The Pomp Letter - Is This The New 60/40 Portfolio?

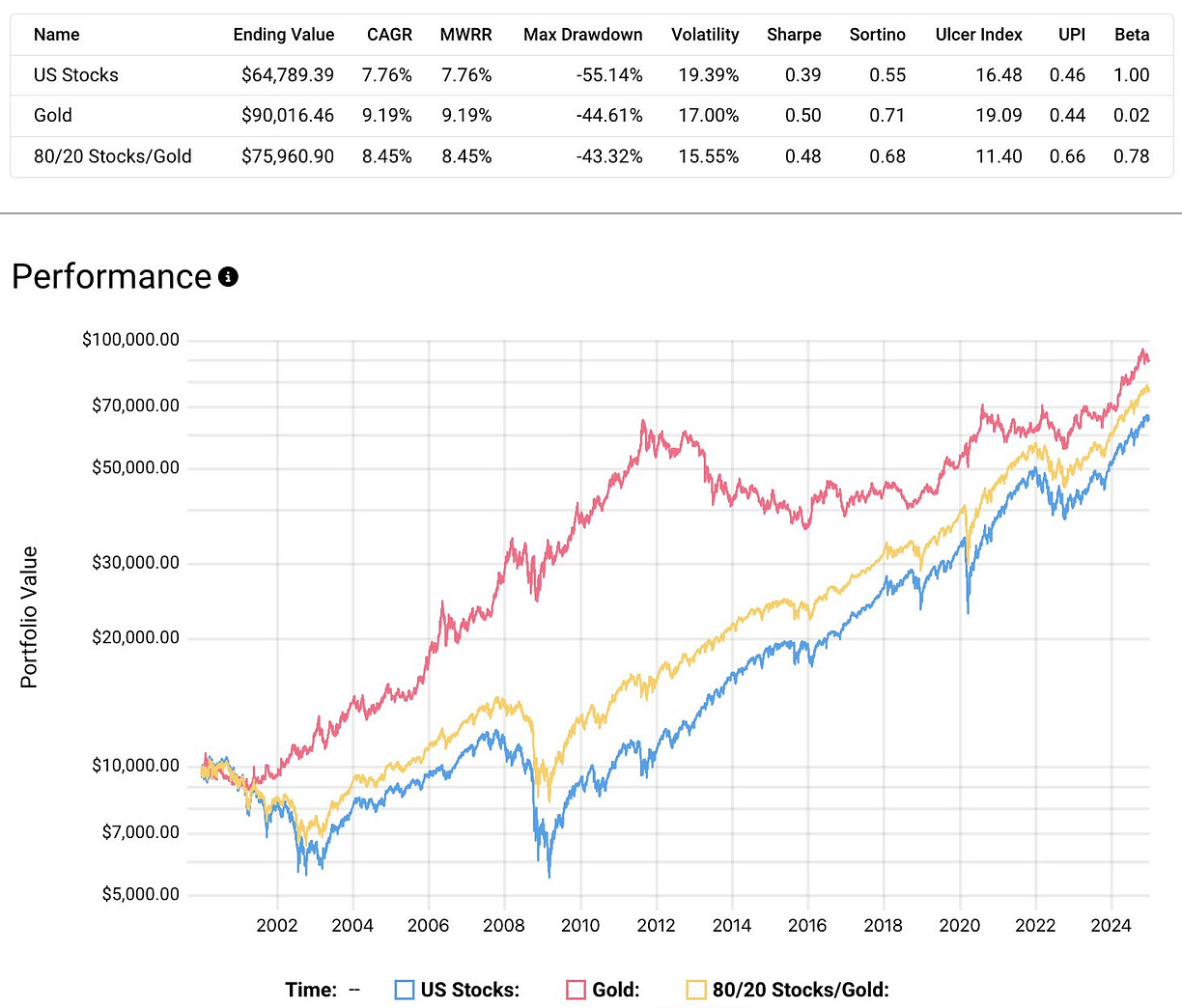

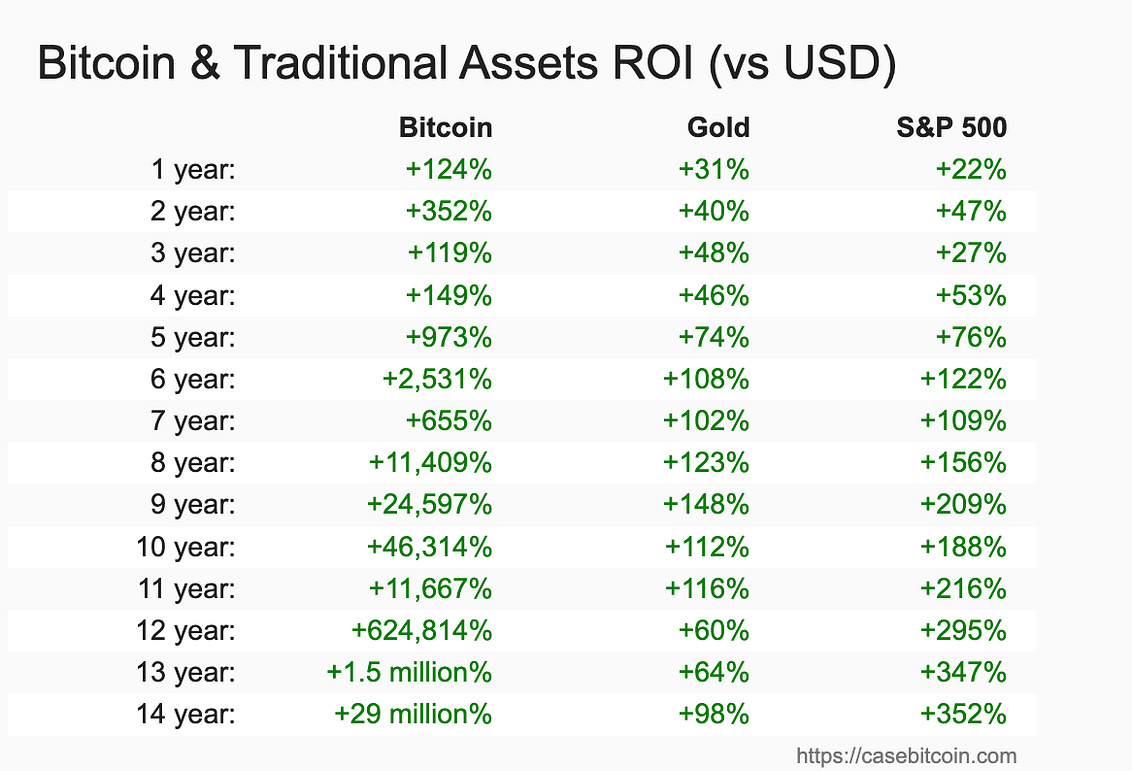

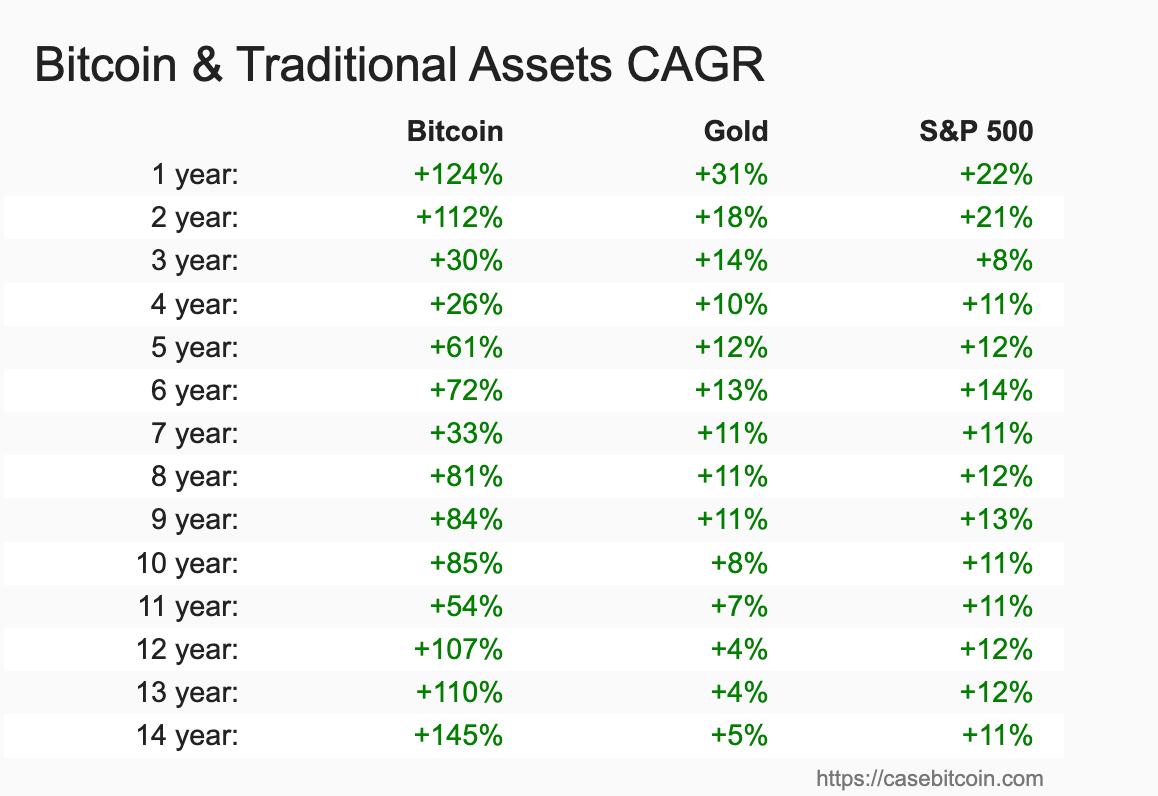

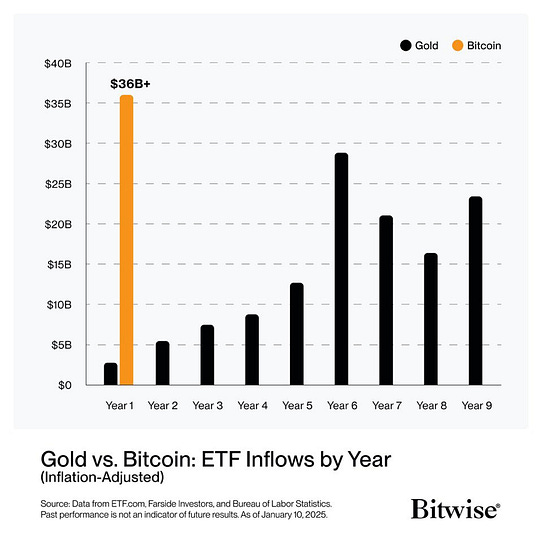

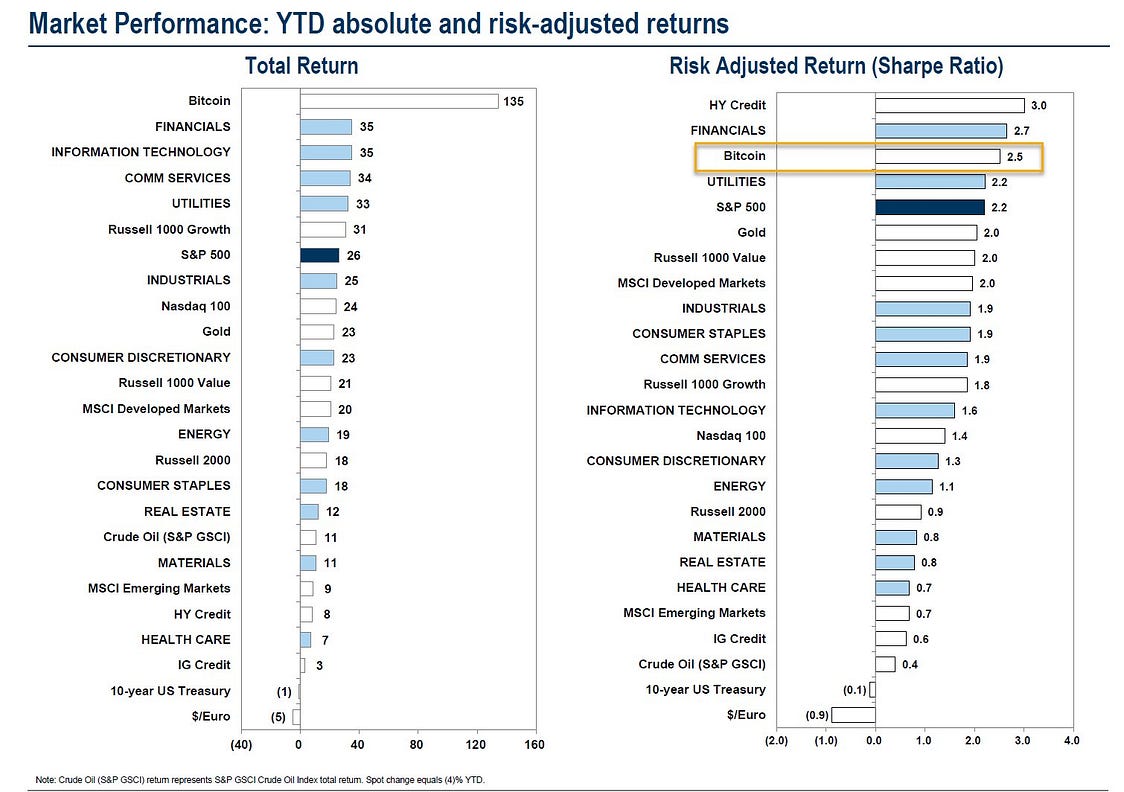

To investors, Every once in awhile I come across a data point that surprises me. The latest surprise came from a chart comparing gold and US stocks over the last 25 years. If you had invested $10,000 in either asset two and a half decades ago, you would have ~$90,000 in gold and about $65,000 in US stocks. Yes, this includes dividends for US stocks too. Equities are supposed to outperform gold over the long-run due to the earnings driven by their products and services. But that hasn’t been true over the last 25 years. This would be noteworthy as a single data point, but the more interesting part is that bitcoin has been significantly outperforming gold and the S&P 500 for years. Here is the aggregate performance for all three assets: Here is the compound annual growth rate of the same three assets: An area in financial