Coin Metrics' State of the Network: Issue 146

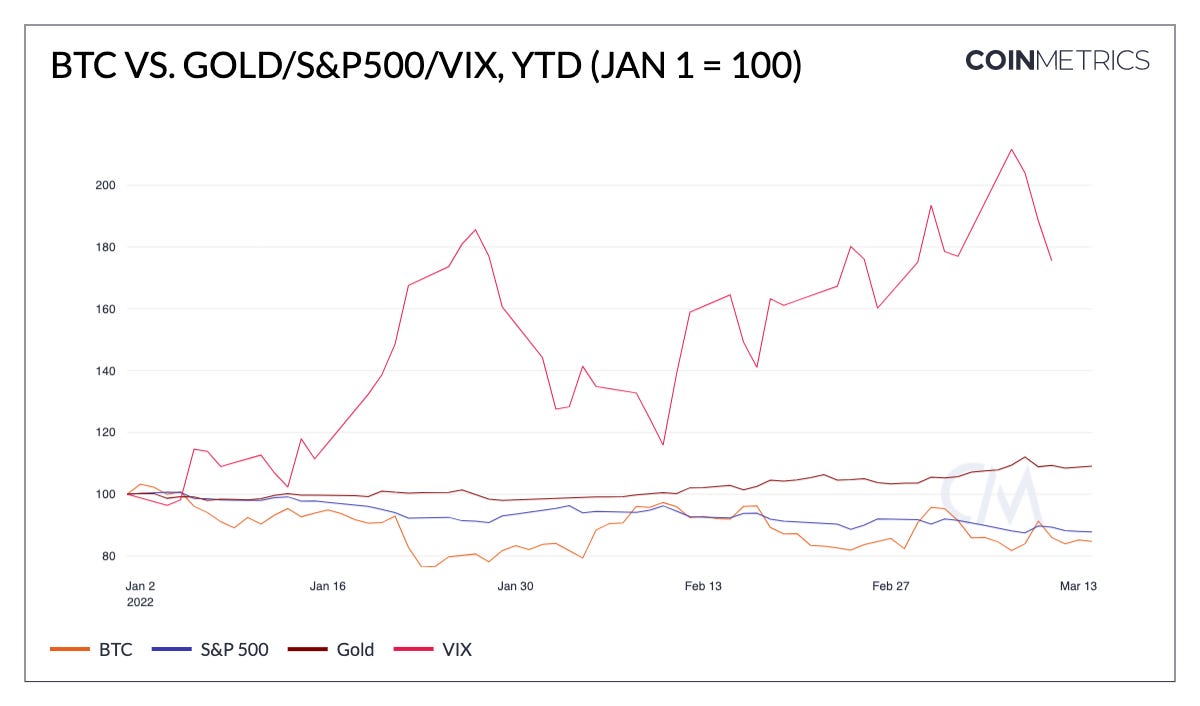

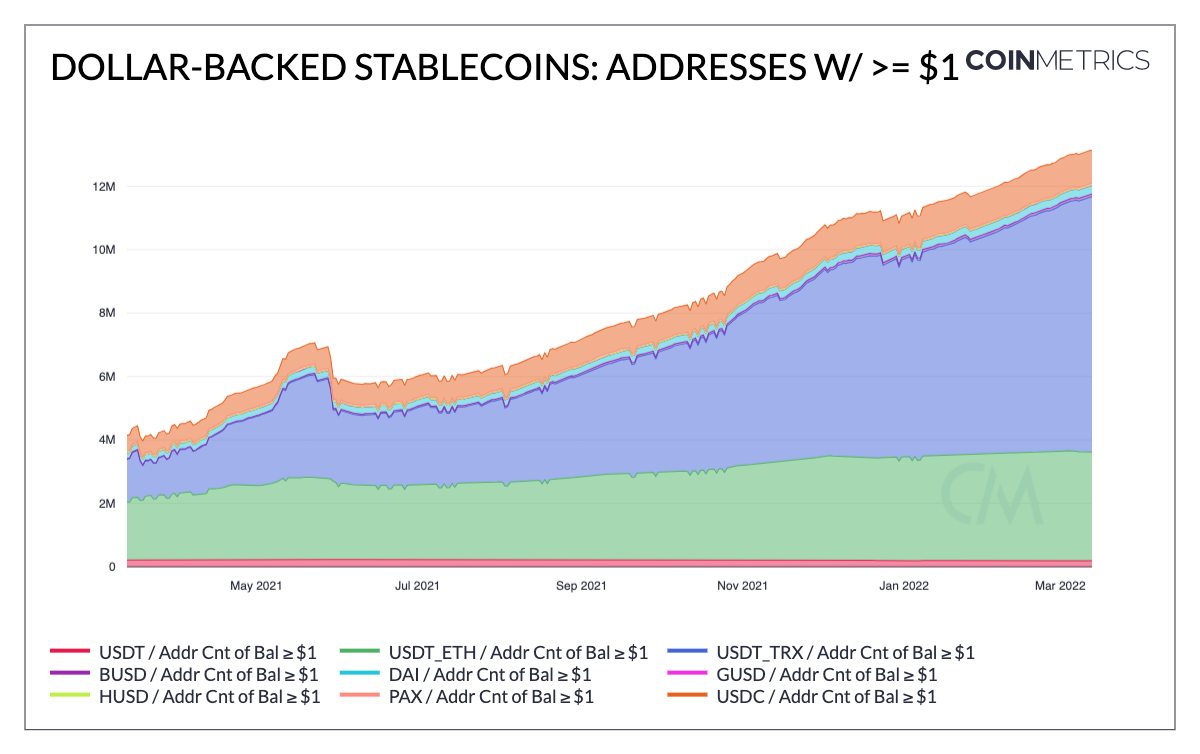

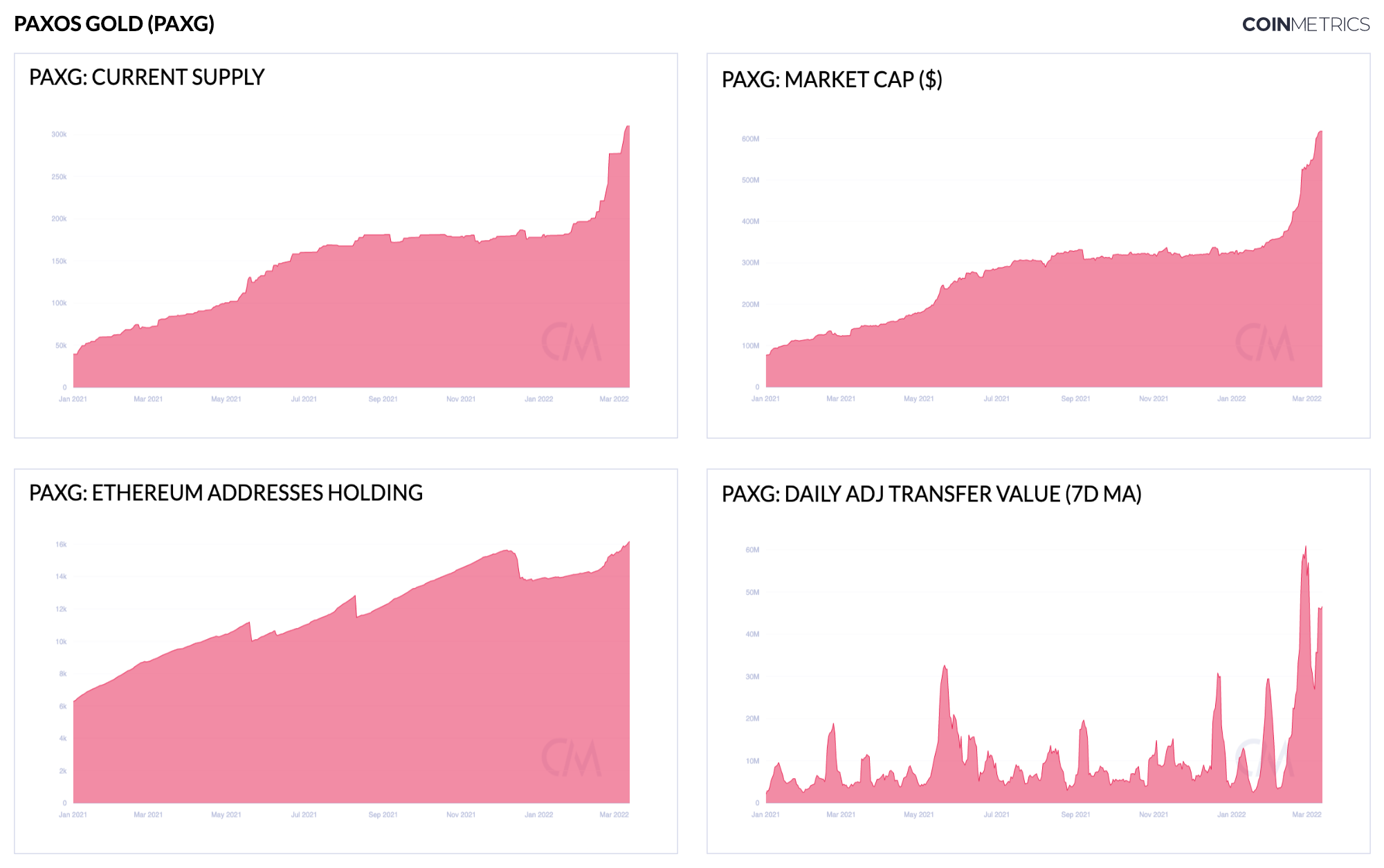

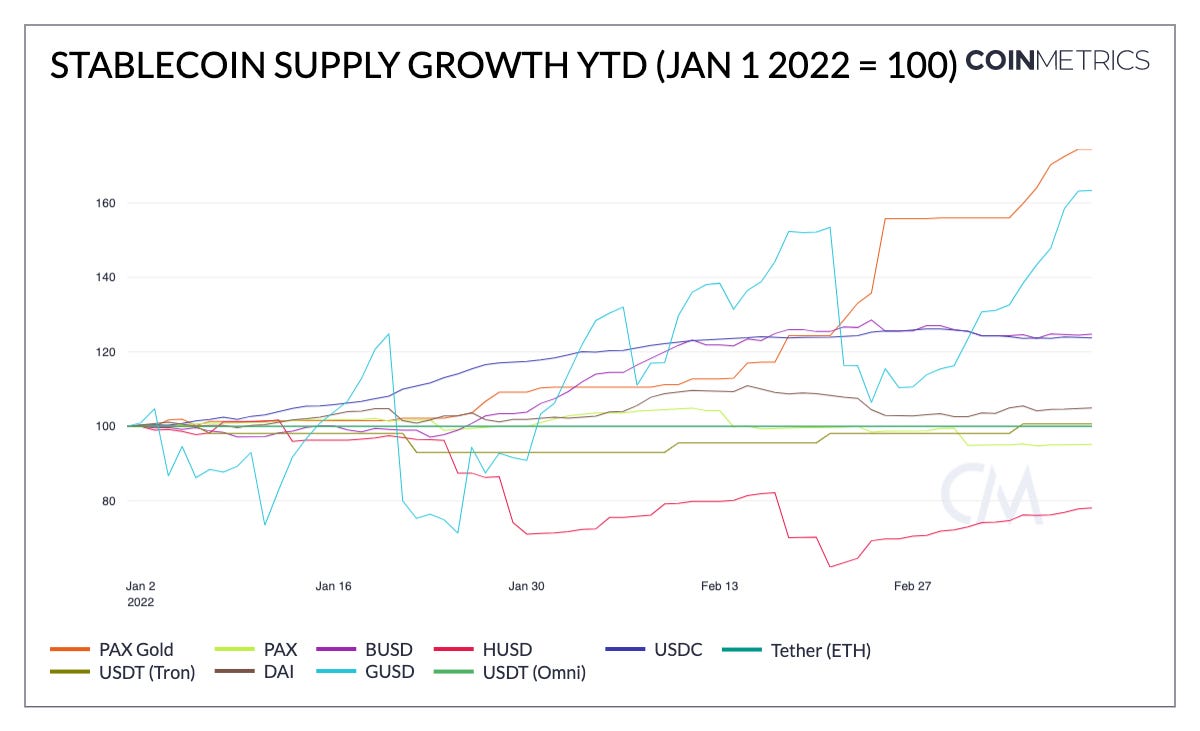

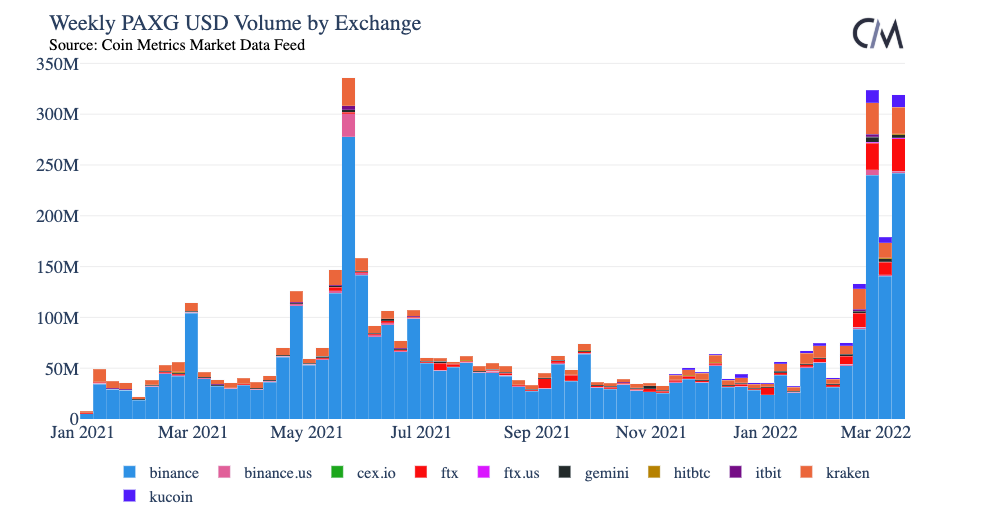

Get the best data-driven crypto insights and analysis every week: Coin Metrics is hiring Research Analysts, Data Scientists, and many other positions. Check out our open roles here. Stablecoins Shine as Safe Haven Crypto AssetsBy Kyle Waters and Nate Maddrey With the crisis in Ukraine entering its third week, crypto markets and the broader financial markets across the globe remain unsettled. Although crypto prices have faced some selling pressure in recent weeks, crypto infrastructure has continued to empower the flow of millions of dollars worth of donations to Ukraine and its people (see network highlights at the end of this issue for an update on the Ukrainian government’s crypto address holdings). Heightened geopolitical uncertainty has reshaped the macro landscape. The CBOE Volatility Index (VIX), which is a proxy for the market’s short-term expectations of stock market volatility, has risen sharply in the last few weeks. Over the last two years, bitcoin (BTC) has tracked the returns of U.S. equities more closely and the last few weeks have followed a similar