Not Boring by Packy McCormick - TrueAccord: Unsexiness-as-a-Moat

Welcome to the 288 newly Not Boring people who have joined us since Monday! Join 108,356 smart, curious folks by subscribing here: Today’s Not Boring is brought to you by… Not Boring When I started writing Not Boring, my plan was to get big enough that I could throw up a paywall, convert some small % of free readers to paid, and hopefully make enough to make a living. Once it started growing, though, I didn’t want to shut it off. I wanted as many people to be able to read and engage with Not Boring as possible. Sponsors make that possible. We’re gearing up for Q2 and looking for companies and protocols to sponsor Not Boring across the newsletter, podcast, and new projects 👀. Just yesterday, we announced that FTX is sponsoring Not Boring Founders Season 2, which means we can turn it into a real podcast (subscribe at Spotify or Apple). I’d love to continue the tradition of Not Boring readers’ companies sponsoring Not Boring, so if you’re interested in reaching this audience, email partnerships@notboring.co or share some info in the form here… Hi friends 👋, Top of the mornin’ to ya and Happy St. Patrick’s Day! A little over a year ago, the Not Boring Syndicate backed TrueAccord. Instead of the typical long Not Boring post, I wanted to mix it up and try something new – I’m sharing the main sections from the memo I wrote for the Syndicate last year as-is, and then adding my thoughts on what’s changed since and where I didn’t think big enough. While I hope that fintech companies read this and want to work with TrueAccord, the main point of this piece is to highlight the importance of a few themes for investors and builders alike:

A common piece of venture capital advice is to back great founders in big markets, because great founders will uncover all of the best opportunities. TrueAccord’s founder, Ohad Samet, has proved that as he’s evolved TrueAccord over the past year. It’s a good reminder that while I can make my best guesses as to where companies and industries are headed, the best entrepreneurs will bend things in unexpected directions. Let’s get to it. TrueAccord: Unsexiness-as-a-MoatDebt collection. Have I scared you away yet? If so, that’s part of the beauty of TrueAccord. It uses unsexiness as a moat, and has quietly built one of the biggest fintech startups you’ve never heard of. When I first spoke to TrueAccord’s founder and CEO, Ohad Samet, last year, he told me, “I would really love to see more second and third time founders try to build something really hard.” He’s doing it himself. Before founding TrueAccord, Ohad worked in fraud protection at PayPal, was the founder of Signifyd, founder of Analyzd (Acquired by Klarna in 2011), and was the Chief Risk Officer at Klarna for three years. While running TrueAccord, he also served a one-year stint as a Board Member on the Consumer Advisory Board at the Consumer Financial Protection Bureau (CFPB). Now, he’s building something really hard. TrueAccord is “debt collection, reinvented,” the largest and fastest-growing technology player in consumer debt repayment. Ohad said the thing that attracted him to debt collection is that it hits the holy grail of major startup ideas: a big, unattended, fragmented, low NPS market, a solution for which would solve a core issue for people. Over the first seven years of its life, TrueAccord built skills in consumer-friendly digital debt collection. At its core is a personalized, self-serve debt repayment experience that uses machine learning to reach consumers at the right time via the right channels. Instead of constant cold-calling, TrueAccord might text or email at times its found are most successful. Because the company has always had ambitions to build a full suite of financial services for its target audience, it’s taken a much friendlier approach to collections, one meant to retain instead of repel. Consumers can and do work with TrueAccord directly to get control of their debt, but the secret sauce in TrueAccord’s approach to date has been Recover: a late-stage recovery (read: debt collection) product through which companies pay TrueAccord to collect debt from their customers. BNPL giants Klarna and Affirm, for example, outsource collections to TrueAccord and pay TrueAccord 22% of what it collects. More importantly, when considering the vision to provide more financial services to the target market, when companies buy Recover, TrueAccord gets paid to acquire customers. That means it has a negative CAC on consumers. It seems to be working. Each month, creditors send TrueAccord 500k - 1 million potential customers, for free, and then pay them a commission on repaid debt! The promise and success of Recover has attracted some of the world’s top investors including Khosla Ventures, Homebrew, Felicis, Arbor Ventures, and PayPal/Affirm founder Max Levchin. We backed the company last year, before there was Not Boring Capital, via the Not Boring Syndicate. When we invested in TrueAccord March of last year, I wrote up a short memo on what excited me about the opportunity. I’m going to include three sections exactly as-is from that memo:

