Surf Report - Surf Report: Perturbed incentives

You’re getting this email because you signed up for Surf Report, my weekly take on economics, investing, Bitcoin, and business. I really appreciate you being here, but if you’d like to leave, simply scroll to the bottom to unsubscribe. Hi everyone—I’m so glad to have you here. What a week. Here, watch the head of the European Central Bank (who was convicted of criminal negligence in 2016) confirm what we all suspected: her master plan is to continue being criminally negligent.

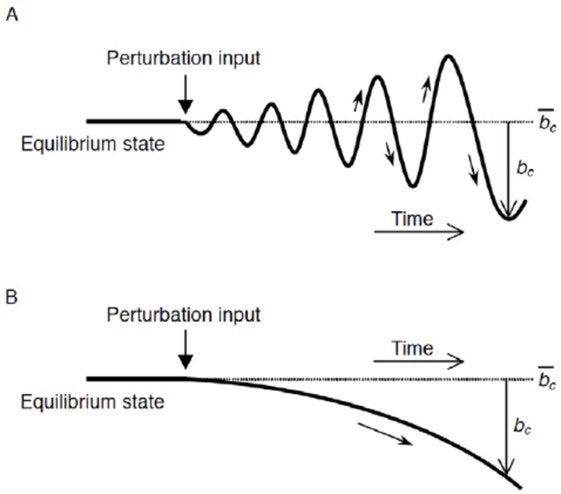

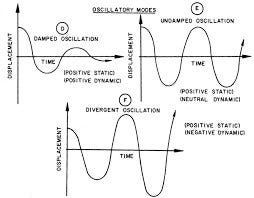

She insists she’s not in panic mode, which is the type of thing someone says when they are in panic mode. Central bankers around the world seem to be at an utter loss, don't they? Their narratives keep shifting like sand under our feet as one by one everything they said wouldn’t be a concern becomes a concern. The sad part is, while you may not like it they are behaving rationally. Their primary concern is to wiggle out of this mess, and since Christine Lagarde and Jerome Powell and other heads of governments, corporations, and banks are elderly, they know they just have to hang on to plausible deniability for just a bit longer to emerge unscathed and pass the responsibility on to the incumbents. Not just their personal successors, but the successive generations. Indeed, the shockwave of socialized consequences is beginning to ripple outwards already. This week we finally saw evidence of what anyone with eyeballs and sense already knew: the housing market has been completely bananas. Exhibit A: new home sales came in way, way below Analyst Expectations™️: just 591k reported (compare that to the 749k that were expected, and March’s 763k). This was considered quite the wake up call, and the first sign for many (surely not you, dear reader) that we may in fact already be in a recession. But that’s not all. This week we also learned that the bottom quintile of households have less excess cash than they did in 2019, the year before the pandemic-induced government & central bank intervention. And this doesn’t even account for the inflation they created. And unfortunately we, unlike those in high places, are increasingly unable to borrow money to ease the pain. As a matter of fact, the entire credit (i.e. debt) cycle is turning and banks are in trouble. Why? Because banks are in the industry most sensitive to interest rates, and a rise in interest rates means tighter lending conditions and more delinquencies. This means losses are going to start having to be realized, leading to bankruptcies, insolvencies, and other euphemisms for “game over.” Inflation is certainly not helping commercial banks the way it helps central banks either. High, persistent inflation usually leads to the real value of bank assets bottoming faster than their liabilities. In normal people speak this is another way of saying that the value of all the Treasury securities and bonds and cash that banks own is going down faster than the amount of money they owe in interest payments—i.e. they’re becoming unable to service all of their debts. (Remember, as the price of a bond goes down its interest rate—i.e. its yield—goes up) So they're getting to be a bit stuck. We’re in the midst of realizing the consequences of irresponsible policies, one of which was irresponsible monetary policy. But we’ve spent years seeing plenty of other examples of deeply troubling foreign policy, domestic policy, labor policy, trade policy, medical policy, and energy policy decisions too. Now the chickens are coming home to roost, and the stench is fowl. Central banking, by sheer virtue of how it operates, inevitably creates an incentive structure where prolonging poor monetary policy is actually beneficial to those doing the prolonging and harmful to nearly everyone else. Much in the same way it behooves the pharmaceutical industry to, on net, be in the business of treating illnesses (all kinds of illnesses) for which they sell the treatment. Ditto wars, food, and literally every other domain associated with a lucrative business vertical. The subscription model is popular for a reason. Malice wishes it could do the kind of harm that simple, boring ol' Poor Incentives can. One thing you might have noticed is that in recent years market fluctuations, like weather patterns, seem to be getting more dramatic. Swings are getting swingier. The turbulence is getting to be a little too aggressive. Passengers are gripping their armrests a bit more tightly than usual. This is what happens when disturbances are allowed to accumulate rather than dissipate: cycles and waves start behaving less linearly and more exponentially. Don’t take my word for it, take physics’: it’s known as phugoid cycle instability, a dynamic “failure mode” state set into motion by an innocent, but consequential, perturbation at the start:    Lyn Alden @LynAldenContact @BitcoinTina @matthew_pines @Will_DeCotiis @SehrLangsam2 @Stimpyz1 @Seanismacro @William97121153 @TSPsmart @chairman747 @traderttt9 @rubecube12 @DiMartinoBooth @JJ04519737 @CEOvonGold @SamanthaLaDuc @MarketInterest @Alex__Salomon @tr8derz @kevinmuir Fed doesn't act protectively. Tighten until something breaks, then loosen. A dumb system, deteriorating over time, but that's how they do it. https://t.co/3DroJn7vyHThis helps to explain why we're all in similar boats in very important ways, regardless of our preferred flavors of investment vehicles be it dividend, blue chip, residential, commodity, or crypto. Just look at some of these tech darlings recently, many of which are creating an outsized drag on the entire S&P 500 index:

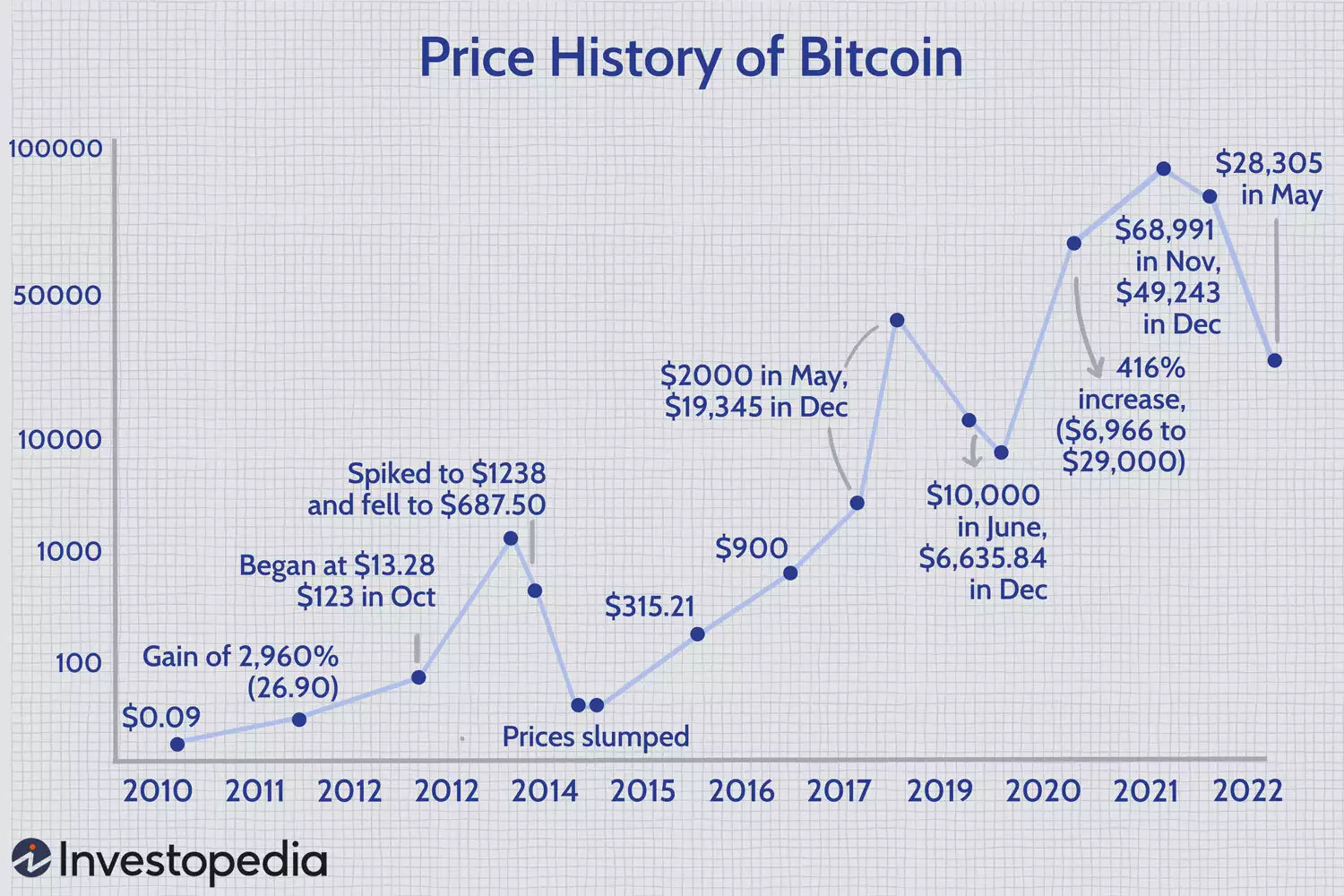

For all the talk of bitcoin being volatile—something that actually makes sense for a novel, nascent asset in the process of monetizing—it has never fallen 43% in a single day. (Though it did come close in March 2020 along with every other asset in existence as the world scrambled for cash in a swirl of panic, dropping briefly on some exchanges to ~$3000-$4000) NYDIG recently broke the news to its newsletter subscribers that not all digital assets will survive a cycle downturn. We are not all, in fact, gonna make it.

