Not Boring by Packy McCormick - Introducing Not Boring Capital

Introducing Not Boring CapitalBehind-the-Scenes of Raising a Fund to Invest in Companies with Stories to Tell

Welcome to the 282 newly Not Boring people who have joined us since Thursday! Join 60,238 smart, curious folks by subscribing here: 🎧 To get this essay straight in your ears: listen on Spotify or Apple Podcasts (in ~an hour) Today’s Not Boring is brought to you by… UserLeap I’ve been telling you how much I love UserLeap for months; thousands of you have given me feedback via UserLeap and it helps me make the newsletter better. In June, investors backed me up. a16z led the company’s $38M Series B alongside FirstRound and Accel. UserLeap is a continuous research platform that makes it easy to build and embed microsurveys into your product to learn about your customers in real-time. Product teams use UserLeap to gather qualitative insights as easily as they get quantitative ones, and automatically analyze the results so teams can take quick action. I check UserLeap at least once a day, and I’m not alone. Teams at Square, Adobe, and Dropbox love UserLeap too. In fact, the UserLeap team knows that once teams start using the product, they don’t stop, so it offers a generous free plan to try it out. Sign up below to start collecting insights today. Hi friends 👋 , Happy Monday! I can’t wait, so… Let’s get to it. Introducing Not Boring CapitalOne year ago this past Friday, I sent out the first ever Not Boring Investment Memo, Apt: The Natively Integrated Developer. There was no Not Boring Syndicate then. Apt was my first angel investment ever. I never thought that I would be a VC. There was no master plan. I just wanted to help my friends Fed and Petr tell their company’s story. Fast forward a year, and we’ve invested over $4 million in over twenty companies together through the Not Boring Syndicate. It’s become a core part of Not Boring. But as I wrote in A Not Boring Adventure, One Year In: This is just the beginning of Not Boring as an investor. More to come on that front very soon 👀 Well, very soon is today, and today, I’m excited to announce the next step: Not Boring Capital. Not Boring Capital is an $8 million venture fund that invests in companies with stories to tell, and helps tell them. We (I’m going to use the Royal We a lot here) will invest mainly in Seed through Series B companies, with the very occasional pre-seed and growth-stage investment. Not Boring Capital might be the world’s smallest multi-stage fund. We’re looking for Worldbuilders, founders and companies executing on complex, non-obvious strategies towards huge visions. Ultimately, there is no Not Boring Capital without all of you, so I want this to be a little bit different than a normal fund announcement.

Most of the time, a new fund gets announced after it’s closed. I’m still fundraising. I just switched the fund designation from 506(b) to 506(c), which means that I’m able to talk about it in public. I did that because I want Not Boring readers and Syndicate backers to get involved, in a few ways:

