Surf Report - Surf Report: Mea culpa

Hi everyone—I’m so glad to have you here. What a week. Secretary of the Treasury Janet Yellen (75) was frog-marched onto national television following some Serious meetings between president Joe Biden (79) and Fed Chair Jerome Powell (69) to take the heat for a decade of poor decisioning that’s left an entire generation wondering how this bizarre retirement community of supposed wisdom could have messed up so consistently.   It’s clear that these elders are not bastions of wisdom and experience after all. In a sane and well-functioning society they would be thanked for their service and promptly relieved of duty. One problem is that Treasury Secretary is an appointed position, not an elected one, so We The People have no say in the matter. Ditto for J-Pow, who is Chair of a cartel of unelected bankers that aren’t even part of the US government at all. Why is this retirement community mafia allowed to continually make mistakes time and time again without consequence and free from retribution from the people they’re inflicting harm upon? That’s a rhetorical question of course. I don’t encourage you to ask it with actual sincerity unless you’d like to be swiftly disillusioned into a nihilist rabbit hole of cynicism lined with barbs of truth needles and corruption shards. It gets dark real quick. We’ve come a long way since Alexander Hamilton became the nation’s first secretary of the treasury. For one thing, Hamilton was about 32 years old. The time horizon and incentives of those making decisions impact the nature of those decisions. Individual perspective unevenly blinds and illuminates, and no one is ever perfectly objective or rational. This is why checks, balances, and term limits are so crucial. Just as a quick reminder, this was Janet just over 4 months ago. Remember this when you see Yellen headlines today. Nothing has changed. We are still very much on our own, and no one is coming to save you: Making mistakes isn’t so bad, that’s how we learn. Repeating them, however, is. And where we are today is a result of the same delayed reaction and failure to understand as we saw leading up to and following the 2008 financial crisis. We’re just being looped inside a poorly written Netflix series where the only difference between seasons is the actors.  Don’t put it past them:  *Walter Bloomberg @DeItaone I’ve written in the past about how history has shown that when a society reaches the end of a debt cycle like this and leaders find themselves wedged into this kind of corner, something Ray Dalio calls a “debt jubilee” occurs. This is when money is given away and debts are magically “forgiven” is an attempt to paper over the problem and cook the books into some semblance of respectability (while keeping the masses happy and not revolting entirely by giving them free stuff). Giving people money to spend is the same thing as removing money people owe. It’s all debits and credits. But this allows them to avoid the term “stimulus check.” Is a society—an economy—healthy if it requires this level of unprecedented intervention, manipulation, and obfuscation? The president wants you to think so. You “have every reason” to “feel” confident about all of these shenanigans, and believe that the US has actually made “progress” and i in “a position of strength,” I’m told. 🤷♂️ Add it to the list Eventually, we need to settle up the tab. The bill will come due, and it’s a doozy. As expected, New York State—home of the incumbent old guard with the most to lose in this new paradigm (Wall Street)—continues to shoot itself in the foot in an attempt to stem the bleeding.    Missing the impact, benefit, and elegance of the bitcoin network is no surprise given that it’s key value proposition has to do with the inability for people like Janet Yellen and Jerome Powell and Joe Biden in their infinite wisdoms to mess with the rules. It is the antithesis and antidote to our current monetary predicament. Saifedean Ammous speaking on February 11, 2017