But then I’m going to show you what I missed, too. I didn’t think big enough. It’s a good reminder – particularly in a period when everyone seems to have turned impossibly bearish – that markets change and evolve in unpredictable ways, and that building blocks can snap together in ways that create bigger-than-anticipated opportunities. In TrueAccord’s case, I didn’t predict how central lending and consumer debt would become to fintech – fueled by the dramatic ascent of Buy Now, Pay Later (BNPL), consumer fintech, and embedded finance. Some of the most successful tech companies have become, wittingly or unwittingly, creditors. The debt market actually shrank last year thanks to stimulus checks, and as it comes back, the lender composition will lean more tech-forward than it was before. In response, last September, TrueAccord launched its second product, Retain, a white-label SaaS product that fintechs can use to collect early-stage delinquencies before consumers default, when they’re much more likely to pay. Like Lithic, Onbo, and of course, AWS, TrueAccord turned many of the tools it built for its own first product, Recover, into infrastructure for other companies with Retain. Ohad calls it the “AWS of Consumer Debt and Delinquency.” Retain uses data on the 16 million consumers it’s worked with directly and through Recover, plus TrueAccord’s HeartBeat machine learning platform, to identify delinquent customers and reach them through the best touchpoint at the best time. Unlike Recover, through which clients outsource collections to TrueAccord, clients embed Retain right in their stack. Instead of collecting post-default, Retain helps keep consumers from defaulting on loans in a much friendlier, more tech-forward, and effective way than any traditional delinquency or collections solution could. It’s growing like crazy – crossing the 1 million consumer mark in less than 6 months – and is used by fintech platforms like SynapseFi and Sila. I also missed just how important the incentive alignment narrative would become in 2021 and 2022. TrueAccord’s business model is aligned with both creditors and consumers: Recover, for example, only makes money when consumers get out of debt. As one sign of that alignment, TrueAccord successfully lobbied for the passage of the CFPB’s Regulation F, which limits debt collectors’ ability to hound people on the phone, among other things. One of the past year’s biggest themes has been reinventing financial services. Fintech and web3 attracted as much attention and venture capital dollars as any category. The promise of many of these products is that they’ll be able to provide opportunities to people who are left behind by the traditional financial system. No one is more focused on making sure that everyone has a fair financial chance than TrueAccord. They’ve been working on this for eight years, despite and even because of the fact that debt collection is an unsexy category. So today, we’ll look back at last March’s memo before looking forward to what the world, and the financial system, look like when TrueAccord achieves its vision:

The 2021 MemoTrueAccord: The Nice Guy in the Massive Debt Collection MarketDepending on which source you use, 50-80 million Americans spend a significant amount of their income on late charges and interest rates, get harassed on a daily basis by collectors, and are locked out of basic financial services. These people, by and large, are neither miscreants nor victims. They’re totally normal people who happen to be in debt, and want a way out that doesn’t involve a massive hit to their credit or a lifetime of ballooning interest payments. I was one of them; when I dislocated my knee in college, the hospital sent the bill to the wrong place, we never paid, and I only found out when a collections agency started harassing me. I was happy to pay, but realized that even paying would represent a black mark on my credit score. It was a no-win situation, and I basically had to pay and then wait for years for it to roll off my score. Luckily, I was young and didn’t have a family, but similar situations mean that normal people can’t access the banking system, further exacerbating their financial situation. TrueAccord helps consumers pull their credit reports, negotiate with creditors and collectors in an informed way by using AI to show them what other people have successfully said and done, uses its heft to negotiate with collectors on consumers’ behalf, offers non-predatory 0% APR loans, and when the consumer is ready to pay, they can do it right through TrueAccord. TrueAccord is not like the collections agencies you’re probably thinking about: it has a 4.8 star rating on Google and an A+ from the Better Business Bureau. Consumers never* love a collections agency, but that A+ is a sign that they at least respect TrueAccord. And the approach works: 75-100% more people pay TrueAccord, at a lower monthly rate, than a traditional collections agency or dirty call center. *Not never. This is an actual review: "I have had other debts in collections with TrueAccord. The thing I love most about TrueAccord is that the (sic) don't threaten to have you arrested like so many other collection agencies do. TrueAccord is flexible and gives you time to pay. They really do work with you epescially (sic) if you are struggling financially." But Ohad is a Worldbuilder, and debt collections is the wedge into a much larger market: banking the underbanked. It all comes down to customer acquisition cost (CAC). Debt Collection as a WedgeFintech startups that have gone after the low-end of the market have traditionally followed the same playbook: spend a ton of money trying to acquire customers via Facebook and Google, and try to earn enough from them to make the payback work. It doesn’t. The CAC is too damn high. In Jack of Two Trades, Marc Rubinstein wrote about why Square’s Cash App viral marketing campaigns were such an advantage: “The strategy kept customer acquisition costs exceptionally low: last year, they were less than $5 per customer.” $5 is cool, but what if someone just gives you customers? TrueAccord’s main customers are companies that need to collect debts from customers -- Yelp, Upwork, and LendUp are some of its clients -- and collectively, they send TrueAccord 500k - 1 million people per month. Yup, instead of paying to acquire customers, companies just send them to TrueAccord. Of those, 5-30% choose to work with TrueAccord (it’s opt-in), and that number is growing as TrueAccord’s positive reputation builds. People in debt are rational and want a way out, and TrueAccord is the friendliest, easiest way to do that. Plus, the companies that send TrueAccord customers pay it 15-20% of the money collected. So really, the consumer debt repayment product that TrueAccord offers right now is a fast-growing, high-margin, negative-CAC channel for its bigger ambitions. Once TrueAccord owns the customer relationship and has helped those consumers out of debt, it can begin to layer on additional financial services: partnerships with neobanks, debit cards, banking services. These are excellent businesses once the customer is in the door, but many attempts die at the hands of high CACs. TrueAccord is playing the long game, and has been for the past seven years, because it knows it can do well by doing good. Fewer consumers in debt, more consumers with access to financial services, more profits for TrueAccord. It sounds like a perfect playbook. Why hasn’t anyone done it before? Unsexiness-as-a-MoatWe can all agree that debt collection isn’t sexy. We all want to avoid it entirely, and those of us who’ve had to engage know that it’s a terrible and hopeless experience. It’s equally difficult to build a business in the space: there are compliance issues, reputational issues, people treat their vendors like shit, it’s commoditized, and there’s fierce competition from boiler room call centers. It’s different than traditional SaaS: your clients don’t love you, there’s no customer obsession. The best you can do is make sure that a customer’s experience with you sucked less than the customer’s experience with another company. For most people, that’s a deterrent. For Ohad, that was an opportunity. He bet that people would be attracted to other, shinier opportunities in fintech and avoid getting their hands dirty in consumer debt collection. He was right, and that’s given him and the TrueAccord team a seven year head start. That head start means it’s worked with more than 16 million consumers, built up a massive database on what works with which types of vendors, and built something counterintuitive: a respected brand in debt collection. After years, people are talking online about their relatively positive experiences with TrueAccord, and that helps convince others to work with them when their collections are handed over. It also means that TrueAccord has been able to build a uniquely cohesive culture. “There’s something bonding,” Ohad quipped, “about a vision so compelling that smart people are willing to tell their friends and families they work in debt collection.” The culture that TrueAccord has built around that vision is one of the company’s strengths and something that keeps it on the right track. He said that if he tried to ask TrueAccord’s head designer to do something that started exploiting consumers now that they’re big enough to do so, “She would tell me to go to hell and then quit on the spot. As she should.” The company culture he described is like an antibody to bad behavior. “We don’t need a ‘no assholes’ rule here because an asshole would naturally feel so out of place.” TrueAccord is mission-driven, operating in an unsexy space, and taking a longer view than anyone in the room. It would be nearly impossible for a well-funded startup to come in and compete with TrueAccord because of the moat it’s built, and no large player wants the reputational risk of working in debt collection. It may be one of the few fintech companies impervious to Stripe’s ever-expanding scope; can you imagine Stripe Collect? What I MissedIn the past year, instead of turning its focus more directly on consumers, TrueAccord discovered an opportunity to reach even more customers by providing white-labeled early-stage collection services to fintech companies via Retain. The vision remains the same, but the sequencing is different. Retain offers the opportunity to help the most people avoid default today. That said, the same strategies apply to Retain:

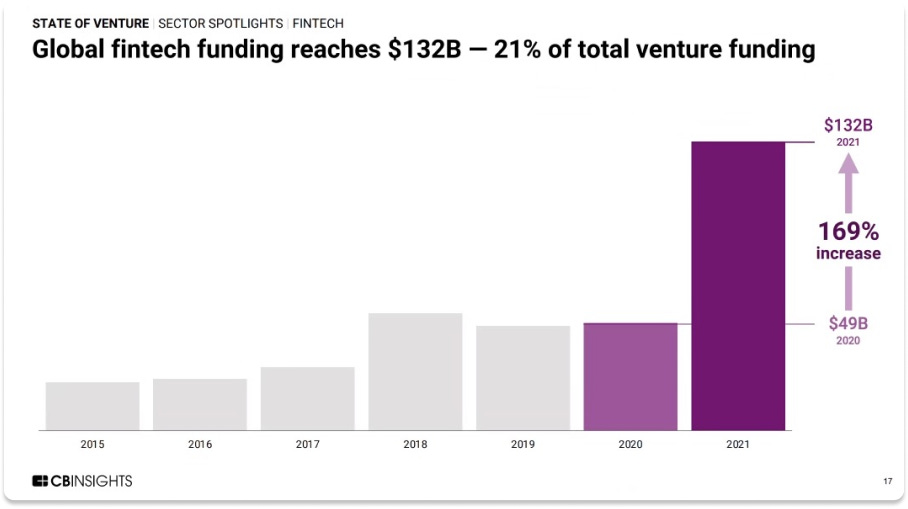

Those two strategies have afforded TrueAccord the rare opportunity to build core infrastructure in a fast-growing space uncontested. Embedded Finance, BNPL, and RetainIn a year of financial markets craziness, 2021 belonged to fintech. That meant more new companies offering more credit products to more consumers. In the private markets, according to CB Insights, fintech companies accounted for $131 billion of the total $621 billion in global venture capital funding. Within fintech, two of the biggest trends have been embedded finance and Buy Now Pay Later (BNPL). Embedded finance is a topic we’ve covered a few times in Not Boring, when we talked about Unit, Lithic, and in a recent Not Boring Founders convo with Stilt’s Rohit Mittal. Fintech Today’s Ian Kar defines it as, “When a non-financial services company creates financial services products for their users, embedding them into its existing products.” For purposes of today’s discussion, what it means is that more non-banks are extending credit to customers than ever before. BNPL – which essentially extends customers zero-interest loans at the point-of-sale in order to increase conversion – had an even bigger year than embedded finance:

Things have cooled off since from a valuation perspective. Affirm, whose biggest customer, Peloton, has struggled, is trading at around $8 billion. Index Ventures’ Mark Goldberg pointed out that, because it’s still private and not marked daily, Klarna is on paper worth more than a basket of big public fintechs combined:  But for our discussion, what’s important is volume, not valuations. A Juniper Research report estimated $226 billion in 2021 BNPL volume, and projected growth to $995 billion by 2026, or roughly 25% of all ecommerce spending. Once again, more non-banks are extending credit to customers than ever before. Both embedded finance and BNPL might want to offer credit to more people, but they don’t have the (old, shitty, harassing, etc…) infrastructure that banks have in place to make sure that they can prevent borrowers from defaulting and collect if they do. They’re faced with a few options:

More and more, embedded finance and BNPL companies are turning to TrueAccord and using one or both of its two products: To see what the world looks like when TrueAccord succeeds…Not Boring Talent CollectiveIf you ever read about a company in Not Boring and think, “I wish I could work there,” then you should apply to join the Not Boring Talent Collective. When companies in the Not Boring portfolio and community look to hire, they’ll find you there. Thanks for reading, and see you on Monday, Packy If you liked this post from Not Boring by Packy McCormick, why not share it? |

Older messages

Fount and the Body's Magical Future

Monday, March 14, 2022

The Mad Scientist Running the Elon Musk Company Formula on Health & Performance

Flow: The Normie Blockchain

Monday, March 7, 2022

Zigging When Others Zag and Progressively Decentralizing to Win the Future

Ukraine

Monday, February 28, 2022

Resources, Links, and a Little Optimism

Wrangling Venture Entropy with Standard Metrics

Thursday, February 24, 2022

Quaestor Rebrands to Standard Metrics and Raises a $23.7M Series A

Web of Relations

Monday, February 14, 2022

Carlo Rovelli, Quantum Theory, and the Nature of Reality

You Might Also Like

🔮 $320B investments by Meta, Amazon, & Google!

Friday, February 14, 2025

🧠 AI is exploding already!

✍🏼 Why founders are using Playbookz

Friday, February 14, 2025

Busy founders are using Playbookz build ultra profitable personal brands

Is AI going to help or hurt your SEO?

Friday, February 14, 2025

Everyone is talking about how AI is changing SEO, but what you should be asking is how you can change your SEO game with AI. Join me and my team on Tuesday, February 18, for a live webinar where we

Our marketing playbook revealed

Friday, February 14, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Cribbage Day, Reader... Don't get skunked! In today's

Connect one-on-one with programmatic marketing leaders

Friday, February 14, 2025

Enhanced networking at Digiday events

Outsmart Your SaaS Competitors with These SEO Strategies 🚀

Friday, February 14, 2025

SEO Tip #76

Temu and Shein's Dominance Is Over [Roundup]

Friday, February 14, 2025

Hey Reader, Is the removal of the de minimis threshold a win for e-commerce sellers? With Chinese marketplaces like Shein and Temu taking advantage of this threshold, does the removal mean consumers

"Agencies are dying."

Friday, February 14, 2025

What this means for your agency and how to navigate the shift ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Is GEO replacing SEO?

Friday, February 14, 2025

Generative Engine Optimization (GEO) is here, and Search Engine Optimization (SEO) is under threat. But what is GEO? What does it involve? And what is in store for businesses that rely on SEO to drive

🌁#87: Why DeepResearch Should Be Your New Hire

Friday, February 14, 2025

– this new agent from OpenAI is mind blowing and – I can't believe I say that – worth $200/month