Surf Report - Surf Report: On sanctity & sanctions

You’re getting this email because you signed up for Surf Report, my weekly take on economics, investing, Bitcoin, and business. I really appreciate you being here, but if you’d like to leave, simply scroll to the bottom to unsubscribe.

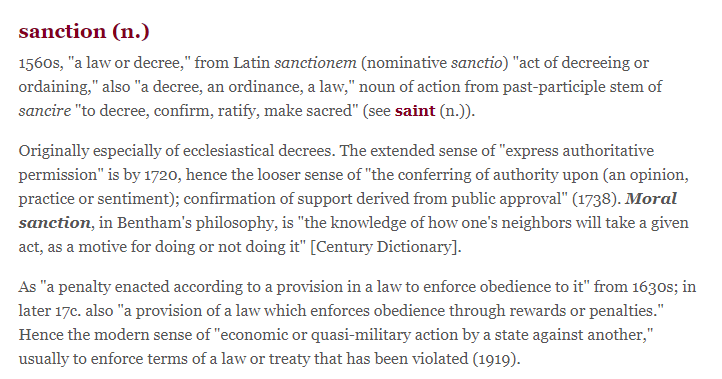

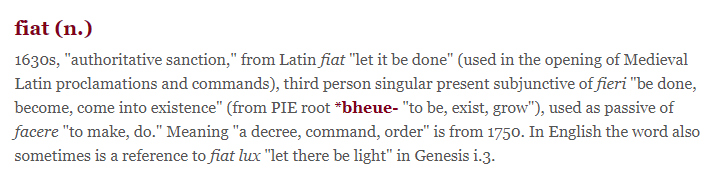

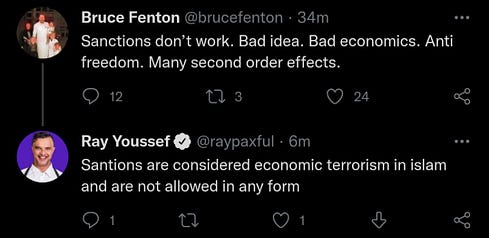

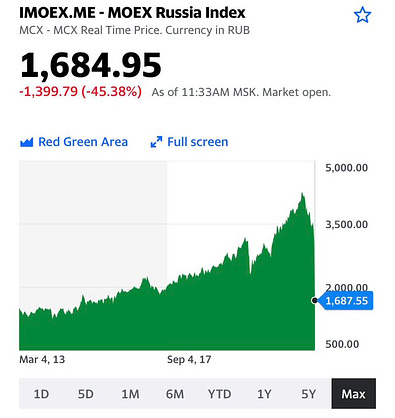

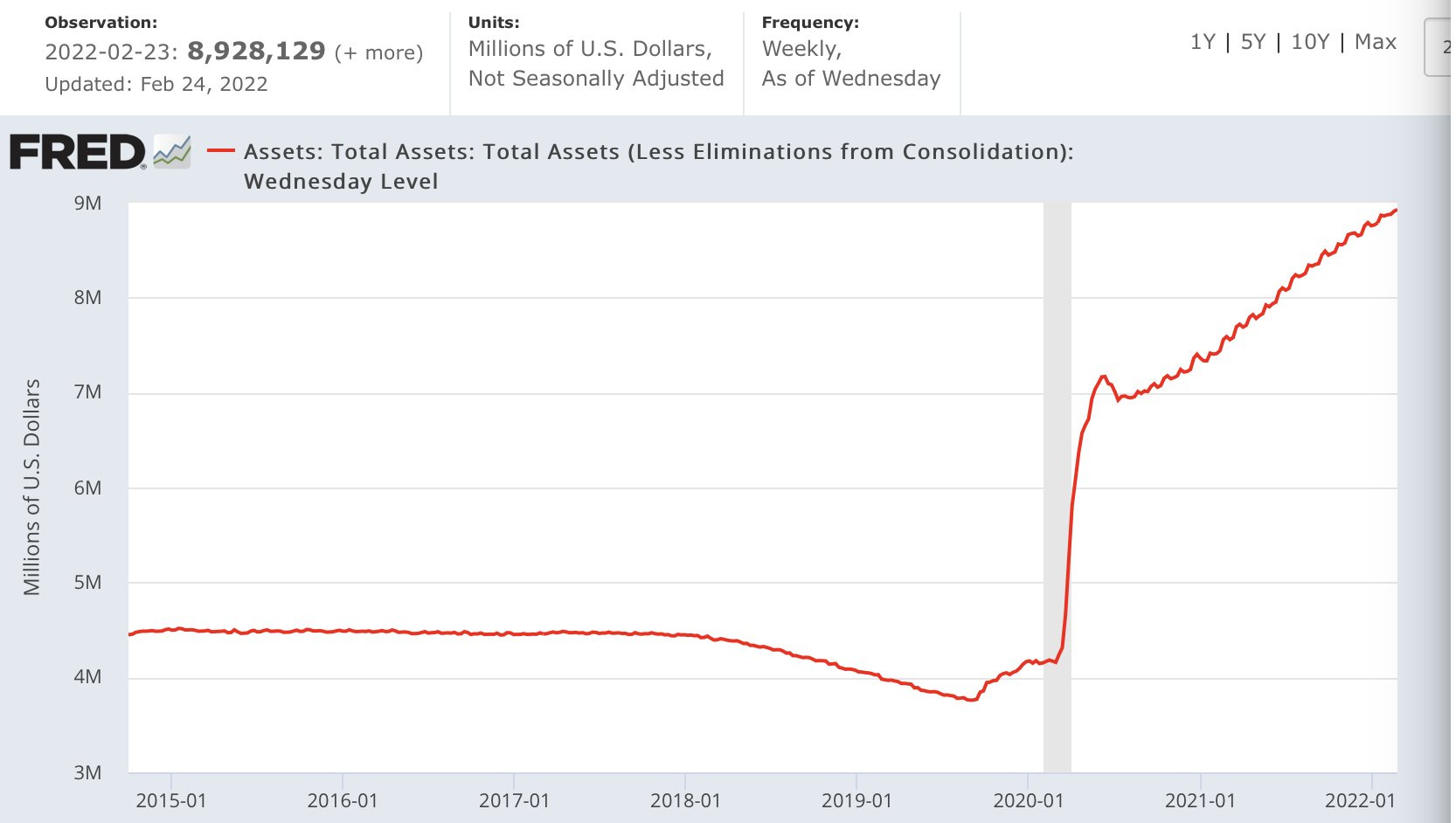

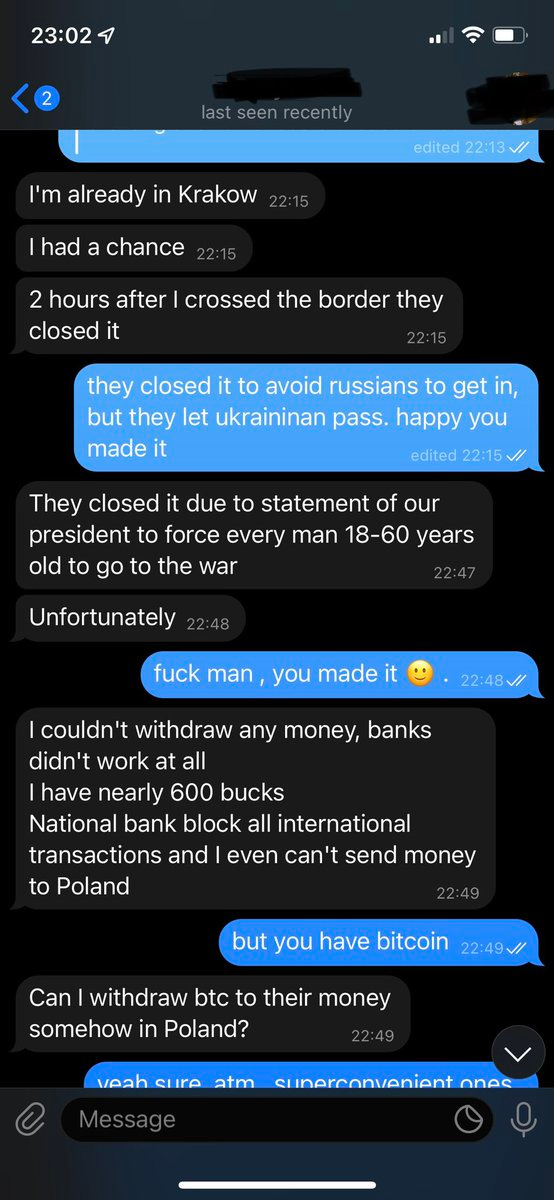

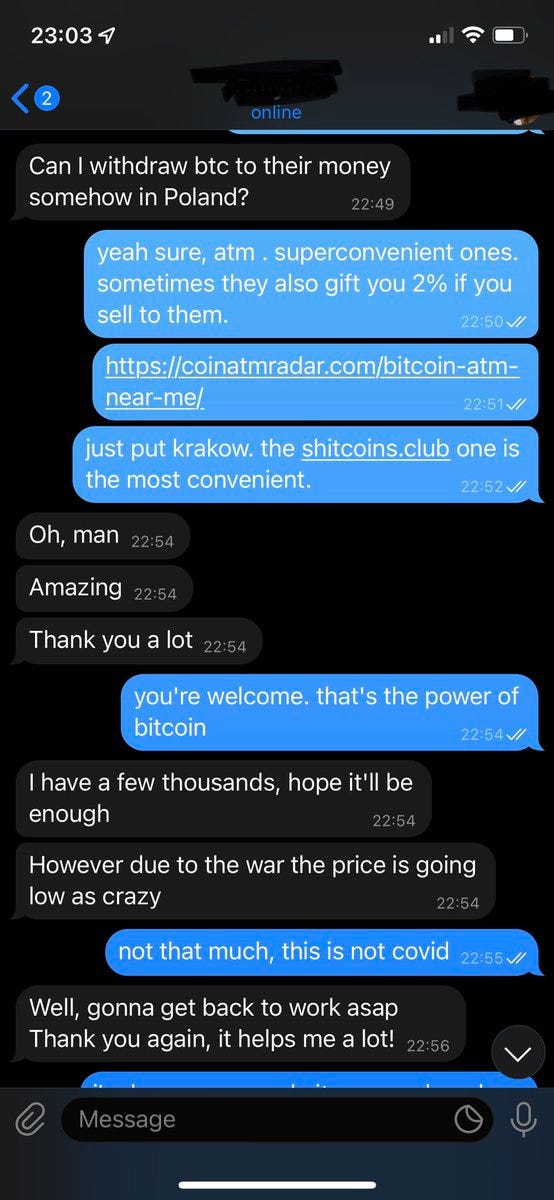

Hi everyone—I’m so glad to have you here. What a week. Russia has invaded Ukraine and missiles have been fired into residential civilian apartment buildings. Kindergartens and orphanages have been hit. Women are giving birth in bomb shelters. Much like the covid hysteria that swept the world in early 2020 and subsequently fomented into sustained sloganry and confusion, it’s important to remain vigilant as the fog of war blurs fact with fiction. There is much going on right now that is true and important, but it is also the fertile soil from which propaganda and false narratives grow. (Confusing the two is always a risk, but I’m doing my best to filter out reports that are unconfirmed or overly speculative.) What’s happening right now is so tragic and unnecessary that it feels trivial to be focusing on anything other than such a senseless loss of human life, with families being broken apart as fathers are sent off to war to defend their country and mothers are taking up arms to defend their families. As it stands, the Ukrainian President, Volodymyr Zelenskyy, is still in Kiev leading the defense effort, sending video confirmation of him and his cabinet.  Hard times call for hard money. It’s hasn’t been 100% verified yet that Ukraine’s Bitcoin treasury claims from last year are true, but that they made such claims at all is at least worth noting given the radio silence among most nations apart from El Salvador. And the justification for such claims might be playing out right now: whenever war descends, the first thing to be stolen or sanctioned is the money. Enemies always come for the money first. We saw this first with Canada, and now US companies like Brex are blocking transactions with Ukraine. The Ukraine central bank has also limited cash withdrawals from accounts to 100,000 hryvnia per day (the equivalent to about $3,300), sending floods of panicked citizens to the ATMs in record droves. Without cash in hand, Bitcoin remains the only way for Ukrainian citizens to transact freely and uninterrupted as they flee the country on foot to take refuge in neighboring Poland.    