Not Boring by Packy McCormick - Minimally Extractive Meta

Minimally Extractive MetaWhy Zuck Might Have to Actually Contribute to the Open, Interoperable MetaverseWelcome to the 1,316 newly Not Boring people who have joined us since last Monday! Join 82,644 smart, curious folks by subscribing here: 🎧 To get this essay straight in your ears: listen on Spotify or Apple Podcasts (shortly) Today’s Not Boring is brought to you by…. Masterworks Once you realize what’s happened in the past week, the only thing you can say is: HOLY SH*T

Quality chaos does keep things interesting. But when it comes to your financial well being, less is more. Despite popular belief, you don’t always need to take big risks to get big rewards. Recently I added one of the most consistent and overlooked investments in history to my portfolio. It’s one that billionaires have used to grow but also protect their wealth for generations. This is an asset class that will explode by over $1 trillion dollars in under 5 years. And, it beat the S&P 500 by three fold from 1995-2020 with nearly 0 correlation to public equities. Most billionaires are bullish on this asset class. In fact, they allocate roughly 10-30% of their overall portfolios to it. This might shock you, but this asset class I’m talking about is contemporary art. New York City’s newest $1B fintech unicorn, Masterworks.io, has revolutionized the lucrative art market by making multimillion-dollar paintings investable like a company’s stock. With already over $250M AUM, Masterworks is off to the races. I’ve invested in eight of their offerings and will be allocating more soon. Use my private link to skip the waitlist today.* Hi friends 👋, Happy Monday! On Thursday, when Mark Zuckerberg announced that his company was changing its name from Facebook to Meta, I missed it. I was filming a video with a portfolio company, talking about, of course, the Metaverse. Whether it should be open or closed. What its currency might be. How web3 ties into the whole thing. When I got out of the shoot, I opened up Twitter and saw that it had happened. My whole feed was Meta jokes. I didn’t want to miss out, I quickly fired off a Meta joke myself. In the intervening four days, many of my favorite tech writers have put out Meta content; Ben Thompson and Matthew Ball both got direct access to Zuck himself. My first instinct was: don’t write something on Meta. It’s been done, everyone did it, they did it well, and Zuck didn’t even slide into my DMs.  But who am I kidding? There’s no way I’m not writing about Meta. This isn’t a piece about whether it’s a good name, or whether Facebook just wanted to change the narrative to get out of trouble after another recent scandal. Those have been written. But I’ve written about the Value Chain of the Open Metaverse and have defended Facebook’s business even though Everybody Hates Facebook, and this is a major development on both of those fronts. Maybe the question isn’t whether the Metaverse will be open or Facebook-run, but whether there’s room for Meta in the Open Metaverse. Let’s get to it. Minimally Extractive MetaIt’s unbelievable how much better AI has gotten in the past decade. Look. Here’s Mark Zuckerberg on-stage with Kara Swisher and Walt Mossberg talking about Facebook’s privacy issues back in 2021:  And look at the most recent demo this past week:  Badum tiss. I’ll be here all week. Jokes aside, Zuck (with the help of the hardest-working Comms team in the business) has gotten so much better at playing the media game that it feels like he’s learning at the speed of AI. Just going direct to Ben Thompson and Matthew Ball in the first place was a savvy move, and the content of both conversations demonstrated at minimum a stronger understanding of the issues at play and the right things to say. At best, he’d have you believe, we’re seeing a new techno-philanthropic Zuck who’s using his company’s vast resources for the betterment of the virtual world. The picture of the Metaverse that Zuck painted, in the Connect Keynote and subsequent interviews, seems pretty fun, and the role he wants to carve out for Meta feels more than fair. Watching the keynote, I almost felt like we, the citizens of the internet, were taking advantage of poor Zuck. He’s willing to lose $10+ billion per year, all in the hope that his company might be able to take its small and hard-earned sliver of the Metaverse economy one day? Canonize this patron saint of the immersive internet! But this is Facebook we’re talking about! Or Meta, whatever. And it’s Zuck. We’ve heard his stilted smooth talk before. Can we trust him now? That’s actually the least interesting question, and one that’s impossible to answer without seeing into his mind, current and future (although we can guess based on the past). The more interesting thought exercise is to assume the worst -- that Meta has the most selfish intentions -- and to ask “So what?” I think that Facebook’s hard pivot into Meta is a good thing for us citizens of the internet, not because Meta is good -- this isn’t a value judgment piece -- but because the entire system is moving in a direction such that being a good actor is the value-maximizing strategy for Meta, and we could use its vast centralized resources to solve a lot of hard problems. It’s hard to imagine Meta as good for us if you just look at Facebook today, statically. Taking Facebook and making it 3D and immersive would blow. Imagine living inside this hellhole (no offense to ClickUp, which seems great, congrats on the C!). Left to his own devices, that 3D, immersive walled garbage can might be what Zuck would have built. It might be the full-stack data ownership play -- from commerce to eyeballs -- that the perma-dystopians have spent the past few days tweeting about. But things aren’t static, and the world is moving towards decentralized ownership and control. This is why web3 matters. In a world in which people are more used to ownership of their digital assets and identity, and how it makes money, Meta’s best strategy will be to operate more like a Minimally Extractive Coordinator than an extractive platform. To reach its full potential, Meta needs to disrupt Facebook by turning itself into something that behaves more like a protocol than a platform. With an internally omnipotent founder at the helm willing to lose $10+ billion annually, it might have the organizational will to do it. It’s already built the best and most popular hardware in the market, an impressive new act from a social media company with a bloated and terrible core product. Meta shouldn’t and won’t be the Metaverse. But it can play an important role in “expanding the GDP of the Metaverse” and participate in the upside it creates. Someone’s gotta build all of this incredibly expensive tech over many, many years, and Meta’s a better people’s champion than Apple. (Seriously.) Fresh competition among the giants is a good thing for creators and consumers. But I know, you probably don’t believe me yet. You’ve been burnt before. I get it. So put on your Quest II and hop down this rabbit hole with me:

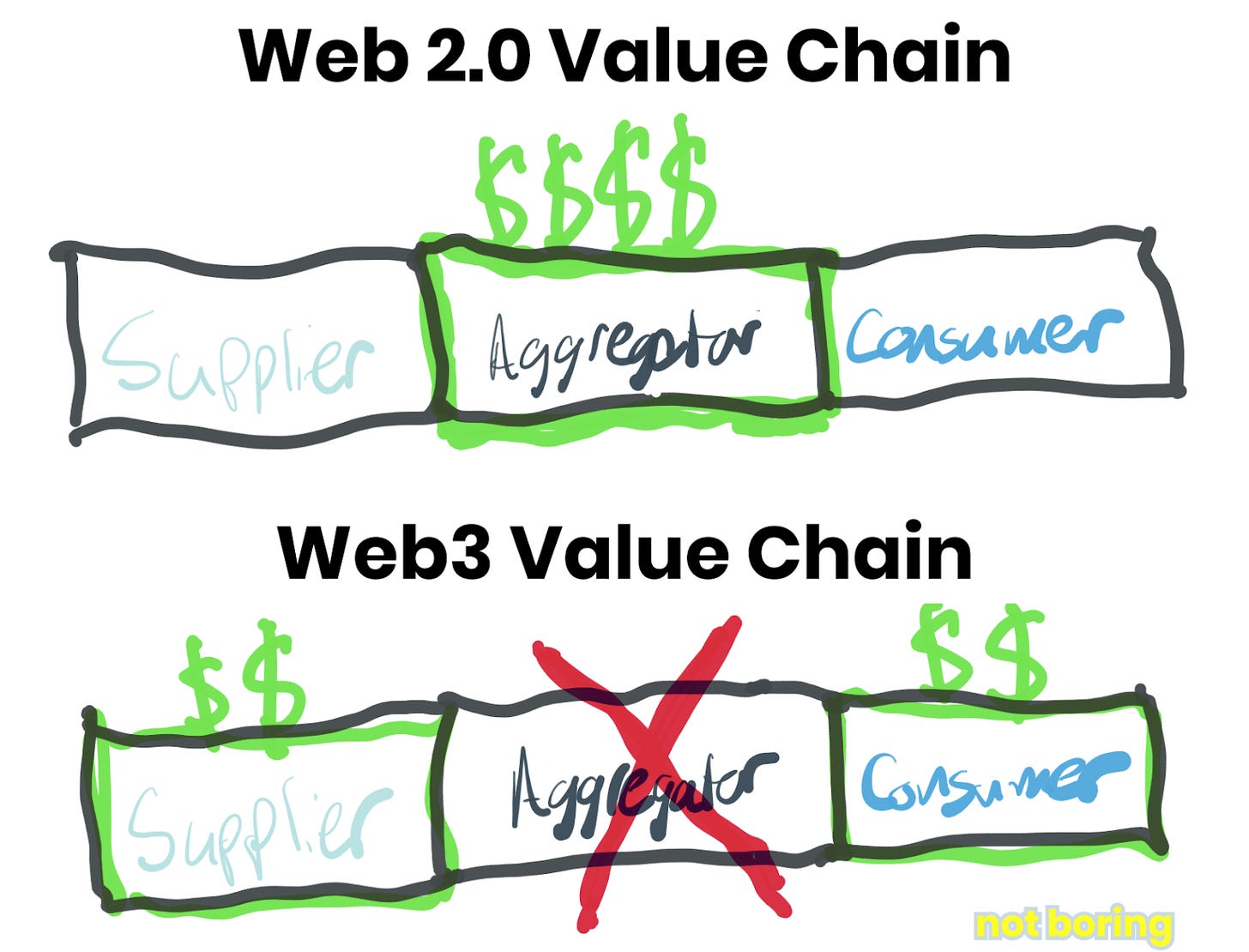

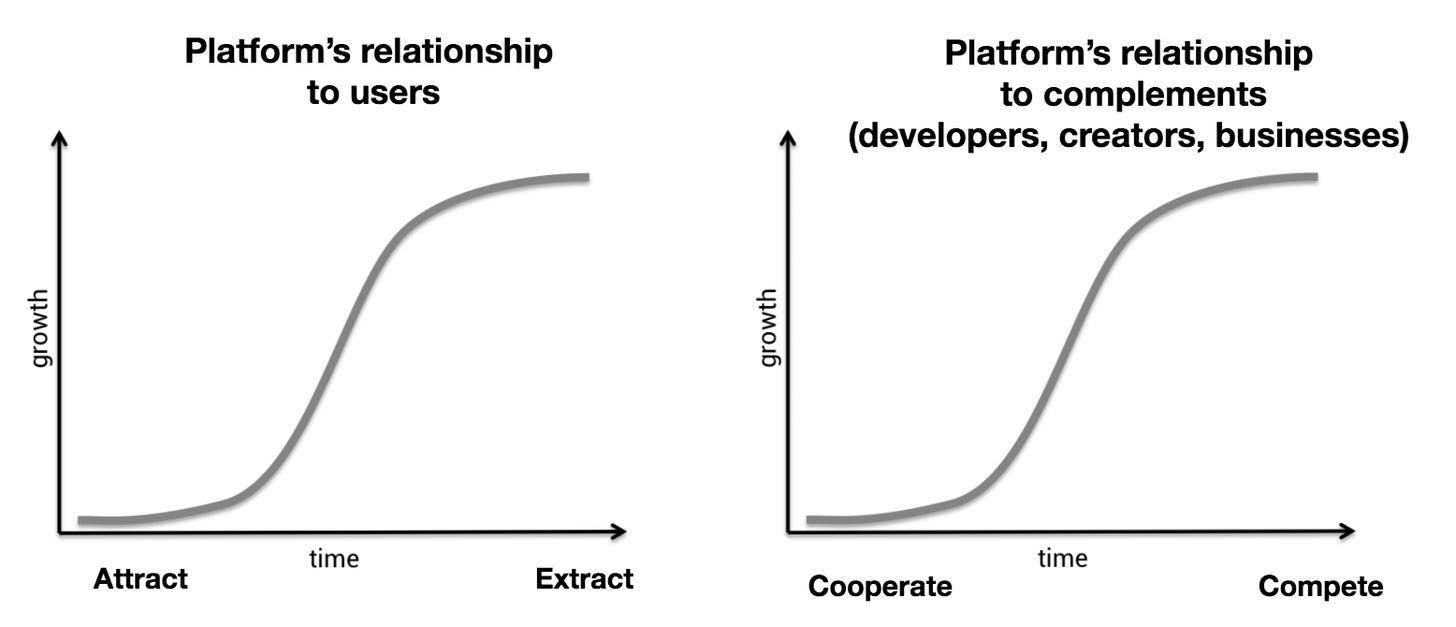

It starts with understanding the how the Metaverse economy will work. The Value Chain of the Open MetaverseBack in January, I wrote my first essay on web3: The Value Chain of the Open Metaverse. After a few conversations with Crucible founder Ryan Gill, the future clicked into focus. I thought crypto was interesting as an asset class then, but I’d realized that if you zoom forward to a time when more of our time is spent immersed in the internet, web3 would become more than a nice-to-have, it would become a necessity. To understand why, it’s useful to think about the Metaverse as a virtual version of the real world, a place in which people work, play, shop, and socialize as avatar versions of themselves, or many, depending on the context. Just like we buy outfits for our physical bodies and just like gamers buy skins in Fortnite, everyone will buy outfits for their avatars. Just like people want to buy nice homes and decorate them to reflect their personal taste, we’ll buy and decorate virtual spaces. And on and on. We will spend real time and real money in virtual worlds. Shaan Puri had a viral thread over the weekend that the Metaverse isn’t a place, but the time at which our digital life is worth more than our physical life to us. If the Metaverse operated like the internet does today, though, we wouldn’t actually own any of those things. They’d be tied to whichever platform we bought or earned them in. Platform changes its mind, lose the items or see their value deflated. Leave the platform, lose the items. Web3 gives digital items physical characteristics, and as the virtual and physical worlds blend, that will just get more and more important. Specifically, tokens give people property rights in the virtual world. Just like it would be absolutely insane if Nike took back the shoes we bought as soon as we