Polymarket and the Power of Collective Intelligence

Get the best data-driven crypto insights and analysis every week: Polymarket and the Power of Collective IntelligenceBy: Matías Andrade Cabieses & Tanay Ved Key Takeaways:

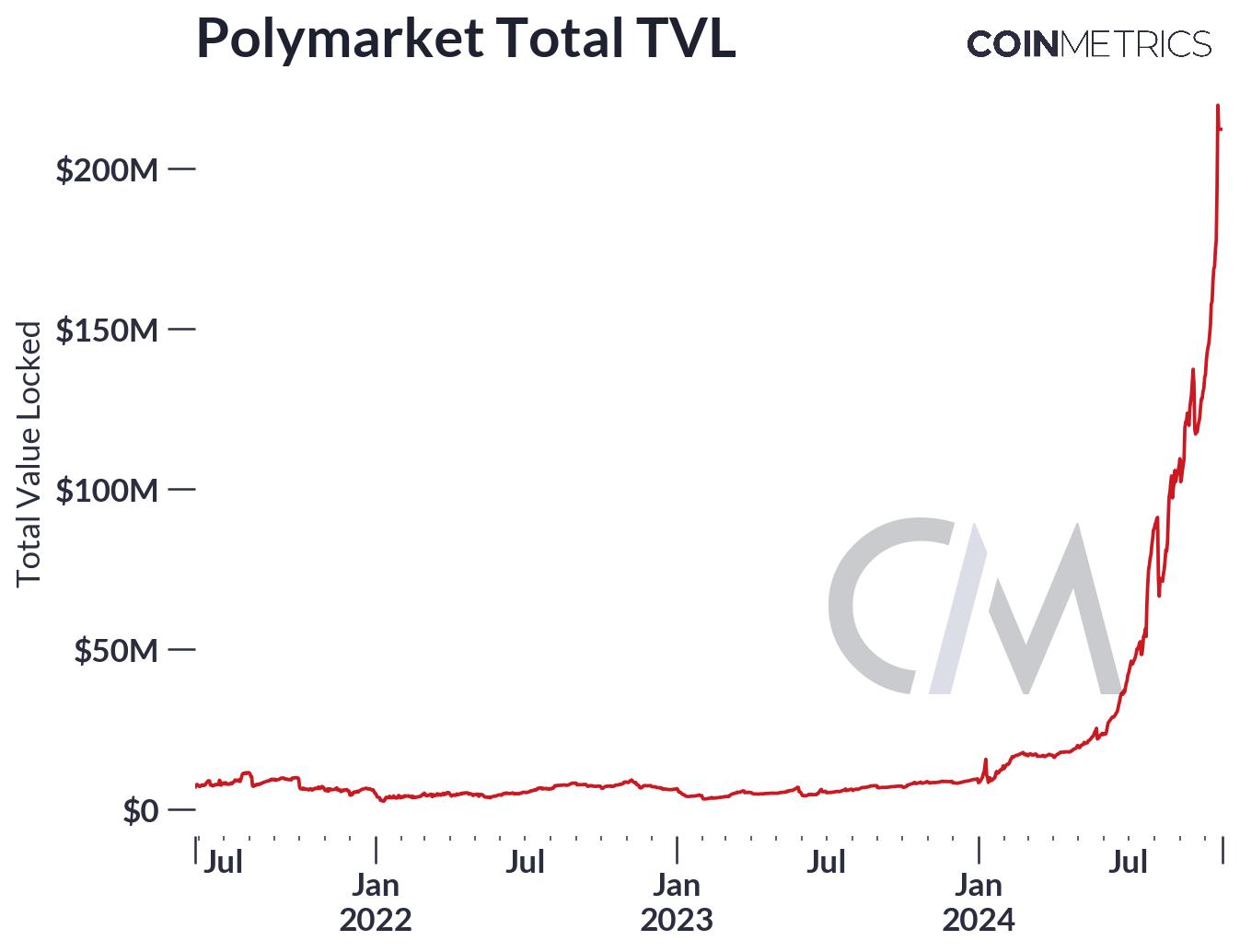

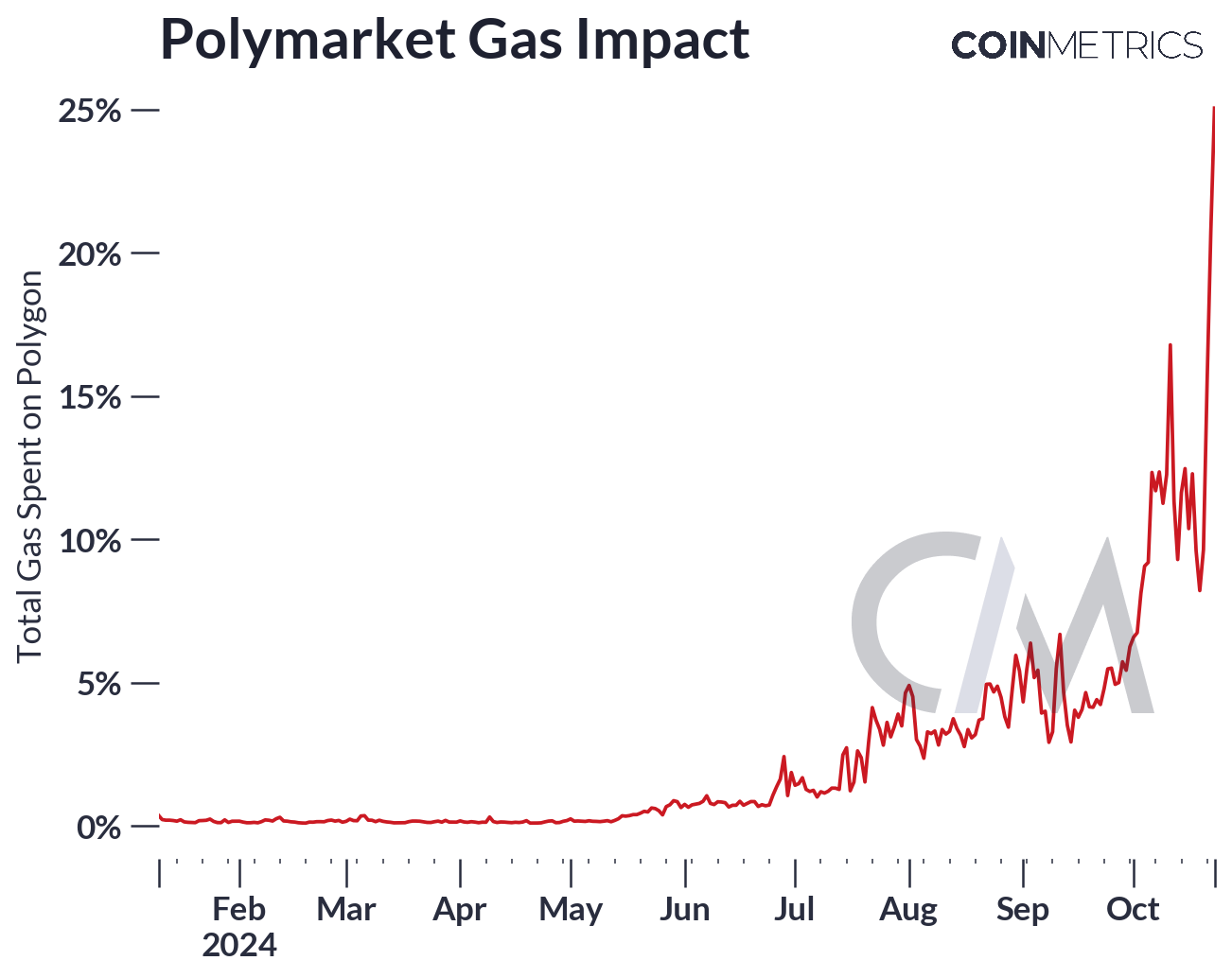

IntroductionPolls have traditionally guided decision-making across domains like political forecasting and consumer behavior. However, conventional polling methods and mainstream media face growing skepticism due to concerns over bias and lack of transparency. Against this backdrop, prediction markets like Polymarket have emerged as a compelling alternative. By leveraging digital infrastructure and public blockchains (in the case of Polymarket), these platforms enable market-driven, real-time predictions that capture collective intelligence—qualities that have fueled tremendous interest in prediction markets, particularly in the lead up to the 2024 U.S. Presidential Election. Polymarket now stands at a unique crossroads where political outcomes and market sentiment intersect with digital asset dynamics. In this issue of Coin Metrics' State of the Network, we dive into how Polymarket’s prediction markets operate on Polygon and analyze data behind the 2024 Presidential Election market to understand potential implications for digital assets. What are Prediction Markets?Prediction markets are platforms where users can buy and sell “contracts” on the outcomes of future events. Similar to a stock exchange, where participants buy and sell shares of publicly traded companies, prediction markets enable users to trade on the probabilities of