Surf Report - Surf Report: The great fugazi

You’re getting this email because you signed up for Surf Report, my weekly take on economics, investing, Bitcoin, and business. I really appreciate you being here, but if you’d like to leave, simply scroll to the bottom to unsubscribe.

Hi everyone—I’m so glad to have you here. What a week. This past week was a heavy dose of reality for people who were under the mistaken assumption that their wealth was on firm footing and things were Fine™. The spell is beginning to break. If you’re a stock person you’ll point to crypto and marvel at the fall. If you’re a real estate person you’ll point and laugh at tech stocks. Everyone is a genius and The Other Guy is a dumb-dumb stupidhead. The reality is that right now stocks, startup equity, real estate, crypto, and Bitcoin are all bound up together to form one colossal mutant stitched together with sutures known as leverage. Loans + debt. Marty Bent did a very great rundown of this tangly situation but I will summarize here for you fine readers:

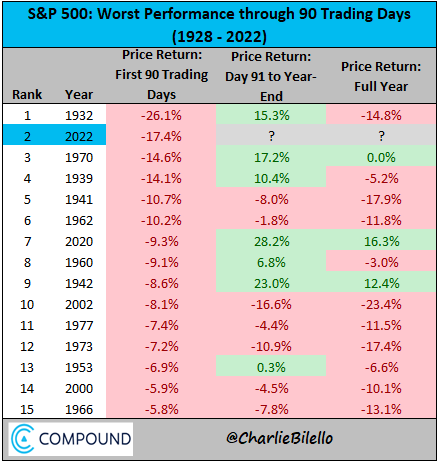

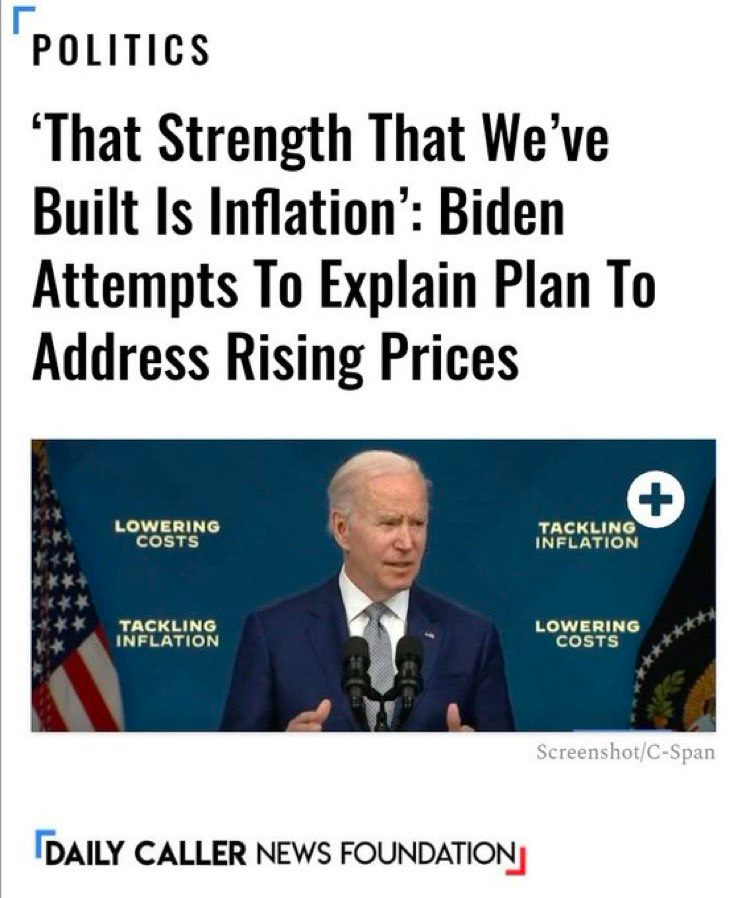

In the end, people come to the harsh realization that all of it was a mirage. They never really had all of that wealth. Tech giants like Apple, Microsoft, Alphabet, and Amazon lost more than $1 trillion in value in just a few trading days. The net worth of Brian Armstrong, CEO of crypto exchange Coinbase, has dropped 84%. These are the consequences of thinking you can shut down the global economy with impunity. No one in power ran a cost benefit analysis. They just panicked. Either that or they knew this would all happen and it’s in service of a larger goal that you and I are not privy to, but I will leave that to the conspiracy theorists (of which there are many). People sell what they can to cover their losses, and this is why investing within your means and with a long time horizon is important. Sadly, most people are not investors they are traders, trading this thing for that on a short timeframe, flipping their way to quick profits and borrowing money to pour fuel on the fire at no point noticing that they are playing with fire. People are living beyond their means, taking out loans to buy things they can’t otherwise afford. That’s why easy money is so pernicious. How bad is it? Well, so far it’s been the 2nd worst start to a year for the S&P 500 in history: -17.4% in the first 90 trading days. (It has also been the worst year in history so far for the US bond market). Have a look at this chart for some context: 2022 is in the company of 1932 (Great Depression), 1970 (Vietnam War), 1939 (Start of WWII), and 1941 (Pearl Harbor/US enters WWII). And amidst all the carnage our leaders are gaslighting us, trying to insist everything is actually great, the economy is strong, and everything they’re doing is a good idea.

