Crypto Market & Polymarket Dynamics Heading into Elections

Crypto Market & Polymarket Dynamics Heading into ElectionsCoin Metrics’ State of the Network: Issue 284Get the best data-driven crypto insights and analysis every week: Crypto Market & Polymarket Dynamics Heading into ElectionsBy: Tanay Ved & Matías Andrade Cabieses Key Takeaways:

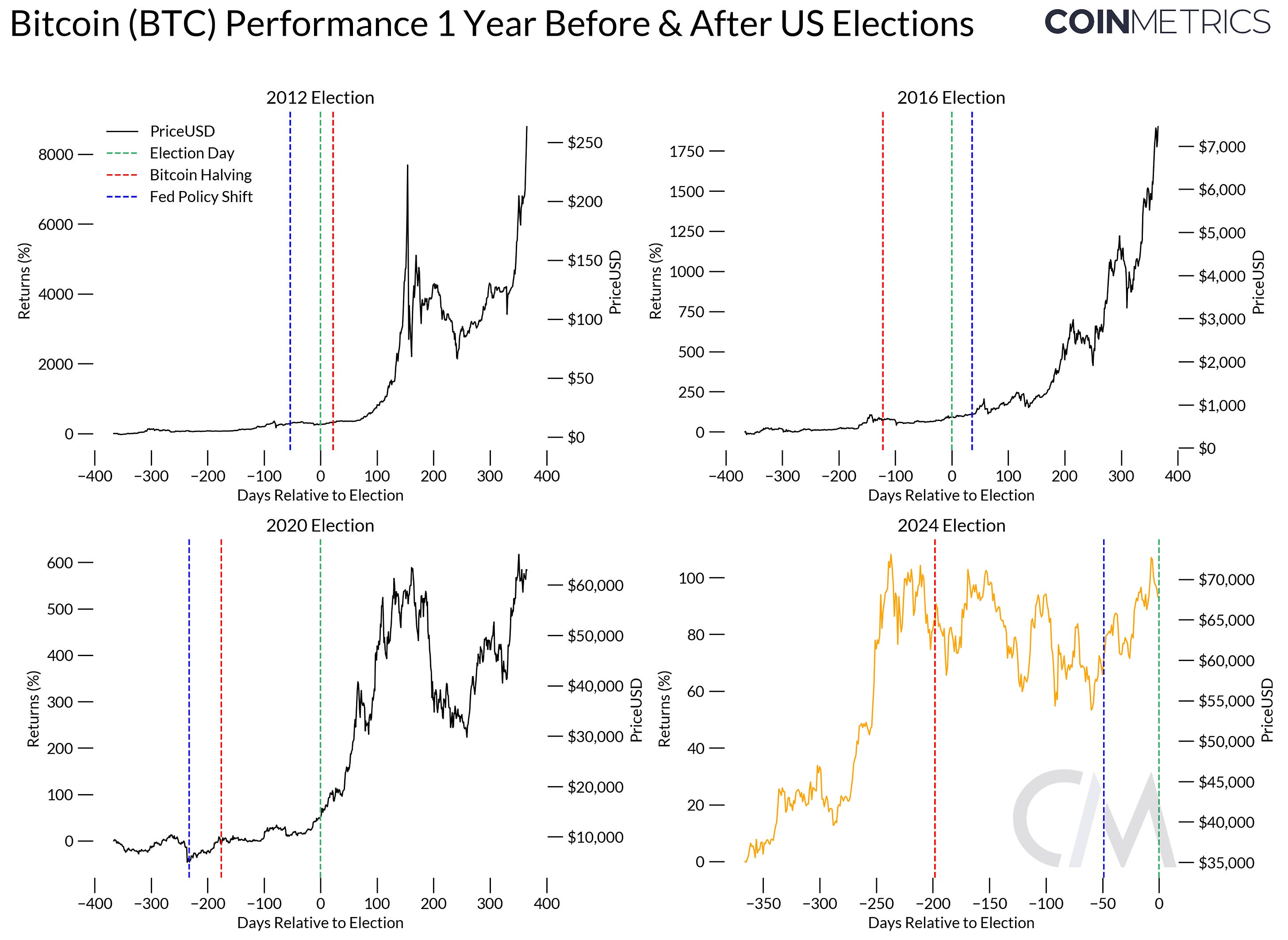

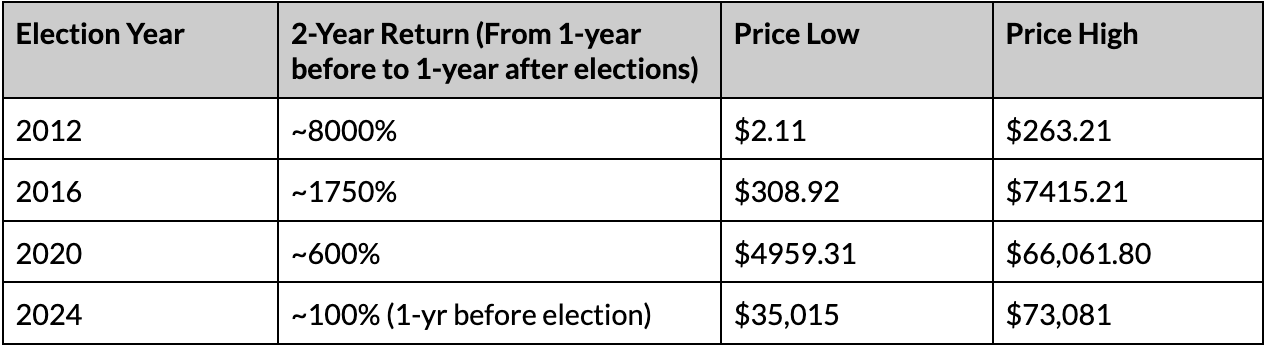

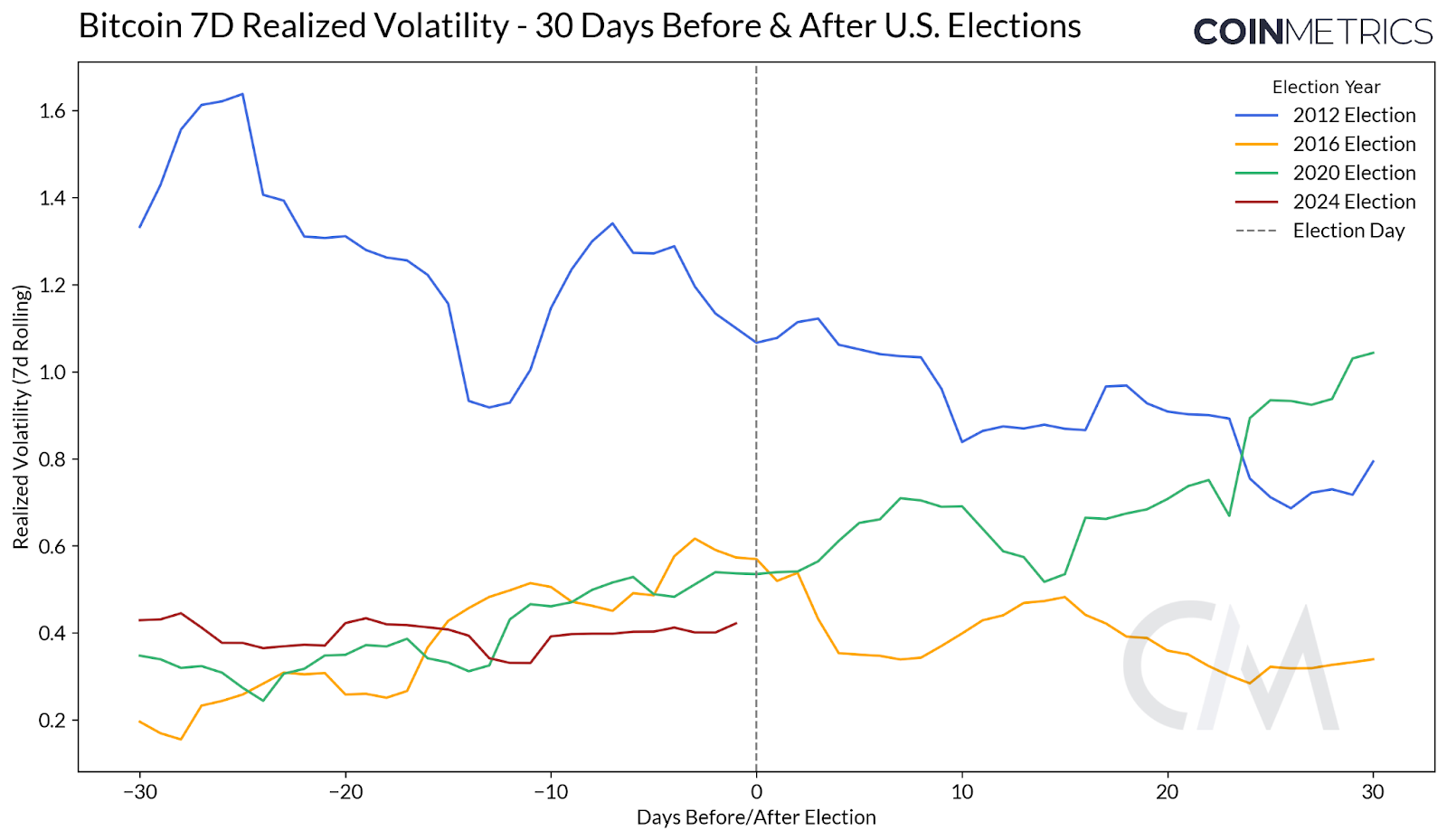

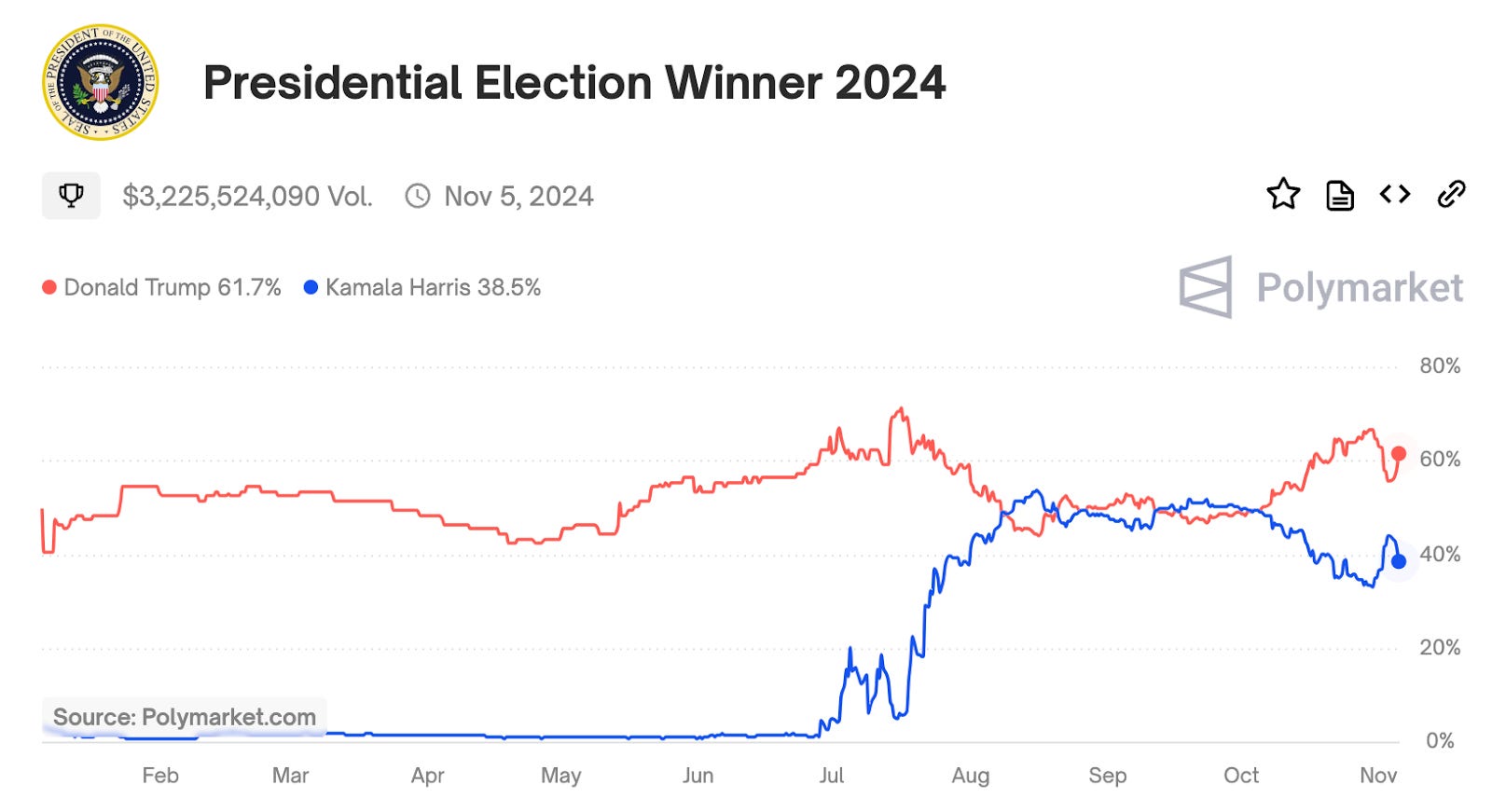

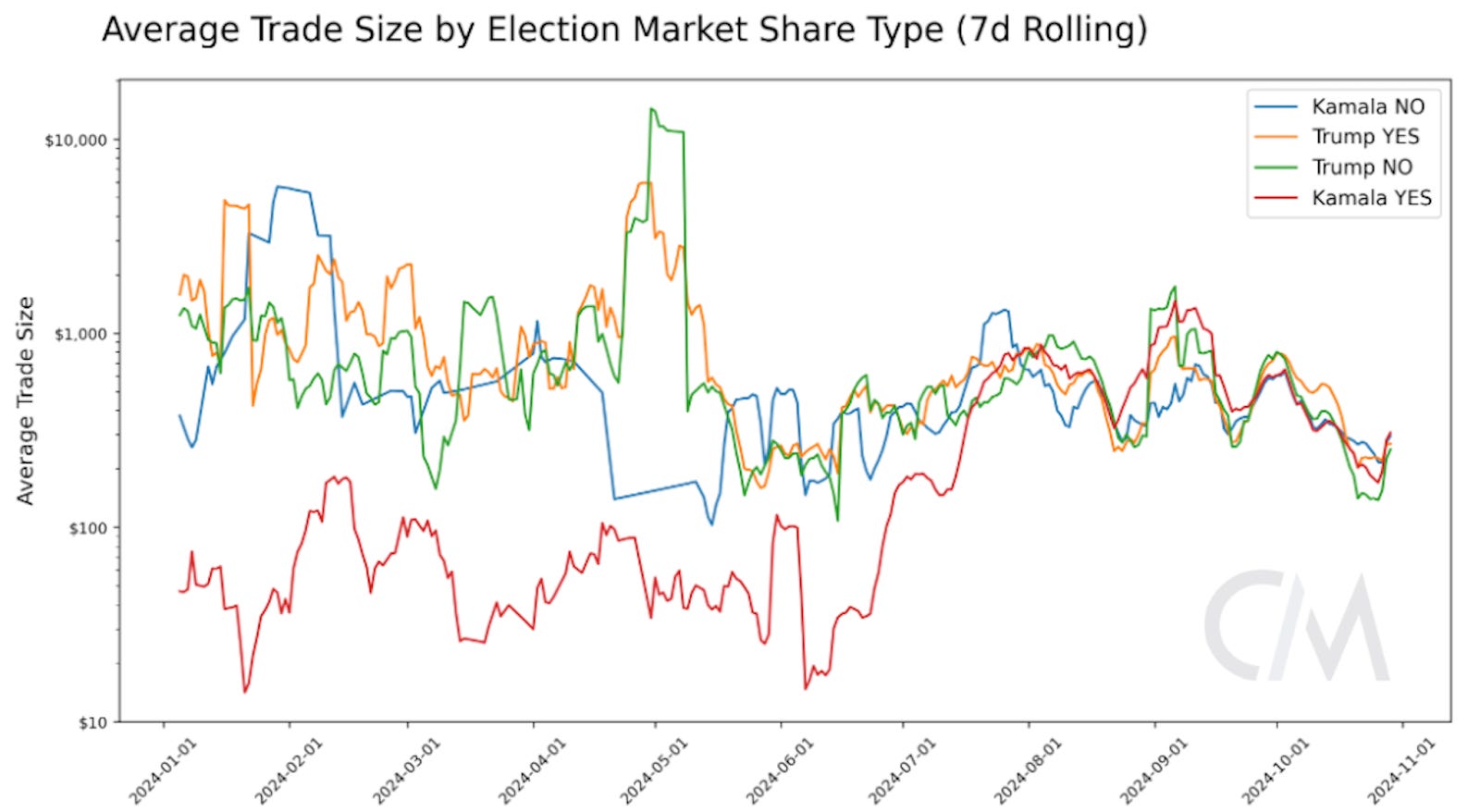

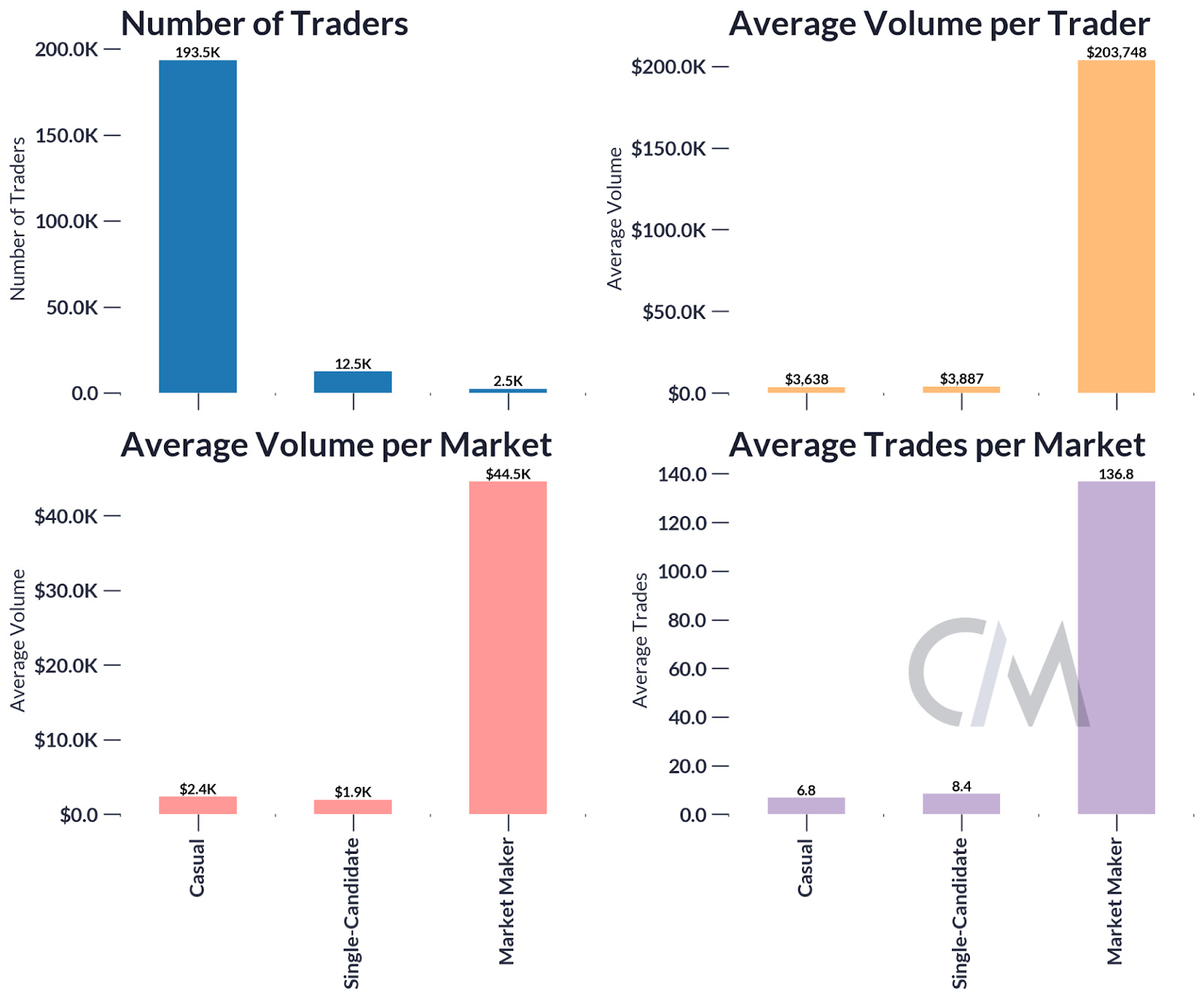

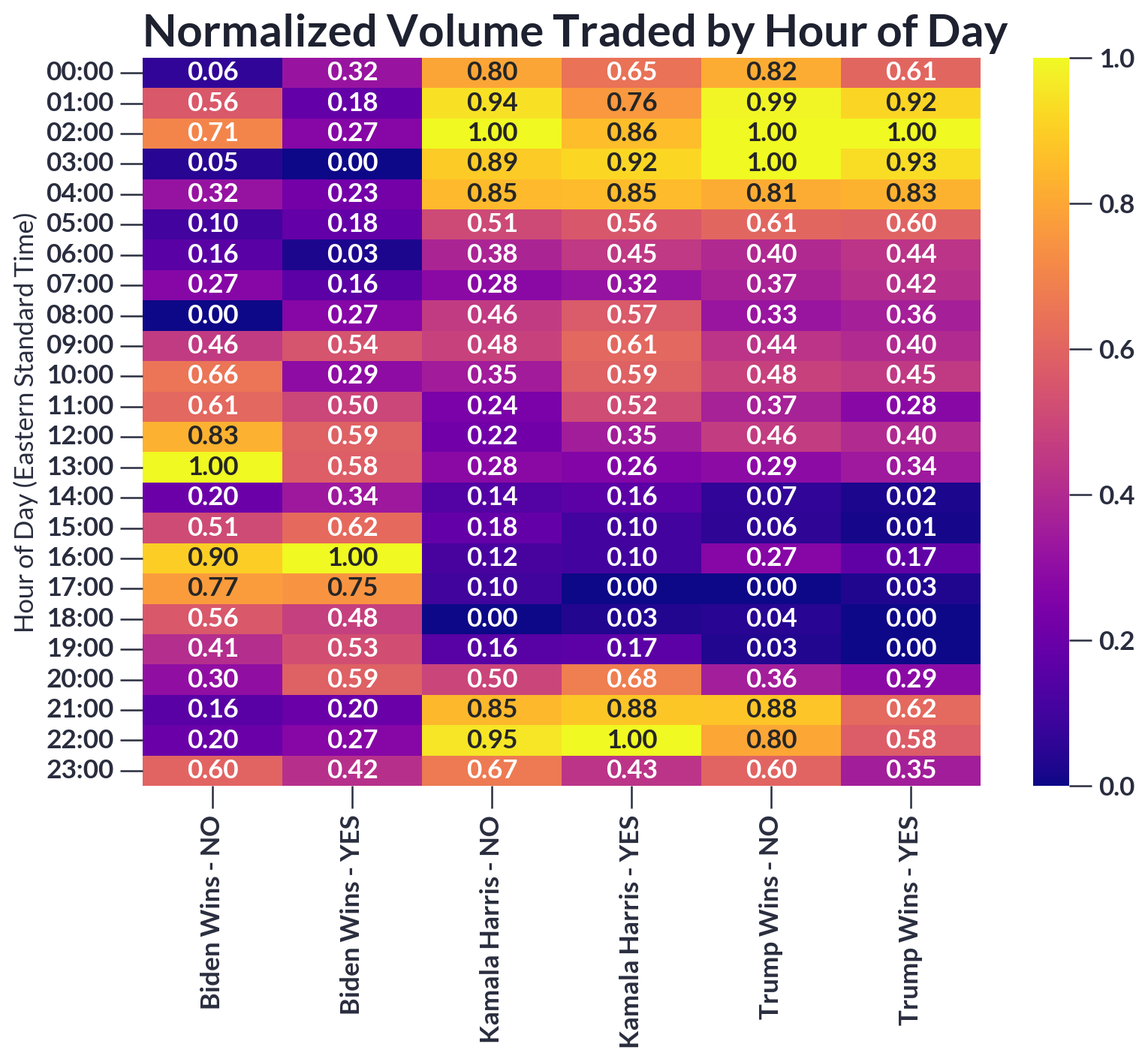

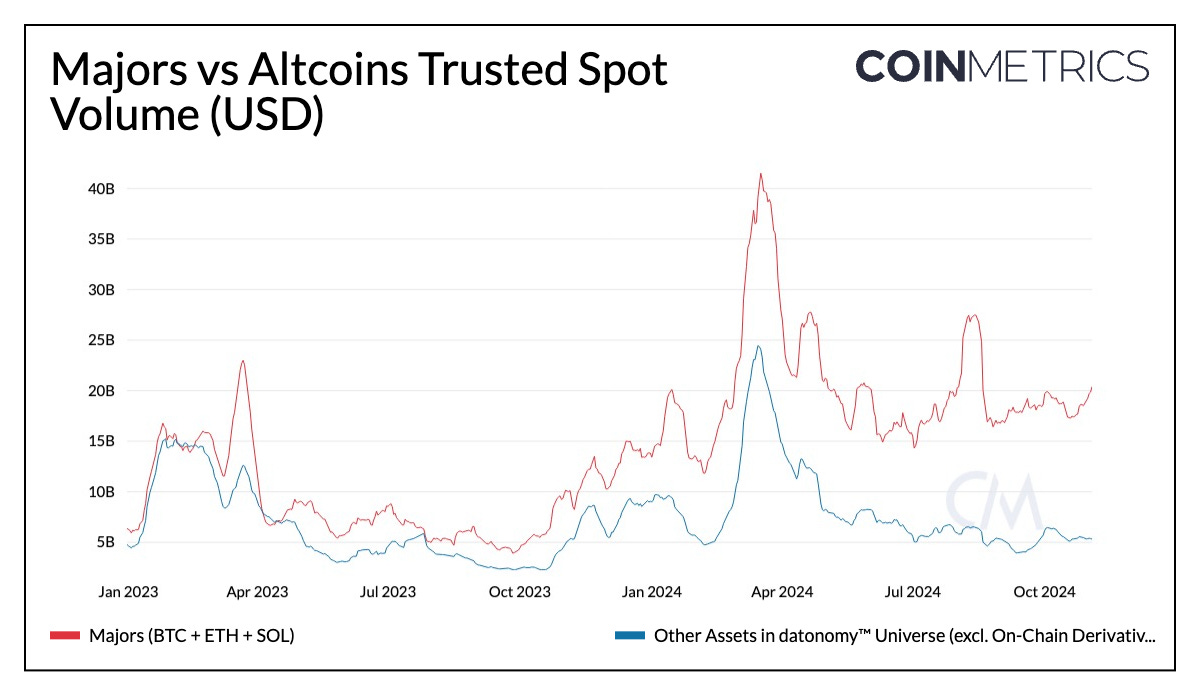

IntroductionAs anticipation builds around the 2024 U.S. Presidential election, global markets are poised for potential outcomes, with significant implications for digital assets and dynamics of the crypto ecosystem. Several political developments have unfolded leading up to the election, with prediction markets like Polymarket playing an increasingly influential role in forecasting sentiment alongside conventional polls. For a deeper understanding of how prediction markets and Polymarket work, see our recent SOTN issue, “Polymarket and the Power of Collective Intelligence.” Now, as election