| Dear friends, In JC’s Newsletter, I share the articles, documentaries, and books that I enjoyed the most in the last week, with some comments on how we relate to them at Alan. I do not endorse all the articles I share, they are up for debate. I’m doing it because a) I love reading, it is the way that I get most of my ideas, b) I’m already sharing those ideas with my team, and c) I would love to get your perspective on those. If you are not subscribed yet, it's right here! If you like it, please share about it on social networks! Share 💡JC's Newsletter

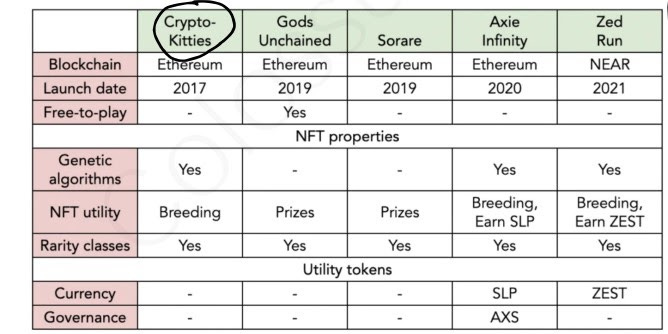

💡Must-read👉Axie Infinity & Yield Guide Games: Deep Analysis (Join Colossus Breakdown) (Join Colossus on YGG) (Join Colossus about Sky Mavis) Concept: Axie Infinity is a community-driven digital pet game which allows players to earn money while battling, breeding, raising, and trading digital pets called Axies. At a very high level, you have your cute Axie game characters that can be used in different games. Some of the games we create as a core team. That would be the one that's most popular right now is the Axie Infinity battle game, where you have a team of three Axies and you battle against either an opponent in a player versus player environment, or you can go travel on adventures and be various creatures and then advance like that, so a player versus enemy environment. So what we started seeing, as we had an open API and people started building very simple games that could be flappy bird Axie style. So if you had your Axie, you could log in with web three, and you could flap around with your Axie in Flappy Axie. And then there was Axie Sushi which was a racing game created by a developer, where you could race against other players. The output of the genes would mean a different thing inside that racing game than it did in the battle game. Specific Axies who were bad in battle could be really good in the racing game.

➡️ The notion of ownership whatever the platform you are on is really fresh and I love it. You could have a unique Marmot NFT, and use it in games :) Each Axie has a genetic DNA sequence that's stored on the blockchain, and that genetic sequence, that also determines the various body parts that that specific Axie gets, and also determines how strong that Axie is in battle. Each Axie has six of >500 possible body parts. Each of the body parts has three genes: dominant, recessive, and minor recessive. The combination of Axie's features determines its win rates and, eventually, return on investment.

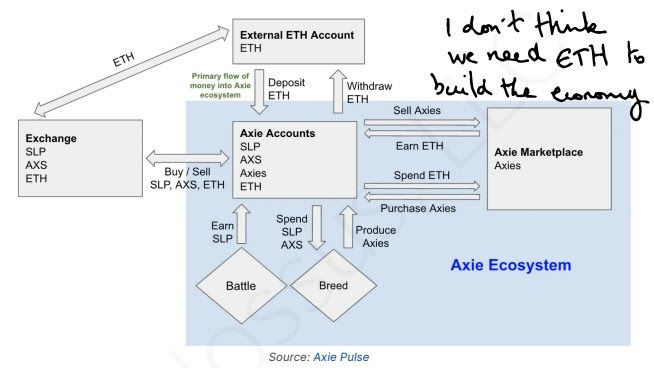

➡️ The power of customisation and uniqueness :) Internal economy: In blockchain games, by actively participating in virtual economies, players can earn rewards, such as in- game assets and tokens, which can then be traded or sold on the open market for other cryptocurrencies or fiat money. The benefit of the new play-to-earn business model is that a gamer always creates some value that they can sell. Even when a gamer needs to pay to start playing, these acquired items can be sold again. All obtained items represent a certain value. So you're seeing this crypto-economic model where I'm a player who has the Axies, I'm winning the games and creating SLP, I'm selling these SLP, the breeders are buying them because they're using them as an ingredient to breed new Axies and they have a stable of Axies that they're selling to new players who are coming in who want to buy Axies because they want to play the game and start their earning SLP as well. So there is this crypto-economic loop that is working as an in game economy, but it also touches the real world because people are buying and selling in crypto or in Ether via the marketplace.

