Not Boring by Packy McCormick - Unit21: No-Code, Much Power

Unit21: No-Code, Much PowerMeet the $300M Tiger-Backed Startup Empowering Operators One Vertical at a Time

Welcome to the 1,133 newly Not Boring people who have joined us since last Monday! Join 59,956 smart, curious folks by subscribing here: 🎧 To get this essay straight in your ears: listen on Spotify or Apple Podcasts (soon) Today’s Not Boring, the whole thing, is brought to you by… Unit21 Unit21 gives operators and analysts powerful activity monitoring tools that they can customize to their needs — from AML to Identity Verification and even to Recruiting and Lead Generation — all without writing any code. They’re well-funded and hiring, join them! Hi friends 👋 , Happy Thursday! After a week off for the 4th of July and a move back to Brooklyn, we are back! Today’s post is a Sponsored Deep Dive — that means they’re paying me — on a fast-growing startup that just yesterday announced a $34 million Series B at a $300 million valuation led by Tiger Global. This essay is a great example of what I want Sponsored Deep Dives to be: a behind-the-scenes look into a fast-growing, under-analyzed startup’s philosophy, strategy, and tactics, chock full of lessons for both builders and investors. Plus, there’s an added bonus: a glimpse into how a Tiger-led round comes together (spoiler: quickly and ferociously). The company announced the raise in TechCrunch yesterday. That gave the “what.” Today’s piece gives the “how and why.” Let’s get to it. Unit21: No-Code, Much PowerWhen my friend Prince Boucher reached out to me in April about the company he’d recently joined, Unit21, I was excited… to catch up with Prince. I’d never heard of Unit21. He explained what they did -- no-code/low-code tools to fight financial fraud -- and asked if I’d be interested in writing about them. If I’m being honest, I was only quasi-interested. To be sure, it’s an important topic -- financial fraud has increased as commerce moved online during COVID, crypto presents new challenges, the Biden Administration is supportive of regulatory tech (“RegTech”) solutions -- but most of you don’t work in risk, compliance, or RegTech. I wasn’t sure if this was something you might be interested in. I told him I’d do a little research and get back to him. Then I did my research. Unit21 isn’t just a KYC/AML tool for financial institutions. That’s just the first product, an appetizer, the white hot core from which it will expand outward. What Unit21 is really building is a business logic, flagging, and reviewing engine that lets non-technical people run rules on constant streams of data. More simply, Unit21 lets ops people get shit done at scale without going through engineers. It lets companies empower their people and focus resources on the right things. My interest was piqued, then serendipity sealed the deal. When I was researching my essay on Scale, I had already spoken with Unit21’s co-founders, Trisha Kothari and Clarence Chio about their vision, so this exchange from a Tegus interview with a former Scale VP hit me in the face:

I would wager a significant sum that he was referring to Unit21. He highlighted both its current offering and its vision. Fraud detection in financial services is where Unit21 has made a name for itself, but what Unit21 is really building is “basically offering AI and ML via kind of a low-code/no-code way.” Low-code/no-code doesn’t mean that Unit21 doesn’t write code -- on the contrary, the team is solving some cutting edge machine learning and engineering problems. It takes high-code to deliver no-code. Unit21’s team handles all of the complexity below the surface and delivers it through a simple API and dashboard so that operators and analysts can customize it to their needs without having to write code themselves. So yes, even if you don’t work in risk or compliance or finance at all, it’s certainly worth learning about, for a few reasons:

Unit21 is fascinating both for what it’s building and for how it’s building. Instead of starting with a generalizable platform, Unit21 built a tool for the financial fraud vertical and is now expanding outward to evermore use cases. The dream end state is a product that feels like it was custom built for each company’s needs even though it was built to flexibly handle all of them. Clarence described it as similar to Amazon’s recommendation engine, for business. The approach is working. Major companies like Coinbase, Chime, Chainalysis, LINE, and Intuit already trust Unit21 with their most important security processes. To date, the company has been laser-focused on financial fraud. The product works well, and each logo it adds in the space makes it easier to acquire the next similar customer. But it’s starting to attract notice beyond that tight-knit ecosystem:

Now, funded up and growing fast, Unit21’s job is to build out the platform, one vertical at a time, balancing flexibility and simplicity, power and ease. When it pulls it off, it will have written the playbook for building broadly-applicable tools that feel custom-built. To understand what Unit21 is building, why it’s important, and how you might be able to wield AI/ML even if you can’t write a single line of code, we’ll cover:

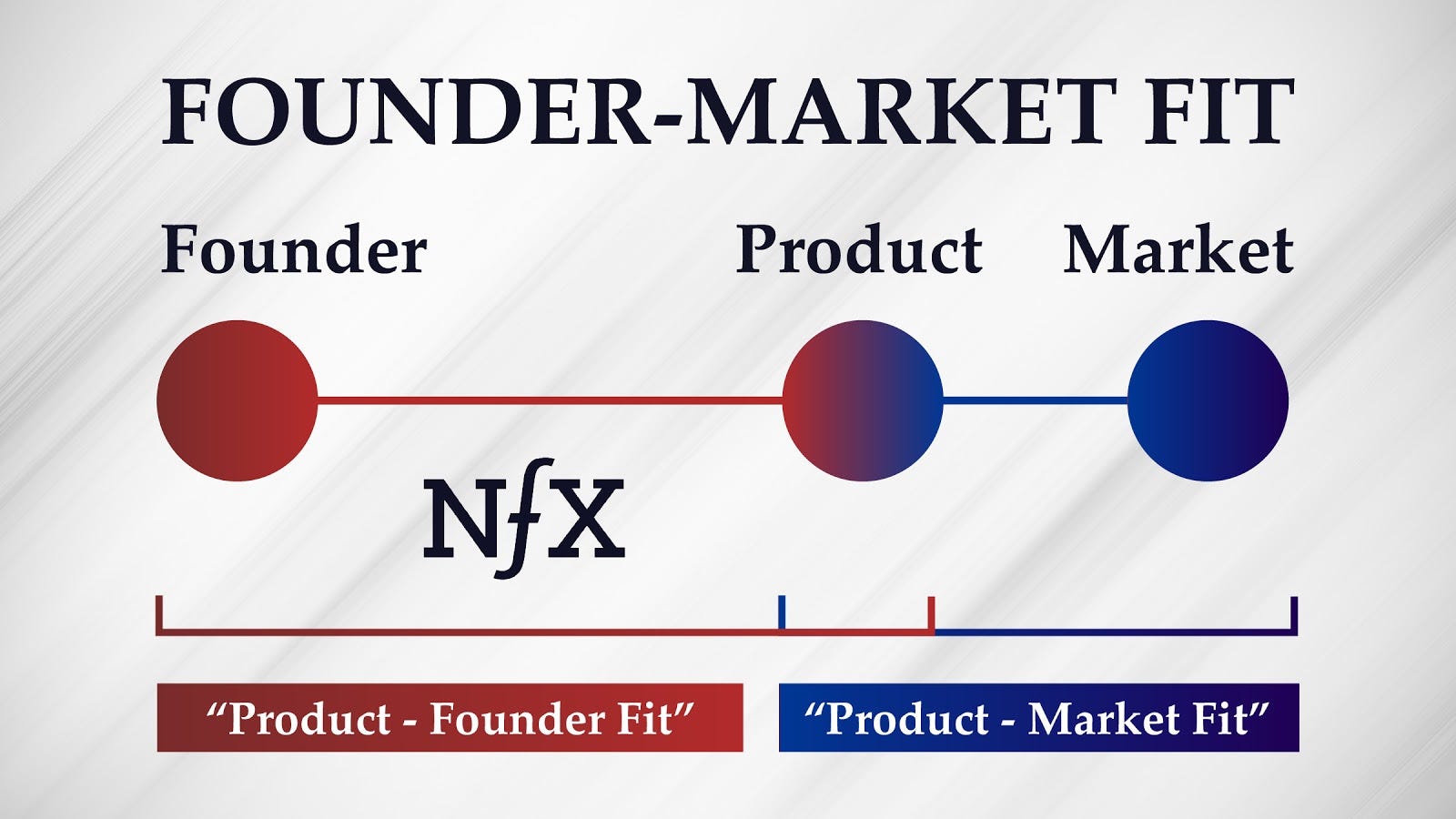

Unit21 exists because of a problem that both Trisha and Clarence faced: ops people aren’t empowered to write their own business logic to fight suspicious activity. The results range from wasteful to disastrous. Founder-Market FitProduct-Market Fit is a well-known phenomenon in Startupland. Like porn, you know it when you see it, and Superhuman CEO Rahul Vohra helped popularize a method for measuring it. Less well-known but equally important is Founder-Market Fit, the idea that certain people are just right to start certain types of companies. This too was defined by a certain “Je ne sais quoi” until NFX laid out four dimensions that contribute to Founder-Market Fit:

Trisha and Clarence hit all four for Unit21. They have tight Founder-Market Fit. Trisha is an experienced engineering and product leader at one of the past half-decade’s most successful startups, Affirm. Max Levchin, who founded both Affirm and PayPal, called her one of the best engineers in the country. She first experienced the issue because Affirm has to decide whether to let any given user “Buy Now, Pay Later” in near real-time. Essentially, Affirm underwrites loans at the point of sale. Fraud is a massive risk to the company. As PYMNTS highlights, “Botching authentication methods could lead Affirm to charge either a phantom or the wrong person, having its money vanish into the ether.” So the company employs a huge team of in-house engineers and data scientists to fight fraud. They’re highly-paid talent playing table stakes defense instead of differentiated offense in a highly competitive space. Clarence’s experience is even more personal. Like Trisha, Clarence is a genius. He grew up in Singapore and came to the US on a government scholarship awarded to the top 50 students in the country each year. He used it to study computer science and AI at Stanford, then joined Shape Security as an engineer