The Daily StockTips Newsletter 07.06.2022

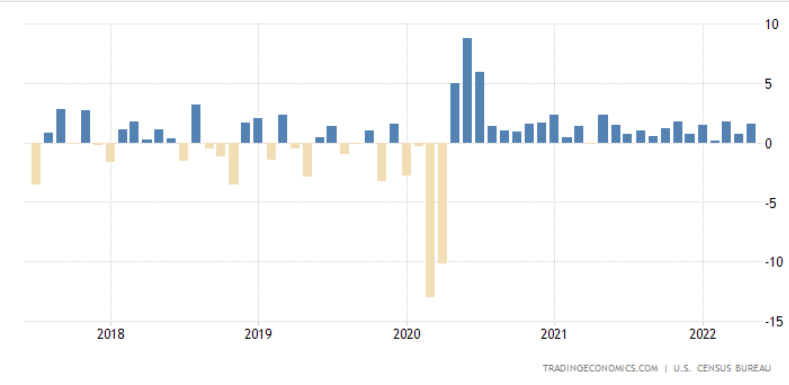

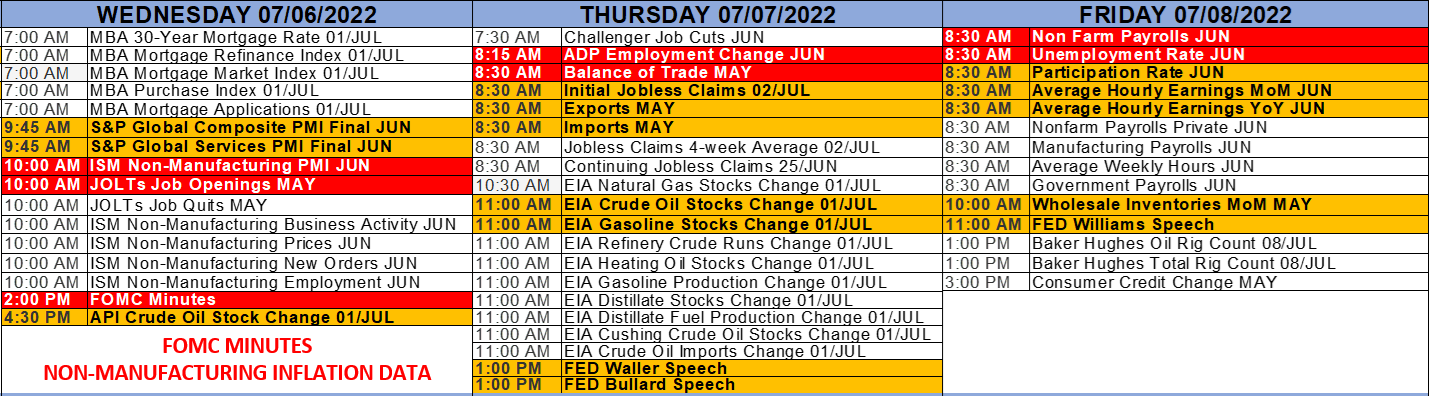

WE’RE ON YOUTUBE NOW! See HERE & HERE (Yeah … I’m REALLY excited about this). Before you Trade Today: Know the Economic Calendar! Also See This Weeks Most Anticipated Earnings. NEVER BE SURPRISED BY EASILY ANTICIPATED MARKET BREAKING NEWS. That’s our goal here. StockTips is NOW on Odyssey. It’s like discord but better in my opinion FAIR WARNING: Note that (including today) we are 5 TRADING DAYS AWAY FROM JUNE INFLATION DATA. ANOTHER SHORT PLAY ADDED: I see some downside catalysts ahead so lets see if we can’t take advantage of inherent uncertainty with crappier than usual valuations. One additional short play added in the paid section below for a total of 3x fresh short ideas. OIL YESTERDAY: Oil dumped below $100bbl yesterday amid expectations of an economic slowdown, but the markets looked favorably at it all the same. WTI & Brent are both back above $100bbl now, but lets put this in perspective. We can refine 19.5gal of gas from 1xbbl of oil. If oil is trading at $95bbl, & we were to deduct refining costs, state/federal taxes, storage costs, labor, additives, detergents, transportation, additional overhead, & the small mark up for profit, (in short, just the gas from the oil with nothing else considered), were looking at $4.87gal. Still bullish? In other words, the increase will continue … just not as fast as it was before … ceteris paribus. Using the same calculation for $100bbl, we get $5.12gal. CREDIT SUISSE SEES A “MILD” RECESSION: Yet another explanation for yesterday’s rally was a few firms are putting lipstick on a pig. I always enjoy watching these folks talk out of one side of their mouth while betting in the exact opposite direction. Only they always release the opposite assessment once they’re well positioned to benefit. Never fails. SOMETHING EVERYONE MISSED YESTERDAY: Factory MoM Orders for May came in at an increase of 1.6% when 0.5% was expected. Factory Orders ex Transportation came in even higher at 1.7%. Remember that we have retailers sitting on large inventories of expensive product they’re having trouble moving. Yet despite this … factory orders increased? Now the markets were reluctant to respond as this was trailing data over 30 days out … but we should expect factory orders to come in at par, if not lower, than analysts expectations, given the Fed Rate Hikes & surging inventories. If inflation is to be tamed, this is not the kind of numbers we want to see. Lets take a look at the factory orders 5 year chart. Notice that factory orders prior to the post COVID recovery routinely dipped into the negative from time to time. Post COVID this happened only once … & not by much. Historically speaking, such MoM increases in factory orders is an anomaly not congruent toward easing inflation. UPCOMING MARKET MOVING NEWS: FOMC Minutes (The transcript from the previous Fed Rate Hike) will be released today at 2:00 PM. Expect more hawkishness than previous transcripts. There’s also plenty of employment data coming out this week. We want to see the job market weakening! It’s the only way inflation is going to get under control folks. So don’t expect the markets to rally on strong jobs numbers. Friday we have Wholesale Inventories. It would be marked in red if only the data was more recent (The numbers are for May). Analyst consensus on Wholesale Inventories are a 2% increase MoM for May. You don’t want to see it come in higher than that … it means businesses are having a hard time moving product. Either way I can’t possibly speak to everything coming out this week. See below. WORLD MARKETS:

RECOMMENDED:

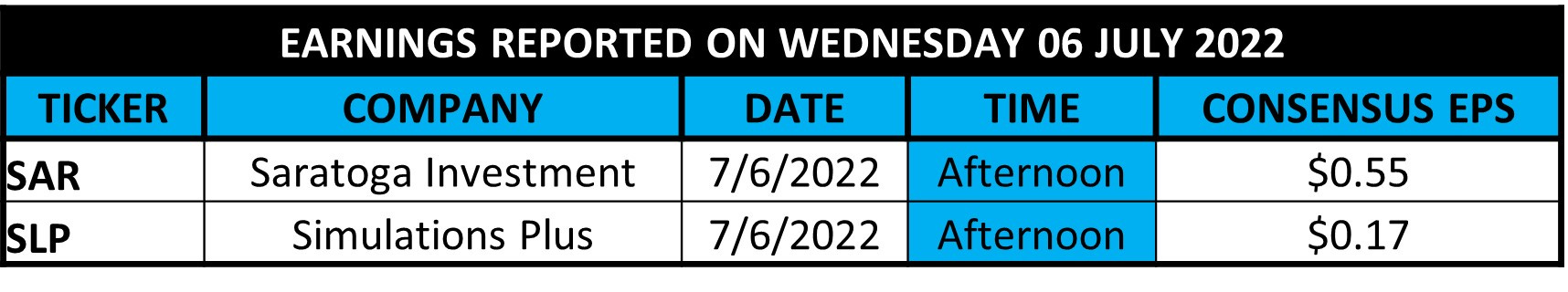

TODAY’S EARNINGS: Subscribe to StockTips Newsletter to read the rest.Become a paying subscriber of StockTips Newsletter to get access to this post and other subscriber-only content. A subscription gets you:

|

Older messages

The Daily StockTips Newsletter 07.05.2022

Tuesday, July 5, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

MARKET RUNNING ESTIMATE & OBSERVATIONS Q1 2022

Monday, July 4, 2022

Prepare for a Brutal Q2 Earnings Season

The Daily StockTips Newsletter 07.01.2022

Friday, July 1, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

Removing Ammo Inc (POWW) From the BUY LIST

Friday, July 1, 2022

Gone but Not Forgotten

The Daily StockTips Newsletter 06.30.2022

Thursday, June 30, 2022

I've Screened the Market for what I Consider the Best, Safest, & Most RELIABLE Profit Opportunities! (Published 7:30 AM ET MON-FRI)

You Might Also Like

Issue #275: You're preapproved… to spend a bunch of money

Wednesday, March 5, 2025

plus Soup Watch 2025 + snacking cakes ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Harry's Take 3-5-25 Economy Suddenly Weakens: Recession Coming Soon?

Wednesday, March 5, 2025

Harry's Take March 5, 2025 Economy Suddenly Weakens: Recession Coming Soon? I've been seeing the economy as the most stretched in history after the longest $27T US stimulus program, by far.

💀 RIP, world's biggest dividend

Tuesday, March 4, 2025

Aramco slashed its billion-dollar handouts, the US faced retaliation, and bitcoin went up against organs | Finimize Hi Reader, here's what you need to know for March 5th in 3:14 minutes. Aramco –

RIP to the 4% Rule

Tuesday, March 4, 2025

How to ignore the retirement strategy ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

President Trump is asserting extraordinary power over independent agencies. Is the Fed next?

Tuesday, March 4, 2025

The rise and potential fall of independent agencies. View this email online Planet Money Not-so-independent agencies anymore? by Greg Rosalsky President Trump vs. the independent agencies. It's a

No Sales, No Survival - Issue #514

Tuesday, March 4, 2025

What smart businesses are doing to win in the long run. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🇺🇸 The president's crypto fund

Monday, March 3, 2025

Crypto's back in favor and European defense stocks got an, uh, arm up | Finimize Hi Reader, here's what you need to know for March 4th in 3:15 minutes. The US president announced plans for a

CDs supercharge your savings

Monday, March 3, 2025

You could earn up to 4.10% for a 1 year term ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI's Impact on the Written Word is Vastly Overstated

Monday, March 3, 2025

Plus! VC IPOs; Sovereign Wealth Funds; The Return of Structured Products; LLM Moderation; Risk Management; Diff Jobs AI's Impact on the Written Word is Vastly Overstated By Byrne Hobart • 3 Mar

Know you’re earning the most interest

Sunday, March 2, 2025

Switch to a high-yield savings account ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