Margins - Robinhood and Promoting Democracy

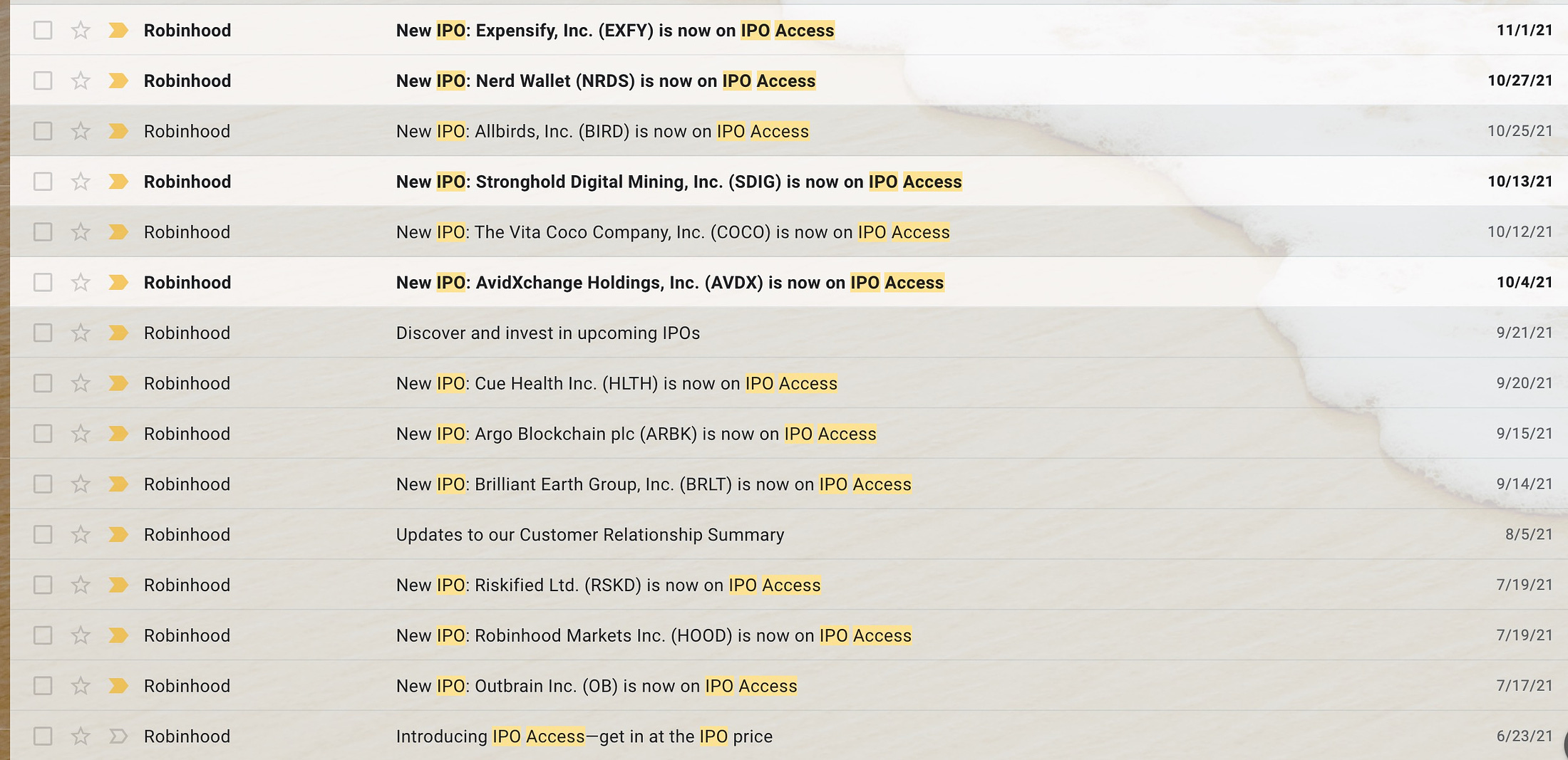

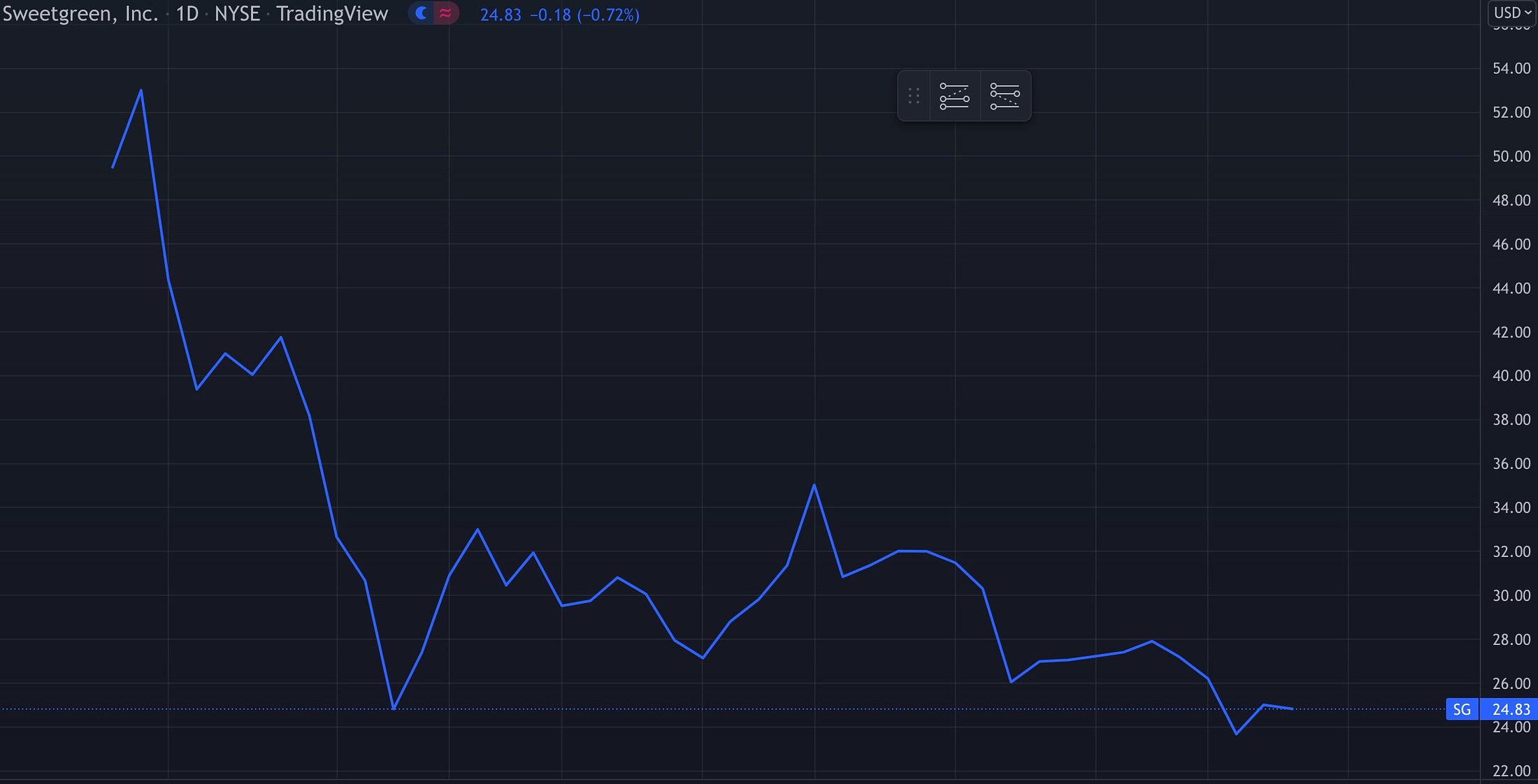

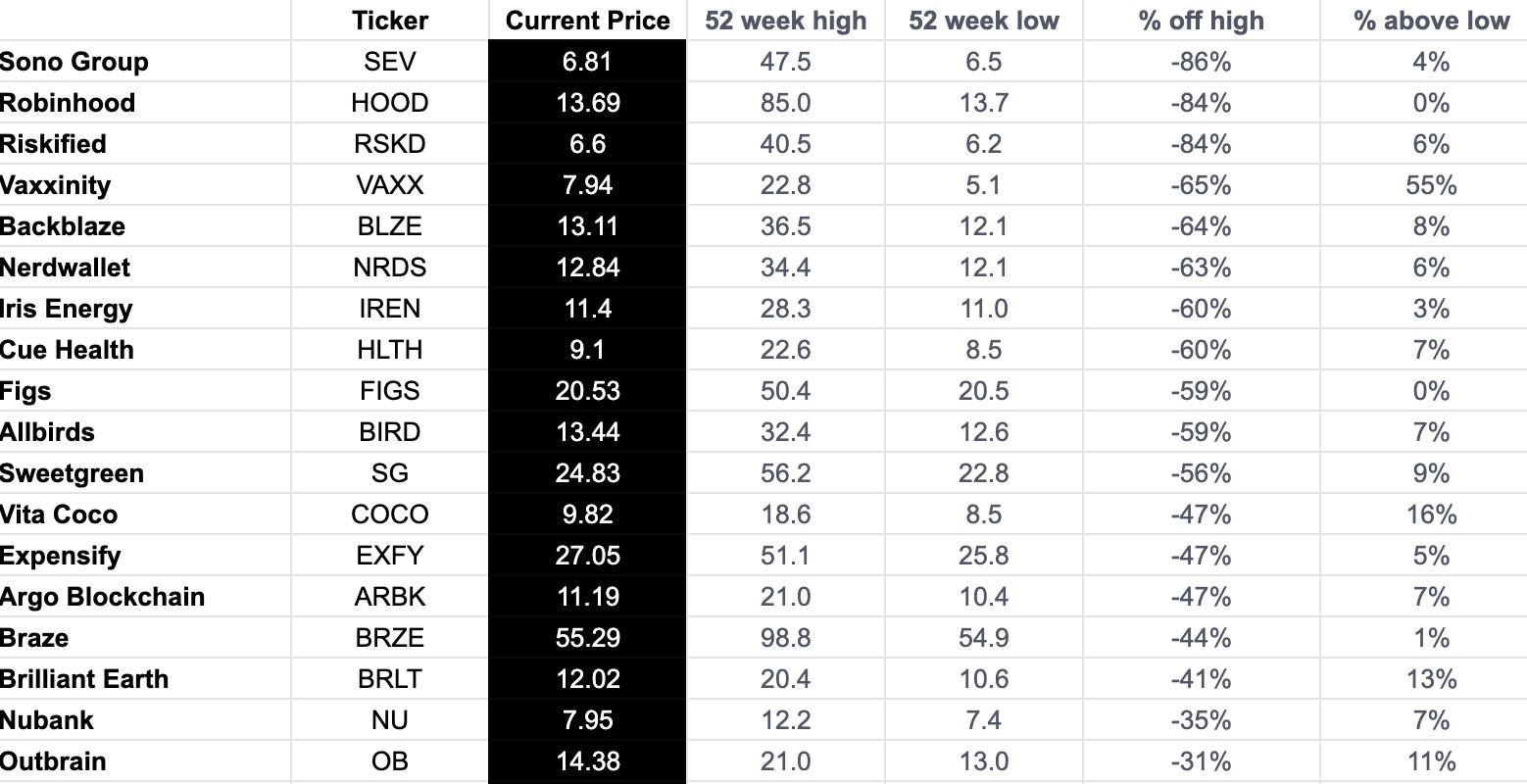

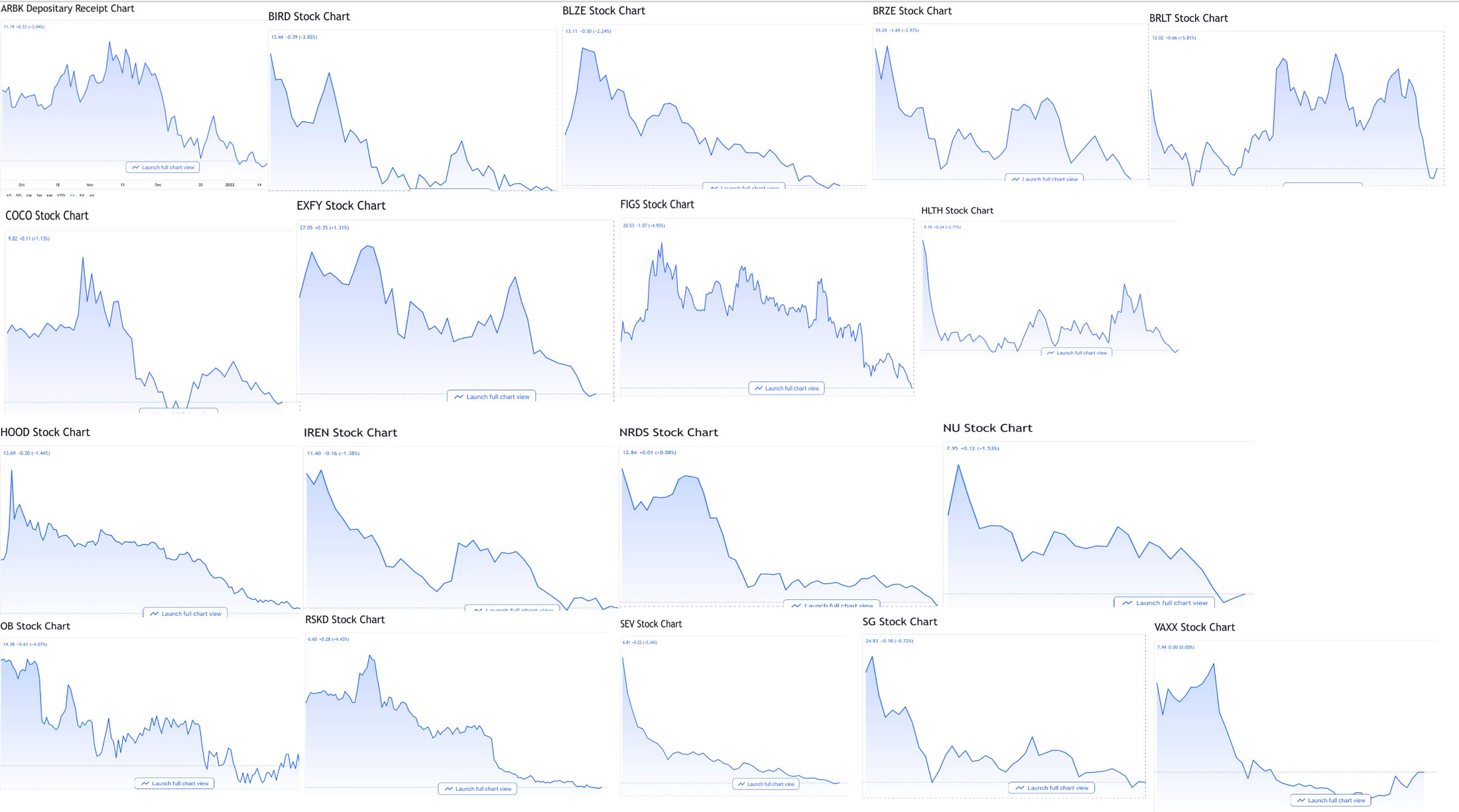

Ranjan here. Today I’m writing about Robinhood, early access to IPOs, and the “democratization of finance”. Now that my co-host Can is back, I once again feel pressured to write on time. This makes me happy. Writing about Robinhood also makes me happy. In March 2021, Robinhood announced they (Note 1) would be building a platform to give everyday investors access to IPOs. It really was the perfect ‘democratizing finance’ story. Until they pushed this, the IPO allocation process was the poster-child of clubby, insider-y, and banker-y. The stereotype was of investment bankers pulling out their Rolodexes (for the younger ones, this is a Rolodex) and calling up their golf buddy money managers to decide who got the juicy access to buy into an IPO that always pop on the open. It was so easy to conjure up images of backrooms with oak furniture and cigars. When Robinhood announced the news, we were back in a world with endless headlines about IPOs shooting up after ringing the bell. It was the easiest of money. Why should the everyday investor be left out? So Robinhood came up with a system where companies would allocate some portion of the equity to be raised to Robinhood users. Those users would be able to reserve their own shares to be purchased at the IPO price. They wouldn’t be left out of the inevitable gains. In May 2021, the