out of school (Shape was recently acquired by F5 for $1 billion). While at Shape, Clarence got bored and started submitting papers to security conferences on the side, for fun. They were good, and conferences flew him around the world to present them. His lectures caught the attention of tech publishing powerhouse O’Reilly Media, who asked him to write a book. He did. It’s called Machine Learning and Security: Protecting Systems with Data and Algorithms. Fun fact: Clarence is also in the GeekPwn Hall of Fame for successfully misleading a machine learning system. One more fun fact: in 2019, Clarence became a lecturer at Berkeley in Applied Machine Learning. OK, back to that personal experience. Shape protected large customers' websites from hackers. Part of Clarence’s job was to take descriptions of attack patterns from security operations professionals, and write rules to defend against them. One night on rotation, he took in a description, wrote a rule, deployed, and closed his computer. He got a frantic call four hours later letting him know that the client’s site had been down the entire four hours since he deployed, costing them $2 million per hour in bookings! Clarence wasn’t fired for the error, but it did light a fire in him. He realized that the disconnect between what ops people know and what they can do is a cause of a lot of problems:

Clarence left Shape in 2017. Trisha left Affirm in 2018. Both were thinking about the same problem from different angles. And both joined South Park Commons (SPC), a vibrant “community of builders, tinkerers, and domain experts” in San Francisco. SPC isn’t an incubator; it’s a place to explore new ideas before they’re anything at all. Trisha and Clarence met at SPC, and decided to explore together, specifically in the Anti-Money Laundering (AML) space. The duo did what so many aspiring founders do: reached out to potential customers to find out if there was a “there” there. Specifically, they reached out to 300 people with “Anti-Money Laundering” in their title on LinkedIn to learn about their challenges and appetite for a solution. One of those people was the head of AML at eBay. He told them he was doing an RFP in three weeks, and that they should submit their company. It’s just... they didn’t have a company yet. Meet Unit21Over those next three weeks, Trisha and Clarence did a lot:

Then, they showed up to eBay’s HQ in San Jose. They brought along one of Kothari’s former Affirm colleagues to make the team look a little bigger. The three of them presented the prototype that they’d built over the last 20 days, went home, and then heard from eBay… that they were the front-runner out of four chosen finalists. Of the other three, the smallest was a $3 billion company. Unit21 was three weeks old and worth $0 on paper. How was three-week-old Unit21 even a contender? In the past, there were two ways that companies built their AML/fraud models:

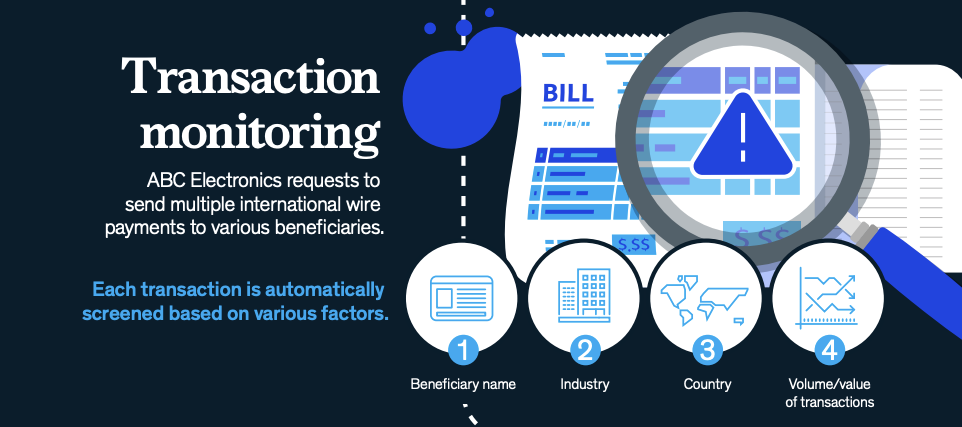

In the latter case, companies would buy a product, integrate it into their system, tweak the inputs, and then trust a black box to spit out when a transaction was suspicious. They often erred on the side of being too cautious, sending humans a rash of false positives to sift through. Every AML product with which Unit21 competes offers transaction monitoring that looks at a few things like who the payment is to and from, what industry they’re in, what country the payment is going to, and the volume and value of transactions. They look at the data and assign a risk score, and higher-risk transactions are sent to humans for review.

