The Daily StockTips Newsletter 05.31.2022

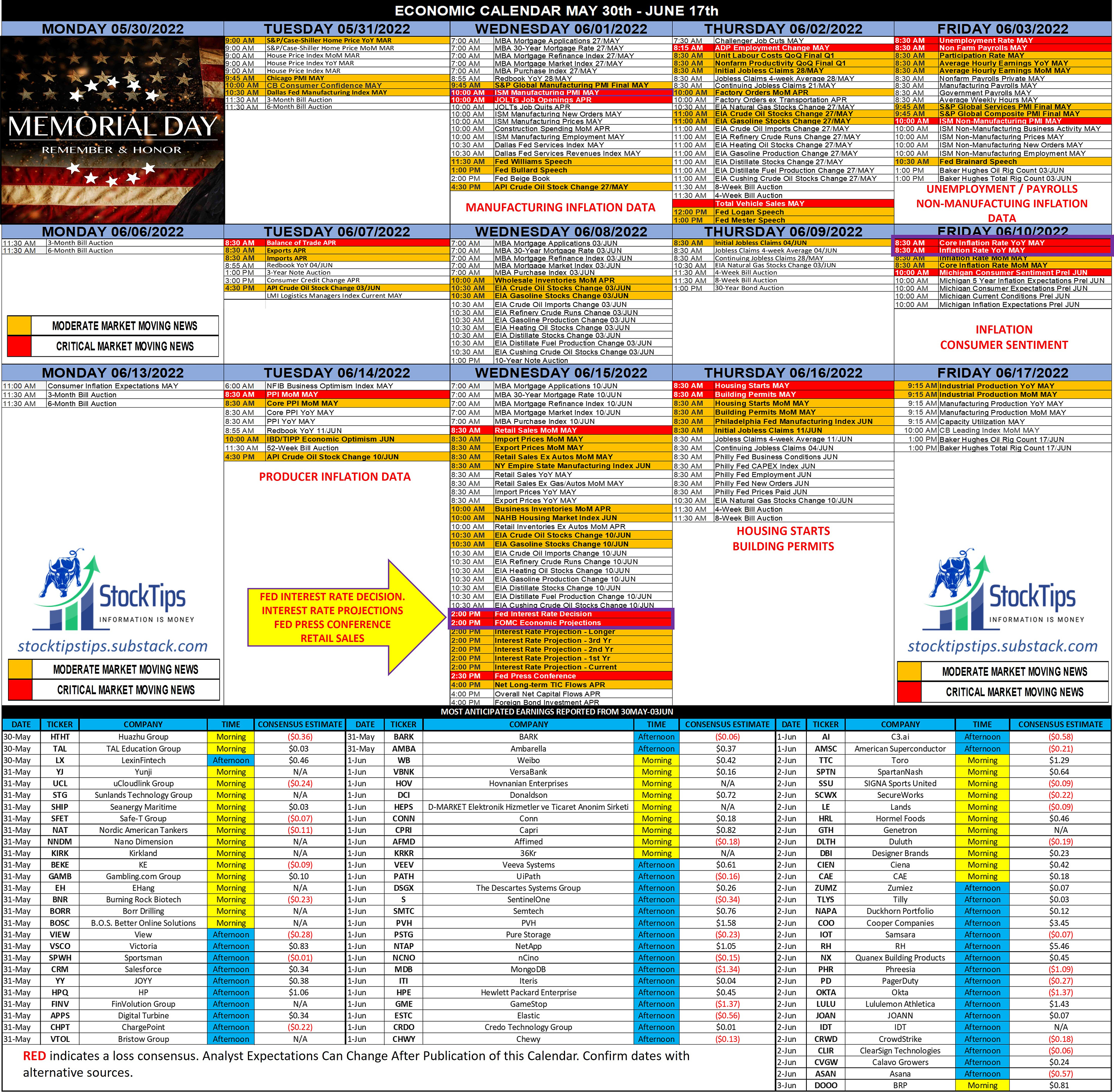

The Daily StockTips Newsletter 05.31.2022I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)CLICK HERE TO SEE THE STOCKTIPS RECORD WE’RE ON YOUTUBE NOW! See HERE, HERE, & HERE (Yeah … I’m REALLY excited about this). Before you Trade Today: Know the Economic Calendar! Also See This Weeks Most Anticipated Earnings (Note: Red on the Earnings Calendar Indicates an Earnings Loss [Not Miss] Consensus), & Yesterdays Insider Buys. NEVER BE SURPRISED BY EASILY ANTICIPATED MARKET BREAKING NEWS. That’s our goal here. TODAYS COMMENTARY: Get a Cup of Coffee & Enjoy Catching Up! If you aren’t reading this daily you are missing out on a wealth of information that could prevent unforced & unnecessary trading errors. TODAY’S MORNING EARNINGS: YJ UCL STG SHIP SFET NAT NNDM KIRK BEKE GAMB EH BNR BORR BOSC TODAY’S AFTERNOON EARNINGS: VIEW VSCO SPWH CRM YY HPQ FINV APPS CHPT VTOL BARK AMBA TODAYS GENERAL OBSERVATIONS: World markets traded higher on Labor Day, although they seem to be giving up those gains today. I understand most folks don’t pay attention to the world markets on holidays, but it’s necessary lest we lose track of what’s driving them. China has eased up on lockdowns which drove markets higher on Labor Day, however the EU has agreed to cut back on Russian oil imports which is already reflected in the oil futures. Moreover the EU just reported inflation data that came in much higher than expected, which may bleed poor sentiment into US markets. I hope we can get one more pump out of this market, … if nothing more than to find some good short plays … but we will see. Firearms & ammo related stocks seem to be the new bullish play (lucky for us considering the lone stock we still have left on the buy list), but remember that they aren’t pumping because of the Texas shooting, but rather threats to regulate firearms more heavily. Such threats aren’t likely to go away anytime soon. THIS WEEK’S MAJOR ECONOMIC CATALYSTS: The May ISM Manufacturing PMI (an inflation indicator) will be released this Wednesday 1000ET. The month to month numbers imply an increase or decrease in manufacturing. May consensus comes in at 55.3 whereas April came in at 55.4. The ADP Employment Change is the day after (Thursday with a 300k Consensus), however official unemployment numbers won’t be until Friday when analyst expect a 3.5% unemployment rate with 320k jobs added. Needless to say there’s much more on the calendar, but these are the big ticket items. Any significant deviation from what’s expected will move markets. LAST FRIDAY’S ECONOMIC NUMBERS: April’s MoM Personal Income came in lower than expected, … an increase of 0.4% when 0.5% was the analyst consensus. Personal spending increased 0.9% while 0.7% was expected. The PCE Price Index MoM & YoY each came in 0.1% lower than consensus at 0.2 & 6.3% respectively. Wholesale Inventories ticked up 2.1% when 2.0% was expected. With numbers so close to expectations … well within margins of error, it’s truly impossible to infer anything from them alone. But taken with the previous numbers we’ve seen, especially the earnings, I think we can safely assess a worn down consumer & retarding growth. Significant News Heading into 05.31.2022:

BUY LIST UPDATE: I’m under a lot of pressure to find plays for you folks (both long & short) to add to the BUY LIST. However the market is too low to short & too bearish to buy. Valuations, given my economic outlook, are garbage in my opinion. Stocks could certainly go lower … indeed they SHOULD go lower. The earnings I’ve been tracking this season are nothing more than underwhelming. In the interim I’ve been posting the daily insider buys/sells above $25,000 in the paid section of the newsletter (under yesterdays earnings tracker), which can generally be used for a quick & easy profit depending on the market conditions & circumstances surrounding the buy/sell. You will note that insiders are selling much more than they’re buying. I’ve also posted the upcoming IPO Lockup & Quiet Period expirations in the paid section which are usually preceded by selling pressure. StockTips is NOW on Odyssey: I’ve been trying out a new Discord like chatroom called Odyssey. I’ve set up a channel HERE. I agreed with one of the developers that I would give it a try. Although I reeeaaaalllly hate Discord. Thus far I find Odyssey a far superior & more manageable platform. Nevertheless if you’re interested you may find StockTips here. I think it may only be for Apple devices thus far, but don’t quote me on that. I think its a great way to ask questions, chat, or contact me as you feel necessary.

👉CLICK HERE TO SEE THE DETAILS OF EVERY STOCK ON THE BUY LIST (AND SEE THE PRICE ASSESSMENT BASED WATCHLIST / THE STOCKS UNDER $20 LIST & THE HIGHLY SPECULATIVE LIST) LOGIN INSTRUCTIONS: You will need to login to see the detailed list. The “email login link” will send the link to login directly to your inbox (Click the link & it will automatically log you in). You can also choose the “login with password” option. You will need to set up a substack password for this option.Subscribe to StockTips Newsletter to read the rest.Become a paying subscriber of StockTips Newsletter to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

The Daily StockTips Newsletter 05.27.2022

Friday, May 27, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 05.26.2022

Thursday, May 26, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 05.25.2022

Wednesday, May 25, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 05.24.2022

Tuesday, May 24, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

The Daily StockTips Newsletter 05.23.2022

Monday, May 23, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

You Might Also Like

Crypto Politics: Strategy or Play? - Issue #515

Thursday, March 6, 2025

FTW Crypto: Trump's crypto plan fuels market surges—is it real policy or just strategy? Decentralization may be the only way forward. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

What can 40 years of data on vacancy advertising costs tell us about labour market equilibrium?

Thursday, March 6, 2025

Michal Stelmach, James Kensett and Philip Schnattinger Economists frequently use the vacancies to unemployment (V/U) ratio to measure labour market tightness. Analysis of the labour market during the

🇺🇸 Make America rich again

Wednesday, March 5, 2025

The US president stood by tariffs, China revealed ambitious plans, and the startup fighting fast fashion's ugly side | Finimize TOGETHER WITH Hi Reader, here's what you need to know for March

Are you prepared for Social Security’s uncertain future?

Wednesday, March 5, 2025

Investing in gold with AHG could help stabilize your retirement ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Issue #275: You're preapproved… to spend a bunch of money

Wednesday, March 5, 2025

plus Soup Watch 2025 + snacking cakes ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Harry's Take 3-5-25 Economy Suddenly Weakens: Recession Coming Soon?

Wednesday, March 5, 2025

Harry's Take March 5, 2025 Economy Suddenly Weakens: Recession Coming Soon? I've been seeing the economy as the most stretched in history after the longest $27T US stimulus program, by far.

💀 RIP, world's biggest dividend

Tuesday, March 4, 2025

Aramco slashed its billion-dollar handouts, the US faced retaliation, and bitcoin went up against organs | Finimize Hi Reader, here's what you need to know for March 5th in 3:14 minutes. Aramco –

RIP to the 4% Rule

Tuesday, March 4, 2025

How to ignore the retirement strategy ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

President Trump is asserting extraordinary power over independent agencies. Is the Fed next?

Tuesday, March 4, 2025

The rise and potential fall of independent agencies. View this email online Planet Money Not-so-independent agencies anymore? by Greg Rosalsky President Trump vs. the independent agencies. It's a

No Sales, No Survival - Issue #514

Tuesday, March 4, 2025

What smart businesses are doing to win in the long run. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