pattern: both U.S. equities (S&P 500 index) and BTC have declined in an increasingly risk-off environment. Source: Coin Metrics’ Formula Builder In times of market distress, investors often seek safe-haven assets that offer reliable stability and security as a store of value. Due to its properties of scarcity, non-sovereignty, and ubiquity, Gold is often viewed as an exemplar of haven assets, and its price has responded accordingly in recent weeks rising to near record highs in dollar terms. Although BTC shares many of these intrinsic characteristics with Gold, recent data are inconclusive to BTC’s mutual acceptance as a safe haven asset; BTC has tracked more closely with risk-on assets, like tech stocks and other growth equities. But as crypto continues to mature as an asset class, BTC’s safe haven status might evolve. However, today it is increasingly clear that public blockchains already serve a critical role for safe haven assets, hosting billions of dollars worth of stablecoins circulating on-chain. Adoption of US-dollar backed stablecoins has continued to accelerate with the total number of addresses holding at least $1 worth of the major stablecoins recently surpassing 12M – roughly three times the value from one-year ago. Source: Coin Metrics’ Network Data Charts (note the chart above may include a small amount of double counting if an Ethereum address holds more than one of the above stablecoins) Although most of the largest stablecoins are pegged to the dollar, not all stablecoins are US-dollar backed. There also exist gold-backed stablecoins such as Paxos’ PAX Gold (PAXG) which is an ERC-20 token on Ethereum (note Tether also issues a gold-backed stablecoin, Tether Gold). Each PAXG token is backed by one troy ounce of 400 oz gold bars held in custody by Paxos. Given its 1:1 redeemability, the market price of PAXG closely tracks the $/oz price of spot gold. As market activity in gold has increased in recent weeks, PAXG adoption on Ethereum has been rising. The charts below show PAXG supply, market cap ($), Ethereum addresses holding PAXG, and daily value settled. Source: Coin Metrics’ Dashboards PAXG supply is currently ~310K which corresponds to a market cap of ~$620M at a gold price of ~$2K/oz. As one token is equal to one ounce, this token supply figure is equivalent to 775 gold bars (310K tokens/400oz bars) that are held to back the stablecoin (a very small portion of gold supply though compared to the 771K gold bars held in London vaults worth about $600B as of Feb. 2022, for example). But for comparison to other stablecoins, USDP, Paxos’ US dollar stablecoin, has a market cap of around $1B. Against other stablecoins Coin Metrics tracks, PAXG supply has increased most YTD (in % terms). Source: Coin Metrics’ Formula Builder The number of ETH addresses holding PAXG is also up 15% since the beginning of February while PAXG trading volume has also increased on centralized exchanges. Source: Coin Metrics’ Market Data Feed Whether it is gold or US dollars, tokenized digital assets continue to proliferate across public blockchains. Distinct benefits such as near-instant settlement, constant network uptime, shared infrastructure, and ease of creating crypto addresses all point to this trend continuing. To follow the data used in this piece and explore our other on-chain metrics check out our free charting tool, formula builder, correlation tool, and mobile apps. Network Data InsightsSummary MetricsWe’re excited to introduce a new summary metrics table for State of the Network! The fresh layout covers core network data fundamentals across the dimensions of adoption, economics, and usage for 39 assets grouped by layer one blockchains (L1s), stablecoins, and ERC-20 tokens. Note that you can click on the image to view it in a browser and zoom in for more detail, which might be especially helpful for our mobile readers. Source: Coin Metrics Network Data Pro Here are a few important things to keep in mind when reading this table.