➡️ How members can create value within Alan that they can sell is the big question :) Axie is fun. People enjoy playing it. But in fact, it's not really competing with Fortnite on the degree of fun. It's really competing with work. It only has to be more fun than work. That's a hook. And then you have the intrinsic side. You come in, you see, hey, there's a lot of people here. These will be my friends. You also have this massive community of people who actually love the game, everything that's around it. They make content.

➡️ I like this paradigm, then moving to the power of community. Different types of tokens & actions: SLP tokens are earned when a three-Axie team successfully defeats a foe in PVP (player-vs-player) or PVE (player-vs-environment) challenges. To meet the demand from new players, who each need three Axies to play, existing Axie holders breed new Axies from a pair of existing ones. Total breeding cost = fixed cost (not related to the number of reproductions, pay in AXS) + variable cost (related to the number of reproductions, pay in SLP). Each SLP that's in creation right now is the result of blood, sweat, and tears, or, well, you can say fun from another player who has actually been playing the game. To ensure that the Axie population remains stable and sustainable, there is a limit on the number of times an Axie can be bred. This number is currently seven with each additional reproduction requiring more SLP tokens. ETH / $ are earned when new players buy current players’ Axies through the marketplace, but can be paid in AXS too. Players receive newly created AXS if they lock up their tokens in the game and actively participate in the game by voting and playing regularly.

➡️ Actions in the game give different types of tokens Infrastructure: We took the Ethereum virtual machine, which is the Ethereum code base initially. We started with that as our code, and then we forked it off, created our own side chain, which is using a lot of the same things that it has on Ethereum, except it's more centralized, it moves faster in terms of transactions, and it's tailor-made for our needs. Through this migration, Ethereum’s high gas fees were removed for users and the transaction settlement times were reduced to seconds. What we're working towards is making it as seamless as possible so that people have their money inside their Ronin wallet and then seamlessly do trades and hold whatever asset that they want to because there is liquidity on the backend to make any trade that they want.

➡️ About the importance of using the right technology. It is interesting to see (cf. image) that most of the transactions happen in their own economy and the interaction with ETH is low. Onboarding: Axie Infinity is not also available on any app stores. You can't download it on Android. You have to sideload it. Besides that, we've gathered over 1.7 million daily active players right now. Getting started isn’t straightforward (which brings to mind Gabe Leydon’s broken but growing idea)...it requires acquiring ETH → signing up for a MetaMask wallet → transferring ETH → downloading another wallet (Axie’s own Ronin wallet) → transferring ETH again → acquiring NFTs on Axie’s own NFT marketplace (see below), logging in with MetaMask → downloading the application itself, on desktop or mobile.

➡️ High barrier and still growing. How Sky Mavis is making revenue: Collecting fees. Sky Mavis takes a 4.25% cut of revenue when players trade in the marketplace (e.g. breeding axies and selling axies) and they earn 2 AXS whenever an Axie is bred. This goes to Community Treasury where they hold stack. Over time, Axie can potentially earn revenue from selling Axies, Land, cosmetics, and in-game consumables. Additionally, there will be fees when players want to level up their game characters, play in tournaments, and craft new assets. YTD, the number of Axie Infinity DAU has grown from 16,000 to 1.7 million. Axie’s protocol revenue currently stands at ~$530 million YTD, almost 2x that of Ethereum ~85% come from Axie breeding fees, paid in AXS to the Community Treasury. ~15% comes from a 4.25% trading fee taken from sales of Axie NFT assets: Axies, land, and land items.

“I think one of the things our players really like is that 95% of the value that flows through the game is going to them".

➡️ Very interesting to understand how the value is created Future ideas: For example, are there sponsorships? Are brands willing to put money in the game and maybe sponsor prizes for people to do tournaments? Right now the economy of Axie Infinity is based on new user growth because every new user that comes in has to buy three Axies, which means that the breeders are making money selling Axies to these users coming in.

Long-term value? Again, virtual world economies are being made and yeah, a lot of people will make the right bets and invest in these digital assets will endure over time and also a lot of people will lose money playing these games that may turn out to nothing over time.