product officially launched. The hip medical scrubs company, FIGS, was the first to be offered. The company had genuinely good numbers (it was profitable - good piece from Sid Jha at the time) and everyone could now share in the wealth creation. I started receiving emails in June announcing upcoming IPOs. The first one I received was for Outbrain (yes, that Outbrain). The second email was the really buzzy one - it was for the Robinhood IPO itself (how meta. Not Meta). The emails slowly trickled in over the following months. ….and the emails looked innocent enough: ...but one thing kept irking me. I’d guess plenty of Margins readers know the difference between transactional emails and marketing emails, but for the uninitiated, think of transactional emails as the “confirm your account” or “reset your password” or “update on your package”. They are emails triggered by some action within an app or service, are sent to an individual (rather than a group), and are usually for informational purposes (Note 2). Marketing emails, in contrast, are the ones built for commercial purposes (to sell something), and are usually sent to groups or entire lists of people. They generally live in different parts of your email service provider and often are built within different parts of an organization. The SEC has strict guidelines around advertising an IPO to investors. This feels like the perfect example of a marketing email disguised as a transactional email. Every time one of these emails were sent out, it’d spark inevitable conversations “are you buying into the XX IPO?” “I might pick up a few shares.” Because of course it did. Robinhood is explicitly avoiding any recommendation, but implicitly has curated this offering. And in some ways, it felt like Cathie Wood’s genius in just publishing ARK’s daily transactions. The act of informational communication is the recommendation and has the downstream effect of catalyzing conversation and purchase interest. It’s even more acute in this situation because this is a one-sided conversation. You can only buy the IPO, and you’ve just introduced a vast new population of buyers. And it worked….And it worked and it was non-stop. Sweetgreen opened at nearly double it’s IPO price. Allbirds surged 90% after the open. Nubank ‘only’ traded up 15% after it’s ‘blockbuster IPO’. I will note, Robinhood, itself, was a bit different. The shares traded slightly down on IPO day, and then shot up 100% on the 4th day of trading. Overall, things appeared to be going according to plan. Finance, democratized. But, of course, that’s not how things have ended up. Here are just a few charts: But I promise you, I’m not cherry-picking. I went through my inbox and every single stock chart that was being marketed through the IPO Access program looked like that. (Note: These are all the emails I got - I’m not sure if they had other IPOs where I didn’t receive an email): I’m the first to recognize that there are endless momentum-y, meme-y stocks have collapsed (this is me in mid-December on CNBC saying the ‘era of the story stock is over’), but this is brutal. So many of