What Will a Bitcoin ETF Mean for Bitcoin? Lessons From ETF History

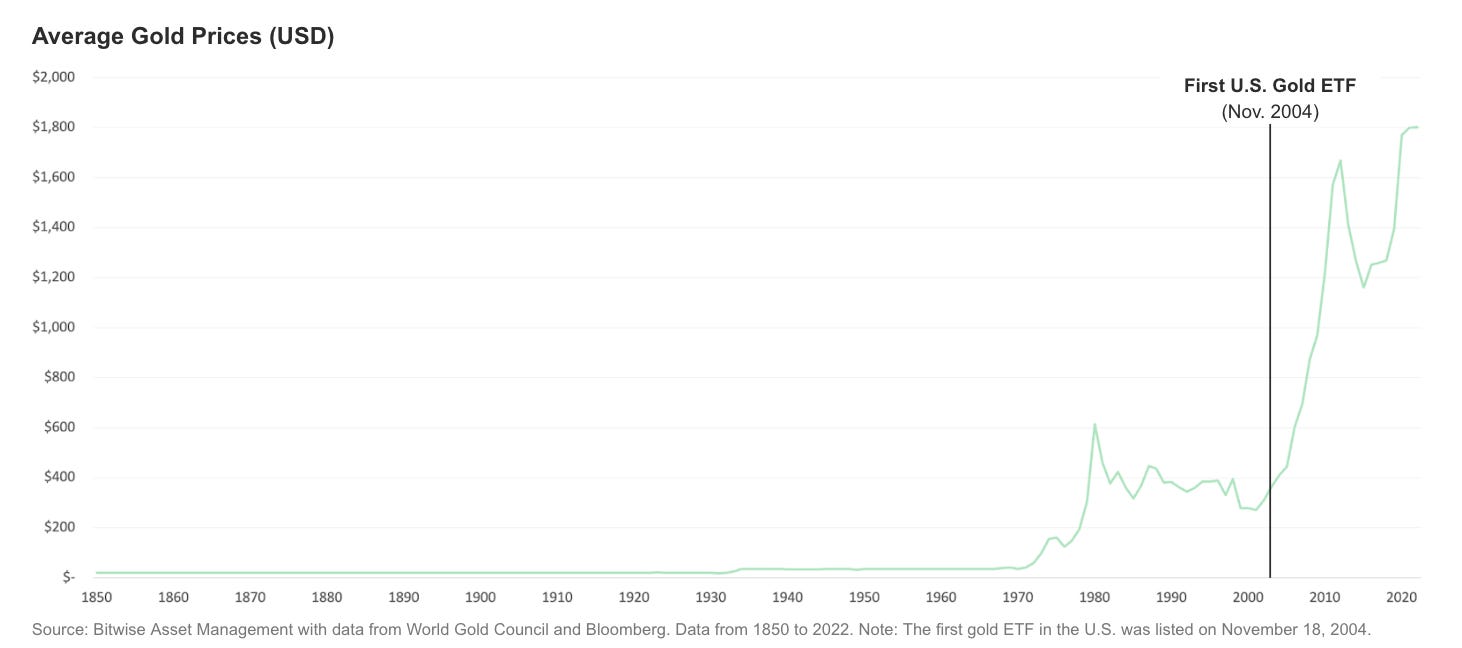

To investors, The bitcoin spot ETF was approved yesterday afternoon. All eleven issuer applications got the green light from regulators and they will begin trading this morning. I asked Matt Hougan, CIO at Bitwise Investments and former CEO of ETF.com, to put together a guest post on lessons we can learn from ETF history to apply to the current situation. Matt is uniquely positioned to share insights here because he not only has an encyclopedia-like understanding of ETF history, but Bitwise is also one of the eleven issuers that got approved to begin trading today (and they are the cheapest in terms of fees!). Hope Matt’s insights are helpful to you as you navigate this historic situation. Today’s spot bitcoin ETF launch is historic, and will have long-ranging consequences. I should know. Prior to joining Bitwise Asset Management six years ago, I spent more than 15 years working in the ETF industry, including as CEO of ETF.com. During that period, I watched multiple times as the launch of an ETF brought a formerly alternative asset or investment strategy into the mainstream. It happened with crude oil futures, master limited partnerships (MLPs), bank loans, volatility futures, buffered exposures, and more. But the most relevant example is gold. The first U.S. gold ETF launched in November 2004. It was hard to launch, taking multiple years of effort and more than $10 million in legal fees (sound familiar?). But it paid off, fundamentally transforming gold as an investment and paving the way for years of positive returns for the asset. I thought I’d share some lessons from that historic event. Lesson 1: Gold’s Price Post-Launch There were many reasons for this historic run apart from the ETF launch. But the ETF played a big role. Over this time period, gold ETFs attracted $89 billion in inflows worldwide, vacuuming up 2,667 metric tons of gold. That’s 86 million ounces—more gold than the countries of China, Switzerland, and Russia hold combined. This fundamentally altered the demand balance for gold. According to the World Gold Council, investment-related demand for gold rose from 4% of total demand in 2000 to 45% in 2009, “driven mainly by an increase in demand for ETF and related products." Given gold’s inflexible supply, this likely contributed to rising prices. There’s absolutely no guarantee bitcoin will do the same thing, of course. Bitcoin is not gold, and the circumstances today are different. For instance, there are already many ways to buy bitcoin, whereas gold was much harder to access as an investment in 2004. Still, it’s an interesting lesson on the potential impact of ETFs. Lesson 2: Investor Flows Won’t Come All at Once Everyone wants to know how much money will flow into bitcoin ETFs. That’s hard to say: I’ve seen long-term flow estimates of $30 billion to $200 billion. But one thing we do know is that the flows won’t come all at once. In fact, it’s more likely that they will build over time. Here are total inflows for the first nine calendar years after gold ETFs launched in the U.S.:

There’s a reason for the slow buildup. For instance, although ETFs make it easy for many people to invest in an asset, they aren’t automatically approved on all platforms. It takes time, for instance, for conservative wirehouse brokerages like Morgan Stanley and Merrill Lynch to approve new ETFs. But as each platform turns on—and as people get more and more comfortable with a new asset—the flows start to build. At Bitwise, we find that many investors start by dipping their toes in the water on bitcoin and then adding to those positions over time. Note: Although I didn’t list it above, there were huge outflows from gold ETFs in 2013, as investors yanked $41.6 billion from the funds worldwide. This contributed to a sharp pullback in prices. It’s important to remember that, once the market matures, ETF flows can cut both ways. Lesson 3: The ETF Won’t Cannibalize Old Ways of Accessing Bitcoin, Like Coinbase One of the biggest questions investors have about the launch of bitcoin ETFs is whether they will tap into new demand or whether they will simply cannibalize other ways of accessing the market. My experience with gold suggests they will find new demand. Investors had lots of ways to access gold prior to the launch of gold ETFs. They could buy gold bars and coins, invest in gold futures, buy gold miners, or access gold through spot trading sites like Kitco. Many people argued that gold ETFs would simply steal market share from these other ways of investing. That’s not what happened, though. Instead, demand for physical gold bars and coins soared after the ETF launch. In 2003, the year before the ETF, investors bought 293 tonnes of gold bars and coins; in 2022, the last year for which there is data, they bought 1,107 tonnes -- more than three times as much. The reason is simple: The launch of the ETF helped establish gold as a mainstream investment and dramatically increased the number of investors interested in the space. Some ended up in the ETF, while others ended up in bars and coins. I suspect we’ll see the same thing here. Many investors will find their way to bitcoin ETFs, even as the number of investors accessing bitcoin through Coinbase and holding it in cold wallets soars. There will likely be some cannibalization, but I suspect the pie will grow so much that no one will care. Conclusion: An Asset Transformed My biggest takeaway from the launch of a gold ETF is more subjective than data-driven: The launch transformed gold into a mainstream asset. I know that it’s hard to imagine today, but when the first gold ETF launched in the U.S., gold wasn’t considered a serious investment by most people. Individuals who bought gold were labeled “gold bugs.” They called gold a “barbarous relic.” Gold mining companies traded mainly on the pink sheets. And the image of the gold investor was more “tin foil hat” than “Brioni suit.” Then the ETF happened, and gold was transformed almost overnight. Today, it is as mainstream as stocks, bonds, private equity, private credit, or venture capital. Not all investors own gold, but people who do aren’t seen as unusual. This, I think, will be the biggest long-term impact of a spot bitcoin ETF. And taking this step will open up bitcoin to trillions of dollars of potential investment, from institutions, family offices, financial advisors, and others. People have often asked me: When will bitcoin go mainstream? The answer might be: Right about now. I hope you enjoyed this guest post from Matt Hougan, CIO at Bitwise Investments. The next few weeks should be quite exciting as the bitcoin spot ETFs begin seeing meaningful inflows. Hope you all have a great day. I’ll talk to everyone tomorrow. -Anthony Pompliano James Seyffart is a ETF research analyst at Bloomberg Intelligence. In this conversation, we discuss bitcoin ETF approvals, what this means for capital inflow, predictions for the first 48 hours, 30 days, & year, fund structures, issuers, and regulatory oversight. Listen on iTunes: Click here Listen on Spotify: Click here Bitcoin ETF Approved - What You Need To Know Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription. |

Older messages

Our Company Reflexivity Research Has Been Acquired

Tuesday, January 9, 2024

Listen now (5 mins) | To investors, We are announcing this morning that Reflexivity Research, a company that I co-founded with Will Clemente, has entered into a binding LOI to be acquired by DeFi

Fee War on Bitcoin ETF Has Begun - Plus 12 Predictions

Monday, January 8, 2024

Listen now (4 mins) | Today's letter is brought to you by Cal.com! What do I have in common with Chad Hurley (YouTube), Tobi Lütke (Shopify), and Alexis (776/Reddit)? We are all early investors in

Thoughts On The Bitcoin ETF That No One Is Talking About

Thursday, January 4, 2024

Listen now (3 mins) | Today's letter is brought to you by Dream Startup Job! Dream Startup Job is the premier marketplace for connecting ambitious job-seekers with the world's most innovative

The Trade Of Our Generation

Wednesday, January 3, 2024

Listen now (4 mins) | To investors, The US national debt crossed over $34 trillion yesterday, which is the highest it has been in history. This all-time high milestone is not one to celebrate. Charlie

The State of Bitcoin Heading Into 2024

Tuesday, January 2, 2024

Listen now (3 mins) | Today's letter is brought to you by Cal.com! What do I have in common with Chad Hurley (YouTube), Tobi Lütke (Shopify), and Alexis (776/Reddit)? We are all early investors in

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these