left the store, OpenSea can’t hold your NFTs hostage. Buy an NFT of a digital shirt on OpenSea and it lives in your wallet, to which only you have the keys. You can bring it with you across the internet, and put it on whenever you feel like it. Platforms and marketplaces have a place in web3 -- OpenSea is a multi-billion dollar company -- but it charges only 2.5% fees on transactions. More value accrues to the creator and the consumer. Web 2.0 platforms and marketplaces charge a lot more than 2.5%. Airbnb takes roughly ~15% from both sides combined. eBay, which is apparently like an OpenSea for physical stuff, charges a 10% seller fee on most items. Apple and Google take 30% in their app stores. While Facebook monetizes through ads, and therefore doesn’t have an explicit take rate, its ads business is essentially a tax on anyone who wants to sell online. Plus, the company is very guilty of flexing its muscle and changing rules at the expense of the developers and journalists who built on top of its platform. In Why Decentralization Matters, Chris Dixon wrote about why centralized platforms always do this. In the early days, centralized platforms do anything they can to attract users, developers, and businesses in order to build up multi-sided network effects. Once they’ve built those network effects, though, and they know that users, developers, and businesses are locked in, they switch from “attract” to “extract.” The easiest way to grow revenue is to start charging businesses and developers to reach customers, and to serve customers ads or products based on the data they’ve accumulated. This isn’t evil. It’s just how the incentives work. Users and creators are free to move, although currently, moving to a new platform does mean leaving behind the data, friends, points, followers, likes, assets, and other digital artifacts they’ve created on the platform. It would be easy to look at Connect