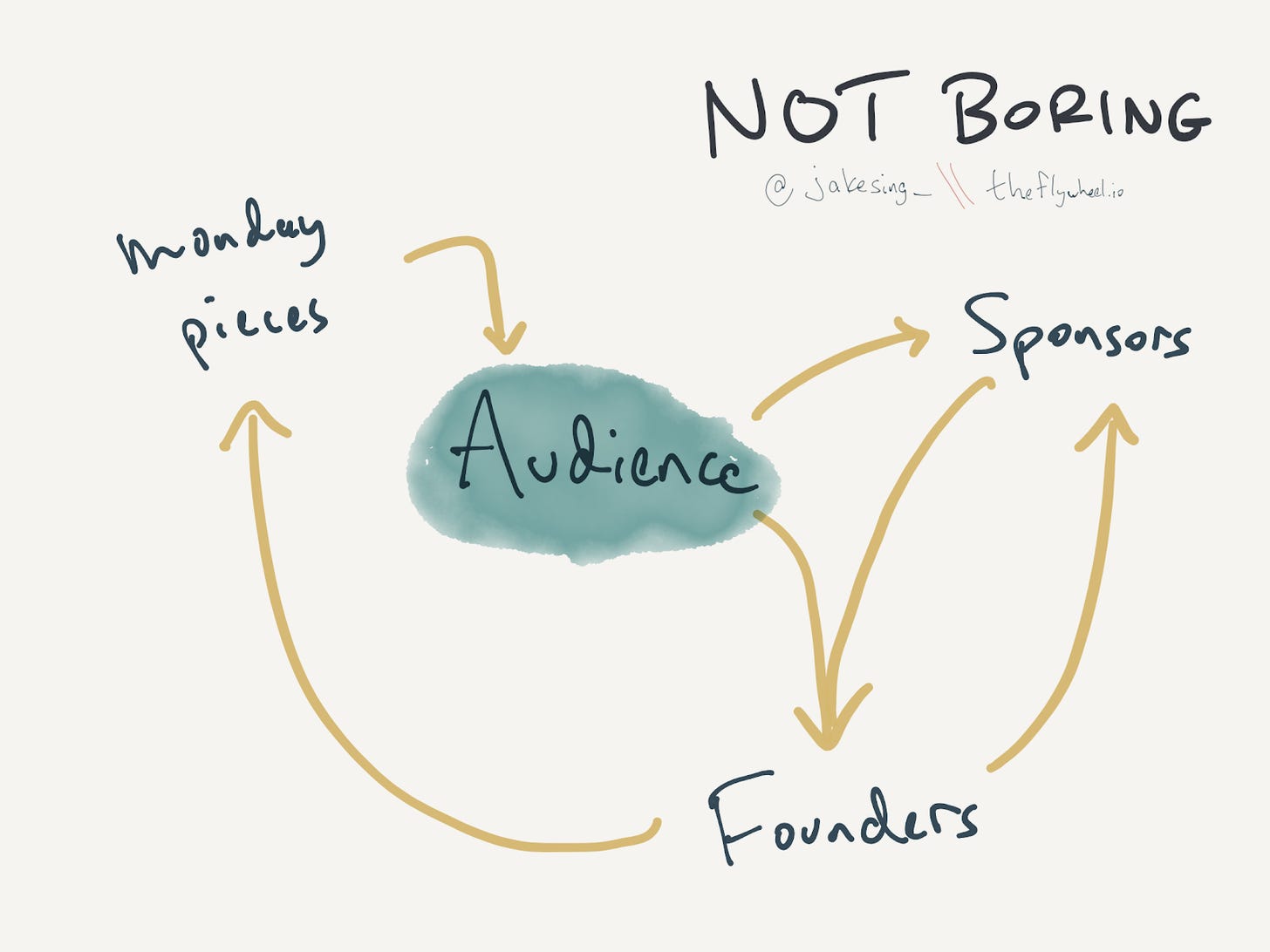

A year or two ago, a newsletter writer launching a venture fund as a solo GP would have been weird and newsworthy. Now, Solo Capitalists are a growing force in the market, and individuals are raising funds more frequently. People like Turner, Li, Nikhil, and Lenny are out there running great funds already. So I can’t just announce the fund. That would be boring. Instead, I’ll take you behind the scenes of the fundraising process, talk about some of the investments Not Boring Capital has made thus far, and share the LP Update I sent yesterday. I’m still learning how all of this works, and as always, I figured it would be more fun if we learned together. Hopefully, after reading the memo and some of the updates, some of you will want to get involved, too. Introducing… Not Boring Capital. Fundraising: The MemoA venture capital fund is kind of like a startup. New fund managers (General Partners, or GPs) put together a deck (or in my case, a memo) highlighting the types of companies they’re planning to invest in, and how they are uniquely positioned to invest in the very best of that type of company, and they go out to pitch investors (Limited Partners, or LPs) on how that will translate into above-average returns. In a traditional PR announcement, this is the part where a journalist would say, “McCormick plans to invest in technology companies across many stages of their life, and believes that his ability to help companies tell their stories will help him get access to deals (we’re skeptical, although founders may be attracted to Not Boring’s audience of 60k readers).” Or something like that. Fair, but not particularly compelling. Instead of trying to boil it down to a pithy one-liner, I’m going to just share the actual memo that I wrote and shared with all of my potential LPs, lightly redacted and heavily annotated with commentary and clarification on certain ideas, examples, and terms. You can read it here in all its glory: The short version of the pitch is that Not Boring is and does a few things -- newsletter, syndicate, investment memos, sponsored deep dives, Twitter, podcast, and Twitter Spaces -- that come together in the Not Boring Flywheel. In early March, Jake Singer wrote a piece on Not Boring called Million Dollar Newsletter in his newsletter, The Flywheel, in which he wrote:

The Flywheel should help me do the three things I need to do to run a successful fund:

All of this sounds good on paper, but LPs understandably want to understand if it, you know, actually works. Since I’d been investing personally and with the Syndicate for nearly a year, I was able to highlight the types of investments that the Flywheel has helped us make. There are a few things people look for here:

