Inflation May Be Much Lower Than You Think...

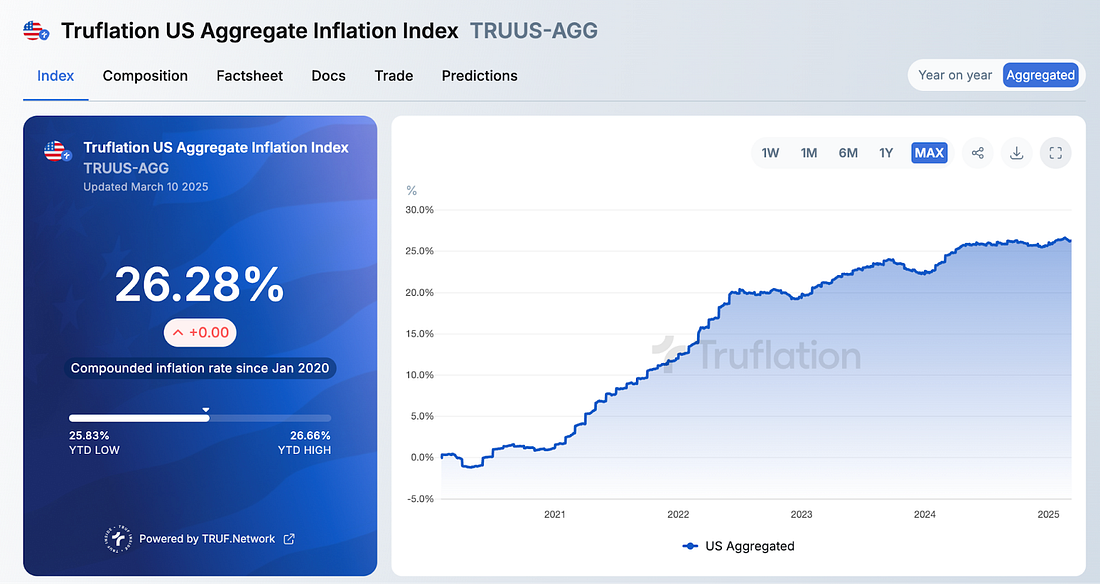

To investors, It is hard to remember a world before the recent hysteria driven by the market sell-off. Do your best to ignore the recent noise and remember back to a few weeks ago when everyone was worried about inflation. The latest CPI report came in at 3% year-over-year change. Economists were issuing warnings that Trump and his administration were going to make inflation skyrocket because of their tariff policies. And mainstream media was doing their best to spin the 3% inflation report as a positive development that wouldn’t hurt President Biden’s legacy. But it turns out these warnings were misplaced. The government’s CPI data uses backwards-looking data to make an educated guess about where inflation is right now. That makes no sense. The more logical approach would be to use real-time data to understand where inflation stands at any given moment in time. This is exactly what Truflation does. They describe their work as “providing real-time, unbiased data to empower decisions and build a transparent economy.” So what is Truflation showing inflation at right now? A measly 1.39%! That means Truflation is showing an inflation reading that is more than 50% lower than the government’s latest report. It would be easy for critiques to claim Truflation doesn’t know what they are doing. They probably constantly under-report inflation compared to the government, right? Wrong. As you can see in the chart above, Truflation actually had inflation reported in real-time at 3.1% back in December 2024. This means they beat the US government to the 3% or higher inflation reading by nearly two months. Now that Truflation’s metrics are falling aggressively, it is likely we will see the government’s stats come down in the coming months as well. The government runs on outdated data. Truflation runs on real-time metrics. So why is it important to pay attention to Truflation? It gives the most accurate measurement of the true damage the American consumer has experienced in the last few years. For example, Truflation shows the aggregate inflation since January 2020 is now over 26%. This means that $1 in 2020 can only buy $0.74 of goods today. It is unsustainable for a currency to lose 26% of its purchasing power every 5 years. But that is what we have lived through for the last half-decade. This brings me to the most important point — if the government’s data is correct, then the Federal Reserve should not cut interest rates. Cutting interest rates with inflation at 3% would be a recipe for disaster. If Truflation is right however, the Fed better start cutting interest rates quickly. We can’t have high interest rates with inflation crashing 50% in a matter of weeks. That would also be a recipe for disaster. So ultimately the Fed’s decision hangs in the balance of which data set you believe — the antiquated methodology using backwards looking data? Or the real-time data calculated by the technologists? I think we all know the answer to which data set and methodology is more accurate, but our opinion doesn’t matter. Only the Fed’s opinion counts right now. And so far we have no reason to believe that Powell and his crew see disinflation as the issue that it probably has become. Hopefully markets don’t punish us later for today’s sins. I wish all of you a great start to your day and I’ll talk to everyone tomorrow. - Anthony Pompliano Founder & CEO, Professional Capital Management Cathie Wood on Bitcoin, The Economy, DOGE, and More Cathie Wood is the Founder & CEO of Ark Invest. This conversation was recorded at Bitcoin Investor Week in New York. In this conversation we talk about what the environment was like buying bitcoin in 2015, why bitcoin is so innovative, institutional interest in bitcoin, global macro world, market uncertainty, DOGE, bitcoin strategic reserve, and the future outlook on the market and bitcoin. Enjoy! Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren't finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription. |

