Not Boring by Packy McCormick - Blockchains As Platforms

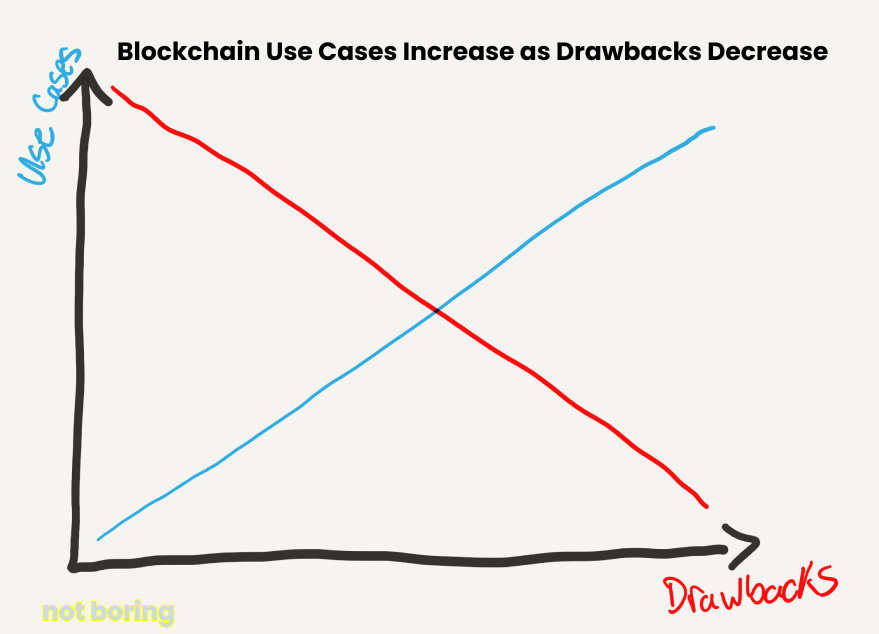

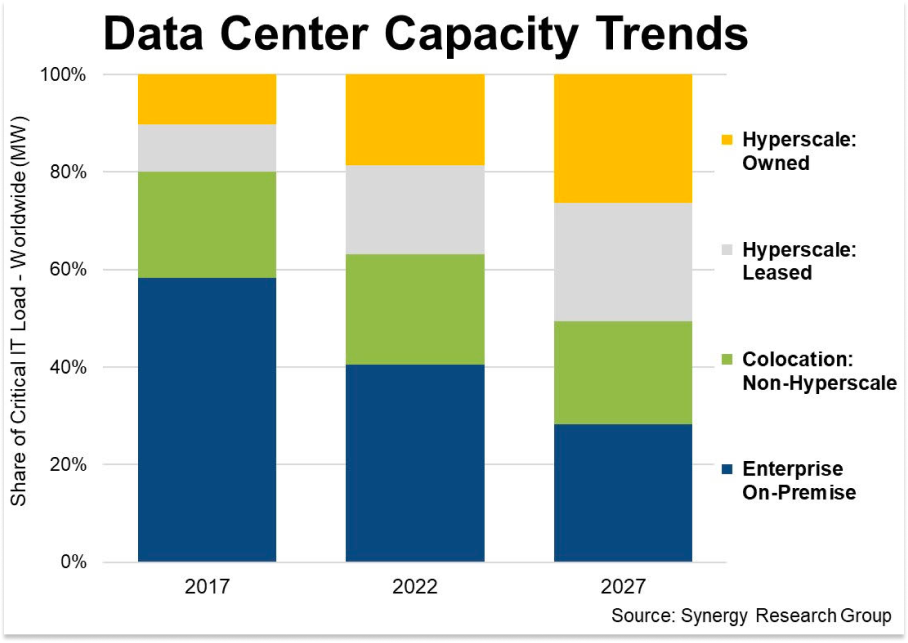

Welcome to the 833 newly Not Boring people who have joined us since last week! If you haven’t subscribed, join 216,055 smart, curious folks by subscribing here: Today’s Not Boring is brought to you by… Alto Alto allows individuals to invest in alternative assets with their retirement funds through a self-directed IRA. I love and use Alto because I can diversify my portfolio, all the while minimizing my tax burden by investing out of tax-advantaged retirement accounts. It’s a win-win. My accountant father-in-law is very proud of me for this type of long-term financial planning. Alternative assets (real estate, private credit, VC funds, crypto, fine art, etc.) have long been thought of as reserved for the ultra-rich and professional investors. Alto set out to change that in 2018 when it launched its platform designed to streamline access to alternative assets for individual investors wanting to invest their retirement funds. That last part is important (and what makes Alto a no-brainer in my opinion), because investing in alternative assets with funds earmarked for retirement means you’re investing for the future with assets that have a longer time horizon and the greater potential upside while also claiming tax benefits. Alto just launched Alto Marketplace, a capital raise platform that connects individual accredited investors to leading funds and exclusive opportunities. If you’re allocating to alternatives, consider investing in a tax-advantaged way and check out Alto. Hi friends 👋, Happy Wednesday! Last week, I promised you an essay on Grand Strategy, and that’s coming, but while writing it, I opened Twitter and I learned something odd… Crypto seems to be not dead. It’s weird because I could have sworn people said it was dead, that if you’re in crypto, you should pivot to AI. And yet, here we are. Now who knows if this recent run-up is the beginning of a new bull market or just a little glimmer of hope in the middle of a long bear. Certainly not me. Long-term, price matters only insofar as it attracts developers to the space to build good products. Crypto is often viewed as this ideological thing. You either love it or hate it. But I think a more useful way to think about the space is that blockchains are just platforms. In their current state, they present unique benefits and real drawbacks. Ultimately, developers will choose to build on blockchains if the benefits outweigh the drawbacks for the specific product they’re trying to build. It’s that simple. If this