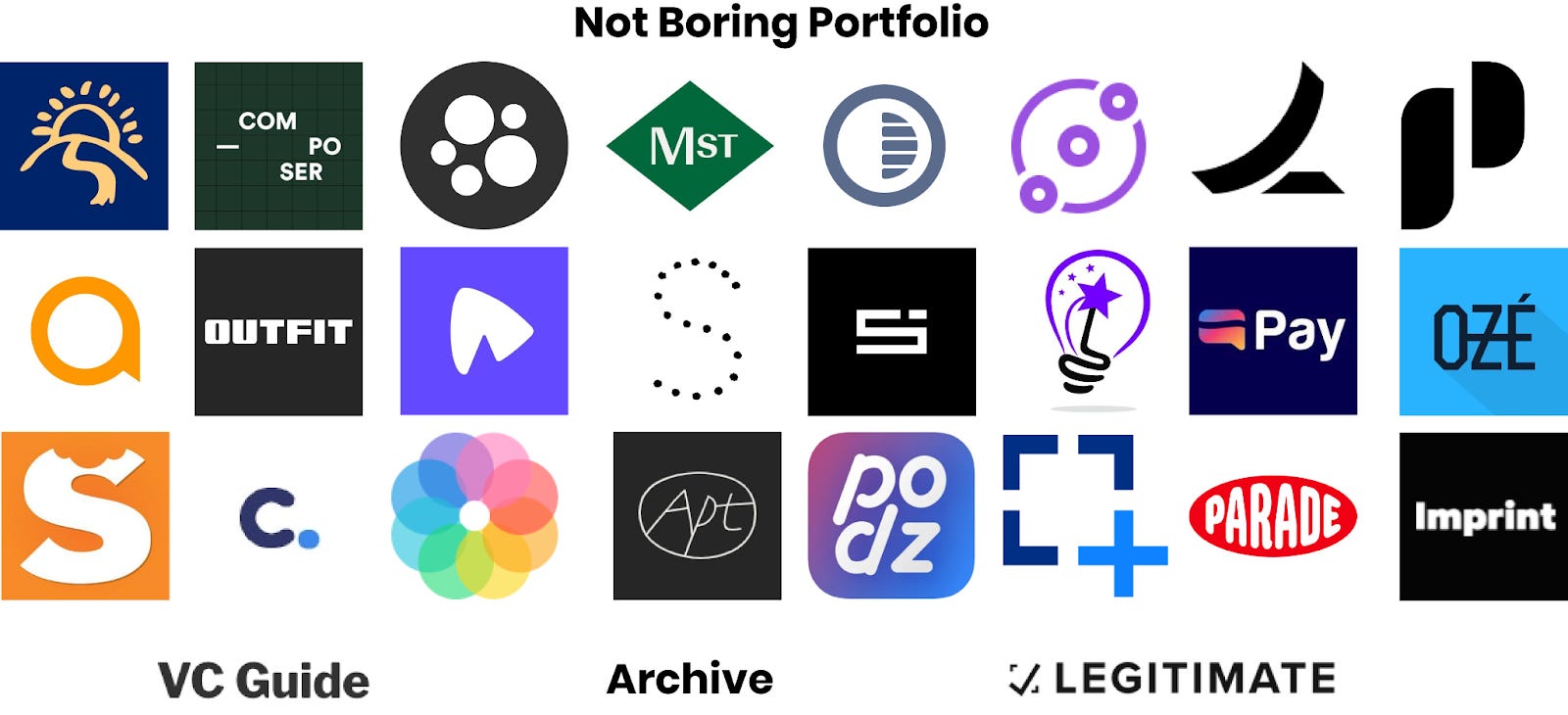

The memo, along with peoples’ familiarity with Not Boring, helped me raise over $7 million from some amazing LPs over the past three months. I pinch myself regularly when I look at the incredible roster of funds and people backing Not Boring Capital. Thrive Capital, a firm that I’ve looked up to since they invested in Harry’s (where Puja worked) and passed on Breather (where I worked), is the anchor LP in the fund. LPs include Bain Capital Ventures, Marc Andreessen and Chris Dixon (a16z), Neil Mehta (Greenoaks), Josh Kopelman (First Round), Giana Bianchini & Jane Stecyk (Mighty Networks), Saurabh Gupta (DST), Ben Gilbert & David Rosenthal (Acquired), Winslow Strong, Lan Xuezhao (Basis Set), Ankur Nagpal (Teachable), Jeff Lo & Eva Weng, Sung Ho Choi (Fubo), John Borthwick (Betaworks), Medha Agarwal (Redpoint), Michael Batnick (Ritholtz), Jeff Richards (GGV), David Lee (Samsung) Niv Dror, Moshe Lifschitz, Todd Goldberg, and Rahul Vohra (Deploy), Stefanie Silverman, Boris Wertz (Version One), Rob Alexander (Capital One), Nick Abouzeid (MainStreet) Doug Imbruce & Molly Borman Heymont (Podz), Adam Nelson (FirstMark), Henry Ault (Eco), Jonathan Wasserstrum (SquareFoot), Dror Poleg, Morgan Sze (Azentus), Benny Page (Epidemic Sound), Jonathan Forster (early Spotify), Nikhil Basu Trivedi (Footwork), Tetsuro Miyatake, Pankaj Agarwal, Andreas Lan, Thomas McGannon, plus some of my closest friends, family, Twitter friends, and Not Boring Syndicate backers. A particularly huge thanks to Gaurav Ahuja at Thrive, Niv Dror at Shrug Capital, and Turner Novak at Banana Capital for your incredible generosity with advice and LP introductions. These guys put the helpful in “Let me know how I can be helpful.” Just like a startup, raising money is just the beginning. It reset the clock on my track record back at 0:00. Investing Out Of Not Boring CapitalI’ve been investing out of Not Boring Capital Fund I for three months, ever since the first checks hit the account. That means that we already have a full quarter under our belts, and in Q2, Not Boring Capital invested $1.78 million in 20 companies. That’s faster than I’d anticipated. Just like startups send their investors updates about the business, often either monthly or quarterly, GPs send their LPs updates. Not Boring Capital sends quarterly updates, and I sent the first one yesterday. So instead of summarizing, I figured it would be more fun and informative to share with you what I shared with my LPs. Here’s the Update I sent out to Not Boring Capital’s LPs yesterday, lightly redacted to protect private company information, covering our portfolio, investment thesis, and thoughts on the market. Since this was the first update (and because I’m physically incapable of writing short emails), I went in-depth on the portfolio, how the Not Boring Flywheel that I’d pitched in the Memo is working, and how I’m approaching portfolio construction. A few highlights: Not Boring Capital is deploying faster than anticipated. As long as the opportunities we see continue to be strong, I’m going to lean into that on this and future funds. I wrote:

