Not Boring by Packy McCormick - Ramping Up

Ramping UpRamp announces an $8.1 billion valuation on the way to a trillion $ transaction opportunityWelcome to the 513 newly Not Boring people who have joined us since last Monday! Join 108,581 smart, curious folks by subscribing here: 🎧 To get this essay straight in your ears: listen on Spotify or Apple Podcasts Today’s Not Boring is brought to you by… the not boring talent collective The Not Boring family is full of smart, curious people and people looking to hire smart, curious people. It only makes sense to keep it in the family. Here’s how it works: if you’re looking for a job in web3, VC, or at a growing Not Boring Capital portfolio company like Ramp, you can apply to join the collective to get in front of dozens of hiring companies, for free. If you’re hiring, you can access over 175 profiles (and growing) of not boring readers looking for their next thing. We have engineers, designers, salespeople, operators, and more from the companies whose logos you see above. These are people willing to read ~8k words per week! (And if you’re a portfolio company, you get free access — message me!) Whether you’re looking to join the collective or looking to hire, you can apply here: Hi friends 👋, Happy Monday! Third time’s a charm. When Ramp CEO Eric Glyman called a couple months ago to let me know they were raising a round and ask if I’d want to write about it, my initial reaction was “Let me think about it.” I’d never written about a company other than Ramp twice, let alone three times. But then Eric and I got to talking about updates and growth and the new things they were working on and how the round came together and all of the little details that go into making the Ramp story so compelling. Less than a year after writing about Ramp the last time, there’s a much bigger story to tell. By the numbers, when I wrote about Ramp in December 2020, the company had just passed $100 million in transaction volume – money spent on its cards; today, it’s sharing that it already crossed a $100 million revenue run rate. It was worth ~$250-300 million then; it’s worth $8.1 billion now. Plus, there’s something fascinating about following one company through its journey from the early days into an octocorn (I’m sorry) that’s set to become one of those all-time special ones. And it wouldn’t be a Ramp story without insiders doubling and tripling down whenever they get the chance. Ramp is a portfolio company, but this is not a sponsored deep dive. It’s just a snapshot in time of one of the companies I appreciate the most, and a look ahead at what it might do in the future. Let’s get to it. Ramping Up(Click 👆 to read online) Larry Page and Sergey Brin founded Google in 1998. They weren’t the first people to create a search engine, or even the tenth. Yahoo! was born in 1994. But Google’s PageRank algorithm generated better search results than competitors, and in 2000, AdWords, their intent-based advertising system, gave their better product a much better business model. Google put itself in the right place at the right time to direct peoples’ attention and dollars across the internet, and charged businesses an auction-based fee for sending them people looking for what they were selling. A quarter century later, Google’s search advertising business is probably the greatest money-printing machine ever known to humankind. In a piece full of effusive praise from all corners, allow me to set the tone: Ramp has the potential to build an even better business than Google. Ramp isn’t the first corporate card, or even the tenth. But it’s the best corporate card company at building technology, and the best technology company with a corporate card. It’s also the first to try to help its customers spend less, an important distinction in the future I think it’s building. This is the third time I’ve written about Ramp, and I didn’t understand the parallels with Google until now. There’s a very good chance I’m being overly optimistic. But here’s the logic: Google built a monster business by owning the search layer. When people want to find something, they go to Google, and Google can send them to the right place. Advertisers pay it a fee each time someone clicks. At some point in the future, automation will overtake manual purchases. That transition will happen in business spend first – businesses are more likely to buy based on specs than individuals are. Ramp has the opportunity to own the transaction layer for businesses. When businesses spend money – a $100 trillion market – Ramp can monetize via interchange, as it does today, but it can also suggest better places to spend or even automatically redirect spend, and take an affiliate cut when appropriate. As more spend is automatically orchestrated with software, as opposed to starting with a search and ending in a manual purchase, whoever controls the transaction controls the flow of dollars. Ramp recently launched Ramp for Travel, a cool but seemingly minor new solution that lets companies manage Travel spend automatically, in a decentralized way. I think it’s huge. I think it’s the first example of transactions as mini-apps. Another of Ramp’s mini-apps is Buyer, which Ramp acquired in August. Buyer by Ramp has begun negotiating software contracts on its customers’ behalf. It’s not a big leap to make to imagine a world in which customers hand over software buying decisions to Ramp. The product’s landing page already says, “Eliminate the headache of buying software—let Ramp do it for you.” The launch of Bill Pay means that Ramp has visibility into spend that doesn’t touch the card, too. With this data, it should have the ability to tell who’s paying too much on a line-item basis, and one day, to redirect customer spend to better-priced vendors. I’m not good at making images, but I’m picturing a world in which cards send out transaction intent, and mini-apps for different categories help direct purchase decisions based on rules set by each company and intelligence gathered from all of them. This is a huge shift, and it’s easy to miss. The best analogy that I can come up with is that it’s like the transition from GUI to APIs, but for business spending. There are a lot of processes that were once manual – that humans did one at a time with pen and paper or through a computer interface – that computers now sort out with each other, via APIs. The same thing will inevitably happen to purchasing. It just takes the ability to get into the transaction (card or invoice) and the right software products. From there, the possibilities are endless. A lot of this spend presents an interchange opportunity, an affiliate opportunity, and even a financing opportunity, all aligned with the customer. But before we get to that future, Ramp’s doing pretty well today. Today, it’s announcing a $750 million round – $200 million in equity and $550 million in debt – that values the company at $8.1 billion, led by Founders Fund. All existing major investors are participating, along with new investors. I’m ecstatic that Not Boring Capital gets to double down. Ramp raised the round on world-class growth and a steep trajectory. The company is worth roughly 25x what it was when then-Mainstreeter Nick Abouzeid introduced me to Ramp co-founder and CEO Eric Glyman in September 2020, 18 months ago. I wrote about Ramp that December to announce a now-quaint $30 million round. The business has grown a lot since then:

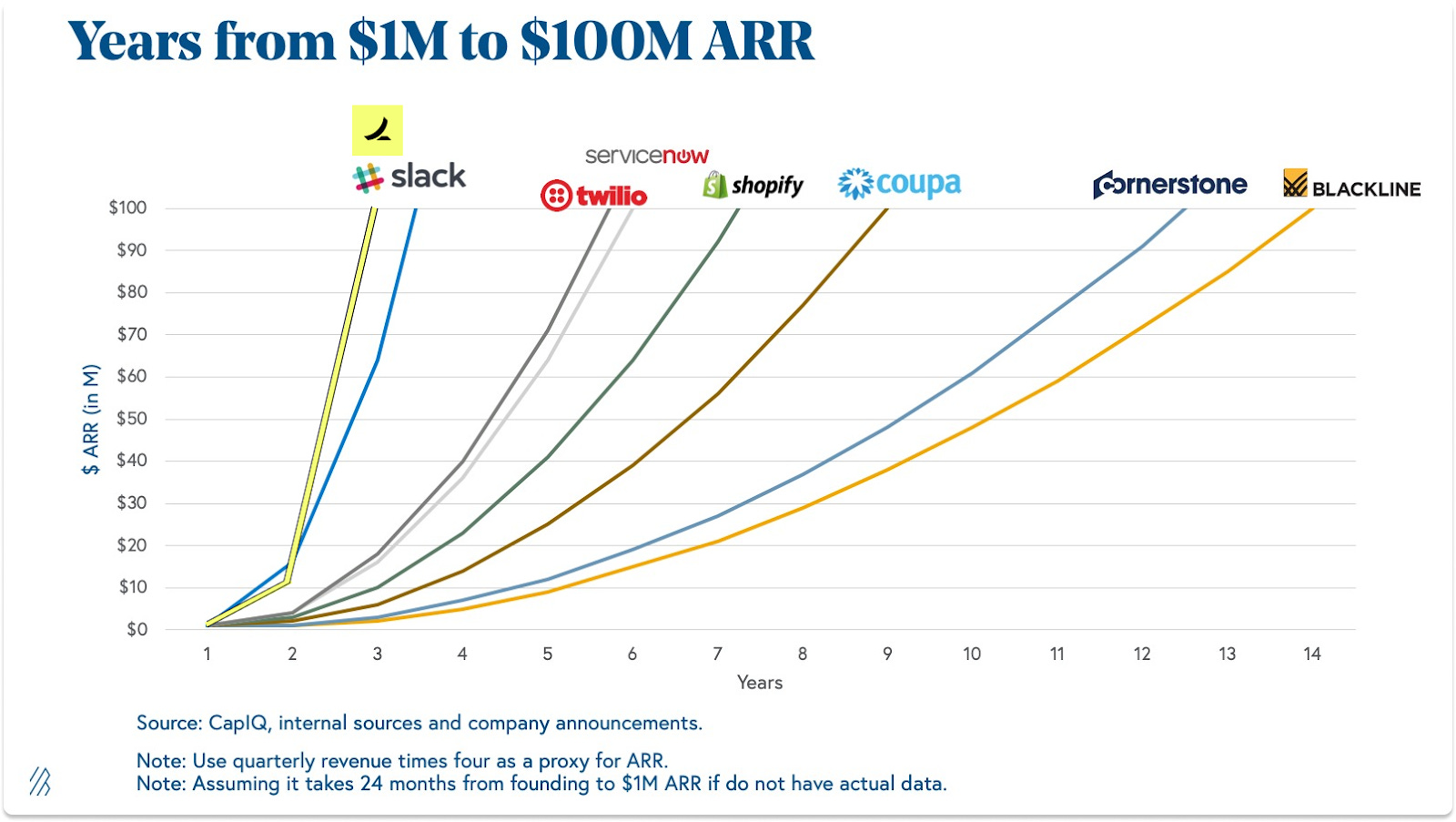

Ramp is the fastest-growing SaaS or fintech company of all time by revenue. It grew to a $100 million revenue run rate in two years from launch. Much of Ramp’s growth to date has been the result of the success of its first product: a corporate card designed to help companies save time and money. It’s done both. Since launching in February 2020, it’s saved customers $135 million and 3.5 million hours of labor (roughly 5.2 human lifetimes’ worth of just doing expenses). It’s done all of that despite only increasing headcount from 60 to 275 between September 2020 and today. So in the first part of the essay, we’ll go behind-the-scenes on Ramp’s recent round and we’ll put Ramp’s exceptional growth, mainly driven by the corporate card, in context. But Ramp’s real magic is its product velocity, or how fast it ships software. That’s what’s going to take it from “fastest-growing corporate card company” to “software-powered transaction-layer orchestrator.” Keith Rabois, the Founders Fund partner who’s led or invested in every Ramp round over the past three years, told me, “Ramp’s product velocity is absolutely unprecedented in my 21 years working with technology businesses.” To build great software fast, Ramp has created one of the densest talent vortexes in tech. It ships big new products every month. Its team is, frankly, overqualified to run a corporate card company. That’s because it wasn’t built to run a corporate card company. In the second half of the essay, we’ll dig into Ramp’s second act, the shift from corporate card and spend management software to comprehensive financial orchestration platform. By starting with the corporate card, Ramp has been able to build an incredibly fast-growing business, raise over $1 billion in financing in three years, and most importantly, wedge its way into the CFO suite. From inside the CFO Suite, it’s been able to launch products to compete with entire multi-billion dollar incumbents like Bill.com, Expensify, and Concur and give them away for free. It’s done so with teams of only 3-5 engineers on each product while maintaining NPS scores as high as or higher than Apple. That’s just the beginning. Ramp is shipping new products monthly and stitching them together in clever ways. It’s combining the product velocity of a SaaS company with the transaction visibility of a fintech. That’s a sneakily powerful combination. The thing I love about Ramp is that each time I revisit the company, I discover an entirely new, enormous opportunity in front of it. This time, the new thing that’s emerged is that by building the best technology company with a corporate card, Ramp might be able to own the business transaction layer and use the transactions themselves as mini-apps. The other thing I love is that Eric and Karim are always willing to share the how – How have they grown this fast? How did they design the team? How will they keep the growth up? – so we’ll cover all of that, too. This one is jam packed with secrets:

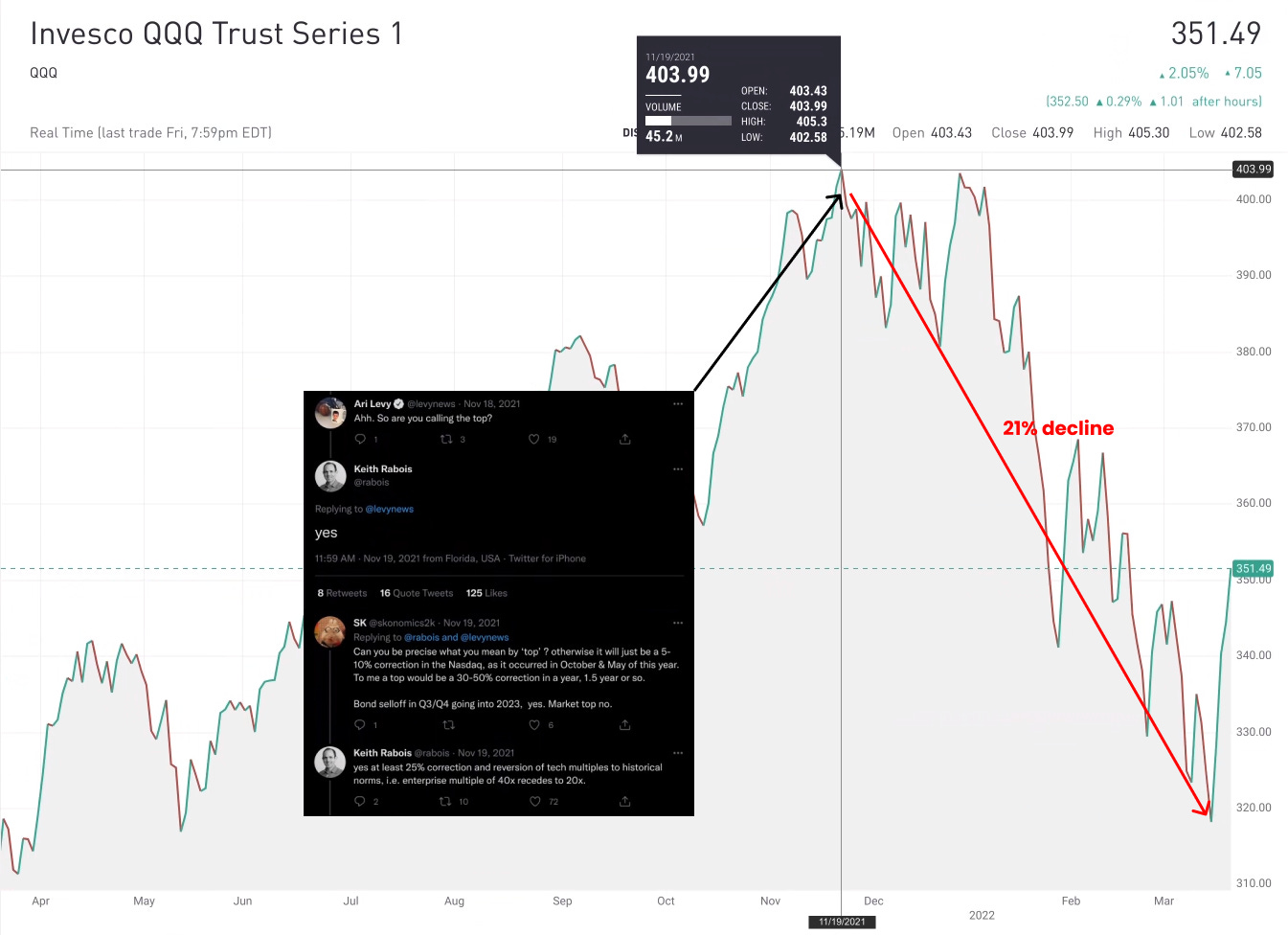

As I’ve gotten to know the team and the company better over the past eighteen months, I’ve become convinced that this is going to be a generational company. There’s a clear path to a $100 billion valuation for itself, but more importantly, Ramp’s in an incredibly high-leverage spot: as it helps companies save time and money, they can reinvest in product and growth. The companies that take us to space, deliver personalized healthcare, fix the climate, and more will be made stronger by working with Ramp. That’s high praise, even for me. But I’m not alone. Let’s turn it over to Keith Rabois. Ramp’s RoundOn November 19th, Keith Rabois called the top. In a back-and-forth on Twitter that day, someone asked if he was calling the top, to which he replied, “yes.” Another person asked if he could be more precise. He could: “yes at least 25% correction and reversion of tech multiples to historical norms, i.e. enterprise multiple of 40x recedes to 20x.” That day, November 19th, marked the all-time high for the Nasdaq Composite, the most commonly-used proxy for public tech stocks. It fell 21% between then and March 14th, the recent low. It may or may not be done falling. He timed it perfectly. So what Keith did next might surprise you. In December, he offered Ramp a term sheet for a $200 million round at an $8.1 billion post-money valuation. The price was roughly double what Founders Fund paid when it led Ramp’s previous round in August at a $3.9 billion valuation. And the multiple wasn’t cheap, either: between 80-100x Ramp’s revenue run rate. Ramp accepted. All in, Ramp raised $750 million in fresh financing – $200 million in equity and $550 million in debt. Founders Fund led the round with participation from all major investors including D1, Thrive, Redpoint, Coatue, Iconiq, Altimeter, Lux, Vista, Spark, and Definition (and minor ones like Not Boring