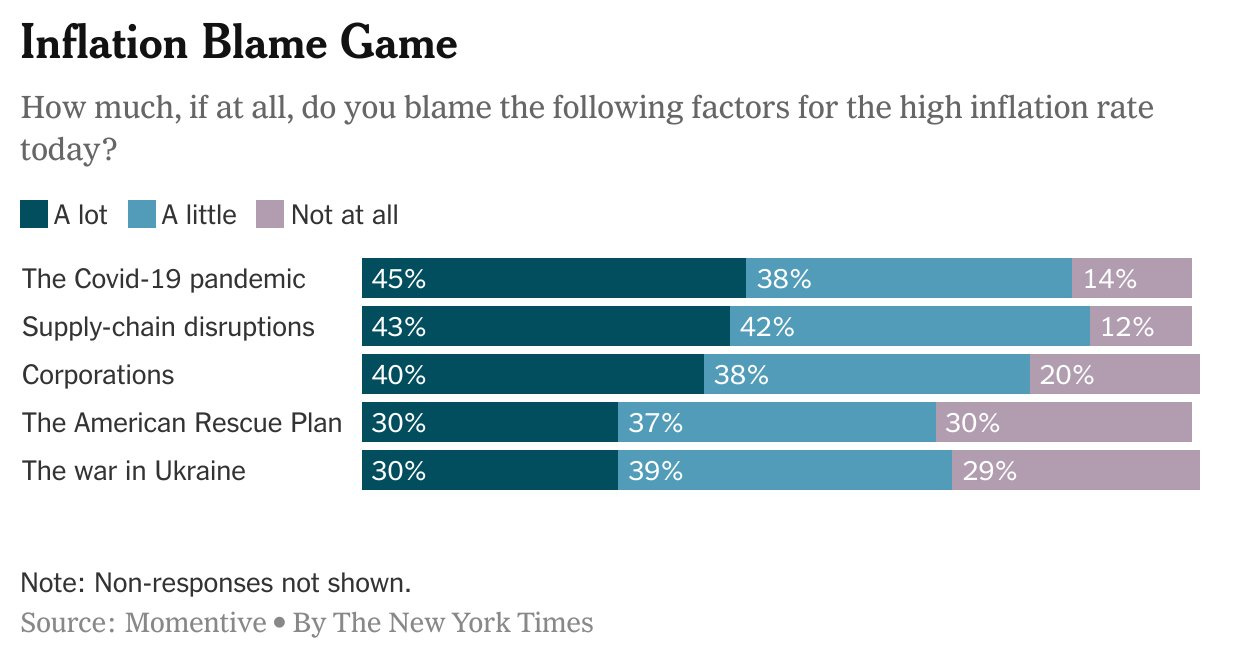

The governor of California proposed an $18,100,000,000 “Inflation Relief Package” that will involve sending people “inflation relief checks.” And when newspapers ask ordinary people what they think the cause of inflation is, “monetary policy” isn’t even offered as an option. This is the misdirection and hocus pocus in action ✨: 3 major oil lease sales were cancelled by the Biden administration amidst a global fuel crisis and rising gas costs and they’re still trying to pin rising oil and natural gas prices on Putin and war. At no point has any branch of the government nor their financier, the Federal Reserve, taken responsibility or accepted blame for any negative consequences that resulted from their policy decisions. (Don’t forget we’ve had two presidents in that time—one red and one blue.) They want to control inflation but also print more money to send $40B to Ukraine which makes no sense, until you understand that war has been and continues to be the justification needed to print money in the first place. It’s no coincidence that the U.S. left behind more than $7 billion worth of weapons and equipment in Afghanistan last year instead of treating them as valuable and worth using elsewhere. These weapons are disposable just like the money printed to buy them. The way they do this is by fudging the numbers. This week’s CPI report included a methodology change to new vehicle prices, switching to an alternative series based on JD Power data. Surprised to learn that the old calculation would have shown higher inflation? I hope not. The whole thing is another fugazi—a shoddily constructed illusion. It’s all fake. An economy is a complex, dynamic system like the weather or an ecosystem or a living creature and trying to control it like you’re changing the radio station is an absurd premise. It’s made excessively absurd when you’re literally just changing all the variables yourself along the way in order to say the thing you want to say.   Bitcoin, too, has been swirling along in the tumult, and it’s weathered the storm well. Below is what bitcoin has been doing for some perspective. That last little red bar is when a bunch of other garbage coins and leverage schemes got completely wiped out this week: Since Microstrategy announced its first bitcoin purchase on August 11, 2020, bitcoin has appreciated 149%, outperforming Silver (-17%), Gold (-9%) Nasdaq (5%), S&P (18%), CPI (11.2%), M2 (19%), US homes (28%), & PPI (33%). What you’ll read in corporate media clickbait industry headlines is that “cryptocurrencies such as Bitcoin are melting down” (“Here’s 4 Things To Know™”) But I suppose folks in the ad sales industry needs to eat too. If it bleeds, it leads, and anything more than a day old is worthless. I wonder what this type of thinking does to an industry and a society over time? 