State of Stablecoins: Signs of Returning Liquidity

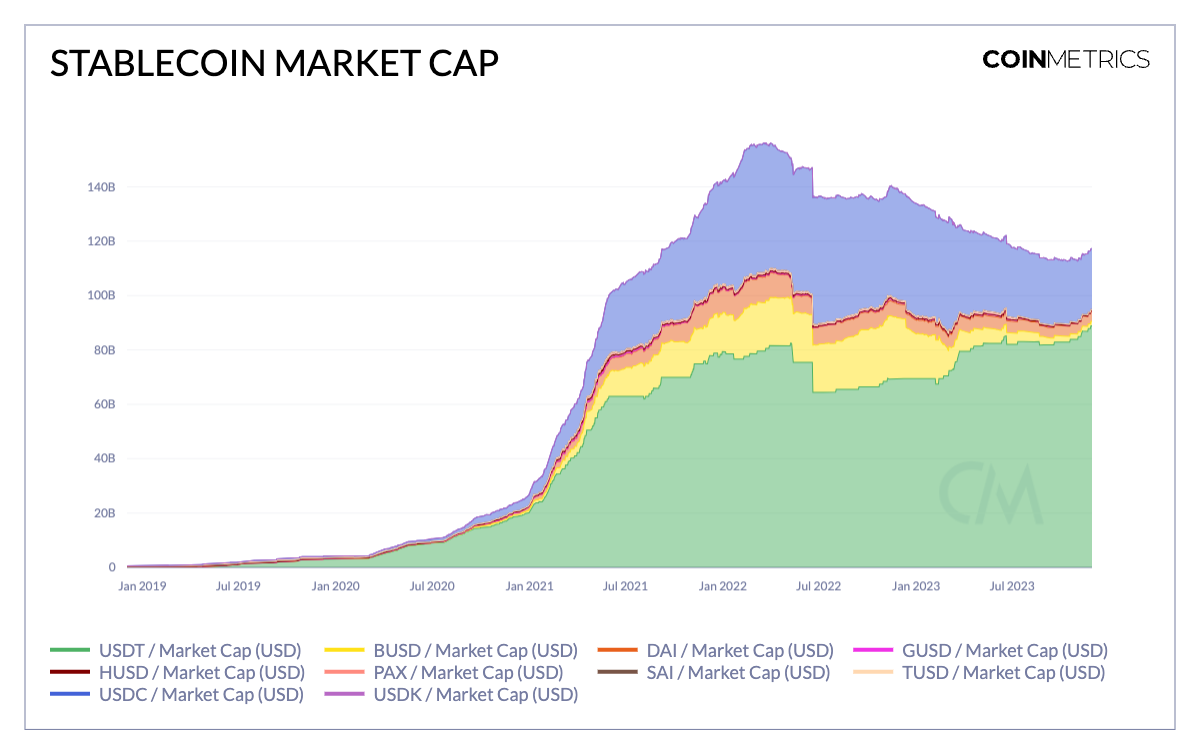

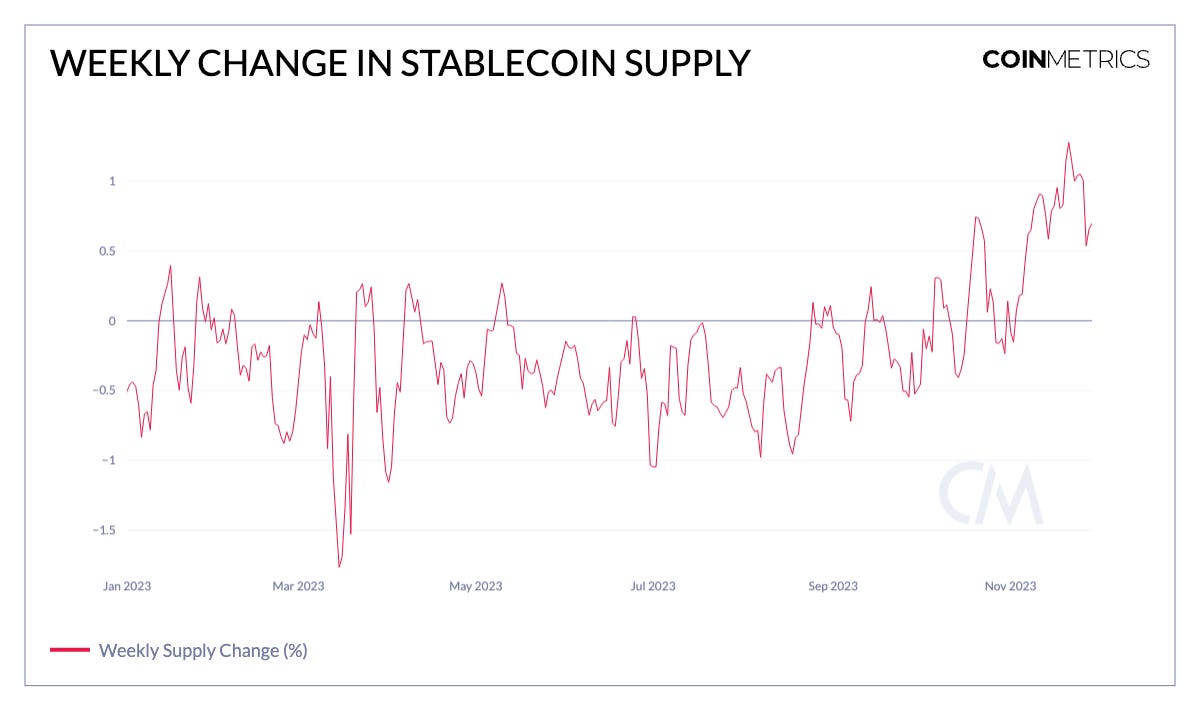

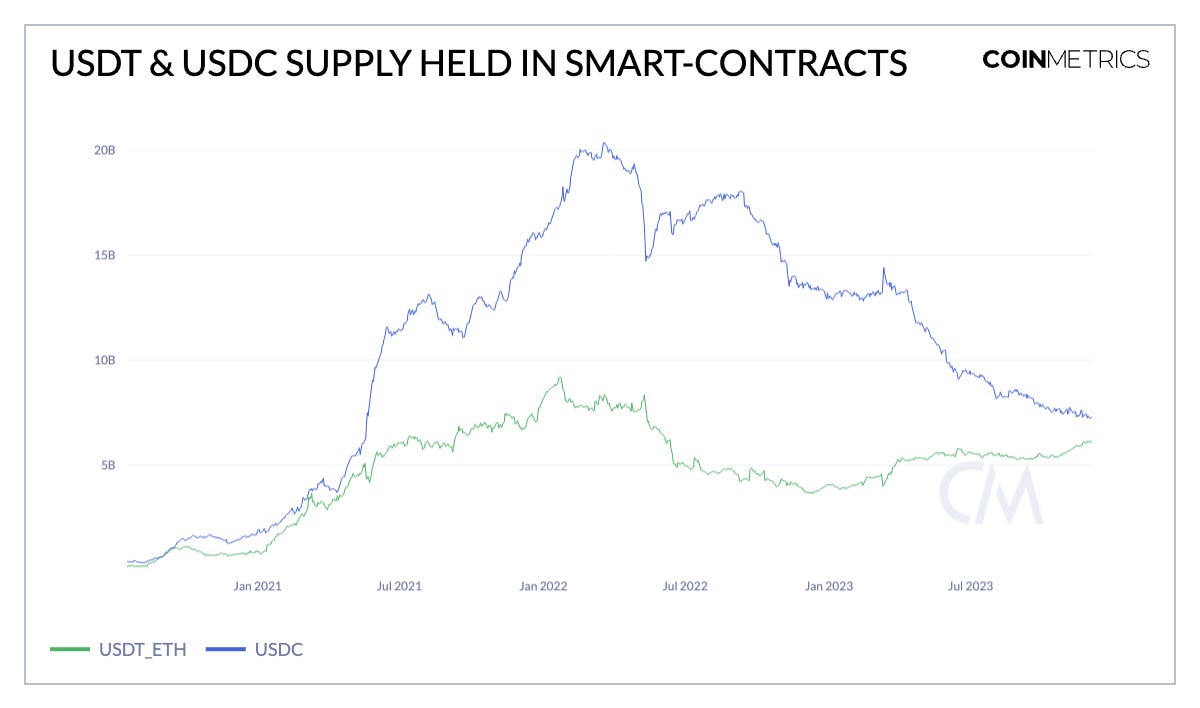

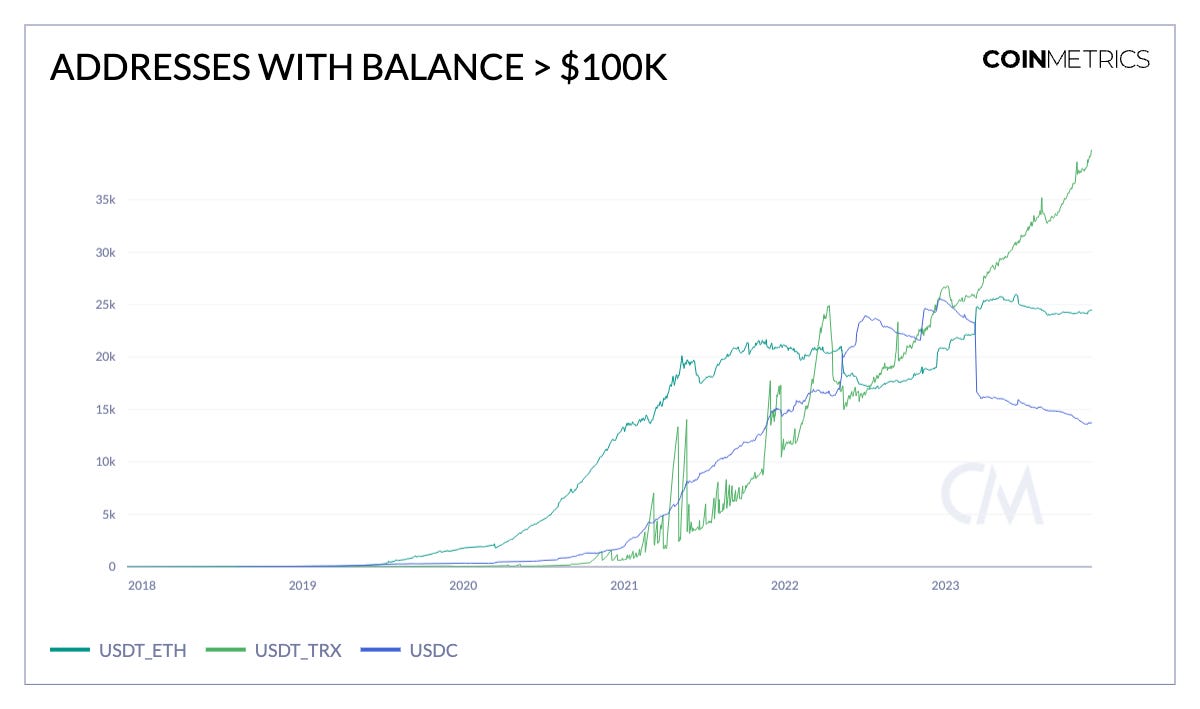

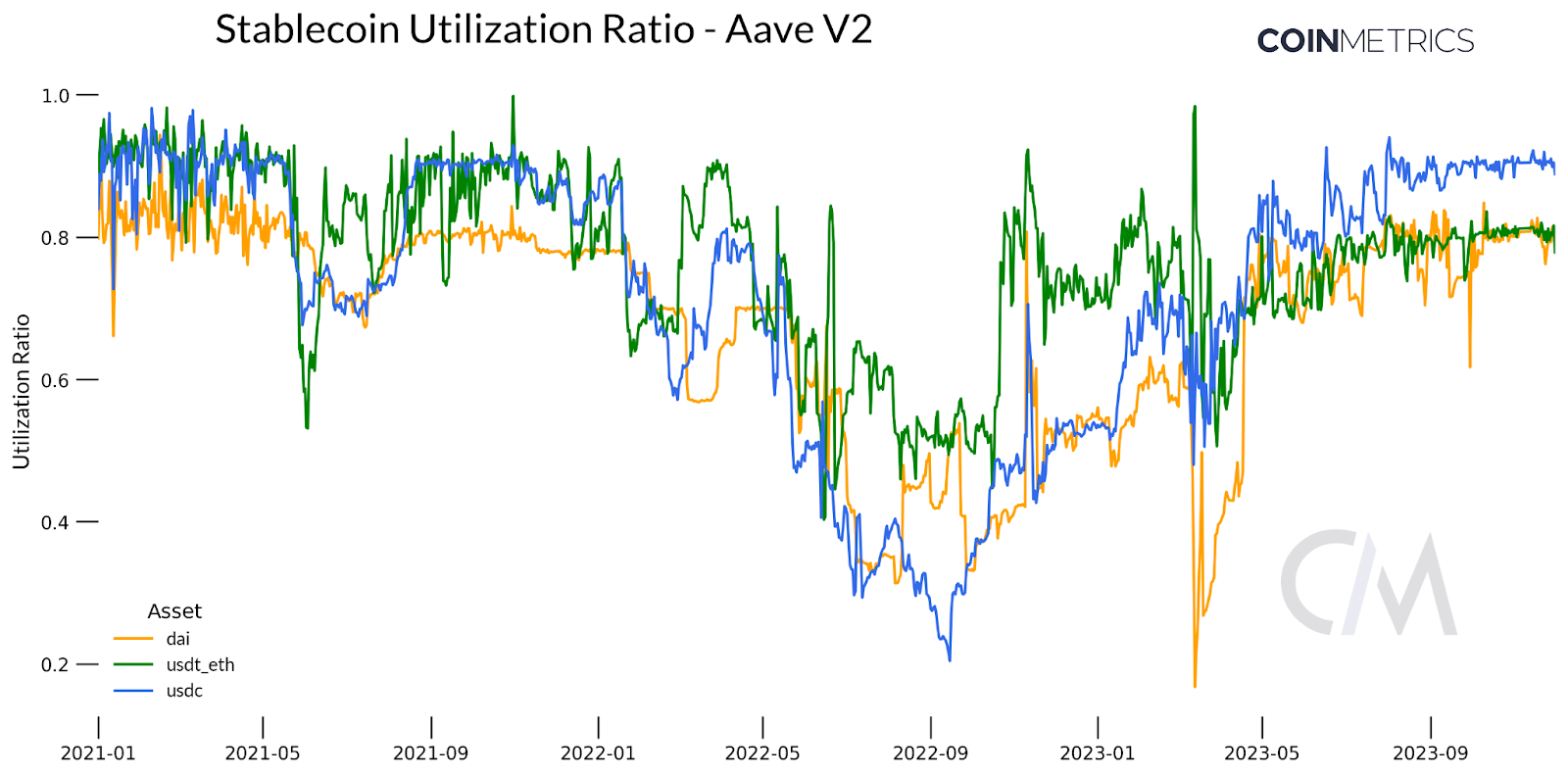

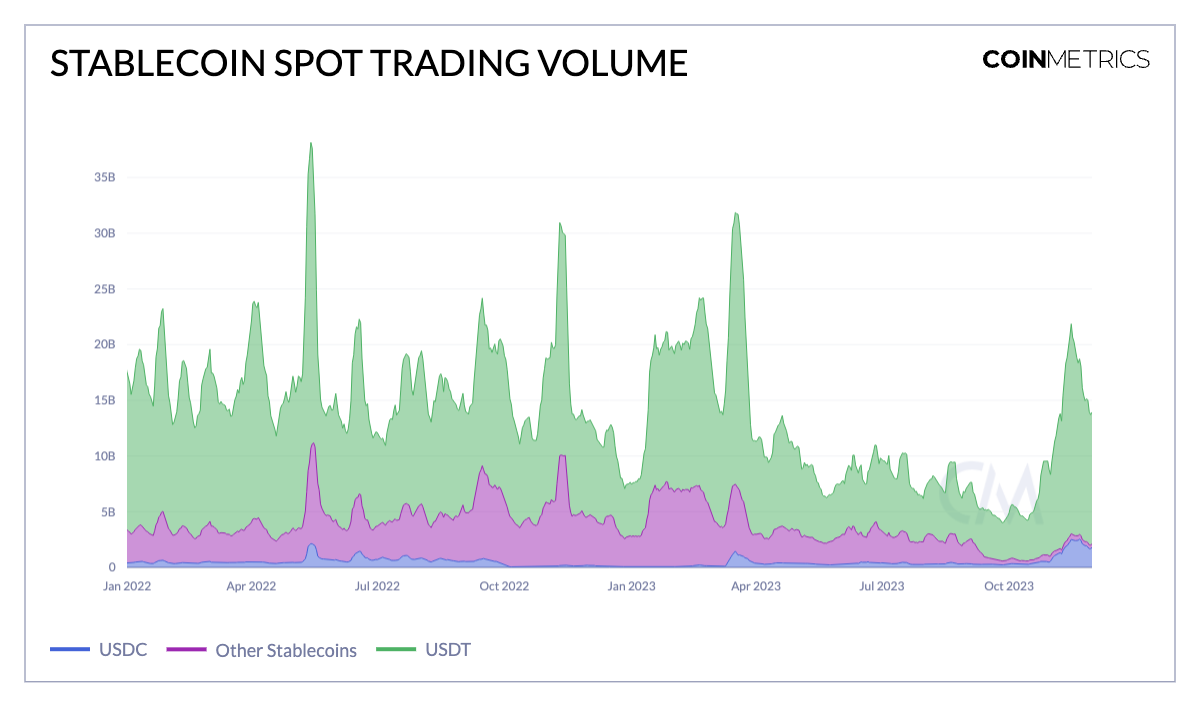

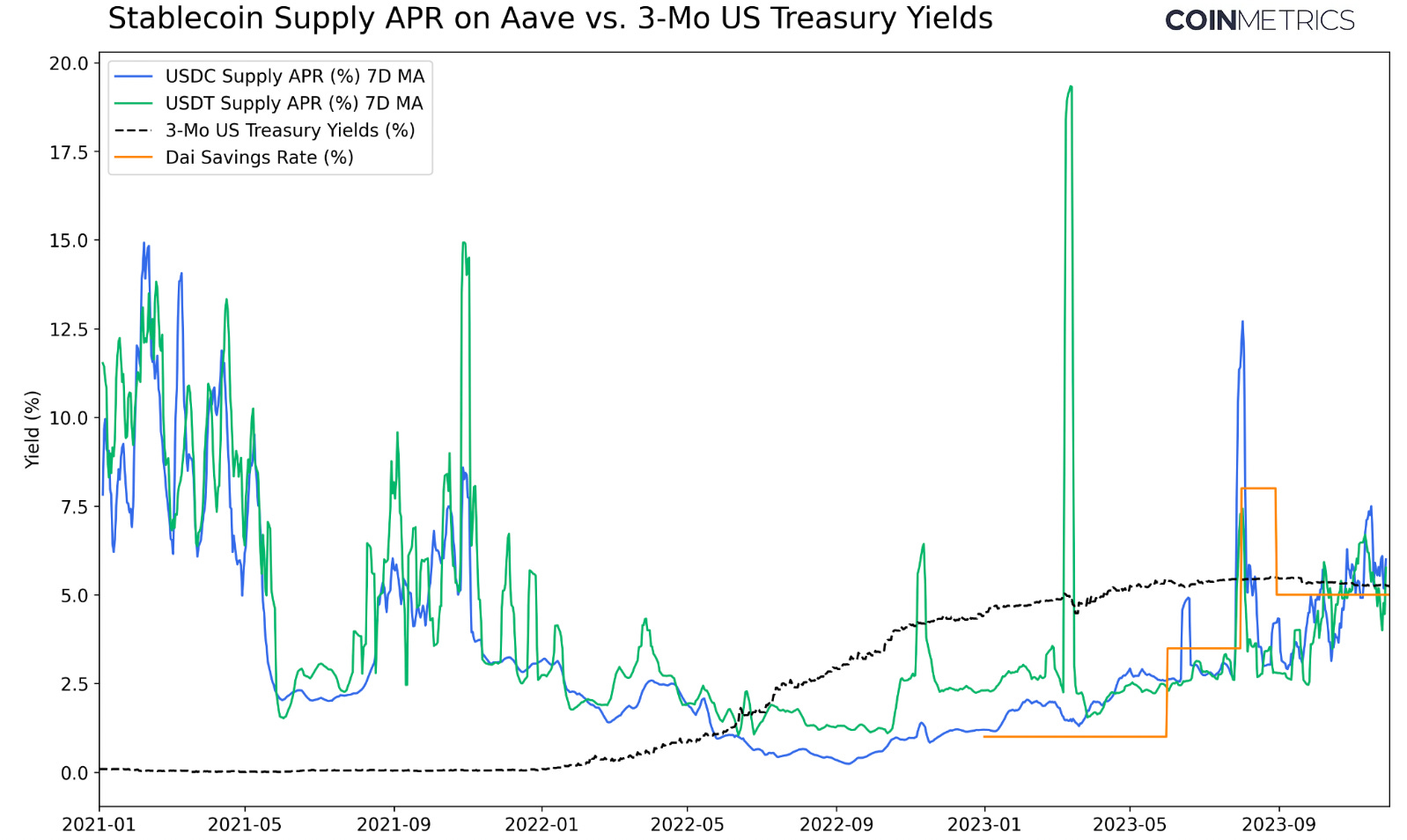

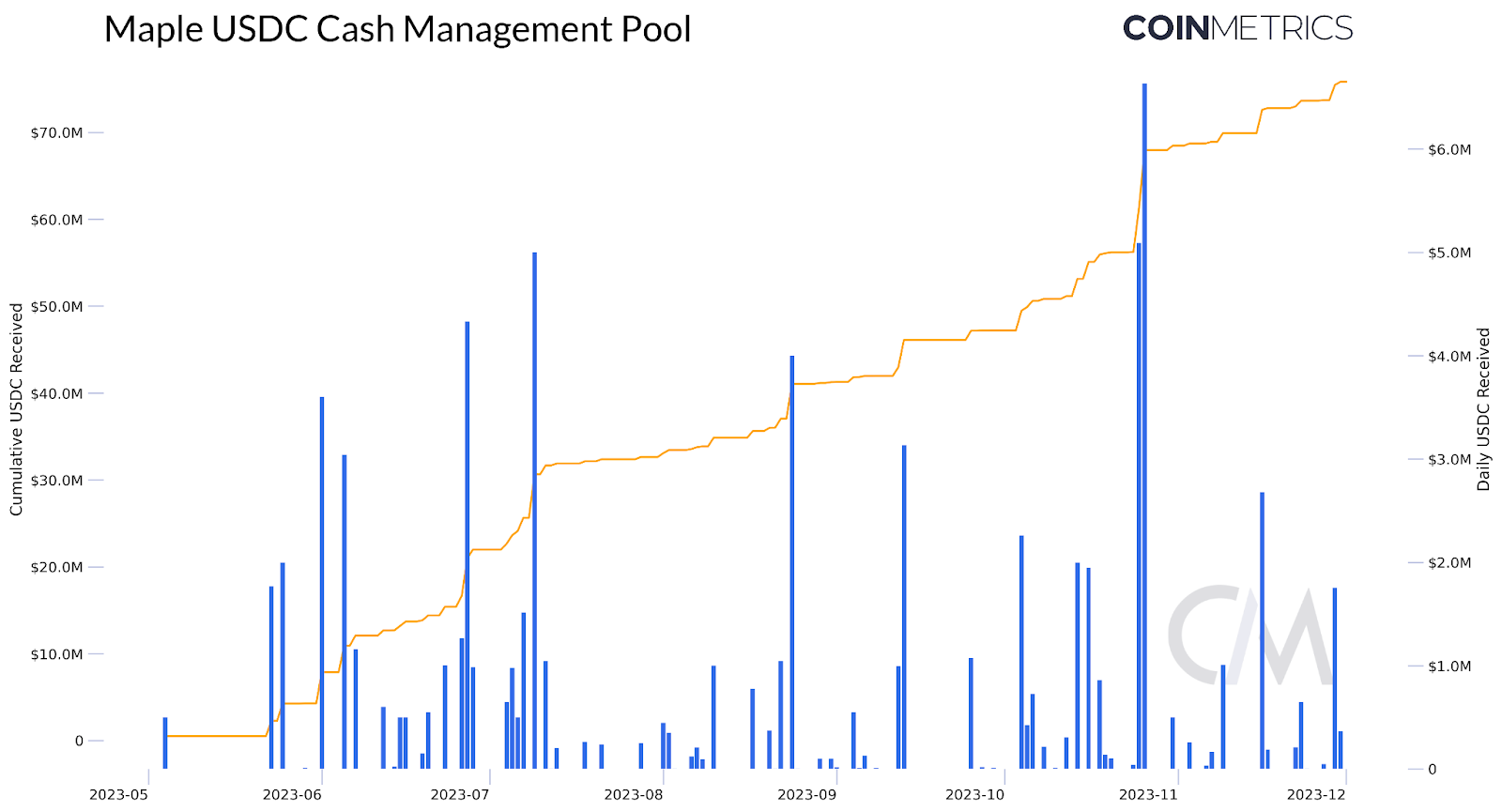

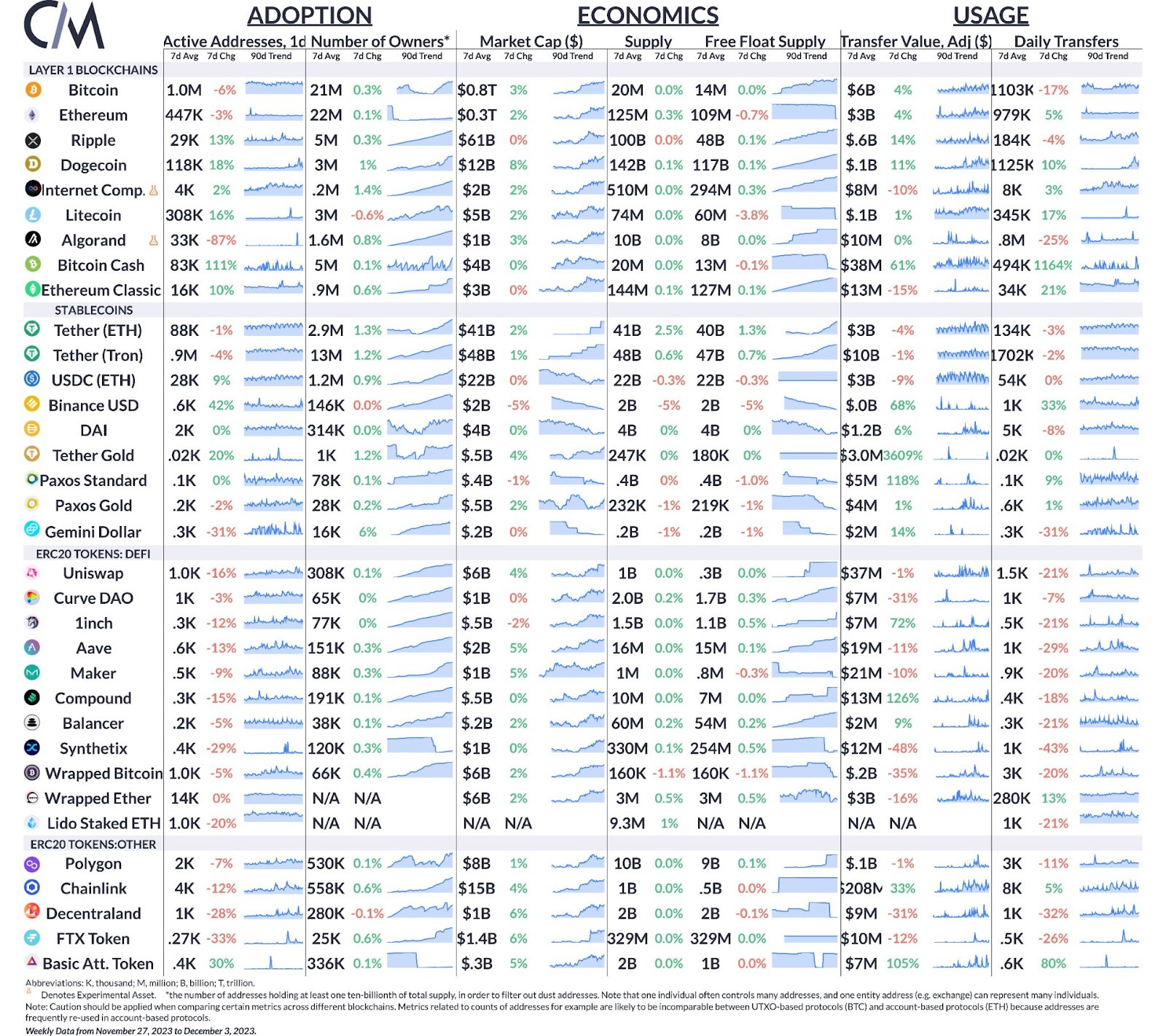

Get the best data-driven crypto insights and analysis every week: State of Stablecoins: Signs of Returning LiquidityBy: Tanay Ved IntroductionStablecoins have emerged as a crucial pillar within the dynamically evolving digital asset ecosystem. Serving as a stable store of value, they bring resilience amidst tides of volatility, providing stability and utility not only in mature markets but also emerging economies grappling with high inflation and barriers to accessing financial infrastructure. The borderless and around-the-clock nature of stablecoins enable seamless cross-border transactions and remittances, making them an instrumental medium of exchange. Beyond these functions, stablecoins also act as a vital bridge to the decentralized finance (DeFi) and traditional financial economy, underpinning trading and lending operations and serving as a barometer for activity on public blockchains. This unique value proposition has propelled the rise of the digital dollars market, peaking at $155 billion in market capitalization in 2022 before declining to $112 billion, a reflection of various challenges that have tempered growth. However, with recent uplifts in digital asset valuations, there's been a noticeable resurgence in stablecoin supply, suggesting a potential revival of on-chain liquidity and the demand for stablecoins in both falling and rising markets. In this issue of Coin Metrics’ State of the Network, we take a closer look at stablecoin supply, usage and adoption, as well as emerging trends shaping the landscape as we potentially transition into a different market regime. Market Cap & Supply TrendsThe market capitalization of the asset class today primarily comprises USDT and USDC, which make up the lion's share of total supply. The recent rise has been fuelled by the growth of Tether (USDT) on the Ethereum ($41 billion) and Tron ($48 billion) networks respectively, resulting in an all time high market cap of $88 billion for Tether, as Circle’s USDC stabilizes at $22.5 billion. Despite the dominance of fiat-collateralized stablecoins, the growth of stablecoins collateralized by crypto-assets (i.e, ETH) and