these stocks are 60-80% off their high, but much more glaring is how uniform the Robinhood IPO Access stock charts look: Please excuse my ugly image as we don’t have a graphics department (Note 3), but just look. It doesn’t matter whether you’re a Brazilian fintech, a fancy salad chain, a cloud backup company, a German solar company, a fantastic expense management SaaS (I love Expensify), something-something-blockchain, coconut water, a biotech claiming to cure chronic disease, a fraud detection company, an Australian energy company, a COVID-19 testing maker, a wallet for nerds, or whatever else. It didn’t matter whether you IPO’ed in May or July or November. Other than the jewelry company $BRLT Brilliant Earth (on the top right) every single company comes out incredibly strong or has a spike early on, and then it slowly dies. Sometimes, like $SEV or $SG or $HLTH, it’s brutal. Other times, like $ARBK or $NRDS, you see glimmers of hope and then goodbye. Seriously, take a look again. Correlation or CausationMy co-host Can said maybe it’s just that Robinhood is the appified version of the Scott Galloway school of stock picking (hey-o). Maybe it’s just self-selecting where the type of company going through this process is the kind that cannot reliably raise from institutional investors. But that distinction between marketing and transactional emails I think is incredibly important here. For an IPO, there is only a finite amount of people selling something. There is new equity issued. There is some set amount of existing shares to be sold. That’s it. By introducing an army of new buyers, there’s an inevitable mismatch pushing prices up. If it doesn’t happen on day one, you’ve now seeded the idea among an army and they slowly come in. That transactional email was a marketing one. When I was in trading, there was a running meme. Whenever someone inquired about a market move up, and no one had a clue what happened, someone would yell “more buyers than sellers!” I know a lot of stocks have lost a lot of value over the past few months, but the mechanics specific to Robinhood’s IPO Access offering feel like it had to contribute to this exact scenario. It literally created....more buyers than sellers. And then maybe people lost interest, or the company really wasn’t great, or the valuation was stupid, it would collapse. Especially if it were predominantly retail investors, you could imagine the initial moves down would be amplified by investors who never cared too much for the company and moved on to the next thing. It’s happened over and over, almost universally (Note 4). Just look again at those charts, and please, once again, excuse the ugly graphic. Finance, democratized?A lot of people have now lost a lot of money. I have no way of knowing what percentage of them were retail investors, but back in July 2020, when I wrote about Robinhood users being ‘the gravy’, this is the kind of stuff I worried about. Even more, this feels exactly like the woo-woo Silicon Valley doublespeak of democratizing finance that has always grated on me. In that original Robinhood post, I had written:

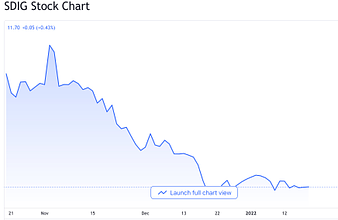

....and we’re at that stage about unintended consequences. It’s yet another example of the language of democratization being deployed without any thought of how to build up the newly democratized world. It feels like Dick Cheney and Paul Wolfowitz’s idea of the democracy they would bring to Iraq and Afghanistan. Access without a plan can be a bad thing. I’m not quite Bill Gurley radicalized, but I recognize there is plenty about the traditional IPO process that could be improved. But this effort gave people a ticket to a process with specific mechanics that made it much more likely to result in a quick rush followed by intense pain. Sending an email to millions of users with no additional analysis or context is probably correct from a regulatory perspective (it’s not a recommendation), but it is a nudge to buy. This is another situation where the SEC should’ve looked a bit deeper at how things were done. Where next?In many ways the crash is already here. On the way up we’ve been inundated with gain porn but no one likes sharing the drips and drops on the way down. I started this post meaning to write about ZIRP and risk (for next week! we’re writing again! [Yes!!! —Can]) but also have been thinking about story stocks and the quiet mechanisms that have exacerbated this cycle. I’m the first to acknowledge, things could still get weirder. But as the era of ZIRP appears to be over, the coming weeks are going to get a lot more interesting. Note 1: Random grammatical question - I had previously always been edited to use the pronoun ‘it’ for a company rather than ‘they’. First, as you’ve clearly seen [especially on my pieces — Can], we don’t edit ourselves too closely (hey, it’s free!), but also, I really think of companies as collections of people rather than inhuman entities. I’m curious about others thoughts on this. Note 2: One standard example of a marketing email masked as a transactional email is a cart abandonment email (“You’ve left these items in your shopping cart. Do you want to go back?” or something like that) Note 3: We don’t have a graphics department, but I would like to plug TradingView as a fantastic tool for tracking stocks. Also, if anyone could do a cool visualization overlaying the lines over each other or something, please do! Note 4: I forgot two stocks when putting together the graphic, and didn’t feel like going back…but here they are. Look familiar? Note 5: Shameless Plug: I guest co-hosted on the Slate Money podcast last week. We talked ZIRP, Wordle, and globalization in banking. It was fun. If you liked this post from Margins by Ranjan Roy and Can Duruk, why not share it? |

Older messages

Margins takes on Web3

Monday, January 10, 2022

Math is hard, let's go shopping

Peloton, Valuations, and Innovation

Thursday, December 16, 2021

Stock prices and strategies

The Teenager Economy

Saturday, October 16, 2021

"I hate you! You don't understand me!"

Memestocks and Reddit redesigns

Monday, September 20, 2021

"You may be interested in...."

Advertising Stagflation

Sunday, August 1, 2021

Its the 1970s for digital marketers

You Might Also Like

Little Stream Software digest for the week of 2024-12-25

Wednesday, December 25, 2024

Hey there, Here's articles I published over the last week. - Eric Davis Merry Christmas Merry Christmas to you and your family. Hopefully you're able to take some well-deserved time off today

Use AI and protect your data

Wednesday, December 25, 2024

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo Next month is Artichoke and Asparagus Month, Reader! Are you a mayonnaise or

A reason to celebrate

Wednesday, December 25, 2024

Whichever way you celebrate the end of the year, my team and I would like to wish you Happy Holidays. Thank you for trusting us to be part of your marketing journey. Let's keep the momentum going

Don’t Write Another Newsletter Until You Read This

Wednesday, December 25, 2024

Why 1/5/10 Changes Everything

How they flipped a domain for $90k (in just 22 days!) 😱

Wednesday, December 25, 2024

You're invited to join in on all the fun! View in browser ClickBank Happy Holidays! TODAY, two of ClickBank's top vendors, Steven Clayton and Aidan Booth, have officially kicked off their 13th

The Gift of Leadership

Wednesday, December 25, 2024

From all of us at The Daily Coach, Happy Holidays!

Hack to define your key activation event

Wednesday, December 25, 2024

Inro, Qolaba, MySEOAuditor, ContentRadar, and SEO Pilot are still available til end of this week. Then, they're gone!! Get these lifetime deals now! (https://www.rockethub.com/) Today's hack

Polymarket, Sora, and The Hallmark Killer

Tuesday, December 24, 2024

What's on the top of my mind today?

ET: December 24th 2024

Tuesday, December 24, 2024

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 Perfume Layering (trends) Chart Perfume

10 Steps to Improve The Odds You Get Funded

Tuesday, December 24, 2024

And happy holidays from SaaStr! To view this email as a web page, click here saastr daily newsletter This edition of the SaaStr Daily is sponsored in part by Prismatic 10 Simple Steps to Improve The