🤔 No matter, this has been the way it goes for as long as there have been newspapers and expenses that need paying for. Best not to blame capriciously and focus instead on seeing clearly. Do not mistake the fata morgana on the horizon as an oasis of stability and financial solidity. It is actually a shimmery lie—a fugazi—projected to convince you that you can’t trust your senses and should instead trust people in government instead. Don’t fall for it, or you’ll fall with it. Until next time 🤙, Recommended Resources For Plan ₿Swan. I became an official Swan partner because I love them so much. So if you're like me and just want an easy, automated way to buy bitcoin on the regular with the lowest fees in the game, head to https://swanbitcoin.com/Mulvey to get $10 in bitcoin for free ✨ Fold Card. Earn bitcoin on everything. You can win up to 100% back on every purchase, and every swipe is a chance to win a whole bitcoin. I use my own Fold card to pay for almost literally everything. If you use this referral link you get 5,000 sats free ✨ Your latest changes have been saved. Version history Settings Thanks for subscribing to Surf Report. If you liked this post, consider sharing it with someone else who might appreciate it! |

Older messages

Surf Report: Priority ingestments

Sunday, May 8, 2022

Listen now | Issue 75: 05.08.2022

Surf Report: Cultural Rot

Sunday, May 1, 2022

Listen now | Issue 74: 05.01.2022

Surf Report: Fury road

Sunday, April 24, 2022

Listen now | Issue 73: 04.24.2022

Surf Report: Dogs and tails

Sunday, April 17, 2022

Listen now (12 min) | Issue 72: 04.17.2022

Surf Report: Wakey wakey

Sunday, April 10, 2022

Listen now | Issue 71: 04.10.2022

You Might Also Like

🌎 Make international sourcing and shipping easier

Tuesday, March 4, 2025

How to prep your business for changing trade regulations. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 How was the masterclass with Arvid Kahl?

Tuesday, March 4, 2025

Your feedback matters + Access the recording ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Letter from the Editor: Why this year's Digiday Publishing Summit matters

Tuesday, March 4, 2025

It's a new era for the media industry. Eras, actually: There's the AI era, the streaming era, the podcast era, the post-cookie era. In other words, media companies are being forced to evolve,

11 social media skills to master (and how AI can help)

Tuesday, March 4, 2025

Perfect these skills now to stay ahead in 2025 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 The masterclass with Arvid Kahl starts in 15 minutes

Tuesday, March 4, 2025

Build In Public Without Giving Away Your Business Secrets ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Age of Economic Chaos

Tuesday, March 4, 2025

Listen now (7 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The next level of content marketing

Tuesday, March 4, 2025

Content marketing isn't just about creating blog posts. If you're still stuck in that mindset, you're leaving money on the table. The best marketers go beyond traditional content and

📱 Google Gemini’s iPhone Hack

Tuesday, March 4, 2025

AI More human-like than ever. Ready to upgrade? ⚡

ET: March 4th 2025

Tuesday, March 4, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 BlueChew (trends) Chart BlueChew is a

🦅 Masterclass with Arvid Kahl: watch the live stream

Tuesday, March 4, 2025

At 10:00 AM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