Capital). New investors like General Catalyst (where former AmEx Chairman & CEO Ken Chenault is a partner), Avenir, 137, and Declaration joined in. But wait… an $8.1 billion valuation? In this market?! In semiconductors, Moore’s Law – Gordon Moore’s 1965 observation that the number of transistors in a dense integrated circuit doubles roughly every two years – has proven steady for half a century. In venture capital, Ramp is developing a law of its own – Glyman’s Law? Atiyeh’s Law? Ramp’s Law? – Ramp’s valuation roughly doubles roughly every six months. One of the notable things about Ramp’s fundraising has been how consistently rounds have been preempted by insiders. To this day, Ramp still hasn’t made a single fundraising deck. Instead, based on board decks or investor update emails, an existing investor typically offers Ramp a term sheet at roughly double the previous valuation. Because Ramp hasn’t burned a lot of money, it never needs to raise, so it seemingly only does so when both sides agree that it’s worth about double what it was in the last round. So how’d Keith square a double with the worsening market conditions? “It was the easiest decision ever. The traditional Founders Fund strategy is to double, triple, and quadruple down into our best companies,” he explained. “Ramp is the quintessential example of the kind of company we want to quadruple down in.” Plus, he told me, venture capital thinks on longer time horizons – 8-12 years for a venture fund, 3-5 years for a growth fund – and he views Ramp as a great opportunity to invest over the long term. On that time horizon, what matters most are velocity and trajectory:

Paying 80-100x revenues in this market after calling the top seems crazy. And ceteris paribus it would be. But companies aren’t snapshots in time; they have motion. Logan Bartlett, who’s invested in each of the past three rounds at Redpoint, explained:

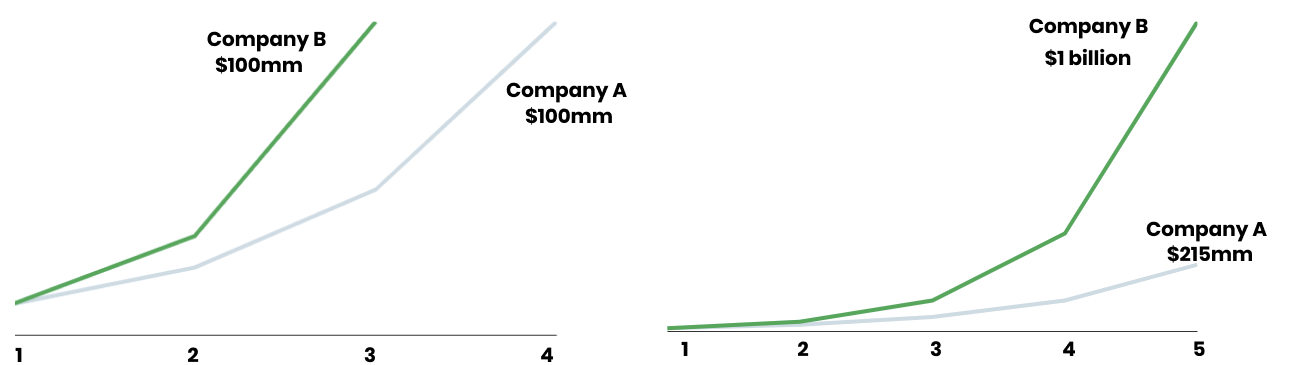

Let’s grok it. Ramp’s Unprecedented Growth and How to Value ItIn the last Ramp piece I wrote, I included a section titled “Has Venture Capital Lost Its Mind?” The pace of funding was so fast, the numbers were so high, and the double-rounds were so uncommon that it was worth asking. Unsurprisingly, I didn’t believe that Ramp’s rounds were a sign of VC madness. Something else was at play: growth. For many reasons – better primitives, examples, funding, talent – companies are growing faster now than they were a decade ago. At the time, Logan guessed that just a decade ago, it would have taken seven or eight years for even a great company to build what Ramp did in two. That has implications on valuation. To highlight how important growth is, I made up an example involving two companies – Company A and Company B – which each start with $10 million in Annual Recurring Revenue (ARR) after a year and grow to $100 million in ARR. Company A takes four years to get there and Company B takes three years. That seems like a minor difference – they both got to $100 million in ARR so fast! – but it’s actually huge. Company A is growing at an impressive 115% per year. Company B is growing at 216%! As time goes on, the difference gets dramatic: by each company’s fifth year, Company A is doing $215 million in revenue; Company B is doing $1 billion! I thought that was pretty stark. Those were some unbelievable numbers. 216% growth!? $100 million ARR in three years?! Whoops… I dramatically undershot what Ramp would do. Ramp launched its product in February 2020. By February 2021, its run rate was around $12 million. And before the company celebrated its 3 year birthday from incorporation, it crossed a $100 million revenue run rate. That is absurd. In 2019, Bessemer plotted how long it took the fastest-growing SaaS companies ever to reach $100 million in ARR. Ramp just broke Slack’s record by hitting a $100 million revenue run rate in two years from the product’s launch (it’s not technically recurring but it’s close enough). As a once-suffering Slack bull, I understand that early growth doesn’t necessarily translate to hundreds of billions of dollars in market cap, but Ramp has some things going for it. First, to go back to our earlier hypothetical, that’s a 734% annual growth rate. That means that by year five, at the same rate, Ramp would be doing $6.9 billion in revenue. To learn how Ramp grows, whether it can keep it up, how it designs its teams for speed, how it can use transactions as mini-apps, and more…Ramp Fireside with Eric and Karim The written story is one thing, hearing from Eric and Karim directly is another. Next Monday, March 28th, I’ll be hosting a fireside with Eric and Karim live from Ramp’s office in NYC. I’ll ask them about their vision for the future of finance, how they’re building to deliver on it, and why it’s shifted focus from features to outcomes. You can ask your own questions, too. To join us virtually, you can sign up for free here. Thanks for reading, and see you on Thursday, Packy If you liked this post from Not Boring by Packy McCormick, why not share it? |

