The Bitcoin ETF Dress Rehearsal Yesterday

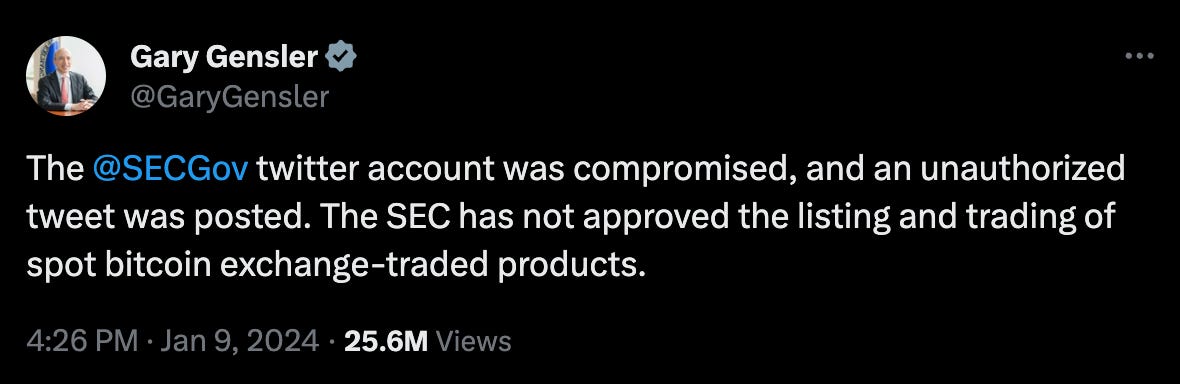

To investors, Yesterday can only be described with one word — madness. The SEC’s account on Twitter/X posted the following message just after 4pm EST: The market immediately went into euphoria. Bitcoin’s price went from approximately $46,600 to nearly $48,000 in less than two minutes. The internet lit up with celebratory messages, memes, and “I told you so!” There was only one problem — the tweet from the SEC was inaccurate. Bitcoin spot ETFs have not yet been approved. SEC Chairman Gary Gensler quickly tweeted from his personal account the following clarification: As I told you, yesterday was madness. The market quickly readjusted from bullish to bearish and Gensler’s tweet was followed by a quick sell-off within minutes to a level lower than it was pre-announcement. So what exactly happened? That is still unclear. The SEC has not explicitly used the word “hacked” so far, but they have described a nefarious situation in the statement that followed later. It read:

Frankly, this is probably the worse case scenario for regulators at this moment. They have held up an ETF approval for years due to concerns around market manipulation, yet the day before a rumored approval the organization is compromised and someone is able to manipulate the price leveraging the SEC’s own account. Many people on the internet are claiming that the SEC may have made a simple mistake of scheduling a tweet for the wrong date. Their logic is that the tweet from the SEC account is worded too closely to what the regulatory organization would actually say. While it could be possible, it appears that theory is not true. X’s safety team tweeted the following statement last night:

We have to assume that there was foul play here until we hear otherwise. Another point that people have pointed out is that the lack of 2-factor authentication goes against prior warnings that the SEC Chairman had tweeted out as guidance for market participants. Again, this entire situation is nightmare fuel for regulators. But what insights can we take away from this debacle as investors? There seem to be three lessons at the moment:

The first two are self-explanatory, but this third one is interesting. Everyone has been paying attention to bitcoin for the last few months. The digital currency is up 160% in the last 12 months. Ethereum’s token is only up 79% in the same time period. But Reflexivity Research’s Will Clemente points out: In a weird way, although yesterday seemed like a complete shit-show, it actually may have served as a dress rehearsal for the real show later today. Bloomberg is reporting that the ETF approval will likely happen after the market closes this evening, which would fall in-line with my expectations for the funds to be trading tomorrow (Thursday). This industry is full of chaos and uncertainty. There is never a dull moment. Through it all, the people who can keep their head calm and focused are the ones likely to find an outsized financial return. Hope you all have a great day. I’ll talk to you tomorrow. -Anthony Pompliano Mitchell Askew is an analyst in the bitcoin community. In this conversation, we talk about volatility, bitcoin ETFs, institutions, inscriptions, miners, bitcoin halving, and more. Listen on iTunes: Click here Listen on Spotify: Click here Earn Bitcoin by listening on Fountain: Click here My Conversation with Mitchell Askew Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren’t finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. Invite your friends and earn rewardsIf you enjoy The Pomp Letter, share it with your friends and earn rewards when they subscribe. |

Older messages

What Will a Bitcoin ETF Mean for Bitcoin? Lessons From ETF History

Friday, January 12, 2024

To investors, The bitcoin spot ETF was approved yesterday afternoon. All eleven issuer applications got the green light from regulators and they will begin trading this morning. I asked Matt Hougan,

Our Company Reflexivity Research Has Been Acquired

Tuesday, January 9, 2024

Listen now (5 mins) | To investors, We are announcing this morning that Reflexivity Research, a company that I co-founded with Will Clemente, has entered into a binding LOI to be acquired by DeFi

Fee War on Bitcoin ETF Has Begun - Plus 12 Predictions

Monday, January 8, 2024

Listen now (4 mins) | Today's letter is brought to you by Cal.com! What do I have in common with Chad Hurley (YouTube), Tobi Lütke (Shopify), and Alexis (776/Reddit)? We are all early investors in

Thoughts On The Bitcoin ETF That No One Is Talking About

Thursday, January 4, 2024

Listen now (3 mins) | Today's letter is brought to you by Dream Startup Job! Dream Startup Job is the premier marketplace for connecting ambitious job-seekers with the world's most innovative

The Trade Of Our Generation

Wednesday, January 3, 2024

Listen now (4 mins) | To investors, The US national debt crossed over $34 trillion yesterday, which is the highest it has been in history. This all-time high milestone is not one to celebrate. Charlie

You Might Also Like

‘We found the thing that gives us joy’: Microchild on the microverse, music, and shared language

Wednesday, March 12, 2025

The wife and husband pair of Shannon Sengebau McManus and Jonathan Camacho Glaser are souls behind the band Microchild. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 Reminder: Masterclass with Jesse Pujji

Tuesday, March 11, 2025

At 1:00 PM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

[Webinar tomorrow] Canadian? How to Grow Your Amazon FBA Business as a Canuck

Tuesday, March 11, 2025

Hey Reader, Are you a Canadian? No? Well, you should never skip a single line on an EcomCrew email but this is one exception and you can continue with your day. Yes? Then congratulations on hitting the

The state of ad serving for brands and agencies

Tuesday, March 11, 2025

How ad-serving technology is changing and unlocking new opportunities

♟️ OpenAI's smart chess move!

Tuesday, March 11, 2025

Guess who's sweating?

March Madness is here: Tap into the hype with these marketing plays

Tuesday, March 11, 2025

And more insights to drive smarter social strategies and ROI ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ET: March 11th 2025

Tuesday, March 11, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Gruns (trends) Chart Gruns is a DTC startup

If SEO is dead…

Tuesday, March 11, 2025

Here's a surefire way to fall behind your competition: Declare SEO as dead and stop optimizing your content. Sure, the strategies that worked five years ago may not work today, but businesses that

Niche = $$$

Tuesday, March 11, 2025

Why Your Tiny Newsletter Could Be an Advertiser's Dream

The Founder Institute targets first VC fund

Tuesday, March 11, 2025

Startups join the M&A big leagues; Hinge Health files for IPO; stablecoin surges with regulation in play; VC-backed IPOs give up post-election gains Read online | Don't want to receive these