specific events occurring. These events can range widely from the winner of the Premier League to the Federal Reserve’s next interest-rate move. Each share’s price, typically structured as a “yes” or “no”, reflects the collective probability of an event, with prices adjusting in response to new information and evolving sentiment. Unlike traditional polls that provide valuable but momentary snapshots of public opinion, the uniqueness of prediction markets lies in their ability to reflect information dynamically, across a plethora of domains. The idea of prediction markets dates back several years with various modern platforms from Kalshi and PredictIt to Augur and Polymarket. While they share a common goal of harnessing collective intelligence to predict outcomes, they differ in their underlying technology, level of decentralization, accessibility and regulatory status. Recently, however, Polymarket has emerged as one of the most widely adopted prediction market platforms, leveraging blockchain rails for global accessibility, transparency and low-cost settlement. How does Polymarket work?Overview of ArchitectureAt its core, Polymarket is a blockchain based prediction market leveraging the Polygon Layer-2 network. It enables users to buy “shares” representing different outcomes of a future event. The platform functions as a hybrid-onchain application, with certain components off chain to support larger trades at greater scale while settlement occurs on-chain in a non-custodial manner. Polymarket utilizes a central limit order book (CLOB), which facilitates trades between ERC-20 collateral assets (currently only USDC) and Gnosis Conditional