markets where we can see a large difference in gold and bitcoin is the ETF inflows for each asset. Bitwise, a crypto-native asset manager, put together this graphic comparing the first year of the gold ETF to the first year of the bitcoin ETF. It shouldn’t be shocking to see the asset with the best performance receiving significant inflows, nor should it surprise us given how many more investors are deploying capital into ETFs today compared to 2003 when the first gold ETF launched. As if bitcoin needed any further tailwinds, Scott Bessent—Donald Trump’s nominee for Treasury Secretary—recently revealed that he owns up to $500,000 of Blackrock’s bitcoin ETF. We are going to go from an abrasive administration to a supportive administration in a matter of months. That should be a very big deal for bitcoin. Remember, bitcoin is only 15 years old. As Matthew Mežinskis recently pointed out, there are only four central bank balance sheets larger than bitcoin now. So bitcoin is “winning,” especially when you compare the progress to critics’ expectations. Now here is a big idea — maybe bitcoin should replace bonds in investors’ portfolios. We know that bonds deliver horrible performance. The 10-year treasury return for the trailing 10 years is about 1.5%, yet inflation was approximately 2.8%. This means investors had a negative real return on government bonds for a decade. If we look at iShares 20+ Year Treasury Bond ETF, the story is not great — the fund is down 38% over the last 5 years. And as I pointed out two weeks ago, bitcoin has a higher sharpe ratio that stocks, bonds, or gold. If you had put 60% of your portfolio in the S&P 500 and 40% in bitcoin, your return would have been about 430% over the last 5 years. Maybe that is the new 60/40 portfolio. 60% domestic equities. 40% bitcoin. 0% bonds. Never say never. There are more and more financial advisors and capital allocators wondering if they should own bitcoin as a larger percentage of their portfolio. Let’s see what happens in the coming years. Hope you all have a great start to your week. I’ll talk to everyone tomorrow. - Anthony Pompliano Founder & CEO, Professional Capital Management 🚨 READER NOTE: I am hosting Bitcoin Investor Week in NYC from February 24-28th. This will be the largest finance conference of the year focused on bitcoin. Speakers include Mike Novogratz, Cathie Wood, Jan van Eck, Anthony Scaramucci, Jack Mallers, and many others. You can purchase tickets here: Get ticket for Bitcoin Investor Week Meet The Man Trying To Get Amazon & Microsoft To Buy Bitcoin Ethan Peck is the Deputy Director for the National Center for Public Policy Research’s Free Enterprise Project. He also wrote a proposal to Microsoft and Amazon for them to put bitcoin on their balance sheet. In this conversation we discuss what he did, why he did it, how these shareholder proposals work, Saylor’s 3 minute pitch, how it gets approved, and what the impact will be. Enjoy! Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren't finding this valuable. Nothing in this email is intedneded to serve as financial advice. Do your own research. Invite your friends and earn rewardsIf you enjoy The Pomp Letter, share it with your friends and earn rewards when they subscribe. |