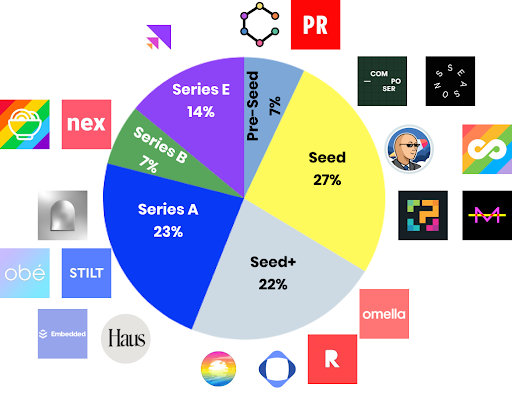

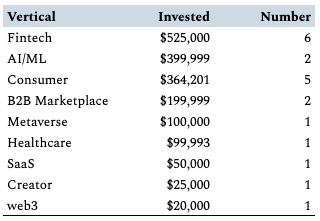

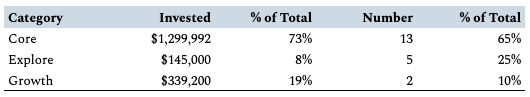

Our stage mix leans slightly earlier than planned. I wrote in the Memo that I was aiming to invest ⅓ in Pre-Seed and Seed, ⅓ in Series A, and ⅓ in Series B and beyond. We’re leaning a little bit earlier, with 79% of invested dollars in Pre-Seed through Series A and 21% invested in Series B and beyond. Fintech is our leading vertical. From a vertical perspective, the winner both by number of investments (6) and dollars invested ($525k) is fintech, with a focus on investing tech (Composer, Party Round, Embedded, Stonks). Here’s the rough breakdown by vertical: You can imagine how devastated I was, then, to see that Prof G came out bullish on fintech yesterday:   As the pace of investments picks up, I’m focused on portfolio construction. There are three categories of investments I’m making: Core, Explore, and Growth.

So far, we’re tracking right in line with those ranges: Honestly, the pace of investments kept me up at night, but I’m confident that if I keep the quality bar incredibly high, I shouldn’t set arbitrary pace constraints. I wrote:

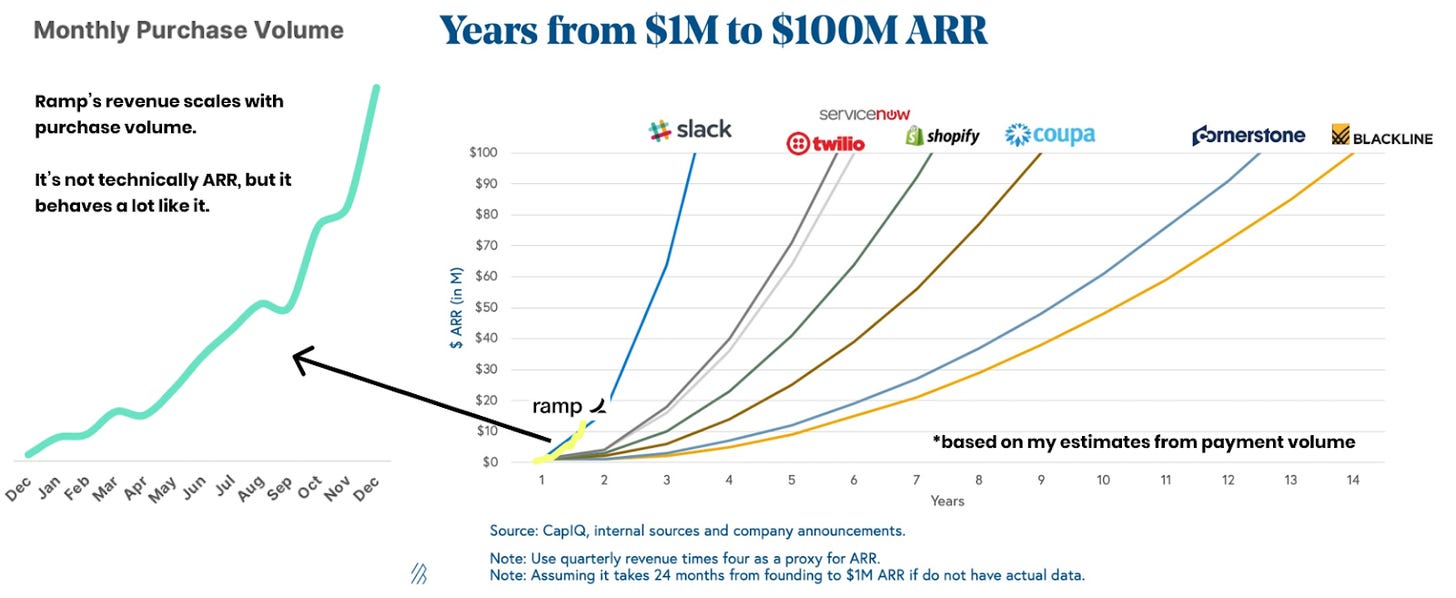

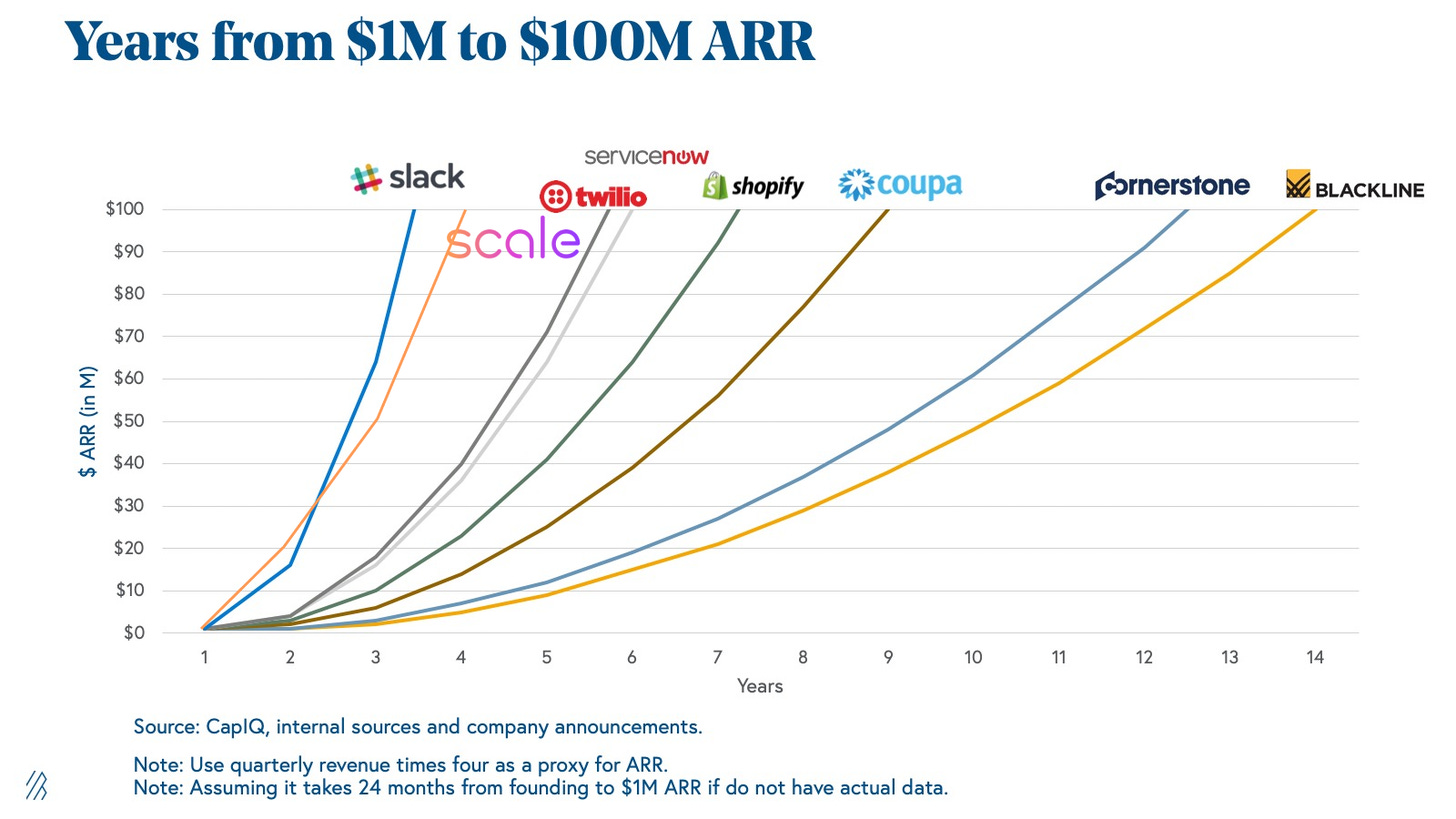

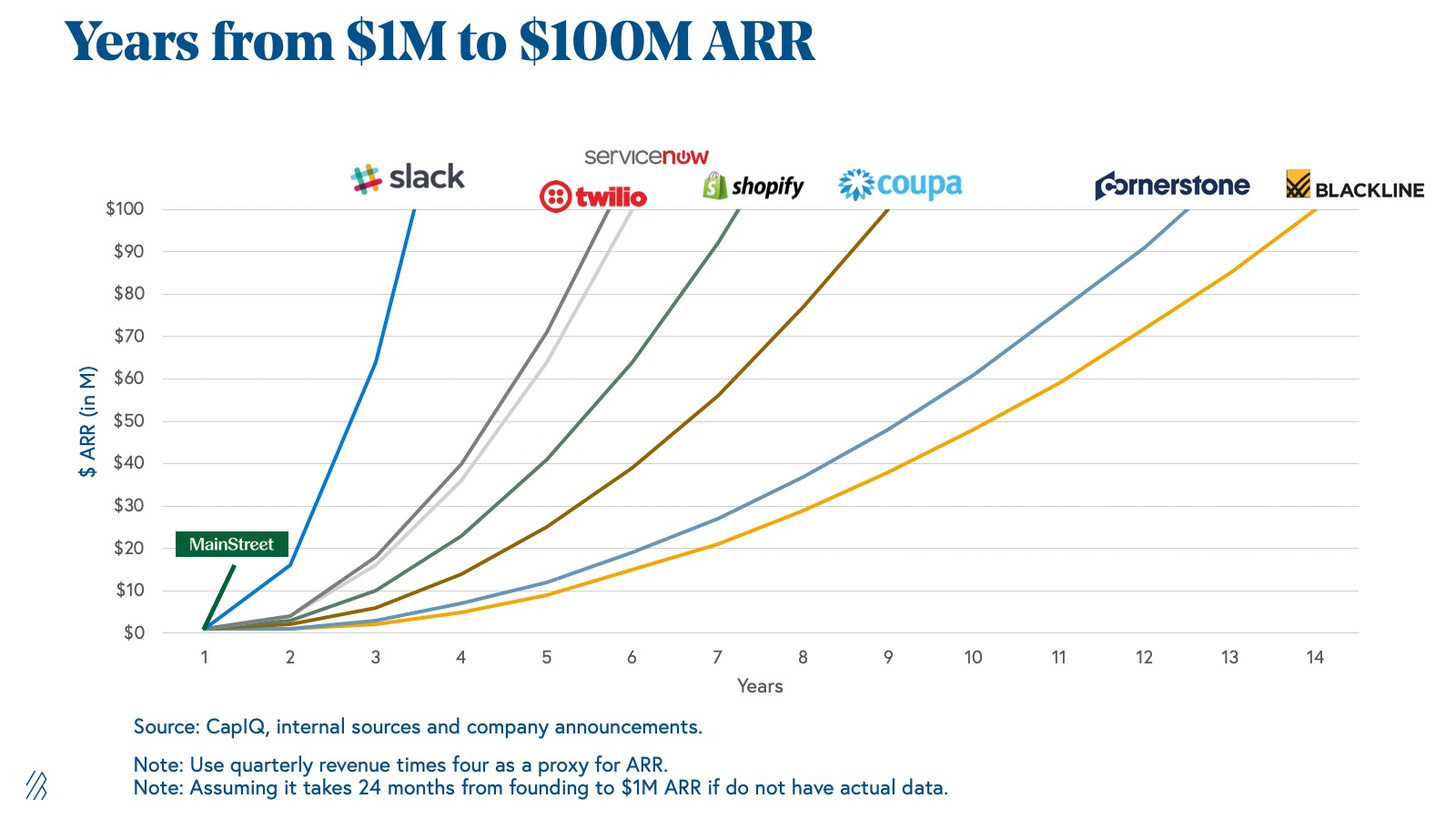

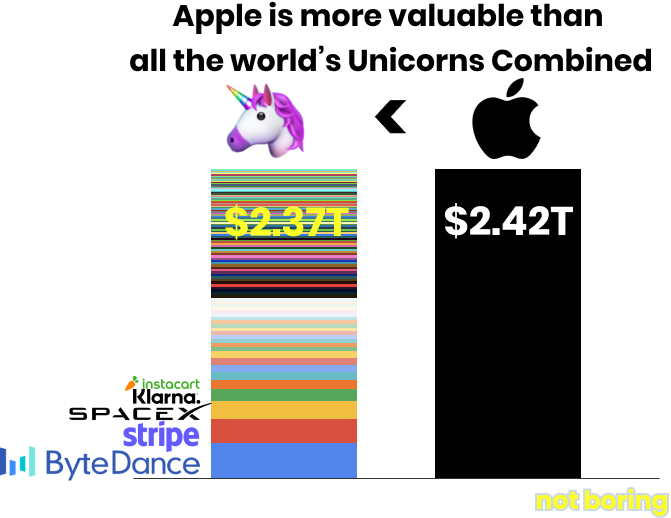

The challenge then becomes finding multiple 100x companies. That’s always hard, but at first glance, it appears to be a particularly big challenge when valuations at every stage have increased. If you’ve been reading Not Boring for a while, though, you’ll know that’s not what I think. I believe that the early stage valuations reflect later stage potential, and that the upside for the best companies is higher than ever. ValuationsThis is a section I wrote in the LP Update, reproduced in full here. Prices are certainly high right now -- the median post-money valuation in the portfolio is $62 million -- but I strongly believe that investing in top decile companies will outperform bargain hunting. As I’ve written about in the newsletter (See: Ramp), the best startups are getting bigger and more mature, and generating more revenue, more quickly. Many of you are familiar with this idea, so I’ll just use a couple of examples to highlight that 1) companies are actually building bigger businesses faster, and 2) the upside for the best companies is higher than ever. Bigger businesses, faster. I love to use that BVP Cloud Index “Years from $1M to $100M ARR” chart