Bitcoin ETFs Saw Significant Inflows Yesterday

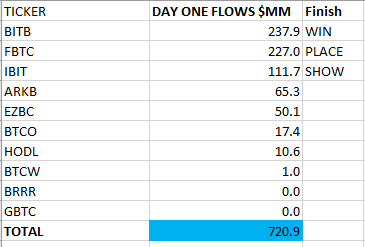

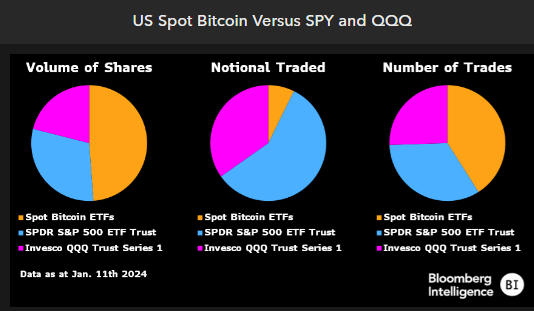

Today’s letter is brought to you by Trust & Will!Trust & Will is the most trusted name in online estate planning and settlement. The company has helped hundreds of thousands of families create their estate plans, and they’re just getting started. Trust & Will enables every American to create a plan that’s customized to fit their needs, their life, and their legacy. Their mission is to make estate planning simple, affordable, and inclusive. All of Trust & Will’s documents have been designed and approved by estate planning attorneys to meet the highest legal standards. Their process is simple, secure, complete, and customized for your specific needs and state requirements. To investors, The bitcoin spot ETFs started trading yesterday and the numbers blew away the previous ETF records. There was more than $4.6 billion in trading volume across the various funds. Grayscale saw more than $2 billion in trading volume and Blackrock had approximately $1 billion. But neither of those funds were the big winner yesterday based on the data we have so far. Bitwise’s BITB saw the most amount of inflows with $237 million, according to Bloomberg’s Eric Balchunas. The total inflows based on the current data is $720 million, but there will be more data that trickles in today that will update these numbers to over $1 billion most likely. Balchunas also tweeted this graphic showing how the spot bitcoin ETFs compared to $SPY and $QQQ in volume yesterday. He said the new entrants “really held their own, especially in number of trades and shares, and even notionally they got a respectable slice of the pie.” All of this activity is driving tons of coverage in the media. CNBC’s Squawk Box had approximately 12 different guests on yesterday during their 3 hour show to discuss the historic launch of these products. Not everyone was as excited as the media unfortunately. Within hours of the ETFs trading, reports started to pour in that various financial organizations were not going to offer the funds to their clients. Vanguard, which has over $ 7 trillion in assets under management, put out a statement saying the following:

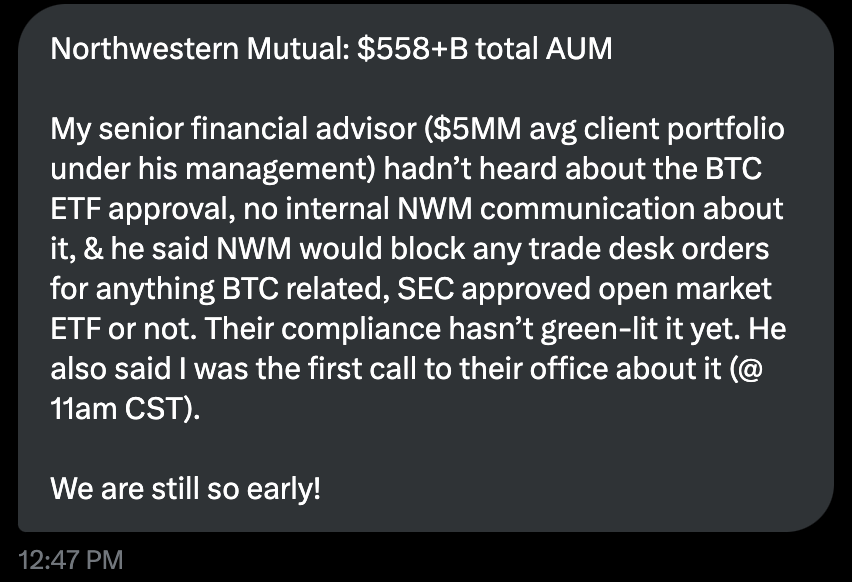

The statement forgot to mention that Vanguard offers penny stocks, levered inverse ETFs, currencies that have been devalued for years, or a variety of other financial products that objectively have destroyed wealth for their clients. Imagine the arrogance it takes to prevent your clients from accessing the best performing asset in the last 15 years. Thankfully, not all financial institutions are taking this approach. Blackrock’s Larry Fink was on television this morning in an interview with Andrew Ross Sorkin talking about bitcoin. In the conversation, Fink said bitcoin is “no different than what gold represented for thousands of years. It is an asset class that protects you.” Again, the data supports Larry Fink’s view of the world. Another important point is that the internet conversation surrounding this asset is a big echo chamber. I received this message yesterday from a follower: The same follower updated me later that the funds will be available next week on the platform, but I was more surprised that the financial adviser said they had not even heard about the bitcoin spot ETF approval. So where do we go from here? The crypto ETF game is not over. We still need to see the data from yesterday, while monitoring the continued inflows today. Additionally, the attention will now shift to a rumored approval of the Ethereum spot ETF. Blackrock’s Fink explicitly said this morning he sees value in having one approved in the United States. Blackrock has a 576 - 1 record when applying for ETF approvals. This is also why you see Ethereum up since the ETF approval, while Bitcoin’s price is down. Markets are forward looking and people are already wondering what the next thing to speculate on will be. This industry never has a dull moment. It moves at warp speed. Do your best to stay informed with the various developments, but remember that the short-term noise will be unlikely to change the long-term trajectory. As I have learned in my career, time in the market is more important than timing the market if you have the macro trend correct. We will see if that remains true in the coming years. Hope you all have a great end to your week. I’ll talk to everyone on Monday. -Anthony Pompliano James Seyffart is a ETF research analyst at Bloomberg Intelligence. In this conversation, we discuss bitcoin ETF approvals, what this means for capital inflow, predictions for the first 48 hours, 30 days, & year, fund structures, issuers, and regulatory oversight. Listen on iTunes: Click here Listen on Spotify: Click here My Appearance on CNBC’s Squawk Box Yesterday Morning Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription. |

Older messages

The Bitcoin ETF Dress Rehearsal Yesterday

Friday, January 12, 2024

Listen now (5 mins) | To investors, Yesterday can only be described with one word — madness. The SEC's account on Twitter/X posted the following message just after 4pm EST: The market immediately

What Will a Bitcoin ETF Mean for Bitcoin? Lessons From ETF History

Friday, January 12, 2024

To investors, The bitcoin spot ETF was approved yesterday afternoon. All eleven issuer applications got the green light from regulators and they will begin trading this morning. I asked Matt Hougan,

Our Company Reflexivity Research Has Been Acquired

Tuesday, January 9, 2024

Listen now (5 mins) | To investors, We are announcing this morning that Reflexivity Research, a company that I co-founded with Will Clemente, has entered into a binding LOI to be acquired by DeFi

Fee War on Bitcoin ETF Has Begun - Plus 12 Predictions

Monday, January 8, 2024

Listen now (4 mins) | Today's letter is brought to you by Cal.com! What do I have in common with Chad Hurley (YouTube), Tobi Lütke (Shopify), and Alexis (776/Reddit)? We are all early investors in

Thoughts On The Bitcoin ETF That No One Is Talking About

Thursday, January 4, 2024

Listen now (3 mins) | Today's letter is brought to you by Dream Startup Job! Dream Startup Job is the premier marketplace for connecting ambitious job-seekers with the world's most innovative

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these