Older messages

The Single Most Important Thing For Bitcoin Right Now

Friday, January 10, 2025

Listen now (4 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bubbles, Crashes & Fiscal Dominance - Should You Be Worried?

Thursday, January 9, 2025

To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Podcast app setup

Tuesday, January 7, 2025

Open this on your phone and click the button below: Add to podcast app

Bitcoin Will Infiltrate Every Corner of Finance and We Are Starting To See It Now

Tuesday, January 7, 2025

Listen now (3 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Bitcoin Is The New S&P 500

Friday, January 3, 2025

Listen now (4 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

Python Weekly - Issue 688

Thursday, February 27, 2025

February 27, 2025 | Read Online Python Weekly (Issue 688 February 27 2025) Welcome to issue 688 of Python Weekly. We have a packed issue this week. Enjoy it! The #1 AI Meeting Assistant Summarize 1-

Free download: 5 ways to improve your proposals

Thursday, February 27, 2025

A free resource for you ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

From living in a car to $1.4M in 5 months

Thursday, February 27, 2025

I love that you're part of my network. Let's make 2025 epic!! I appreciate you :) Today's hack From living in a car to $1.4M in 5 months Taro Fukuyama and 2 of his friends from Tokyo

I'm launching a meme coin live RIGHT NOW

Thursday, February 27, 2025

(All for charity dw) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Vibe shift

Thursday, February 27, 2025

Billions added to values as investors warm to sector earnings ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Midnight Society Bows Out While ChronoForge Aims for a Bigger Stage 😮

Thursday, February 27, 2025

PlayToEarn Newsletter #260 - Your weekly web3 gaming news

WTF is open-source marketing mix modeling?

Thursday, February 27, 2025

Marketers should be wary of open-source programs promoted by purveyors with a walled garden history. February 17, 2025 PRESENTED BY WTF is open-source marketing mix modeling? Marketers should be wary

👀 What Content Is AI Citing?

Thursday, February 27, 2025

Another parasite SEO gift for you 🧙✨🎩 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The 2021 GTM Playbook Is Mostly Dead

Thursday, February 27, 2025

But What's The AI Era Replacement? To view this email as a web page, click here saastr daily newsletter The 2021 GTM Playbook Is Mostly Dead. But What's The AI Era Replacement? By Jason Lemkin

'Do Your Job: The Art of Winning' with Bill Belichick

Thursday, February 27, 2025

In his upcoming book “The Art of Winning,” set to be released in May, Coach Bill Belichick shares several key secrets to his extraordinary success on the field.