It should come as no surprise to anyone that the events business has been in dire straits since COVID-19 hit. With the fear of rapid transmission and the need for social distancing, no one was going to attend events at closed venues like hotels.

The results are in from the Center for Exhibition Industry Research and, as you might expect, they’re pretty bad. According to the report:

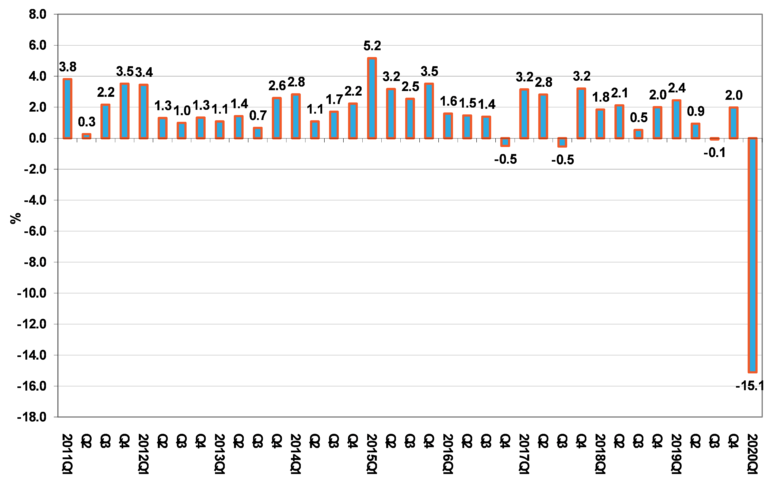

Growth of the exhibition industry plunged during the first quarter of 2020 as 72.6% of events originally scheduled for the second half of March were cancelled. As a result of many cancellations, the CEIR Total Index, a measure of exhibition industry perform, registered a record 15.1% decline from a year ago.”

The full chart can be seen here:

|

For publishers that have grown dependent on events for additional revenue streams, cancellations continue to hurt. It hasn’t been all bad news, though. Many publishers have pivoted to virtual events, some of which have seen strong results.

Digiday wrote last week about the variety of publishers that are seeing success with virtual events:

Since launch in April, Verizon-owned TechCrunch has hosted 10 members-only investor Q&A series events, Extra Crunch Live, via its subscription tier, Extra Crunch. Most of its 2020 events are for Extra Crunch members. Extra Crunch subscriptions have increased by 600% year-on-year, the company said.

“With the huge success we’ve had with virtual events — over a quarter of a million attendees have tuned in from over 110 countries — we’ve realized that a significant portion of our attendees were not current NYT subscribers,” said Jessica Flood, managing director, NYTLive.

As Digiday goes on to say, many publishers are looking at these virtual events as a great way to engage with their subscribers. Publishers are finding that a subscriber that attends an event becomes more engaged with the site afterward.

The good thing here is that the costs are far lower than in-person events. As I wrote in April:

However, there is a lot to be excited about tvirtual events. The two primary benefits? Your audience can be far larger and you can bring the greatest speakers without ever having to worry about geography. Plus, the margins are significantly greater.

Think about it… You’re not stuck getting a hotel, paying for AV, dealing with those pesky food and beverage minimums, physical build out of stages and sets, paying for travel and the list goes on.

With a virtual event, your costs are basically the online event platform. Suddenly, an event that might have cost you $2 million to put on only costs a fraction of that.

At the same time, with the world able to attend, you can bring far more people into the fold than you normally would. First, there’s no high-priced ticket (some of us event organizers charge 4 figures for a ticket). Second, there’s no travel. That saves time here.

Those are very real and very tangible benefits.

But let’s call a spade a spade… Cancelled events still hurt. Hosting an event that could bring millions of dollars in revenue and turning that into a virtual event that might only bring hundreds of thousands hurts, even if the margins are better.

EventMB, a publication focused on event planning, spoke with Dr. Brian Labus, an epidemiologist back in May, and he had a series of quick takeaways worth looking at when it does come time to start reopening events. One part, in particular, really jumped out to me. On being asked if local and small events was a good strategy, he said:

Oh, absolutely. Small, local events are definitely recommended over national or international events because you'd take out that travel piece, you take out the lodging piece. You just have the same people that are in your community right now, and you're merely bringing them together in a slightly different way.

This is clearly very logical and is something event professionals have been talking about for the past couple of months. Instead of taking an event over multiple days, keep it focused to a single day, which minimizes the need to stay in a hotel.

This is where the creativity of event professionals can become interesting. Just because an event is local, that doesn’t mean it can’t also be global at the same time—this time virtually.

I was talking with Peter Bordes, the head of events and a colleague of mine at CoinDesk. He said:

Offer the virtual experience to the attendee around the world. They can get the content for one price; they can network with other virtual attendees for a higher price. Then, at the physical event, you have speakers agree to do scheduled roundtable discussions as an added benefit to the in-person attendee, who has already spent more to attend. At the end, notes from those discussions can be distributed to all virtual attendees.

Each event will have to find its own way, but there are exciting opportunities for event managers to pull off the scale of a virtual event with the social distanced intimacy of an in-person event.

None of this means we’re all clear, of course. If there is a second wave, we’re right back to square one. But as we continue moving into the summer months, thinking local and global at the same time could be exciting.

Layoffs at The Athletic

Axios obtained an internal memo announcing that 46 people were being let go, equal to about 8% of the company. The Athletic told Axios:

"While we are hopeful that sports will soon resume, this measure was necessary to ensure that the company can weather the uncertainty that lies ahead. Overall, our subscriber base remains steady and we are proud of our newsroom's continuing coverage of the return of sports."

A few things jump out to me here that are bizarre:

The NBA announced the day before that the season was coming back at the end of July. Sports are coming back.

CEO Alex Mather told Axios that “new subscriber growth was 20-30% down,” but in their statement, also said subscriber numbers remain steady.

They closed a $50 million round back in January and were expecting to be profitable this year.

Something seems off…

I can’t fault a business for needing to make tough decisions to ensure the entire operation stays afloat. I’m not one of those armchair analysts that pretends to know a company’s P&L. And based on my math back in September, they were burning cash.

Let’s simply take the average of those two numbers, which is $87,500 and then round up to $100,000 when you factor in benefits, real estate, etc. So, 600 employees at $100,000 a pop is $60,000,000. It could be higher and it can certainly be lower.

According to the Bloomberg article, the company has 600,000 paying subscribers with an average revenue of $64 per subscriber. That means revenue is $38,400,000.

$60,000,000 in cost - $38,400,000 in revenue = $21,600,000 deficiency

Another possible explanation is that subscription numbers are not remaining steady. To follow up, the start of this year was a very pivotal moment for The Athletic. In a tweet, I wrote:

I did the math. Based entirely on the numbers originally reported by Bloomberg, it had 250,000 first year subscribers who were going to start coming up on their renewal in the beginning of 2020. Historically, The Athletic has had an 80% retention rate. If that dropped to 70%—a drop in 25,000 subscribers—that’s equal to $1.5 million in revenue. Assume that 10% of the subscriber base dropped off—650,000 total people. That’s nearly $4 million. It starts to add up.

Before this all started, The Athletic was talking about how it was on its way to 1,000,000 subscribers. Whether it ever hit that or not, we don’t know. However, the cancellation of sports has definitely hurt the business. I certainly hope the revival of the NBA and other sports will have an impact on the business.

Thanks for reading. With New York City opening up, I am hopeful that we can start to see other media companies start to rise again. Let me know how you’re feeling. I’m always interested in hearing from you.

Please consider sharing this piece and I’ll see you next week!