Plans to sanction Russia and ban them from the use of the global SWIFT payment network are now ramping up, which would effectively mark the end of the USD Global Reserve currency era and trigger any number of possible cascading scenarios and alternatives. We’re already seeing footage of ATM and bank runs in Russia in anticipation of such a reality. Even large wealth management firms are feeling the effects of a Russian economy in the process of being repriced and precipitously devalued:  Of course, the very profitable ad-driven clickfarm industry has decided to use all this as an opportunity to sling propagandistic fears and scolding at Bitcoin. Which, to be fair, should always be expected. Whenever politicians or bureaucrats or economists get mad at Bitcoin it's because they don't get to control it, and therefore can't benefit disproportionally from its influence. It's really that simple. Behind all the fear-mongering & screeching is a spoiled child. Meanwhile, Russia’s own rules for civilian Bitcoin ownership include the taking of an online test, allowing those who pass to buy $7,700 worth of Bitcoin per year or $650 worth if failed. Ownership is fully identified via Know Your Customer (KYC) regulations, and only via fiat onramps. Its restrictive and controlling policies are consistent with Russian policy, while the country itself is well situated to benefit greatly from accumulating Bitcoin and start mining it to both stabilize and strengthen its very robust energy industry. The notion of banning an entire nation from using SWIFT—the primary payment rails of the global economy and interbank transfers—is a big deal. (SWIFT stands for Society for Worldwide Interbank Financial Telecommunication) And the Bitcoin network is a technologically better solution than SWIFT for transmitting value across space in the first place, being faster, cheaper, and more robust. Instant conversion on the sending and receiving ends bypass the need to be concerned about the price that the bitcoin token is trading at. Preventing Russia from accessing SWIFT would just be akin to squeezing a long balloon on one end—the air isn’t eliminated it’s just displaced. Sanctions can coerce but they can’t destroy. Believe it or not, the words sanction and fiat both share similar etymological origins regarding the “sacred” and saintly ability to force people to do and accept things by nothing other than “because I said so.” Artificial, faith-based enforcement. There was a time when the money used and traded was not fiat—”by decree”—but rather actual commodities such as salt or grain (our English word “salary” comes from the Latin sal, “salt”), and it’s no coincidence that Russia’s wheat-producing regions are now cleared for export to China in advance of Western nations cutting the country off as a trade partner. China is where a lot of the balloon money will be squeezed into. This is why the idea that Bitcoin will be used to skirt sanctions is a bit too clever by half—in all likelihood, China and other countries could