Earnings+More - Crossroads

Hard Rock Bet is gearing up for 2025 with a focus on amplifying brand and product engagement. With a powerful, custom-built bonusing system and an ambition to redefine traditional CRM, we're seeking leaders who are driven to challenge the status quo:

Next stepsUncertain smile: Bet365 controls an enviable place in the global betting and gaming space and has a remarkable history. But its recent annual results have prompted questions among observers over what happens next at one of the UK’s greatest modern business stories.

Off the pace: Hence, any disappointment at lackluster growth is “perhaps therefore relative.” Yet, the team suggested bet365 is “only” growing single digits in a double-digit growth environment amid increasing signs that it is off the pace.

D&A: With almost any other large company in the sector, the answer to any hint of malaise is M&A. But this has never been the answer at bet365, noted the sources who spoke to Earnings+More.

Name recognition: Most M&A in the sector involves buying another brand name, but bet365 has no need for this because “it already has the top brand name in the sector,” said another corporate consultant with extensive experience in transactions, who added “Flutter would kill for a single global brand like this.”

Not for sale: Conversely, a buyout seems implausible, at least for now. The closely held company has a flat management structure and sources suggested that only if either Denise Coates or brother John “fell out of love with the game” would an exit be contemplated.

The big what if? A disinclination to sell on the part of the Coates doesn’t mean, however, that it isn’t eyed "covetously,” as one source put it.

Overpaid, oversexed and over here: Such a dramatic turn of events wouldn’t come with its controversies. Asked what the likely reaction would be to DraftKings CEO Jason Robins walking into bet365’s Stoke headquarters as the new owner, one source simply laughed.

Making an exhibition of yourself: The other route would be a public offering, with bet365’s evident progress in the US market being crucial. “It has the nexus to support a US listing,” said one source.

Unwelcome attention: The company’s position as one of the UK’s most successful private companies hasn’t stopped the criticism in the press of, in particular, Denise Coates’ pay.

As you were. For now: Asked whether bet365 is faltering, the corporate consultant said they “don’t think there is a black and white answer.” Similarly, the Regulus team concluded the company’s future might be a toss-up.

GeoComply's international solutions are unlocking compliance and security for the global market, so players everywhere can enjoy seamless, worry-free gaming experiences. GeoComply’s Brazilian solution is designed specifically for the local market, offering seamless geolocation compliance (without requiring a companion app), robust anti-fraud measures, and streamlined licensing support—all while minimizing customer friction. Visit GeoComply at ICE Barcelona (booth #5L16, Jan 20-22) and learn how our advanced geolocation, identity, and fraud solutions safeguard your platform from account takeovers, fraudulent chargebacks, promotion abuse, and more! +MoreBreaking: Entain has issued a trading statement reiterating its 2024 guidance, including that of BetMGM, saying that despite customer-friendly results in Q4 it is sticking with its previously communicated FY24 EBITDA losses for BetMGM of $250m.