The value of “cool”: So famously like in Fortnite, the stuff that people spend a lot of money on, like a lot of fiat money, it doesn't change the game. Like they don't become a stronger player because they bought a superweapon or something. They just look cooler. And a lot of, especially I think in the west, a lot of the money spent on games and items in games is cosmetic versus having some actual utility

➡️ How to help people to look cooler thanks to Alan? :) Yield Guilde Games Token: What we're doing at Yield Guild is that we want the people that are creating value for the network to also capture some of that upside value in themselves. And there's going to be reflected in the YGG token. So the YGG token, think of it as like a share of the ownership of the entire guild. If you own a portion of YGG tokens, that means you, I guess, have a proportion of claim to all of the assets that are in the balance sheet plus the fees that are being produced. One of the things we've done is that for the 5% of the supply of YGG token is not for sale. It is actually there to be earned by our player base. So we're setting up what we call the community mining program where if you play the games that we are partnered with, we're overlaying like a professor system in these games so that if you do these quests actions and complete them, you actually earn a bit of the YGG tokens for yourself.

➡️ Every Alan Member gets an Alan Token. You get Alan tokens as you help the community.

🏯 Building a company👉The Lightness of Windows (Stratechery) To return to the Windows/Mac comparison of twenty years ago, Apple’s problem was certainly a lack of developers, but that was, above all, because the company simply didn’t have enough users. The way the company fixed the problem was exactly what you would expect from Apple: they relied on themselves. One of the most brilliant and underrated moves of the Steve Jobs era was the development of the iLife suite of apps — iMovie, iPhoto, iTunes, iDVD, and GarageBand

➡️ That is why we should develop our first verticals to be attractive to developers :) The way I’ve interpreted what platforms do is: they have to create opportunities for people who build on the platform. That’s the way to keep a platform relevant. 👉How to work hard (PaulGraham) If you want to do great things, you'll have to work very hard. There are three ingredients in great work: natural ability, practice, and effort. Once you know the shape of real work, you have to learn how many hours a day to spend on it. You can't solve this problem by simply working every waking hour, because in many kinds of work there's a point beyond which the quality of the result will start to decline. You have to notice when you're being lazy, but also when you're working too hard. I do make some amount of effort to focus on important topics. Many problems have a hard core at the center, surrounded by easier stuff at the edges. Working hard means aiming toward the center to the extent you can. Some days you may not be able to; some days you'll only be able to work on the easier, peripheral stuff. But you should always be aiming as close to the center as you can without stalling.

➡️ I liked this article about the necessity of working hard to do great things. It also means focusing on the hard problems. Working too hard is counter-productive, and every one should spend time learning to know how they are the most impactful.

🗞In the news📱Technology👉My first impressions of web3 (CEO of Signal) (Moxie) ➡️ Very interesting article about the inevitability of centralisation through platforms even if it is contrary to the mission of web3. Even strictly on the technological level, though, I haven’t yet managed to become a believer. The general thesis seems that web3 should give us the richness of web2, but decentralized. People don’t want to run their own servers, and never will. Even nerds do not want to run their own servers at this point. A protocol moves much more slowly than a platform. After 30 years, email is still unencrypted; meanwhile WhatsApp went from unencrypted to full e2ee in a year. People are still trying to standardize sharing a video reliably over IRC; meanwhile, Slack lets you create custom reaction emoji based on your face. If something is truly decentralized, it becomes very difficult to change, and often remains stuck in time. That is a problem for technology, because the rest of the ecosystem is moving very quickly, and if you don’t keep up you will fail. Partisans of the blockchain might say that it’s okay if these types of centralized platforms emerge, because the state itself is available on the blockchain, so if these platforms misbehave clients can simply move elsewhere. However, I would suggest that this is a very simplistic view of the dynamics that make platforms what they are. Instead of storing the data on-chain, NFTs instead contain a URL that points to the data. What surprised me about the standards was that there’s no hash commitment for the data located at the URL. Looking at many of the NFTs on popular marketplaces being sold for tens, hundreds, or millions of dollars, that URL often just points to some VPS running Apache somewhere. Anyone with access to that machine, anyone who buys that domain name in the future, or anyone who compromises that machine can change the image, title, description, etc for the NFT to whatever they’d like at any time (regardless of whether or not they “own” the token). There’s nothing in the NFT spec that tells you what the image “should” be, or even allows you to confirm whether something is the “correct” image. What I found most interesting, though, is that after OpenSea removed my NFT, it also no longer appeared in any crypto wallet on my device. This is web3, though, how is that possible? In short, MetaMask needs to interact with the blockchain, NFT on OpenSea Same NFT on Rarible Same NFT in a wallet but the blockchain has been built such that clients like MetaMask can’t interact with it. So like my dApp, MetaMask accomplishes this by making API calls to three companies that have consolidated in this space. All this means that if your NFT is removed from OpenSea, it also disappears from your wallet. It doesn’t functionally matter that my NFT is indelibly on the blockchain somewhere, because the wallet (and increasingly everything else in the ecosystem) is just using the OpenSea API to display NFTs, which began returning 304 No Content for the query of NFTs owned by my address! The space is consolidating around... platforms. Iterating quickly on centralized platforms is already outpacing the distributed protocols and consolidating control into platforms. “It’s early days still” is the most common refrain I see from people in the web3 space when discussing matters like these. Objectively it has already been a decade or more. It seems like we should take notice that from the very beginning, these technologies immediately tended towards centralization through platforms in order for them to be realized, that this has ~zero negatively felt effect on the velocity of the ecosystem, and that most participants don’t even know or care it’s happening. This might suggest that decentralization itself is not actually of immediate practical or pressing importance to the majority of people downstream.