still trade with Russia and make up the difference left by US sanctions. Remember, Russia is the third largest oil producer in the world and oil just hit $100 a barrel for the first time since 2014. The effects of this fact alone will propagate throughout world stock and commodity markets in the months and years to come, and likely reconfigure a lot of trade routes and partnerships. Which begs the question: was this an attack to capture Ukraine, or was the capturing of Ukraine intended to be used to attack the global financial system?   You don’t have to go very far to realize that the bankers and the money hold the answers to most puzzles. In fact, much of what we’re experiencing today is the culmination of an accumulation of consequences stemming from the 2008 global financial crisis and subsequent Great Recession. From 2010: “Russia urged China to dump its Fannie Mae and Freddie Mac bonds in 2008 in a bid to force a bailout of the largest U.S. mortgage-finance companies, former Treasury Secretary Henry Paulson said.” For now, none of this has been good for Russia. Its stock markets have already suffered the worst day on record. This is also why I’m seeing such clear similarities between the Russia-Ukraine crisis and the rise of covid in January 2020. We went to war with a virus right when we needed to go to war with something, and if you’ll recall I saw the same writing on the wall earlier this month.  You may be wondering: why did the US need to go to war with something prior to 2020? The answer is: because September 2019 is when the repo market blew up. The repo market is the system we have for banks to lend money to one another overnight and then buy it back again in the morning. It’s sort of like a pawn shop: they trade Treasuries for cash at night and then buy it back + a tiny bit of interest in the morning. They do this because when banks have cash on hand that they can’t invest for one reason or another they don’t just want it sitting there melting like an ice cube in the sun of inflation. They’d rather lend it out to get some kind of interest on it at least. In September 2019 this pawn shop went bust, and the Fed intervened to prop it up by adding $50B to keep the system afloat. To be clear, that was $50 billion on the first day. Then it was another $50B the next day. And the next. And soon it was $75B, then $100B... until they got up to injecting $1T per day. And this was months before the covid crisis ever hit. From Sept 2019 to July of 2020 they injected $11T into the repo market to keep it solvent. $11T in 6 months. (You probably never heard about this. That was the idea.) The Fed is supposed to be the lender of last resort to backstop the commercial banks, but that's not where this $11T went. It went to investment banks, who are not supposed to be backstopped. Investment banks are the ones who go out