Older messages

TrueAccord: Unsexiness-as-a-Moat

Thursday, March 17, 2022

Bringing Debt Collection Into the New World

Fount and the Body's Magical Future

Monday, March 14, 2022

The Mad Scientist Running the Elon Musk Company Formula on Health & Performance

Flow: The Normie Blockchain

Monday, March 7, 2022

Zigging When Others Zag and Progressively Decentralizing to Win the Future

Ukraine

Monday, February 28, 2022

Resources, Links, and a Little Optimism

Wrangling Venture Entropy with Standard Metrics

Thursday, February 24, 2022

Quaestor Rebrands to Standard Metrics and Raises a $23.7M Series A

You Might Also Like

🔮 $320B investments by Meta, Amazon, & Google!

Friday, February 14, 2025

🧠 AI is exploding already!

✍🏼 Why founders are using Playbookz

Friday, February 14, 2025

Busy founders are using Playbookz build ultra profitable personal brands

Is AI going to help or hurt your SEO?

Friday, February 14, 2025

Everyone is talking about how AI is changing SEO, but what you should be asking is how you can change your SEO game with AI. Join me and my team on Tuesday, February 18, for a live webinar where we

Our marketing playbook revealed

Friday, February 14, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Cribbage Day, Reader... Don't get skunked! In today's

Connect one-on-one with programmatic marketing leaders

Friday, February 14, 2025

Enhanced networking at Digiday events

Outsmart Your SaaS Competitors with These SEO Strategies 🚀

Friday, February 14, 2025

SEO Tip #76

Temu and Shein's Dominance Is Over [Roundup]

Friday, February 14, 2025

Hey Reader, Is the removal of the de minimis threshold a win for e-commerce sellers? With Chinese marketplaces like Shein and Temu taking advantage of this threshold, does the removal mean consumers

"Agencies are dying."

Friday, February 14, 2025

What this means for your agency and how to navigate the shift ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Is GEO replacing SEO?

Friday, February 14, 2025

Generative Engine Optimization (GEO) is here, and Search Engine Optimization (SEO) is under threat. But what is GEO? What does it involve? And what is in store for businesses that rely on SEO to drive

🌁#87: Why DeepResearch Should Be Your New Hire

Friday, February 14, 2025

– this new agent from OpenAI is mind blowing and – I can't believe I say that – worth $200/month