off-chain assets (i.e, public securities) underscores the growing diversity and adaptability of the asset class. Source: Coin Metrics Network Data This is reflected in the chart below, which illustrates weekly changes in stablecoin supply over the year. In the aftermath of significant events like the Luna collapse in June 2022, and the Silicon Valley Bank (SVB) crisis in March, we observed a notable decline in total stablecoin supply, indicative of wavering market confidence. However, since October 2023, the aggregate stablecoin supply has trended upwards, marking a shift towards positive growth. This upward trend can be interpreted as a leading indicator of improving liquidity on-chain, suggesting an environment where more capital is available for deployment. Source: Coin Metrics Network Data Source: Coin Metrics Network Data

|

Older messages

Dollar-Cost Averaging Portfolio

Tuesday, November 28, 2023

Coin Metrics' State of the Network: Issue 235

Checking On-Chain Indicators for Green Shoots in the Digital Assets Market

Tuesday, November 21, 2023

Coin Metrics' State of the Network: Issue 234

Coin Metrics’ State of the Network: Issue 233

Tuesday, November 14, 2023

November Rally Reaches New Corners of the Digital Asset Market

Coin Metrics’ State of the Network: Issue 232

Tuesday, November 7, 2023

Ethereum Staking Through the Lens of Lido

Coin Metrics’ State of the Network: Issue 231

Tuesday, October 31, 2023

Unpacking the Forces Behind the Market Rally

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