and make risky investments, and should be allowed to fail. Covid created the conditions to justify more money printing and hide the broken system underpinning the whole grift. If it wasn’t a pandemic it would have been something else eventually. It doesn’t matter what the large-scale systemic event is, what matters is that public perception and attention is tunnel-visioned onto it. A threat is amplified, its danger is magnified, so that the reaction can be subsidized. Just weeks ago the Federal Reserve was saying it is planning for multiple rate hikes this year in an effort to reign in inflation, a.k.a. “tapering.” I said this was ridiculous and impossible, and that they would figure out excuses to wiggle out of this and reverse course on pumping the brakes on their quantitative easing and continue printing more money, inflating the currency supply further. And wouldn’t you know, the Fed not only isn’t tapering but it’s actually increased its balance sheet to another all-time high despite record high inflation levels, and the US president has officially asked Congress for $6.4 Billion in additional funding “for Ukraine conflict.” Who’s to say where this all goes. My guess is they are swapping in the Ukraine crisis for the covid crisis and will continue to inject funds into this crumbly corpse of an economy for as long as they have to until they’re ready to roll out a new Fed-designed digital dollar, so they can more precisely surveil and control your spending and wipe clean all the debt they racked up in favor of a new system entirely. It’s called a debt jubilee, and it’s what happens at the end of long-term debt cycles which we happen to be in right now. If this all sounds like a step too far into tin foil hat territory perhaps it shouldn’t. I’m just reading the news: “How politics are affecting the design of a Fed digital dollar” This is why what really matters—actual human lives and the suffering of innocent people for no good or clear reason—is unfortunately never far away from something far more dispassionate and craven: the global financial system. This is also why I don’t need to be an expert in foreign policy, geopolitics, or macro game theory to have something to say about it. The reasons Vladimir Putin ordered his military to stage a widespread and multi-pronged attack on Ukraine are less important right now than the mere fact that he did. War is upon us. That is now a fact. And it’s all you need to know to understand that it will be used by those in power as a tool for enrichment, excuse, and escape. War has always been the necessary condition for justifying the emergencies necessary to suspend the law, legalize theft, and take by force the most sacred resources we have as people—life, liberty, and property. Those are the things that ultimately get looted and stolen… and not necessarily in that order.