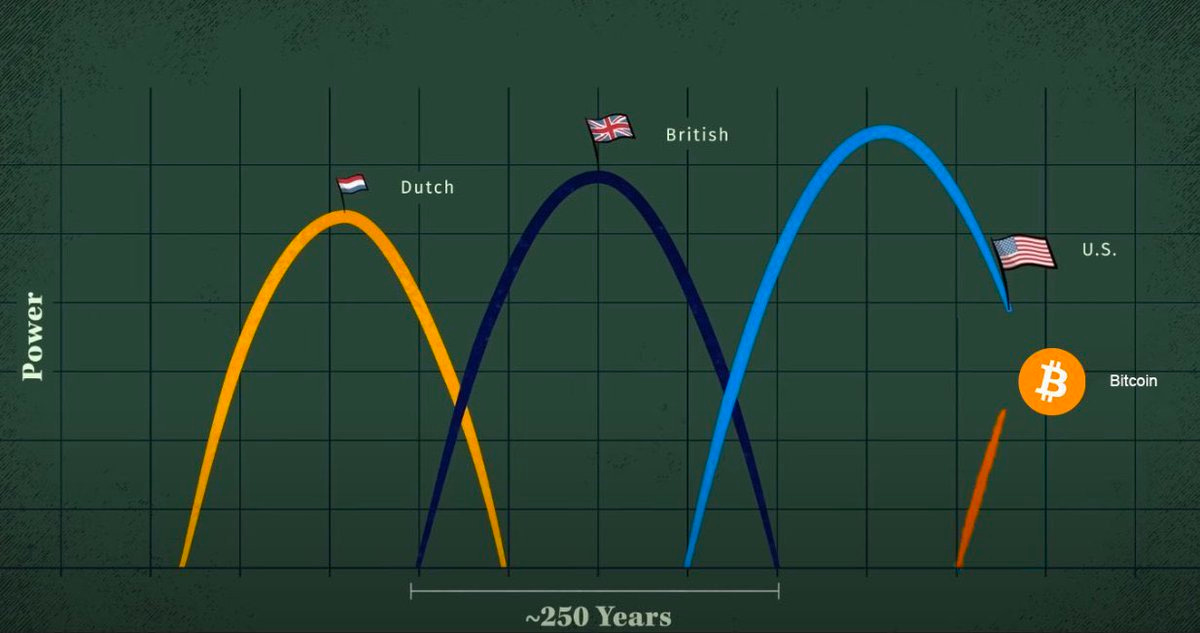

The perturbations are deepening, and cycles are sloshing around in a volatile, storm-stricken ocean of overleveraged trades, malinvestments, and index-correlated global market corrections due to corrupted price signals and the resulting supply-demand distortions. Numbers trail reality, reactions are delayed, and intervention is inevitably misplaced and mis-timed. So troughs get deeper, peaks get peakier, and everyone’s now getting sick and just wants off the ride altogether, selling whatever they have until the storm subsides. Or so they hope. But zoom out. Perhaps we are living through a larger, secular cycle of the falling of one standard and the rise of another? Time will tell, but it would explain a lot and be consistent with the lessons of that great teacher we all love to forget or ignore: history. One of my favorite aspects of the bitcoin protocol is its inherent incentive structure, which is a big part of why so many sophisticated investors have decided to allocate a non-zero amount to it. It's a system that actually improves when attacked (a trait famously dubbed ‘antifragility' by Nassim Taleb, of Black Swan fame), incentivizing miners to seek profit by making it more secure, and individuals to seek profit by not spending it on frivolous garbage thus making it more scarce—and desirable—to acquire. When the bitcoin hash rate falls then it becomes easier to mine, thus making it more attractive to mine, which increases its hash rate, which makes it harder (more expensive) to mine, and so on. No one knows what the future holds, but we all know how self-interested humans tend to behave when money is involved. That may not be a certainty either, but in probabilistic terms it's pretty close. Those in positions of power overseeing our current fiat monetary system are incentivized to perturb—to tap the water's surface and keep its floaty sailors in states of uncertainty and instability, to confuse and obscure from them the source of the real storm. That not all of our overlords are perturbing things is beside the point. The system incentivizes such a strategy. Those more likely to do well in it are most likely to fall prey to the temptation to use the optimal strategy. This doesn’t make them evil, it makes them rational. Which, whenever I think about it, always gets me feeling a bit perturbed. Until next time 🤙, Recommended Resources For Plan ₿Swan. I became an official Swan partner because I love them so much. So if you're like me and just want an easy, automated way to buy bitcoin on the regular with the lowest fees in the game, head to https://swanbitcoin.com/Mulvey to get $10 in bitcoin for free ✨ Fold Card. Earn bitcoin on everything. You can win up to 100% back on every purchase, and every swipe is a chance to win a whole bitcoin. I use my own Fold card to pay for almost literally everything. If you use this referral link you get 5,000 sats free ✨ Thanks for subscribing to Surf Report. If you liked this post, consider sharing it with someone else who might appreciate it! |