and say that we’re in the “attract” stage of Facebook’s Metaverse development, and that they’ll once again switch to “extract” as soon as humanly possible. Which is probably true, except that it might not be possible. Companies and protocols exist inside of a broader ecosystem. Web 2.0 platforms could extract because all of the other Web 2.0 platforms were extracting, and because users and builders are loath to give up everything they’ve built there. There was nowhere else to go, and even the alternatives that looked attractive had no built-in guarantees that they wouldn’t make their heel turn one day, too. Crypto, as they say, fixes this. In some cases, on a local level, web3 means that strong commitments are written into the code itself. The web3 version of Facebook might not be able to arbitrarily change algorithms on which entire businesses and industries had come to rely. That’s important. But there’s an equally important force, the one that keeps OpenSea in line: competition combined with portability of assets. If OpenSea were to start charging 5% or 10% or certainly 30% to sit in between sellers and buyers, people would move their business to another platform immediately. For decentralized protocols, which are open source by default, the threat of being forked serves as an incentive to treat both the supply and demand side well, and to keep fees as low as possible. Protocols aren’t businesses themselves. Protocols are minimally extractive coordinators. Protocols as Minimally Extractive CoordinatorsIn 2019, Chris Burniske wrote one of the most useful essays out there for understanding web3: Protocols as Minimally Extractive Coordinators. In it, he laid out a short but compelling argument that protocols will need to extract as little value as possible or risk being abandoned or forked (essentially copied). You should take a couple of minutes and read it, but this summarizes it well:

Protocols can still charge fees. They shouldn’t lose money. They can become incredibly, incredibly valuable (see: Bitcoin, Ethereum, Uniswap, and on and on). But if they charge fees that are too high, they’ll lose. As Burniske put it, “Any unnecessary extraction from the process of exchange is a tax that will ultimately be weeded out by copy-paste competition in the world of open-source protocols.” This applies to fees directly, and also to the protocol’s decision and actions. When Tron’s Justin Sun bought Steemit, the people who ran the Steem blockchain executed a soft fork of the blockchain to keep him from being able to control it. When some Uniswap users were unhappy that Uniswap hadn’t issued a token, they forked it and created SushiSwap. After both forks, users were free to vote with their feet and dollars between alternatives. This is the same way that Epic CEO Tim Sweeney, the closest thing we have to a Godfather of the Metaverse, believes that the platforms underpinning the Metaverse should operate. In a July 2020 interview with Deconstructor of Fun, he made the case for open app stores that are subject to the forces of competition instead of the closed and “fake open” app stores that Apple and Google, respectively, run today. Sweeney thinks that platforms in the Metaverse should essentially charge enough to cover their costs plus a reasonable margin, but that they should be subject to market forces:

Sweeney is a missionary for the Metaverse, but he’s also a capitalist, and one fiduciarily obligated to increase Epic’s long-term shareholder value. He wants Epic to make a lot of money, he just understands that in a transparent and open system, the platforms and protocols on top of which the most activity occurs will be the ones that are minimally extractive. Interestingly, that’s the language that Facebook is using to describe its own plans. Zuck laid out his philosophy for the business model in the Connect video (right around minute 35):

To understand how Meta’s VR / Strategy has evolved, why the AppleVerse would be a dark place, and why I think Facebook will have no choice but to follow through on the open vision it painted at Connect… How did you like this week’s Not Boring? Your feedback helps me make this great. Loved | Great | Good | Meh | Bad Thanks for reading and see you on Thursday, Packy *See important disclosures at Masterworks If you liked this post from Not Boring by Packy McCormick, why not share it? |

Older messages

Sc3nius

Monday, October 25, 2021

We're all gonna make it.

Playing Solo Games

Monday, October 18, 2021

Not Boring Capital: Fund I, Update II

The Model of Everything

Thursday, October 14, 2021

Not Boring Investment Memo on ScienceIO

Log in to Not Boring by Packy McCormick

Tuesday, October 5, 2021

Click here to log in

Log in to Not Boring by Packy McCormick

Tuesday, October 5, 2021

Click here to log in

You Might Also Like

🔮 $320B investments by Meta, Amazon, & Google!

Friday, February 14, 2025

🧠 AI is exploding already!

✍🏼 Why founders are using Playbookz

Friday, February 14, 2025

Busy founders are using Playbookz build ultra profitable personal brands

Is AI going to help or hurt your SEO?

Friday, February 14, 2025

Everyone is talking about how AI is changing SEO, but what you should be asking is how you can change your SEO game with AI. Join me and my team on Tuesday, February 18, for a live webinar where we

Our marketing playbook revealed

Friday, February 14, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Cribbage Day, Reader... Don't get skunked! In today's

Connect one-on-one with programmatic marketing leaders

Friday, February 14, 2025

Enhanced networking at Digiday events

Outsmart Your SaaS Competitors with These SEO Strategies 🚀

Friday, February 14, 2025

SEO Tip #76

Temu and Shein's Dominance Is Over [Roundup]

Friday, February 14, 2025

Hey Reader, Is the removal of the de minimis threshold a win for e-commerce sellers? With Chinese marketplaces like Shein and Temu taking advantage of this threshold, does the removal mean consumers

"Agencies are dying."

Friday, February 14, 2025

What this means for your agency and how to navigate the shift ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Is GEO replacing SEO?

Friday, February 14, 2025

Generative Engine Optimization (GEO) is here, and Search Engine Optimization (SEO) is under threat. But what is GEO? What does it involve? And what is in store for businesses that rely on SEO to drive

🌁#87: Why DeepResearch Should Be Your New Hire

Friday, February 14, 2025

– this new agent from OpenAI is mind blowing and – I can't believe I say that – worth $200/month