Until next time 🤙, Recommended Resources For Plan ₿Swan. I became an official Swan partner because I love them so much. So if you're like me and just want an easy, automated way to buy bitcoin on the regular with the lowest fees in the game, head to https://swanbitcoin.com/Mulvey to get $10 in bitcoin for free ✨ Fold Card. Earn bitcoin on everything. You can win up to 100% back on every purchase, and every swipe is a chance to win a whole bitcoin. I use my own Fold card to pay for almost literally everything. If you use this referral link you get 5,000 sats free ✨ Thanks for subscribing to Surf Report. If you liked this post, consider sharing it with someone else who might appreciate it! |

Older messages

Surf Report: The Sus Special™ - On trust, risk, & vulnerability

Sunday, February 20, 2022

Listen now | Issue 64: 02.20.22

Surf Report: Brrrassic Park

Sunday, February 13, 2022

Listen now (11 min) | Issue 63: 02.13.2022

Surf Report: Jo-Jo the idiot circus boy

Sunday, February 6, 2022

Listen now | Issue 62: 02.06.2022

Surf Report: Fact from fiction

Sunday, January 30, 2022

Listen now (10 min) | Issue 61: 01.30.2022

Surf Report: Do you see what happens?

Sunday, January 23, 2022

Listen now | Issue 60: 01.23.22

You Might Also Like

🌎 Make international sourcing and shipping easier

Tuesday, March 4, 2025

How to prep your business for changing trade regulations. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 How was the masterclass with Arvid Kahl?

Tuesday, March 4, 2025

Your feedback matters + Access the recording ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Letter from the Editor: Why this year's Digiday Publishing Summit matters

Tuesday, March 4, 2025

It's a new era for the media industry. Eras, actually: There's the AI era, the streaming era, the podcast era, the post-cookie era. In other words, media companies are being forced to evolve,

11 social media skills to master (and how AI can help)

Tuesday, March 4, 2025

Perfect these skills now to stay ahead in 2025 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 The masterclass with Arvid Kahl starts in 15 minutes

Tuesday, March 4, 2025

Build In Public Without Giving Away Your Business Secrets ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Age of Economic Chaos

Tuesday, March 4, 2025

Listen now (7 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The next level of content marketing

Tuesday, March 4, 2025

Content marketing isn't just about creating blog posts. If you're still stuck in that mindset, you're leaving money on the table. The best marketers go beyond traditional content and

📱 Google Gemini’s iPhone Hack

Tuesday, March 4, 2025

AI More human-like than ever. Ready to upgrade? ⚡

ET: March 4th 2025

Tuesday, March 4, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 BlueChew (trends) Chart BlueChew is a

🦅 Masterclass with Arvid Kahl: watch the live stream

Tuesday, March 4, 2025

At 10:00 AM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