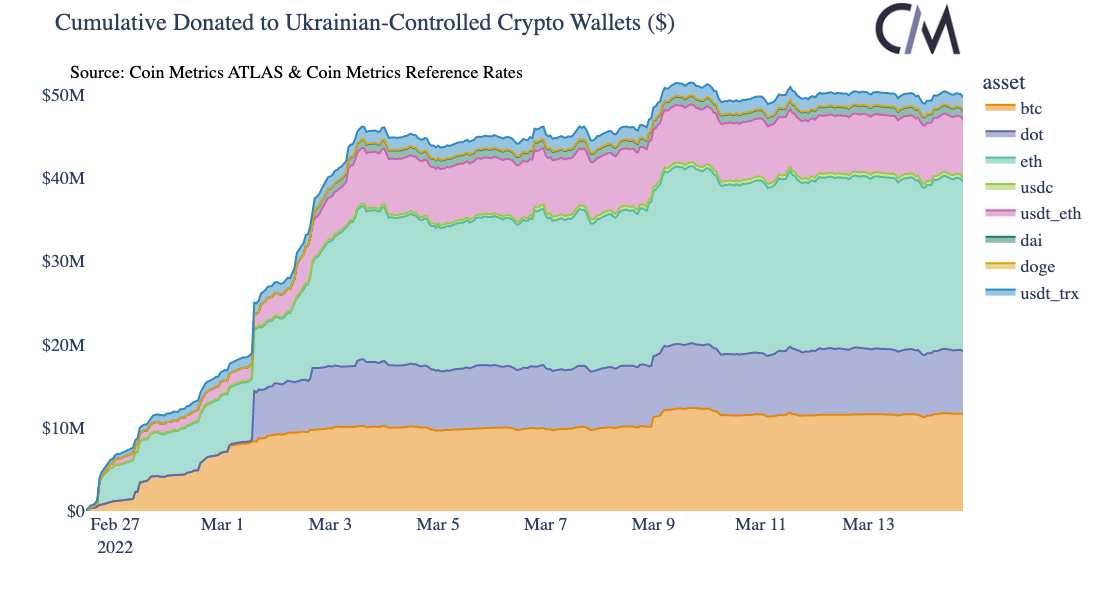

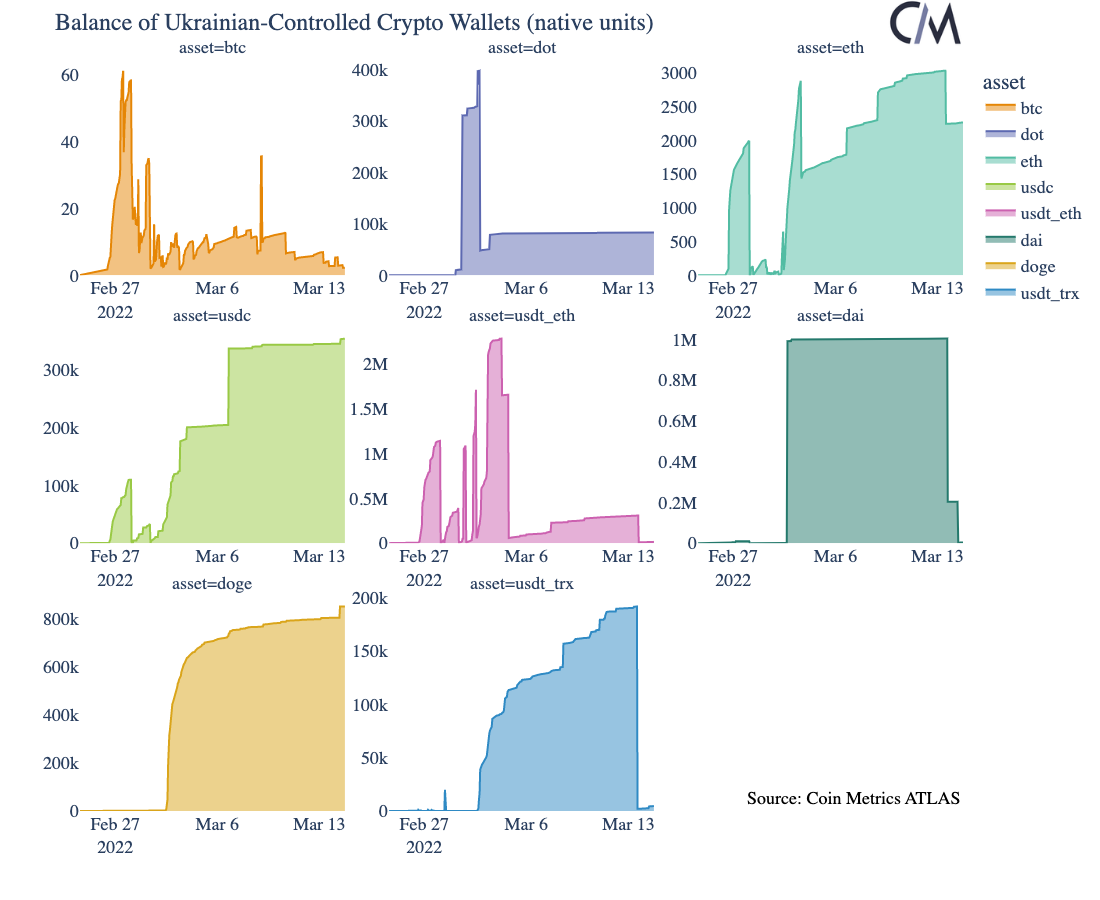

Coin Metrics is continually evaluating and onboarding new crypto assets so expect more additions for comparison and analysis in the near future. If you have questions or feedback please let us know at info@coinmetrics.io or @coinmetrics on Twitter. Update on Ukrainian Crypto DonationsCumulative bitcoin donated to Ukraine’s government-held address crossed 300 BTC (~$12M) on March 14th. In dollar terms, the cumulative value sent has slowed. However, on Monday government officials announced a partnership with FTX and Everstake to facilitate more donations through a designated website. On Monday, total ETH donations also topped 75K with about 8K total ETH sent (~$20M). Sources: Coin Metrics ATLAS and Coin Metrics Reference Rates The Ukrainian government has continued to put these received funds to use: the government’s Bitcoin address held only about 2 BTC as of Monday afternoon ET. Network HighlightsWeekly Summary Video  Coin Metrics UpdatesThis week’s updates from the Coin Metrics team:

As always, if you have any feedback or requests please let us know here. Subscribe and Past IssuesCoin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data. If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here. Check out the Coin Metrics Blog for more in depth research and analysis. © 2022 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter. If you liked this post from Coin Metrics' State of the Network, why not share it? |

Older messages

Coin Metrics' State of the Network: Issue 145

Tuesday, March 8, 2022

Tuesday, March 8th, 2022

Coin Metrics' State of the Network: Issue 144

Tuesday, March 1, 2022

Tuesday, March 1st, 2022

Coin Metrics' State of the Network: Issue 143

Wednesday, February 23, 2022

Wednesday, February 23th, 2022

Coin Metrics' State of the Network: Issue 142

Tuesday, February 15, 2022

Tuesday, February 15th, 2022

Coin Metrics' State of the Network: Issue 141

Tuesday, February 8, 2022

Tuesday, February 8th, 2022

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