and overlay today’s fastest-growing companies. See Ramp… Or Scale... Or MainStreet... MainStreet and Ramp are pacing ahead of Slack’s revenue growth, and Scale actually achieved the $100M mark faster than anyone other than Slack (beating out Twilio and Shopify). Higher Ceilings. So the businesses themselves are getting bigger faster, and from a valuation perspective, there’s more room to run to the upside. In late June, CB Insights released its latest Unicorn Market Map. As of June 24th, there were 728 private companies worth over $1 billion, up 221 since the beginning of the year, including thirty-two companies worth more than $10 billion. Between June 24th and today, 22 new Unicorns have joined the list; there are now 750 in CB Insights’ Real-Time Unicorn Tracker. The list doesn’t even include crypto… Of course, private funding rounds are not liquidity events, but valuations are anchored on real prices. As I wrote about in Dreams All the Way Up, it feels like early-stage valuations are based on a probability that the early stage company might become as valuable as the most valuable companies in the market or a category. In 2011, Exxon was the most valuable company in the world, with a market cap in the low-$400 billion range. Today’s most valuable company, Apple is worth $2.4 trillion, nearly 6x higher. Or put it this way: you could buy all of the unicorns in the world for less than Apple. The 750 unicorns have a combined valuation of $2.37 billion. Apple’s market cap is $2.42 trillion. If just one of those companies ends up being worth more than Apple one day, you get the other 749 for free. As those top-end valuations increase, at the same probability, you’d expect early stage valuations to increase in line. Plus, tech is spreading to places that were previously unreachable and creating new markets, and doing so with gross margins in the 70-90% range. The scale of the opportunity, and the benefits of scale, have changed permanently. Even at today’s higher prices, great companies that are growing fast, have strong business models, and are strategically savvy still have a lot of room to run. InvestmentsSo who are those great companies with room to run? In the second half of the memo, I went through each of the twenty companies in the portfolio and explained what they do and why I invested. Since a lot of the information in that section is non-public and not mine to share broadly, I had to remove it from the version of the Update I linked to above, but I do want to give a shout out to all of the companies that we invested in in Q2. You should 100% buy their products / follow them on Twitter / tell all of your friends about them.