outcomes draw near, crypto markets have regained momentum, with Bitcoin (BTC) pushing past $70,000, within touching distance of its all-time high. As we look ahead, the election’s outcome is likely to further shape crypto’s policy landscape and influence market sentiment in the months to come. In this issue of Coin Metrics’ State of the Network, we analyze Bitcoin’s (BTC) historical performance around prior elections, dive into market movements and examine Polymarket data driven by 2024 elections. Bitcoin's Historical Performance Around U.S. ElectionsWith potential outcomes for digital assets on top of mind for market participants, we can look back to BTC’s performance during past elections to understand whether they’ve had any noticeable influence or impact. Source: Coin Metrics Reference Rates Above, we can see the returns for BTC a year before and after the last 3 U.S. presidential elections, alongside the current 2024 election (highlighted in orange). Notably, bitcoin halvings, major Federal Reserve policy shifts and presidential elections have all typically occurred closely within this time-frame, preceding a major price rally. While returns have diminished over each cycle, BTC has historically experienced significant price appreciation around 100 days post-election, as the cyclical reduction of BTC issuance, monetary policy shifts, and election outcomes reduce market uncertainty and boost sentiment. While the positive outcome of these events is evident, these trends also reflect Bitcoin’s growth as part of broader market cycles, which are also influenced by global monetary policy and expanding money supply. BTC's performance around election cycles may align with these structural factors rather than imply a direct relationship. Source: Coin Metrics Market Data Feed As we approach each election, volatility tends to increase as market participants process new information and adjust their positions in anticipation of election outcomes. The chart above shows realized volatility over a 7-day period, which has typically risen leading into previous elections (2016 and 2020) and remained elevated around 30 days after. While volatility ahead of the 2024 election has remained relatively subdued, it’s likely we’ll see an increase in the coming days. Polymarket User BehaviourSince the beginning of October, Donald Trump and Kamala Harris’ odds to win the presidential election on Polymarket have widened substantially from ~50% each to a gap of ~34% in favor of Trump. However, in the last week this divergence