Older messages

Surf Report: Yelling shark

Sunday, May 22, 2022

Listen now | Issue 77: 05.22.2022

Surf Report: The great fugazi

Sunday, May 15, 2022

Listen now | Issue 76: 05.15.2022

Surf Report: Priority ingestments

Sunday, May 8, 2022

Listen now | Issue 75: 05.08.2022

Surf Report: Cultural Rot

Sunday, May 1, 2022

Listen now | Issue 74: 05.01.2022

Surf Report: Fury road

Sunday, April 24, 2022

Listen now | Issue 73: 04.24.2022

You Might Also Like

Letter from the Editor: Why this year's Digiday Publishing Summit matters

Tuesday, March 4, 2025

It's a new era for the media industry. Eras, actually: There's the AI era, the streaming era, the podcast era, the post-cookie era. In other words, media companies are being forced to evolve,

11 social media skills to master (and how AI can help)

Tuesday, March 4, 2025

Perfect these skills now to stay ahead in 2025 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 The masterclass with Arvid Kahl starts in 15 minutes

Tuesday, March 4, 2025

Build In Public Without Giving Away Your Business Secrets ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Age of Economic Chaos

Tuesday, March 4, 2025

Listen now (7 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The next level of content marketing

Tuesday, March 4, 2025

Content marketing isn't just about creating blog posts. If you're still stuck in that mindset, you're leaving money on the table. The best marketers go beyond traditional content and

📱 Google Gemini’s iPhone Hack

Tuesday, March 4, 2025

AI More human-like than ever. Ready to upgrade? ⚡

ET: March 4th 2025

Tuesday, March 4, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 BlueChew (trends) Chart BlueChew is a

🦅 Masterclass with Arvid Kahl: watch the live stream

Tuesday, March 4, 2025

At 10:00 AM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Where Are The 2021 Unicorns Today?

Tuesday, March 4, 2025

60% Are Stuck In Limbo To view this email as a web page, click here saastr daily newsletter Where Are The 2021 Unicorns Today? 60% Are Stuck In Limbo, Per Carta By Jason Lemkin Sunday, February 2, 2025

Ranking 2024's busiest investors

Tuesday, March 4, 2025

CoreWeave files for IPO; Anthropic banks $3.5B Series E; Ramp hits $13B valuation in secondary deal; one month in global markets Read online | Don't want to receive these emails? Manage your