ERC-1155 assets (a multi-token standard). In practice, units of a user’s USDC collateral is split into binary outcome tokens (“yes” or “no”), maintaining a market price that adds up to one unit of collateral. Users can also acquire these tokens through direct trading on the orderbook or by interacting with AMM liquidity pools. “Operators” are actors responsible for matching, ordering, and submitting trades to the exchange for settlement on chain. Source: Coin Metrics Labs Polymarket also integrates with the UMA protocol’s oracle to determine the correct outcome of an event. If there is a dispute about the outcome, UMA token holders vote to determine the final resolution. This hybrid approach, combining the Polygon network, Gnosis Conditional ERC-1155 tokens, a CLOB with off-chain order matching, and the UMA protocol’s oracle, allows Polymarket to function with greater scalability and performance compared to a purely on-chain solution. As a result of its recent traction, Polymarket has amassed over $200M in total value locked and contributes to over 25% of gas consumption on Polygon. Source: Coin Metrics Labs Understanding Events, Markets & OddsAt the core of Polymarket are events, markets, and odds, which work together to enable the system to function. Events refer to the specific outcomes that users are attempting to predict, also referred to as questions. These can range from political events, such as the results of an election, to real-world occurrences, like the weather or the outcome of a sports game. Markets are the platforms where users can place bets on the potential outcomes of these events. Polymarket offers two types of markets:

Source: Polymarket

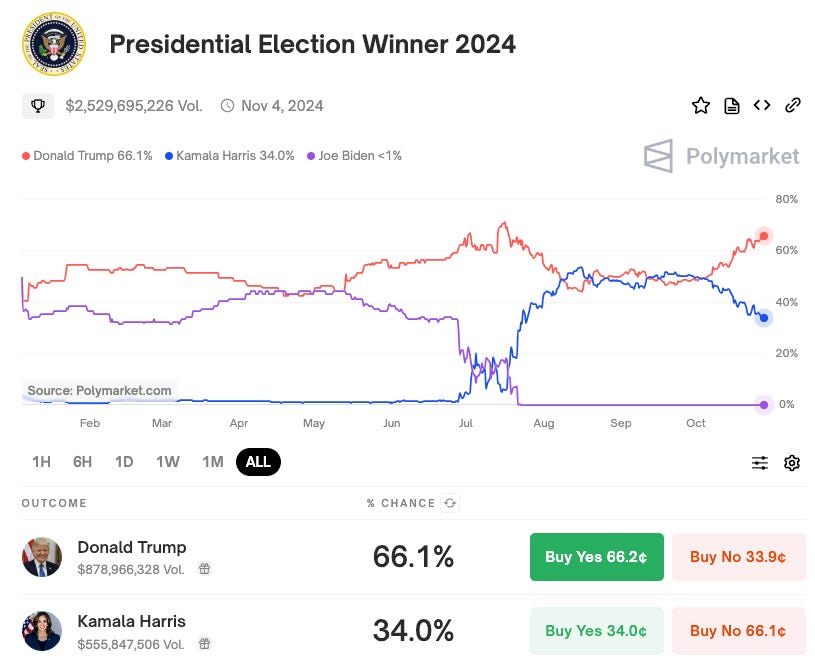

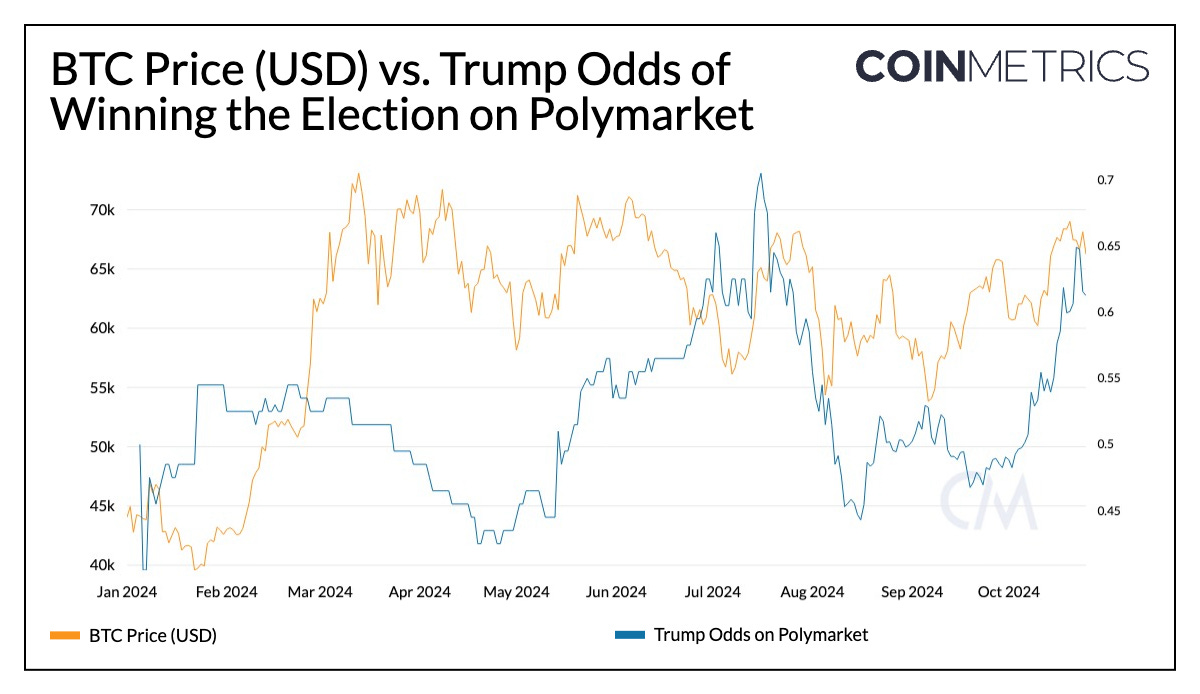

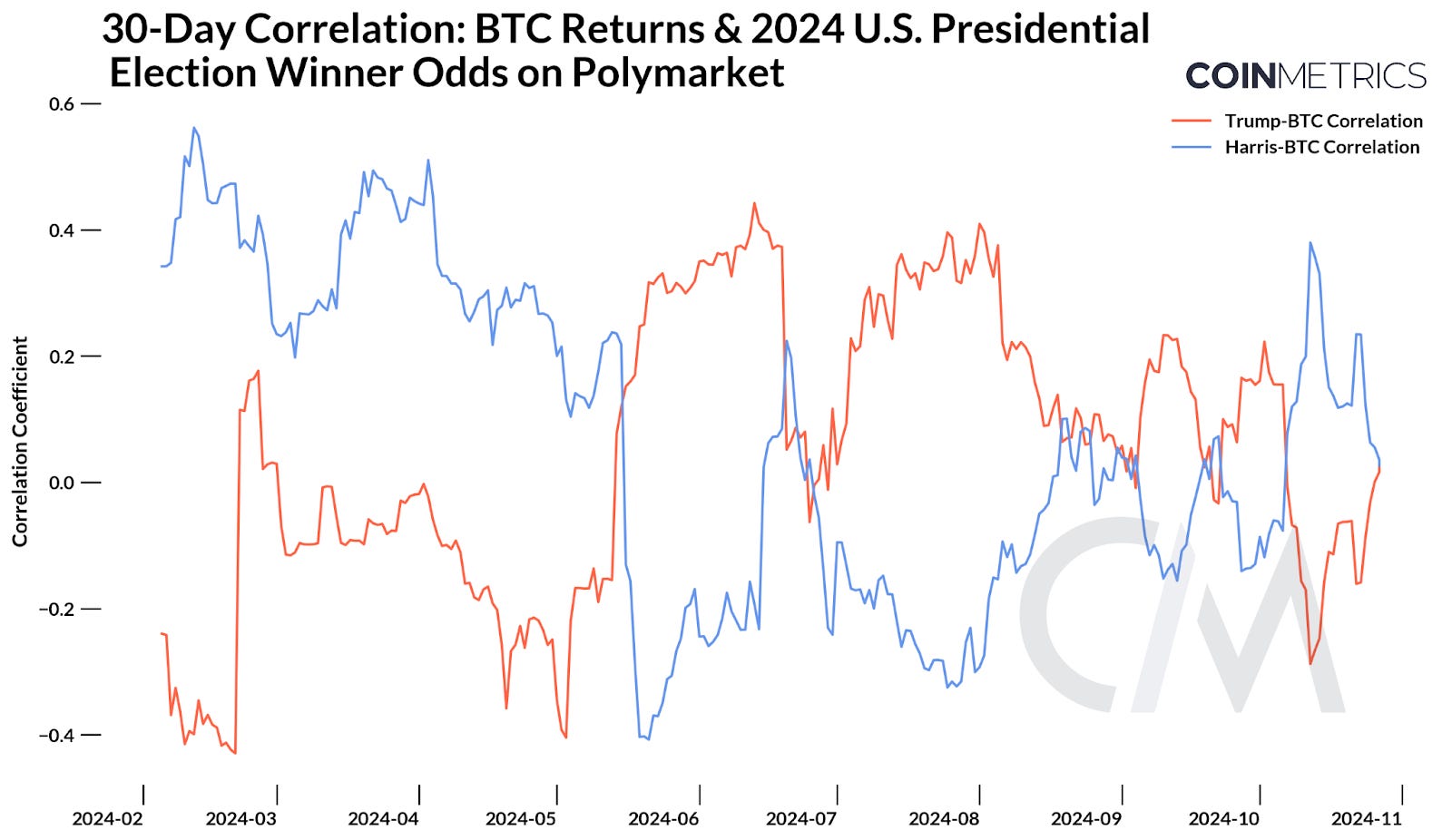

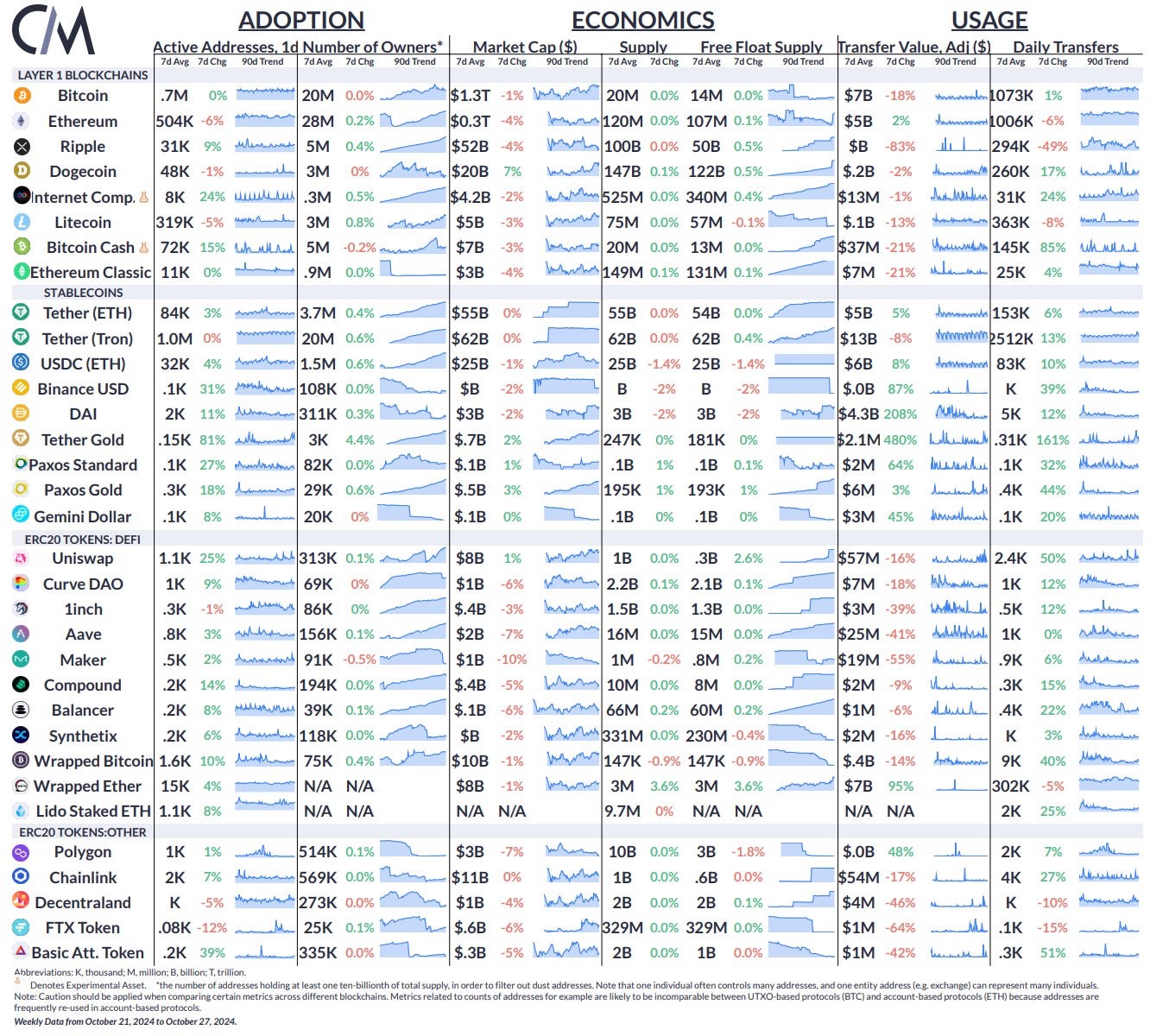

Source: Polymarket Users deposit USDC as collateral on the Polygon network to participate in these markets, which is split into binary outcome tokens representing yes or no positions for an event. Users can trade these tokens via a centralized limit order book or on-chain AMM contracts, with token prices (or “odds”) reflecting the market’s collective assessment of each outcome’s probability. As market conditions shift, token prices fluctuate, allowing users to adjust their positions. Once an event is resolved, anyone can propose a resolution using UMA by posting a USDC bond and earning a reward if the outcome is undisputed. UMA token holders vote on the outcome of the event when disputed over the challenge period. Poorly worded markets can lead to such disputes, like a recent event on whether Israeli troops will invade Lebanon. After an event is resolved, owners of shares of the winning outcome can trade them one to one for USDC collateral, while the losing shares become worthless. Zooming into the 2024 Presidential Election MarketThe politics category, and in particular the “Presidential Election Winner 2024” has been the largest and most actively traded market on Polymarket. As of October 28th , this market has attracted $2.5B in cumulative trading volume