop of a recent surge in valuations within the digital assets ecosystem. On-Chain RatiosThe Network Value to Transfer Value (NVT) ratio, which is the network value (or market capitalization) divided by the adjusted transfer value, offers an interesting view to start with. Essentially, NVT compares a blockchain's market capitalization against its on-chain transactional activity. A blockchain with a high NVT indicates low usage relative to its market cap, serving as a counterpoint to the concept of velocity. Put simply, a high NVT means that an asset's valuation is rising much faster than underlying activity on the network. Due to inherent differences in how various blockchains are used, direct comparisons of NVT across different assets can be challenging. As we can see below, NVT has risen sharply for both BTC and ETH, hinting that their valuations are currently rising faster than underlying transfers. This might be due to a lag in underlying activity, which might pick up in the wake of recent price action. Source: Coin Metrics Network Data Pro Moving on to another popular indicator, market value to realized value (MVRV) has historically been one of the most reliable on-chain indicators of bitcoin market tops and bottoms. MVRV is calculated by dividing bitcoin’s market capitalization by its realized capitalization. Realized capitalization can also be thought of as a gross approximation of bitcoin’s aggregate cost basis. Historically, a high ratio of market capitalization to realized capitalization has signaled that bitcoin price was near a local maximum, while a low ratio has indicated that price is near a local minimum. Source: Coin Metrics Network Data Pro The few times that MVRV has dropped below one have historically been some of the best times to buy bitcoin. An increasing MVRV indicates that current sentiment is increasing fast relative to estimated aggregate cost basis, while decreasing MVRV signals the opposite. The MVRV of bitcoin has increased recently, but is still below historical levels at 1.8. Market Cap MultipliersWe can also examine the relative market capitalizations of different segments within the ecosystem to gauge investor sentiment and trends. The chart below compares the relative market caps within the Ethereum ecosystem, focusing on Ether (ETH), stablecoins, and other ERC-20 tokens in the datonomy™ universe. Sources: Coin Metrics Network Data Pro & datonomy™ A notable observation is the increasing valuation of ETH and ERC-20 tokens compared to stablecoins. The market capitalization of stablecoins has not kept pace with these other segments. This divergence could indicate a shift in capital from stablecoins, perceived as safer assets, to ETH and ERC-20 tokens, which are generally considered riskier but with greater potential for appreciation in a bull market. Another intriguing aspect is the market cap ratio of ETH to ERC-20 tokens. There has been a recent decline in this ratio, suggesting that some ERC-20 tokens have experienced more significant gains than ETH. This trend could reflect a growing appetite for risk among investors, as ERC-20 tokens often exhibit higher volatility and are more sensitive to market changes (a higher beta) compared to ETH. This movement towards riskier assets could be propelled by investors chasing higher returns, fueled by optimistic sentiment surrounding the anticipated launch of a bitcoin spot ETF in the U.S., an event seen as a clear catalyst for institutional re-evaluation of the digital assets market. An intriguing trend is the relative underperformance of “meme” coins like DOGE and SHIB compared to BTC and ETH. The “majors-to-meme” ratio below, which compares the combined market value of Bitcoin and Ether to that of Dogecoin and Shiba Inu, now stands at 60x—the highest it has been in over a year. This disparity may reflect a growing investor preference for assets with more established fundamentals and clearer investment theses. Source: Coin Metrics Network Data While BTC and ETH are increasingly viewed as 'quality' assets due to their broader adoption and more defined roles in the digital economy, meme coins, often driven by retail enthusiasm, lack similar levels of institutional acceptance and clear long-term value propositions. On-Chain FundamentalsExploring on-chain fundamentals provides another valuable perspective. This involves analyzing the real-time data from public ledgers, which offers a view of the adoption and usage of blockchain networks. While adoption generally unfolds over an extended period, on-chain data can help us understand if recent valuation increases are paralleled by a growth in the number of users joining or actively using the network. One metric we can look at is the growth in new addresses holding a non-negligible amount of native units. The chart below, with a 30-day moving average, shows that while there has been an uptick in address growth, it hasn't been markedly significant. In terms of active addresses, Bitcoin has seen a recent increase, but Ethereum has not experienced a similar surge. However, it's important to note that with the rise of layer-2 networks on Ethereum, the significance of active addresses on its layer 1 as a fundamental metric may be diminishing. Source: Coin Metrics Network Data Another important indicator is the fees paid by users. Recently, fees on both Bitcoin and Ethereum have escalated. On November 16th, users paid over $11 million in transaction fees on Bitcoin, exceeding the total fees paid on Ethereum for the first time since December 2020. A significant driver of this increase is the growing interest in ordinals and inscriptions on the Bitcoin network. This surge in activity has resulted in the Bitcoin mempool reaching its highest level of congestion in recent times. Source: Coin Metrics Network Data ConclusionThe current digital assets landscape presents a multifaceted picture. While the NVT ratio indicates that valuations are outpacing underlying network usage, MVRV remains historically low. Adding another layer to this complexity is the liquidity of bitcoin in the market, with only a small percentage, <30%, of BTC having been active in the past year. This scenario underscores the importance of not relying too heavily on any single metric or ratio for a complete market assessment. Market capitalization trends suggest a growing preference for established and 'quality' assets, yet there is also noticeable momentum in some altcoins. The recent increase in the total market cap of stablecoins, albeit at a slower pace than the rise in asset prices, could be indicative of new liquidity flowing into the crypto-economy. On-chain activity provides additional nuance. For instance, address growth is only beginning to accelerate, while transaction fees have seen a sharp increase. Overall, the market shows a mix of bullish indicators. It's important to approach these signs with some balance, but they could very well be signs of a more significant trend on the horizon. Network Data InsightsSummary MetricsSource: Coin Metrics Network Data Bitcoin active addresses declined 7% while Ethereum active addresses fell 6% over the week. The market cap of Tether (USDT), continued to push higher to a new all-time high above $87B. Coin Metrics UpdatesThis week’s updates from the Coin Metrics team:

As always, if you have any feedback or requests please let us know here. Subscribe and Past IssuesCoin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data. If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here. © 2023 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter. |

Older messages

Coin Metrics’ State of the Network: Issue 233

Tuesday, November 14, 2023

November Rally Reaches New Corners of the Digital Asset Market

Coin Metrics’ State of the Network: Issue 232

Tuesday, November 7, 2023

Ethereum Staking Through the Lens of Lido

Coin Metrics’ State of the Network: Issue 231

Tuesday, October 31, 2023

Unpacking the Forces Behind the Market Rally

Coin Metrics’ State of the Network: Issue 230

Tuesday, October 24, 2023

Navigating the Liquidity Landscape: Insights into Digital Asset Markets

[Report] Coin Metrics’ State of the Network: Issue 229

Thursday, October 19, 2023

Coin Metrics ⨉ Bitcoin Suisse—Exploring Supply Transparency

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