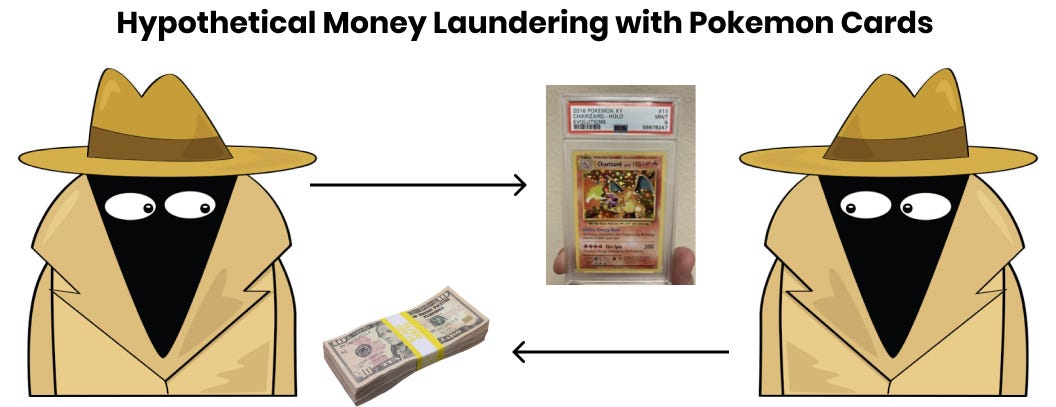

Unit21 took a new approach, one that worked well for eBay’s wide range of products, and in turn, should work for a multitude of use cases beyond financial fraud. Instead of just monitoring the usual financial transaction data points, they told eBay, “You can give us any data and we’ll treat it like a transaction.” For example, an analyst at eBay could tag Pokémon cards by Pokémon. Unit21’s model would learn that a Charizard normally goes for $100, and flag a $1,000 Charizard purchase as anomalous. Or the system might flag a user who purchased too quickly -- if they clicked buy in one second, before having time to review anything, that might mean they didn’t actually care about the item they were buying. What’s more, Unit21’s system wouldn’t make decisions for eBay, or spit answers out of a black box. It showed the analysts and operators the guts of the system and let them make the rules. Ultimately, eBay told Unit21 they were too small and chose another vendor, but the process gave Trisha and Clarence confidence that they were on to something, and as they talked to more and more potential customers, they kept hearing similarly positive feedback on their approach. So they decided to go for it. In December 2018, Unit21 raised a small seed round from Gradient Ventures and got to building. While they built, they realized that while AML was a killer use case, it wasn’t the whole product. What they were really building was a no-code tool for sophisticated business users who know how to create complex business rules or even statistical models, but can’t write or deploy code. They were developing a new way for non-technical people to write and deploy business logic, and building out a platform, one vertical at a time. To learn how Unit21 is building its platform, how Tiger invests, how Twitter verifies, and where Unit21 is headed… Thanks to Prince, Trisha, and Clarence for working with me on this piece! How did you like this week’s Not Boring? Your feedback helps me make this great. Loved | Great | Good | Meh | Bad Thanks for reading and see you on Monday! Packy If you liked this post from Not Boring by Packy McCormick, why not share it? |

Older messages

Not Boring AMA

Monday, June 28, 2021

Peak of Hand-Drawn Graphics? How could Not Boring Fail? Biggest misses?

The Secret 3-Step Master Plan to Cure Healthcare

Thursday, June 24, 2021

NexHealth is Raising a $31 Million Series B to Fuel its Ambition

Scale: Rational in the Fullness of Time

Monday, June 21, 2021

Meet the Five-Year-Old, $7.3 billion Stripe for AI

The Cooperation Economy 🤝

Friday, June 18, 2021

Or How to Build a Liquid Super Team

Cityblock Health

Friday, June 18, 2021

The Vertically-Integrated, Value-Based Arbitrageur Fixing Healthcare

You Might Also Like

🔮 $320B investments by Meta, Amazon, & Google!

Friday, February 14, 2025

🧠 AI is exploding already!

✍🏼 Why founders are using Playbookz

Friday, February 14, 2025

Busy founders are using Playbookz build ultra profitable personal brands

Is AI going to help or hurt your SEO?

Friday, February 14, 2025

Everyone is talking about how AI is changing SEO, but what you should be asking is how you can change your SEO game with AI. Join me and my team on Tuesday, February 18, for a live webinar where we

Our marketing playbook revealed

Friday, February 14, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Cribbage Day, Reader... Don't get skunked! In today's

Connect one-on-one with programmatic marketing leaders

Friday, February 14, 2025

Enhanced networking at Digiday events

Outsmart Your SaaS Competitors with These SEO Strategies 🚀

Friday, February 14, 2025

SEO Tip #76

Temu and Shein's Dominance Is Over [Roundup]

Friday, February 14, 2025

Hey Reader, Is the removal of the de minimis threshold a win for e-commerce sellers? With Chinese marketplaces like Shein and Temu taking advantage of this threshold, does the removal mean consumers

"Agencies are dying."

Friday, February 14, 2025

What this means for your agency and how to navigate the shift ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Is GEO replacing SEO?

Friday, February 14, 2025

Generative Engine Optimization (GEO) is here, and Search Engine Optimization (SEO) is under threat. But what is GEO? What does it involve? And what is in store for businesses that rely on SEO to drive

🌁#87: Why DeepResearch Should Be Your New Hire

Friday, February 14, 2025

– this new agent from OpenAI is mind blowing and – I can't believe I say that – worth $200/month