is the end of the bear market, it seems odd that it’s come without new killer use cases. My guess is that higher prices will make developers take another look at blockchains, and that when they do, a larger number will find that the trade-offs make sense for what they’re trying to build. This is a shorter one, so if you’re looking for something to fill the void, Age of Miracles is about to hit the halfway mark, with our fifth (and best yet) episode coming out Friday. Subscribe and listen to our first four on Apple, Spotify, or YouTube. Let’s get to it. Blockchains As PlatformsBlockchains are platforms on top of which developers can build products. Their success depends on whether developers choose to build products on top of them. As more developers build better products on blockchains, they will attract more users. Generally, developers, in their enlightened self-interest, build the products that they believe will make them the most money. That means building products that will attract the most users, or attract a smaller number of users who are willing to pay them more money. Certainly, there are other considerations – impact, self-actualization, novelty, whatever – but for our purposes, let’s assume developers build the products that they think will make them the most money. When choosing which platforms to build on top of, developers need to weigh trade-offs. What benefits does the platform offer the product, and ultimately its users, and what drawbacks does the platform present? Different developers will make different trade-offs depending on what they’re building. Over time, as infrastructure improves, the trade-off calculus will come out in blockchains’ favor for more use cases. Take the cloud as an example. When Amazon first built AWS, startups were early adopters while larger companies and governments with higher security requirements remained on-prem. For startups, the low upfront cost, scalability, and ease of AWS outweighed the potential security risks and lack of full control of the cloud. The cloud made previously infeasible companies feasible. For large companies and governments, the familiarity, tooling, and security of on-prem servers outweighed AWS’ benefits. Over time, as Amazon and the other cloud providers invested in performance, tooling, and security, the drawbacks shrank as the benefits grew. Cloud usage has grown as the trade-off has flipped in its favor for more and more developers. The decision of whether or not to build on a blockchain depends on trade-offs, too. On the benefits side, blockchains offer:

But blockchains in their current form come with significant drawbacks:

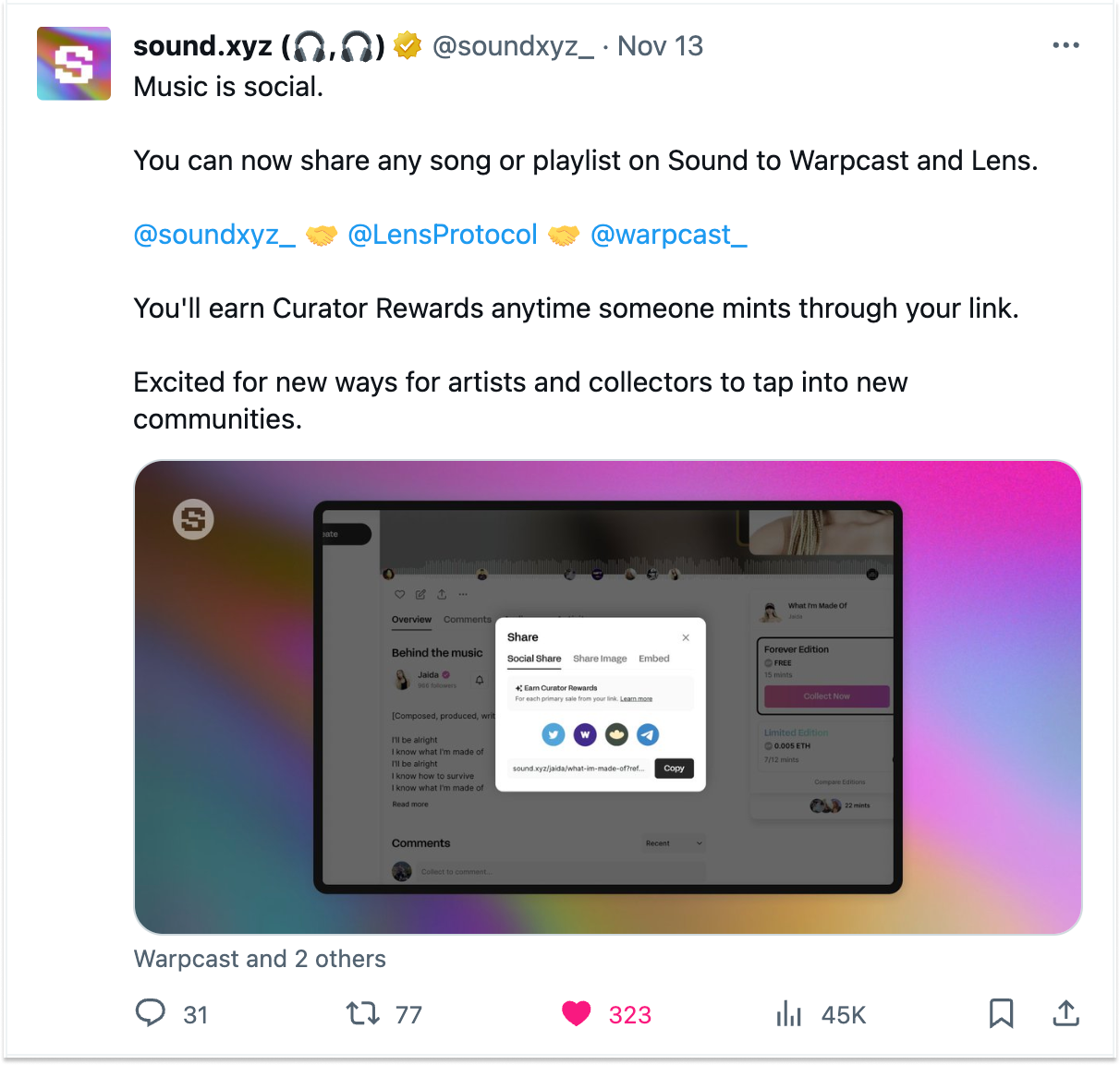

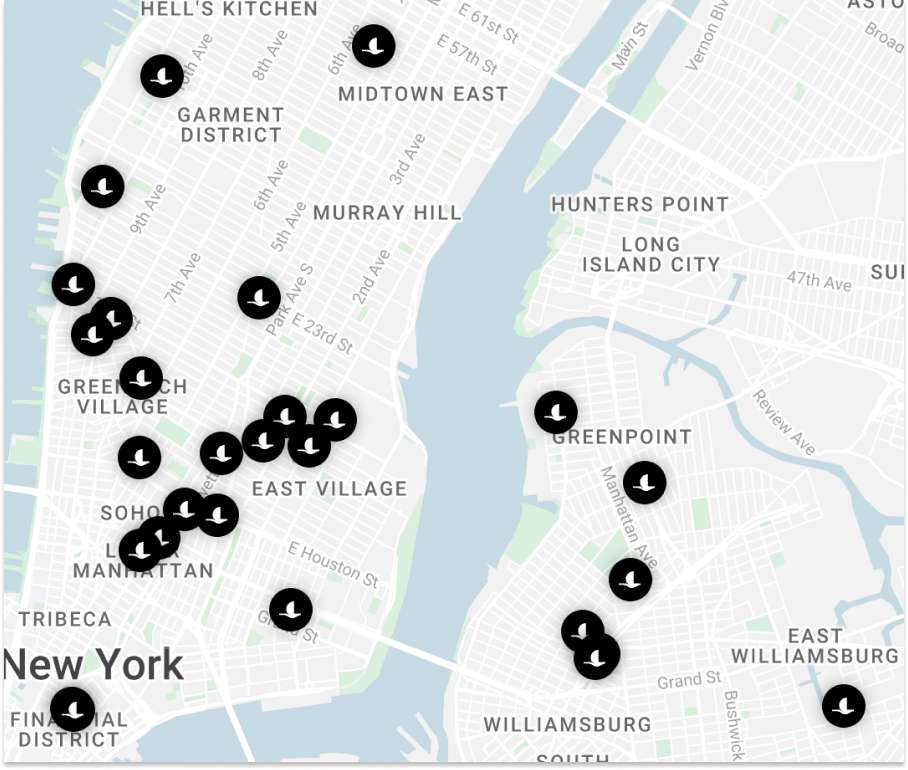

Whether a developer chooses to build their product onchain depends entirely on whether the benefits outweigh the drawbacks for the specific product they’re trying to build. Today, according to the latest numbers from a16z’s State of Crypto Index, there are 23.3k active developers building in crypto out of roughly 1,000x that many developers in the world. The drawbacks currently outweigh the benefits for 99.9% of developers. But for a small number of developers, the benefits outweigh the drawbacks because blockchains allow them to do things that they could not otherwise do. A significant proportion of products built on blockchains are financial – exchanges, NFTs, and payments – because they are the products that couldn’t be built on traditional infrastructure. Slowness, higher costs, and a clunky UX don’t matter as much as the fact that these products are possible to build on blockchains. It’s no surprise that the most popular social product in crypto over the past year, friend.tech, is one with money baked into its mechanics – it’s a product that’s only possible in crypto. The app crashes and the product is slow and clunky, but those drawbacks are outweighed by the unique ability to make money every time someone trades your keys. It won’t always be just about money, though. As blockchains’ capabilities expand, performance improves, and drawbacks get figured out, the number of things built on blockchains grows. The more “free” you can make the benefits, the easier the decision becomes. Bitcoin the blockchain was good at sending and receiving bitcoin the cryptocurrency. It didn’t attract many developers besides those who were philosophically aligned or wanted to build with something new, and there are few examples of popular products built on Bitcoin. When Ethereum introduced smart contracts, it expanded the things that developers could do on blockchains. It increased the benefits and decreased the drawbacks, but it was still slow and expensive and clunky enough that it captured mostly newly possible use cases. With faster and cheaper blockchains and L2s, the trade-offs tilt further in the favor of developing certain products onchain. With zero-knowledge proofs that provide privacy onchain, the trade-offs tilt further in the favor of developing certain products onchain. With UX improvements like embedded wallets, multi-party computation, and account abstraction, the trade-offs tilt further in the favor of developing certain products onchain. Take social apps. web3 social products like Farcaster and Lens won’t win by being