has reversed, with Harris’ probability of winning the election reaching 46%, narrowing the gap between the candidates. A similar shift in odds is also reflected on Kalshi, a U.S. regulated prediction market alongside some other forecasts. To understand how Polymarket users have influenced candidates odds over the year, we can examine patterns in average trade sizes across different shares. The chart below, showing the 7-day rolling average bet size reveals notable patterns in trading behavior across election outcomes. Over the entire period, “Trump YES” and “Trump NO” shares exhibit higher average trade sizes, ($971 and $955 respectively) with spikes on some occasions suggesting a shift in sentiment driven by external events or the influence of larger, concentrated bets. On the other hand, “Kamala YES” and “Kamala NO” positions generally have lower trade sizes ($274 and $622 respectively) with a divergence in the early period. As we move closer to the election, trade sizes have converged across shares leading to a more stable market environment. Source: Coin Metrics Labs We can further analyze the trader activity across Polymarket for the 2024 election. We can break down the bets made in Polymarket using the simple heuristic that if traders have traded more than 50 times and in favor or against two candidates they are classified as market makers, isolating traders that bet exclusively in favor of a single candidate, and casual traders who make up the rest of the activity on Polymarket. While market makers make up a small percentage of the total proportion of traders on Polymarket, they drive a large proportion of trades and volume on the platform. Source: Coin Metrics Labs One of the questions about Polymarket trading for the election is based on the fact that Americans are not allowed to participate on these markets. We can start by looking at the normalized volume traded by hour across different prediction market contracts related to Biden, Harris, and Trump, where there's a clear pattern suggesting that much of the trading activity occurs outside typical US trading hours. Source: Coin Metrics Labs While we do see some volume during the US market hours for the Biden Wins market, the highest trading volumes are consistently observed during what would be overnight hours in the US, especially between 01:00-04:00 ET considering that the Biden Wins markets have much lower overall volume compared to Trump Wins and Kamala Wins markets. This timing aligns more with European and Asian trading hours. However, given