👉 Netflix is raising prices—again—to as much as $20 a month. Today’s increase is the third time in just the past three years that Netflix has raised prices in the U.S. The service’s top tier is now 42% more expensive than it was in late 2018. 👉 Bull & Bear: Agora, the API Powering Clubhouse (Not Boring) If you’ve joined a conversation on Clubhouse , attended a virtual event on RunTheWorld, or binged livestreams on Bilibili you’ve experienced Agora. It’s been sitting there, in the background, making sure the audio and video come through clearly. Agora is not for static video or audio. The next YouTube, Netflix, or Spotify won’t be built on Agora. It’s for interactive, real-time video and audio, like one-to-many livestreams, audio chat rooms, or one-on-one use cases like telemedicine or tutoring. Before Agora, and even occasionally today, companies spun up their own products by building on top of the open source WebRTC standard. WebRTC is built on the public internet, which is a “best-effort network” - it will make the best effort to deliver your data. In many cases, that best effort is not good enough, leading to laggy or glitchy video and audio. If your business relies on video and audio, you need a better solution. According to multiple customers interviewed on Tegus, all of whom evaluated multiple competitors for their products and whose uses range from video-game audio chat to one-to-many online video education, Agora’s advantage comes down to a combination of price, ease, scalability, and quality. Dolby.io has more top-end audio functionality, for example Hopin, one of the fastest-growing startups in history, is built on Mux, as are SoulCycle and Equinox’s streaming and on- demand classes.

➡️ Some tools for when you want to do audio or video. I recently tuned in to Amazon Live, and promptly shut the window after 2 minutes. It was so bland. The livestreamers didn’t know how to engage with the audience; the audience asked bad questions, there were no stickers or mini-games that made it engaging. It was all functional and no fun.

➡️ Importance of bringing fun in every interaction :) 🏥 Healthcare👉Air Quality, Breathing, and Health (Out-Of-Pocket) Because of the rapid and visible decline in air quality, we’re starting to see a slew of research coming out on different air quality <> health effects related to the wildfire that builds on a lot of research about the effect of pollution as well: Fine Particles in Wildfire Smoke and Pediatric Respiratory Health in California (guess what, turns out it’s not good). BreezoMeter (the company powering Apple’s weather app) even have an entire page for their digital health offering.

As the evidence between air quality and pregnancy issues grows, we could see plans spend more time trying to help at-risk patients manage their exposure to poor AQI environments. The relationship between indoor air quality and health is seemingly way less studied than outdoor air quality. Beyond just sickness there’s also research that suggests stale air is making us sluggish and less productive. Companies like Awair are building hardware to monitor different aspects of indoor air quality and see changes in real-time.

➡️ Would you like to have notifications in the Alan app when Air Quality is bad? 👉Women’s Digital Health Startups Reap Record VC Funding on Covid Surge (Bloomberg) New York-based Tia -- which raised $24 million in venture capital last May -- aims to capture the full spectrum of women’s health from primary care, gynecology and therapy to nutrition counseling and acupuncture through its hybrid model of virtual and in-person clinics. For a fee of $15 a month, patients have access to Tia’s one-stop shop of in-house physicians, unlimited messaging and centralized medical records. Oula Health, a pregnancy-care startup based in Brooklyn, launched in December. The company provides midwives, obstetricians, doulas and lactation consultants through a telehealth platform in addition to regular in-person prenatal visits at its brick-and-mortar clinic.

It’s already over! Please share JC’s Newsletter with your friends, and subscribe👇 Let’s talk about this together on LinkedIn or on Twitter. Have a good week! If you liked this post from 💡JC's Newsletter, why not share it? | |