Twitter, but decentralized. Users care about speed, experience, and dopamine more than they care about decentralization. But as the infrastructure improves, the benefits of building on blockchains begin to outweigh the drawbacks. In August, Farcaster moved from Ethereum Mainnet to Optimism, a faster and cheaper Layer 2. It integrated NFT minting directly in casts with Zora and song minting directly in casts with sound.xyz. It’s reducing speed and cost drawbacks while leaning into the benefits of composability. The trade-off tilts further in favor of developing onchain. There are plenty of products that would benefit from the unique features of crypto if the drawbacks were low enough. Verification, for example, becomes more important with the rise of generative AI, as does the ability to own your own models and tap into decentralized compute. Tokens and value exchange can be useful for loyalty and rewards products. When transactions cost $50 in gas fees and took minutes to finalize, the drawbacks weren’t low enough. But with cheaper, faster transactions and UX improvements, those products start to make sense. Blackbird, for example, is a restaurant loyalty app founded by Resy co-founder Ben Leventhal. It’s built on Coinbase’s Base L2 and uses embedded wallets so that it’s fast, cheap, and doesn’t feel like a crypto app. It feels like a regular app, with crypto benefits, and it’s rapidly expanding with great bars and restaurants in NYC. Soon, it will be crazy to launch a loyalty product that doesn’t use crypto. In short, as crypto’s infrastructure continues to improve, more and more developers will find that its benefits outweigh its drawbacks and decide to build onchain. This is the simplest way I’ve come up with to think about what use cases currently make sense in crypto and which don’t yet, and the simplest way to track progress in the space. It’s as much art as science, since developers will have to make a judgment call on what users will care about more. Some will build products onchain believing the trade-off has flipped in blockchains’ favor, only to realize that the benefits don’t quite outweigh the drawbacks. I think that’s what Dani Grant and Nick Grossman at USV were describing in their 2018 blog post, The Myth of the Infrastructure Phase: “First, apps inspire infrastructure. Then that infrastructure enables new apps.” It takes people being a little early and trying things that don’t quite make sense yet to show other developers which drawbacks need to be attacked next. But the drawbacks are being addressed. During the bear market, crypto has improved most of the drawbacks I listed above:

There’s still a ton of improvement left to be made. Onchain actions need to get nearly as cheap as fast as offchain actions for the benefits to outweigh the drawbacks for many use cases. Developers will need to be thoughtful about which actions need to be onchain, which can take place offchain, and the best ways to build experiences that combine the two. We’ll likely never get to a world in which everything is built onchain. For some products, crypto’s benefits might not matter and might even be counterproductive. That’s OK. But over time, as infrastructure developers attack crypto’s drawbacks, and app developers get crypto’s benefits for closer to free, I expect that we’ll see a surprising amount of products move onchain. Thanks to Dan for editing! That’s all for today. We’ll be back in your inbox with the Weekly Dose on Friday! Thanks for reading, Packy |

Older messages

Weekly Dose of Optimism #68

Friday, November 10, 2023

devday, DACs, Zepbound, Turmeric, Humane, AoM e4

Tech is Going to Get Much Bigger

Wednesday, November 8, 2023

What happens when energy, intelligence, and labor get cheap?

Weekly Dose of Optimism

Friday, November 3, 2023

Mini Lasers, Giant Reactors, DNA Origami, AoM e3, AI EO, Palmer

Medicine's Endgame

Tuesday, October 31, 2023

The past, present, and future of cell-based therapy

Age of Miracles

Friday, October 27, 2023

Launching Season 1: Nuclear Energy

You Might Also Like

🔮 $320B investments by Meta, Amazon, & Google!

Friday, February 14, 2025

🧠 AI is exploding already!

✍🏼 Why founders are using Playbookz

Friday, February 14, 2025

Busy founders are using Playbookz build ultra profitable personal brands

Is AI going to help or hurt your SEO?

Friday, February 14, 2025

Everyone is talking about how AI is changing SEO, but what you should be asking is how you can change your SEO game with AI. Join me and my team on Tuesday, February 18, for a live webinar where we

Our marketing playbook revealed

Friday, February 14, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Cribbage Day, Reader... Don't get skunked! In today's

Connect one-on-one with programmatic marketing leaders

Friday, February 14, 2025

Enhanced networking at Digiday events

Outsmart Your SaaS Competitors with These SEO Strategies 🚀

Friday, February 14, 2025

SEO Tip #76

Temu and Shein's Dominance Is Over [Roundup]

Friday, February 14, 2025

Hey Reader, Is the removal of the de minimis threshold a win for e-commerce sellers? With Chinese marketplaces like Shein and Temu taking advantage of this threshold, does the removal mean consumers

"Agencies are dying."

Friday, February 14, 2025

What this means for your agency and how to navigate the shift ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Is GEO replacing SEO?

Friday, February 14, 2025

Generative Engine Optimization (GEO) is here, and Search Engine Optimization (SEO) is under threat. But what is GEO? What does it involve? And what is in store for businesses that rely on SEO to drive

🌁#87: Why DeepResearch Should Be Your New Hire

Friday, February 14, 2025

– this new agent from OpenAI is mind blowing and – I can't believe I say that – worth $200/month