that US political news influences trading patterns, as evidenced by some significant trading activity during US daytime hours, this pattern suggests that international traders are actively monitoring and reacting to US political developments. The fact that the majority of trading volume occurs outside US hours while still maintaining significant activity during US times suggests a global trading community that's heavily influenced by, but not primarily based in, the United States. What Lies Ahead for Majors & Altcoins? Metrics to WatchMuch has been discussed about the outlook for different sectors of the digital asset market and how election outcomes may shape their trajectory. Segmenting the market into majors (BTC, ETH, & SOL) and altcoins within the datonomy™ universe (excluding on-chain derivatives like stablecoins) reveals a notable divergence in trusted 14-day spot trading volumes. Majors currently account for $19.7B in trading volume, compared to $5.4B for altcoins. While trading volumes for majors are ~2x higher than past averages, overall levels remain relatively subdued, awaiting election outcomes and potential policy changes to confirm a directional trend. Source: Coin Metrics Market Data Feed & datonomy™ While a Trump victory has been regarded as beneficial to BTC and a wider cohort of crypto-assets as a result of his proposed initiatives around Bitcoin and involvement in projects like World Liberty Financial—a DeFi borrowing & lending protocol, it remains to be seen how various sectors respond to either outcome. Going into elections, a few metrics may serve as indicators for shifts in market sentiment. The ETH/BTC ratio sits at 0.035, approaching April 2021 levels while the SOL/ETH ratio is near an all time high of 0.07. Speculation has heightened, with BTC futures open interest near record-highs ($34B). Consequently, implied volatility is expected to grind higher, reflecting market anticipation. ConclusionAs the U.S. election approaches, anticipation is building among global market participants and the crypto ecosystem alike. While election outcomes may steer the short-term course of digital assets, the industry remains on path for sustained, long-term growth as market uncertainty fades. As we’ve seen through past cycles, Bitcoin has shown resilience through multiple elections, reinforcing its status as an apolitical macro asset. As the broader crypto ecosystem continues to mature, we can expect greater investment participation and deeper on-chain adoption to shape its evolution over time. Coin Metrics UpdatesThis week’s updates from the Coin Metrics team:

Subscribe and Past IssuesAs always, if you have any feedback or requests please let us know here. Coin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data. If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here. © 2024 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter. |

Older messages

Polymarket and the Power of Collective Intelligence

Tuesday, October 29, 2024

Coin Metrics' State of the Network: Issue 283 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Introducing Exchange Flow Metrics

Tuesday, October 22, 2024

New metrics tracking exchange-flows in BTC and ETH ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

An Overview of the Flow Blockchain

Sunday, October 20, 2024

A data-driven overview of the Flow Blockchain ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

State of the Network’s Q3 2024 Mining Data Special

Tuesday, October 8, 2024

Get the best data-driven crypto insights and analysis every week: ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

State of the Network’s Q3 2024 Wrap-Up

Tuesday, October 1, 2024

A data-driven overview of events shaping crypto markets in Q3–2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