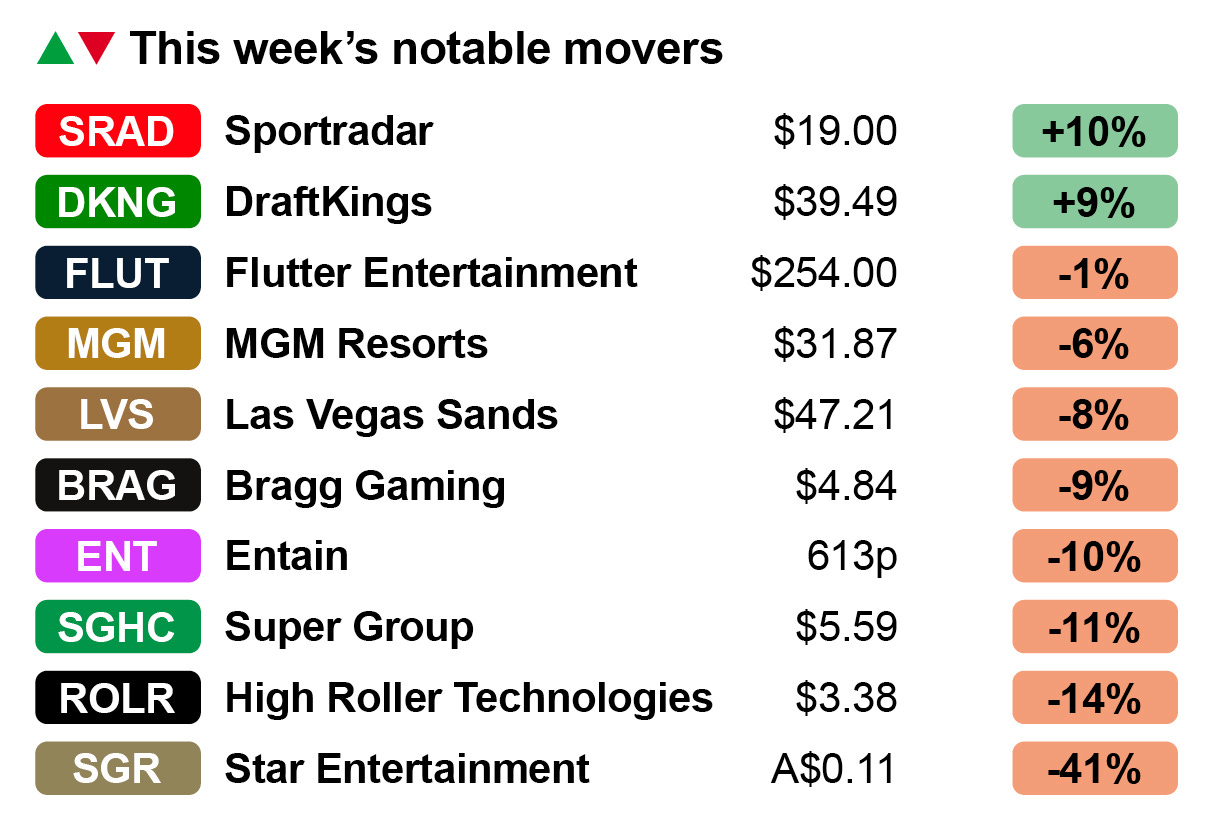

Las Vegas Sands said on Friday it has made a $963m payment to the Singapore government in return for a lease on the land earmarked for its MBS II expansion. DraftKings announced a partnership with Delta Air Lines at last week’s Consumer Electronics Show in Las Vegas. A travel industry blog noted that gambling on aircraft remains illegal, but that a “SkyMiles-earning for sports betting” might be plausible. J&J Gaming has completed the acquisition of Leisure Gaming, a Nevada-based route gaming operator, following the approval of the regulators. Sportradar has announced it will be showcasing its AI capabilities through a live 3x3 basketball demonstration at ICE Barcelona. Markets watchUnlucky general: All the good work being done by CEO Gavin Isaacs to steady the ship following the uncertainties of the Nygaard-Anderson era at Entain are in danger of being undone by shareholder apprehension over what comes next, going by recent share price movements.

Hit and hope: The shares are now trading over 20% below that level and were down nearly 10% last week. No surprise then that there should have been a note from the analysts at Peel Hunt last week suggesting investors should “go on, have a look, you might be surprised.”

🪃 Back where we started: Entain’s last six months Fallen at the first: Leading the fallers last week was Australia’s Star Entertainment, a company for which the appellation ‘troubled’ has become permanently attached.

The dog that didn’t bark: Perhaps surprisingly given last week’s news from Flutter about Q4 sports-betting margins, DraftKings ended the week up 9% after it signally failed to issue its own warning.

We simplify game development by doing the heavy lifting, so you can focus on creativity. Whether you’re an emerging studio or an established one looking to relieve development pressure, we ’ve got you covered.

Analyst takesAsp bite: Wynn Resorts’ acquisition of Crown London announced last week was welcomed by the team at CBRE.

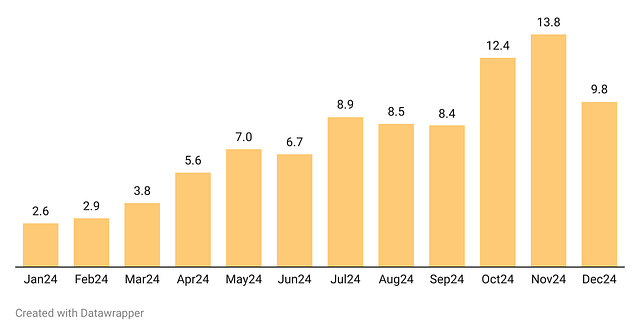

By the numbers – New YorkFriendly fire: Weekly handle came in at over $600m in the week to January 5, the largest ever total since the market opened three years ago. The figures for December, meanwhile, showed handle of $2.28bn but GGR coming in at a lowly $150m.