Q3 is just getting started and we’ve already added some more excellent companies to the portfolio. I won’t mention any of them just yet because fundraises are still ongoing, but will be shouting them from the rooftops here and on Twitter when the time comes! Not Boring 🤝 Not Boring CapitalThere is no Not Boring Capital without all of you. I fully recognize that the reason LPs and founders are willing to talk to me is that all of you take the time to read, share, and engage with Not Boring. Most venture firms have a handful of people. Some have a hundred or so. We have 60,000 people. Not Boring Capital can do pretty well if it’s just me, but it can do phenomenally well if we’re all aligned and working towards our portfolio companies’ success. I want all of you to view these as your portfolio companies, but of course, we need to make it more interesting than that. My first inclination was to set up a DAO or social token that split a portion of Not Boring’s carry with all of you… until I talked to my friend Jess Sloss, the founder of Seed Club and my DAO/social token/web3 guru, who told me that was illegal. I love y’all, but I don’t want to go to jail. That said, we’re looking into other ideas on that front that are more legal and generally better. Stay tuned In the meantime, there are a few ways that you can get involved: Invest in Not Boring Capital I kept about 25 LP slots open for Not Boring readers and Syndicate LPs. Unfortunately, for now, you need to be an accredited investor to participate. If you’re interested in investing in Not Boring Capital, please fill out this quick form here: Not Boring Capital LP Interest. Priority will be given to long-time readers, people with high open rates, people who have backed Not Boring Syndicate deals, commitments over $25k, and women and people of color. Deal Partners Just last week, in the nick of time, AngelList rolled out a new feature: Deal Partners. I’m now able to share carry in specific deals with the people who introduce me to the teams. Here’s how it works: if you introduce me to a founder and I invest in the company based on your introduction, I’ll share some of the carry on that deal with you. If you know great founders who are raising or about to raise, you can submit deals here: Not Boring Capital Deal Submission. Deal Partners is new and I’m still figuring out exactly how it works, but there may also be ways to share carry with people who are particularly helpful to existing portfolio companies. Watch this space 👀 Party Round and Stonks There’s nothing better than Not Boring Capital portfolio companies helping Not Boring readers help Not Boring Capital portfolio companies. Both Party Round and Stonks may be able to let both accredited and non-accredited investors invest in companies (non-accredited via Reg CH). I can’t wait to be able to run syndicates alongside Not Boring Capital deals in which we can all invest together. Not Boring Syndicate The Not Boring Syndicate will remain alive and well. While there will be fewer deals since I need to give the fund the first look, I’m going to be pushing for larger allocations so that I can continue to bring deals to the Not Boring Syndicate. I will also continue to co-syndicate other syndicates’ deals. A year in, founders really appreciate the power of getting dozens of Not Boring people in their corner in just one line on the cap table. To the extent that you have creative ideas to get the Not Boring community more involved in Not Boring Capital, I’m all ears. A solo GP is way less impactful than a 60k-person strong army. Just Getting StartedI’ve always told Puja that if I were somehow able to retire young, I’d want to do three things:

Thanks to all of you, I’ve somehow been able to turn that amalgamation of desires into my job. Instead of sitting on the sidelines and pontificating, I get to roll up my sleeves and help the companies we talk about in the newsletter. I feel unbelievably lucky, and honestly, I feel an unbelievable amount of pressure. I don’t want to mess this up. As I told Not Boring Capital’s LPs in yesterday’s letter: “If things go well, one day 25 years from now, I’ll be sending LP Update 100.” I want to do this for a long time. I want to build a world-class fund. And I want to use this platform we have to give our portfolio companies the best possible chance of success. The best way I know to do that is together. Thanks to Dan, Puja, and Henry for editing! How did you like this week’s Not Boring? Your feedback helps me make this great. Loved | Great | Good | Meh | Bad Thanks for reading and see you on Monday! Packy If you liked this post from Not Boring by Packy McCormick, why not share it? |

Older messages

Unit21: No-Code, Much Power

Saturday, July 10, 2021

Meet the $300M Tiger-Backed Startup Empowering Operators One Vertical at a Time

Not Boring AMA

Monday, June 28, 2021

Peak of Hand-Drawn Graphics? How could Not Boring Fail? Biggest misses?

The Secret 3-Step Master Plan to Cure Healthcare

Thursday, June 24, 2021

NexHealth is Raising a $31 Million Series B to Fuel its Ambition

Scale: Rational in the Fullness of Time

Monday, June 21, 2021

Meet the Five-Year-Old, $7.3 billion Stripe for AI

The Cooperation Economy 🤝

Friday, June 18, 2021

Or How to Build a Liquid Super Team

You Might Also Like

🔮 $320B investments by Meta, Amazon, & Google!

Friday, February 14, 2025

🧠 AI is exploding already!

✍🏼 Why founders are using Playbookz

Friday, February 14, 2025

Busy founders are using Playbookz build ultra profitable personal brands

Is AI going to help or hurt your SEO?

Friday, February 14, 2025

Everyone is talking about how AI is changing SEO, but what you should be asking is how you can change your SEO game with AI. Join me and my team on Tuesday, February 18, for a live webinar where we

Our marketing playbook revealed

Friday, February 14, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Cribbage Day, Reader... Don't get skunked! In today's

Connect one-on-one with programmatic marketing leaders

Friday, February 14, 2025

Enhanced networking at Digiday events

Outsmart Your SaaS Competitors with These SEO Strategies 🚀

Friday, February 14, 2025

SEO Tip #76

Temu and Shein's Dominance Is Over [Roundup]

Friday, February 14, 2025

Hey Reader, Is the removal of the de minimis threshold a win for e-commerce sellers? With Chinese marketplaces like Shein and Temu taking advantage of this threshold, does the removal mean consumers

"Agencies are dying."

Friday, February 14, 2025

What this means for your agency and how to navigate the shift ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Is GEO replacing SEO?

Friday, February 14, 2025

Generative Engine Optimization (GEO) is here, and Search Engine Optimization (SEO) is under threat. But what is GEO? What does it involve? And what is in store for businesses that rely on SEO to drive

🌁#87: Why DeepResearch Should Be Your New Hire

Friday, February 14, 2025

– this new agent from OpenAI is mind blowing and – I can't believe I say that – worth $200/month