since its inception. Share prices (or odds) for each candidate have fluctuated significantly throughout the year, capturing shifts in public perception and market sentiment as real-world events have unfolded. Trump's election odds fluctuated around 50% early in the year before rising to over 65% in recent months, while Harris saw increased odds following Biden's withdrawal in July. Given Trump's perceived pro-crypto stance, analyzing the relationship between candidate odds and bitcoin prices offers insights into potential correlations between political and crypto market sentiment. Source: Coin Metrics Reference Rates & Polymarket With bitcoin’s price largely range-bound over the year, its relationship with Donald Trump’s odds of winning the election on Polymarket isn’t immediately clear. However, they show periods of alignment, especially during significant trend reversals—such as Trump’s rise over 50% in May, drop below 70% in July and recent climb towards 65% in October. As seen below, the rolling 30-day correlation between BTC returns and changes in odds provides a clearer picture. Trump's odds showed a moderate positive correlation with bitcoin returns (peaking at 0.4) between May and August, while Harris' odds displayed weaker, often inverse correlations, reflecting perceptions of her stance on digital assets. The recent convergence of both correlations toward zero suggests that while short-term relationships exist, BTC’s long-term outlook is not currently tied to either candidate’s success. Instead, the market may be awaiting election outcomes before decisive moves, with global factors like money supply driving BTC’s broader trajectory. Source: Coin Metrics Reference Rates & Polymarket Looking AheadPolymarket has garnered undeniable traction as a widely utilized blockchain-based prediction market and for its role leading up to the elections. However, it also faces certain challenges in the form of dispute resolution and regulatory scrutiny. The platform was recently subject to allegations of market manipulations from “whales” against the backdrop of rising odds of a Trump victory. It appears that a single user, controlling four accounts with a combined $46M in election bets was responsible for this divergence. Notably, other prediction markets and polls have trended in a similar direction. While this does not suggest the presence of market manipulation, Polymarket may continue to be subject to regulatory hurdles as an offshore platform, however, recent court rulings in favor of Kalshi—a U.S based prediction market may offer a precedent. As we approach the final stretch of the 2024 U.S. elections, it remains to be seen if Polymarket and similar platforms will sustain their prominence in decision-making. However, they bring clear and unique advantages, offering dynamic, transparent, free market driven “source of truth” that complement traditional models and proprietary data. The election outcome may provide further validation of Polymarket’s forecasting capabilities and value in shaping informed decision-making. Network Data InsightsSummary HighlightsSource: Coin Metrics Network Data Pro Coin Metrics UpdatesThis week’s updates from the Coin Metrics team:

Subscribe and Past IssuesAs always, if you have any feedback or requests please let us know here. Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data. If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here. © 2024 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter. |

Older messages

Introducing Exchange Flow Metrics

Tuesday, October 22, 2024

New metrics tracking exchange-flows in BTC and ETH ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

An Overview of the Flow Blockchain

Sunday, October 20, 2024

A data-driven overview of the Flow Blockchain ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

State of the Network’s Q3 2024 Mining Data Special

Tuesday, October 8, 2024

Get the best data-driven crypto insights and analysis every week: ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

State of the Network’s Q3 2024 Wrap-Up

Tuesday, October 1, 2024

A data-driven overview of events shaping crypto markets in Q3–2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Real World Assets (RWAs) & Tokenization

Tuesday, September 24, 2024

Coin Metrics' State of the Network: Issue 278 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