Fan pleasers: In market share terms, FanDuel held on to 46% market share while rival DraftKings generated $46.5m for 31% share.

Since taking over the license from PointsBet in April 2024, Fanatics has substantially improved upon its existing market share, more than doubling from 3% in April to 6.5% in December.

What we’re reading: Michael Rubin, Fanatics’ founder, in the London Times on why the company is really going “all-in” on gambling and says the company will eventually IPO but only after sports betting is profitable.

ESPN Bet watch: Struggling in New York with a GGR total of a mere $1.3m, or less than 1% share, was ESPN Bet. The picture is, if anything, worse in Iowa, which also reported December numbers last week where it made zero GGR, leaving its grand total for 2024 at $5.5m or 2.5% share.

Venture capital firm Yolo Investments manages in excess of €500m in capital across 100 exciting fintech, gaming and blockchain companies. The Yolo Investments' Gaming fund, regulated by the Guernsey Financial Services Commission, has taken positions in fast-growth suppliers and operators, including Dabble and Enteractive. Yolo Investments (yolo.io) wants to hear from readers of this newsletter. Get in touch with your pitch, or for a chat about innovative products which can plug into our investment ecosystem. Earnings calendar

Join 100s of operators automating their trading with OpticOdds. Real-time data. Proven trading tools. Built by experts. Unlock complimentary access until year-end at www.opticodds.com. An +More Media publication. For sponsorship inquiries email scott@andmore.media. |

Older messages

Patience pending

Friday, January 10, 2025

Will others follow Flutter's lead and buy their way into Brazil? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Fourth down

Wednesday, January 8, 2025

Flutter warns after 'historically bad' NFL season ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Luxury tax

Monday, January 6, 2025

DraftKings adds 'subscription' option in New York ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Out of left field

Friday, January 3, 2025

Crypto.com's further threat to OSB status quo ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Last chance saloon

Friday, December 20, 2024

Can Hollywood save Penn's online business? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

'Do Your Job: The Art of Winning' with Bill Belichick

Thursday, February 27, 2025

In his upcoming book “The Art of Winning,” set to be released in May, Coach Bill Belichick shares several key secrets to his extraordinary success on the field.

Good Questions

Thursday, February 27, 2025

About Google's Performance Max.

Don't Pay

Thursday, February 27, 2025

Often referenced in discussions about wealth, what does it mean, and how can you determine yours?

Turo's troubling signal for tech IPOs

Thursday, February 27, 2025

Europe's VC valuations back on track; pets, dental care drive healthcare services deals; crypto VC dealmaking on the rise; VC returns inch up Read online | Don't want to receive these emails?

Gaming exits could get an extra life

Thursday, February 27, 2025

UK VC dealmaking carries on; fund performance gap narrows; gift card specialist Raise rises with $63M Read online | Don't want to receive these emails? Manage your subscription. Log in The Daily

🛒 Alexa+ Wants to Run Your Life

Thursday, February 27, 2025

Shopping, booking, planning—Amazon's AI is getting way too smart.

🧠 Musk’s Grok 3

Thursday, February 27, 2025

"The Smartest AI on Earth" or just another chatbot hype?

Get the AI SEO Playbook

Thursday, February 27, 2025

AI can help you streamline your SEO processes and drive more traffic with less effort. But it can also hurt your SEO performance if you're not careful. Find out how to use AI to your advantage

LinkedIn Updates, Meta Ads, and YouTube Growth

Thursday, February 27, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... presented by social-media-marketing-world-logo Mondays can feel overwhelming, Reader, but don't worry...we've got your

📣 New Digiday Publishing Summit speakers announced

Thursday, February 27, 2025

New Speakers Announced New speakers have been added to the lineup for the upcoming Digiday Publishing Summit, taking place March 24-26 in Vail. Explore some of our newest additions below and discover