Older messages

Is The Trump Administration Crashing The Market On Purpose?

Monday, March 10, 2025

Listen now (4 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

We Finally Have A Strategic Bitcoin Reserve

Friday, March 7, 2025

Listen now (4 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Maybe We Are Getting A Bitcoin-Only Strategic Reserve After All

Wednesday, March 5, 2025

Listen now (3 mins) | Today's letter is brought to you by Osprey Funds! ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Age of Economic Chaos

Tuesday, March 4, 2025

Listen now (7 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What I Think About The Crypto Strategic Reserve

Monday, March 3, 2025

Listen now (8 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

The Art of Being a Great Teammate: How Great Teams Are Built, One Person at a Time

Tuesday, March 18, 2025

Great teammates commit to a standard of excellence, lift each other up, and work toward something bigger than themselves—focusing on we, not me.

Gen Z is Listening 🎧

Tuesday, March 18, 2025

to audio-only podcasts.

Brian Wieser revises ad forecast downward as U.S. ad market grows wary

Tuesday, March 18, 2025

Ad spending's new forecast: ad growth slower, caution higher. March 18, 2025 PRESENTED BY Brian Wieser revises ad forecast downward as US ad market grows wary Ad spending's new forecast: ad

🔔Opening Bell Daily: 2022 Redux

Tuesday, March 18, 2025

History may repeat itself as equities attempt to rebound from a correction.

The *other* men's college basketball tournaments are a disaster

Tuesday, March 18, 2025

A perfectly good thing appears to have been burned down...for no good reason

2x signup rate (study)

Tuesday, March 18, 2025

Launching a product? I'm helping startups build better products and reach product-market fit. To do that, we've built ProductMix and you should use it: https://rockethub.com/deal/productmix

📓The new digital playbook

Tuesday, March 18, 2025

A sr manager shares her proven digital strategy View in browser MastersInMarketing-logo-email Prep your Bookmark clickin' finger; you're gonna want to come back to today's post again and

Perverse incentive

Tuesday, March 18, 2025

Does Penn have the will – or the wherewithal – to make ESPN Bet a success? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🔔Opening Bell Daily: US vs. World

Tuesday, March 18, 2025

Wall Street is mixed on whether to buy the dip as the stock market tumbles.

'Just don't say DEI': Brands sit out advertising around Black History Month, other heritage months this year

Tuesday, March 18, 2025

Brand clients have either paused marketing around days geared toward honoring historically marginalized communities or tweaked language away from anything that could be deemed DEI. March 12, 2025