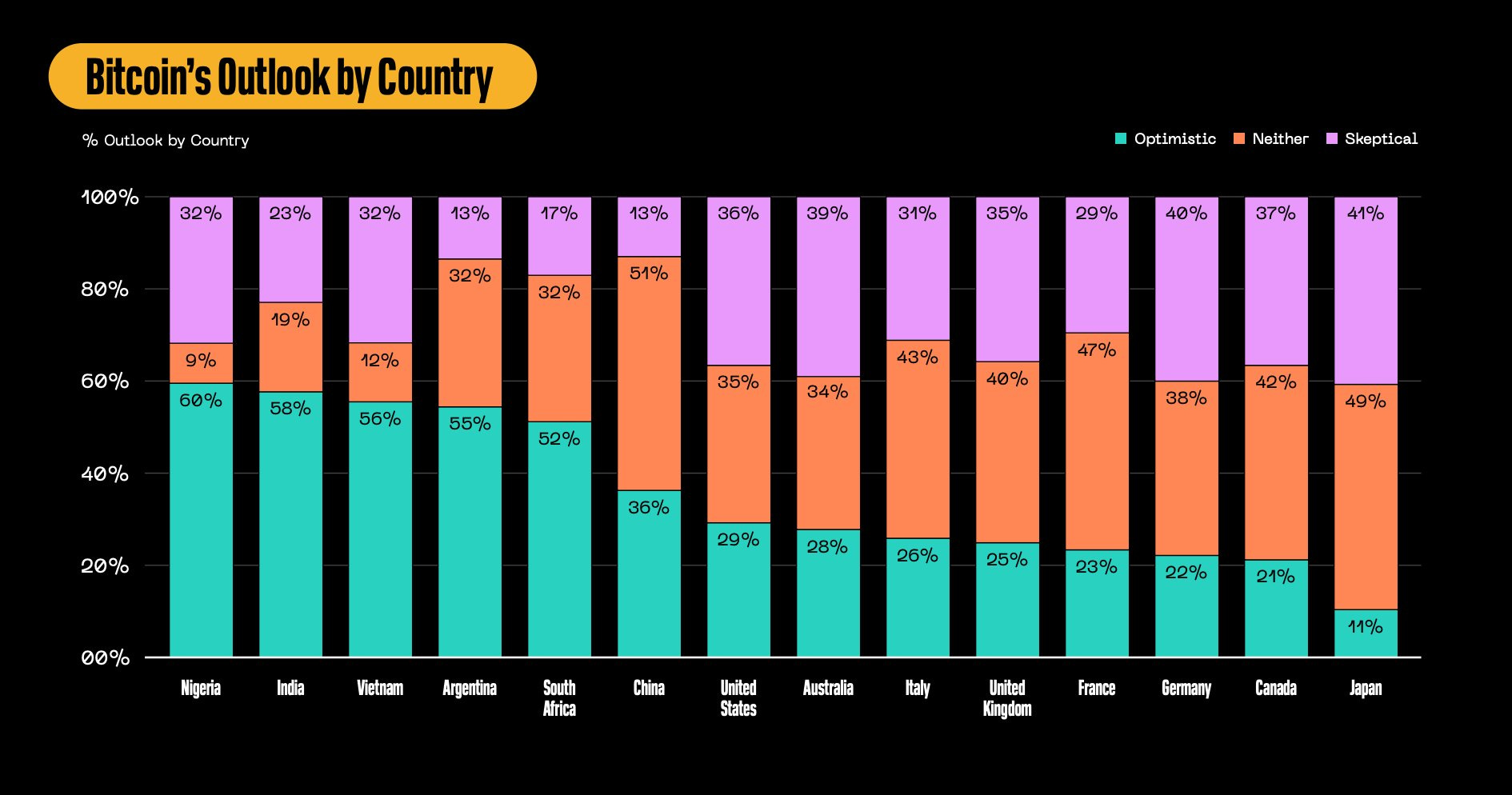

Who's most optimistic on Bitcoin? People from emerging market countries or authoritarian regimes. Who's least optimistic? People living under reserve currencies and liberal democracies. No matter. Everyone gets bitcoin at the price they deserve. Yellen, Powell et. al. may or may not realize the err of their ways when it comes to monetary policy, but bitcoin doesn’t care. That can be their culpa. It doesn’t need to be ours.  Until next time 🤙, Recommended Resources For Plan ₿Swan Fold Card Thanks for subscribing to Surf Report. If you liked this post, consider sharing it with someone else who might appreciate it! |

Older messages

Surf Report: Perturbed incentives

Sunday, May 29, 2022

Listen now | Issue 78: 05.29.2022

Surf Report: Yelling shark

Sunday, May 22, 2022

Listen now | Issue 77: 05.22.2022

Surf Report: The great fugazi

Sunday, May 15, 2022

Listen now | Issue 76: 05.15.2022

Surf Report: Priority ingestments

Sunday, May 8, 2022

Listen now | Issue 75: 05.08.2022

Surf Report: Cultural Rot

Sunday, May 1, 2022

Listen now | Issue 74: 05.01.2022

You Might Also Like

Letter from the Editor: Why this year's Digiday Publishing Summit matters

Tuesday, March 4, 2025

It's a new era for the media industry. Eras, actually: There's the AI era, the streaming era, the podcast era, the post-cookie era. In other words, media companies are being forced to evolve,

11 social media skills to master (and how AI can help)

Tuesday, March 4, 2025

Perfect these skills now to stay ahead in 2025 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🦅 The masterclass with Arvid Kahl starts in 15 minutes

Tuesday, March 4, 2025

Build In Public Without Giving Away Your Business Secrets ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Age of Economic Chaos

Tuesday, March 4, 2025

Listen now (7 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The next level of content marketing

Tuesday, March 4, 2025

Content marketing isn't just about creating blog posts. If you're still stuck in that mindset, you're leaving money on the table. The best marketers go beyond traditional content and

📱 Google Gemini’s iPhone Hack

Tuesday, March 4, 2025

AI More human-like than ever. Ready to upgrade? ⚡

ET: March 4th 2025

Tuesday, March 4, 2025

Exploding Topics Logo Presented by: Exploding Topics Pro Logo Here's this week's list of rapidly trending topics, insights and analysis. Topic #1 BlueChew (trends) Chart BlueChew is a

🦅 Masterclass with Arvid Kahl: watch the live stream

Tuesday, March 4, 2025

At 10:00 AM Eastern Time (US and Canada) ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Where Are The 2021 Unicorns Today?

Tuesday, March 4, 2025

60% Are Stuck In Limbo To view this email as a web page, click here saastr daily newsletter Where Are The 2021 Unicorns Today? 60% Are Stuck In Limbo, Per Carta By Jason Lemkin Sunday, February 2, 2025

Ranking 2024's busiest investors

Tuesday, March 4, 2025

CoreWeave files for IPO; Anthropic banks $3.5B Series E; Ramp hits $13B valuation in secondary deal; one month in global markets Read online | Don't want to receive these emails? Manage your