Together, More Bull, More Bear, More Fun

Together, More Bull, More Bear, More FunPinduoduo: A Chinese Characteristics x Not Boring Collab

Welcome to the 2,932 newly Not Boring people 🤯 who have joined us since last Monday! Join 64,437 smart, curious folks by subscribing here: 🎧 To get this essay straight in your ears: listen on Spotify or Apple Podcasts (soon) Today’s Not Boring is brought to you by… Write of Passage I’ve never made a higher-ROI investment than Write of Passage. It’s not even close. Back in April 2019, I was bored at work, my brain was atrophying, and I was at best a passive participant in the Great Online Game. Then I saw a tweet from David Perell about a course he was running, Write of Passage. I loved writing and I was bored, so I decided to take a flyer. Two years later, I can trace every good thing that’s happened to me professionally -- this newsletter, Not Boring Capital, friendships with great people -- back to that course. Over the next couple of weeks, I’m going to go in-depth on my writing journey, leading up to a live workshop with David on August 11th. Over 4 short essays, I’ll tell you about:

I can’t recommend the course highly enough… but I’ll try. Sign up here to receive four emails from me and learn what writing online can do for you. Hi friends 👋 , Happy Monday! We’re back with China Tech Bull & Bear. Back in January, I wrote a piece about Alibaba. Lillian Li, whose writing on Chinese tech I’d read and respected, but who I’d never met, DUNKED on it on Twitter. She said that “the piece missed local context.” Which was fair. Among other points, she also pointed out that Pinduoduo was a threat to Alibaba. Lillian and I got to know each other after that exchange and decided to team up on a bull & bear piece about Agora, which we published in April. Now, we’re going right back to where it started in that original thread: Pinduoduo. When it comes to China tech, Lillian is one of a small handful of people I turn to. She writes a great newsletter called Chinese Characteristics. You should subscribe if you’re interested in China tech, and you should be interested in China tech: Let’s get to it. Pinduoduo: Together, More Bull, More Bear, More FunThe Summer of 2020 was the Summer of Pinduoduo. The Chinese ecommerce company that describes itself as “Costco meets Disney” for its mix of great deals and great fun flew under the radar for two years after its July 2018 IPO. Despite unprecedented revenue growth -- the company did $1.9B in top-line revenue in 2018, its fourth year in operations -- its stock, PDD, climbed slowly to only $33 by the time COVID locked down the US. Then COVID unleashed the beast. In April, PDD broke $40. In May, it climbed over $60. It closed June at $85. That explosion, of course, caught the attention of the tech Twitterati. In May, Y Combinator’s Anu Hariharan wrote Pinduoduo and The Rise of Social E-Commerce. In July, Acquired dropped Pinduoduo. In August, Turner Novak went deep in Pinduoduo and Vertically Integrated Social Commerce. Packy even poked fun at all of the attention the company was getting and the US copycats that were sure to follow in a deck (Packy note: I was bored). As the temperature outside dropped, things cooled off for Pinduoduo in the fall. By late September, PDD fell back down to a more modest $71. The write-ups and podcasts slowed to a trickle. We’d acclimated to the awe. Nothing shocked us anymore, not even a business that doubled revenue to $4.3B in 2019as a five-year-old company. And then it RIPPED. As growth stocks around the world flew, PDD flew further and faster, rising as high as $212 per share in mid-February, good for a market cap north of $250 billion. Since then, due to a mix of China fear, the departure of its founder Chairman, and reversion to the mean, PDD has fallen over 50%, back down to where it stands today, a nice, palindromic $96.69 per share for a market cap of $122 billion. It’s been a bumpy ride. Where’s it all going to shake out? Would PDD’s $250B fall market cap still stand absent regulatory concerns? Or is PDD still overvalued at $122B? Is it just kind of just like a Groupon for fruit? Groupon grew quickly too... before it fell just as fast. Whether you’re a bull or a bear, Pinduoduo is an absolutely fascinating company that has created, remixed, and popularized key innovations like team buying, “Interactive Ecommerce,” and Consumer-to-Manufacturer (C2M). Fans argue that PDD brought the shopping mall to customers’ phones for the first time. No one can argue that its ascent from $0 to nearly $10 billion in revenue has been anything short of spectacular. In the bullest of bull cases, it even has a shot at powering commerce in the Metaverse, backed by its largest outside shareholder and Metaverse-kingmaker, Tencent. But questions remain. Under “new” leadership, will Pinduoduo continue to innovate, or will it slowly blend into the Chinese ecommerce landscape as it steals features from its bigger rivals, and they do the same to it? Today, we’re going to explore PDD’s last year before debating whether its stock is a buy or sell. (Of course, this is for entertainment purposes only, and is not investment advice!) When we wrote about Agora in April, Lillian took the bear case, and I, as usual, took the bull case. For PDD, the roles are… exactly the same. Lillian’s playing the pragmatic bear, Packy is playing the wide-eyed gweilo optimist. Before we get there, we’ll cover:

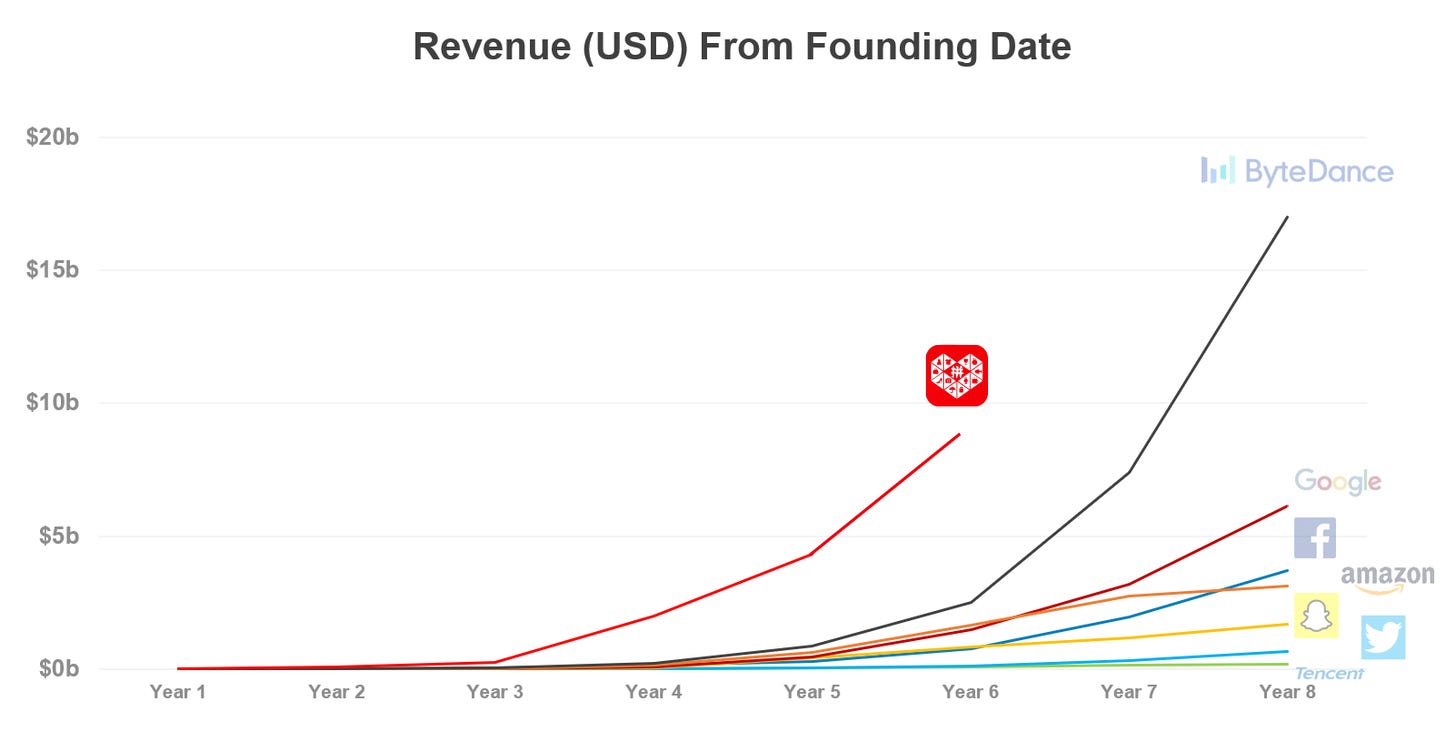

A Brief History of PinduoduoPinduoduo’s meteoric rise is unprecedented. In just six years, the company, founded by Colin Huang in 2015, reached $9.2B in revenue on the fastest revenue growth trajectory of any company in history. It hit the $100B market cap mark faster than any company in history, too. That kind of growth attracts attention, and Pinduoduo has been well-covered. If you want to go super deep and get the full backstory, we highly recommend you check them out:

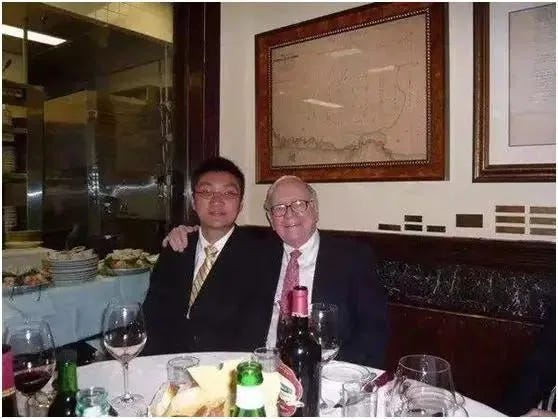

For today, we’ll stick to the bits that will be most important for the rest of the piece, including giving the new CEO and Chairman Chen Lei a little more shine. Investors were rightly concerned by Founder, CEO, and Chairman Colin Huang’s departure from his company; they should know that they’re in familiar hands with Lei. From that perspective, the first thing to know is that both Lei and Huang are geniuses with a long history of studying and working together. Huang, Pinduoduo’s founder, grew up humbly in Hangzhou, the home of Alibaba. His prodigious math skills took him to the upper-class Hangzhou Foreign Language School at age 12 and to Zhejiang University to study computer science on scholarship in college. The president of the University called Colin personally to persuade him to attend. During college, he interned at Microsoft in both China and the US, and spent time on online forums, where he met NetEase founder William Ding. Ding opened doors for Huang, introducing him to a who’s-who of Chinese tech, including SF Express founder Wang Wei, Tencent founder Pony Ma, and BBK Electronics founder Duan Yongping. Yongping proved to be an especially important friend and mentor: after Huang graduated from a Masters program at the University of Wisconsin-Madison, for example, Yongping convinced him to join Google pre-IPO. That decision made Huang millions. He later backed Huang’s startups and even took him to lunch with Warren Buffett in 2006.

That same year, while at Google in Mountain View, Huang was tasked with launching Google China along with Dr. Kai-Fu Lee and a small team. Part of the job was flying back and forth between China and California to get even minor changes approved by Google’s founders, Larry Page and Sergey Brin, and he hated it. In 2007, he quit and began his entrepreneurial journey by launching ouku.com, an online electronics store. With him at Ouku was an R&D Architecture Engineer named Chen Lei. As impressive as Huang’s math skills were, Lei’s may have been superior. And Lei had the medals to back up his world-class brilliance. In 1996, the 17-year-old Lei won Gold at the International Olympiad in Informatics in Hungary, and he came back the next year and grabbed a Bronze. He attended Tsinghua University, widely recognized as the best Chinese university, and afterwards obtained a PhD from the University of Wisconsin-Madison, like Huang.

Lei attended Wisconsin a few years before Huang, so the two didn’t meet there, but after stints at Google (like Huang), Yahoo!, and IBM, Lei moved back to China in 2007 to work at Huang’s first startup: ouku.com. The duo has worked together ever since. In 2011, Lei went to work for Huang’s online gaming company, Xinyoudi Studio, as CTO. Four years later, Huang got the band back together at Pinhaohuo, a DTC fruit company that was the predecessor to Pinduoduo. Lei was a member of the founding team in 2015, and was promoted to CTO in 2016. Pinhaohuo lasted only a year as a standalone company, but it did two things that would contribute to Pinduoduo’s eventual success: WeChat and Logistics. WeChat is China’s most popular messaging app. Today, its 1.2 billion users spend more time on WeChat than Americans spend on all social media apps combined. It’s a huge firehose of traffic... that the incumbent Alibaba couldn’t touch. WeChat is owned by Alibaba’s rival, Tencent, and as Turner points out:

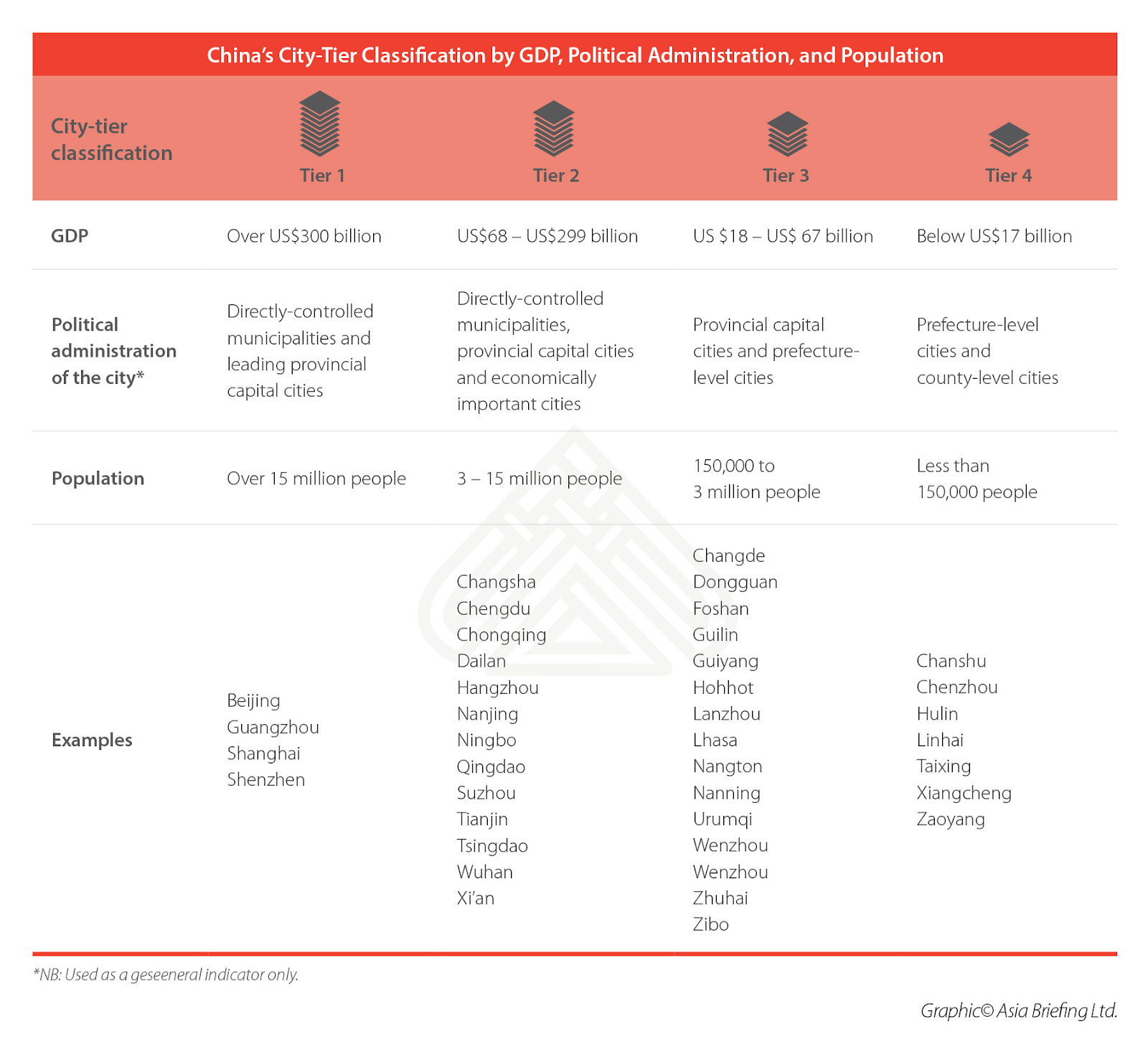

Hamilton Helmer fans will recognize that as one of the 7 Powers: counter-positioning. It worked beautifully. By September 2015, Pinhaohuo was the #1 free app in China, and handled over 100k orders per day, facilitated by its use of WeChat’s WeChat Pay, which made small transactions frictionless and affordable. The influx of demand for extremely perishable items (fruit) also forced Pinhaohuo to beef up its logistics. According to Turner, a surge in demand for lychees led Pinhaohuo to add 100 new ops employees, open six new warehouses, and reduce turnaround times dramatically. “Within a month, most fruit spent only a few hours in any of PHH’s six fulfillment centers,” Turner wrote. “The time from farm-to-table was often no more than two or three days.” Pinhaohuo also opened up their logistics beyond early partner SF Express (founded by Huang’s friend and investor, Wang Wei) in order to meet growing demand, and built features that let couriers bid for orders in real-time. They both tapped into China’s robust and affordable local logistics network, and built software to wrangle some of the chaos. When Huang merged Pinhaohuo with his gaming-commerce company, Pinduoduo, in 2016, the combined company had tens of millions of users, gaming DNA, and the logistics backbone to fulfill all of the demand that might create. Pinduoduo means “Together, More Savings, More Fun;” the name literally described exactly the combination the company was going for. That combination -- dubbed “social commerce” -- was a revelation that took the market by storm. When Pinduoduo entered the Chinese ecommerce race in earnest in 2016, the market was already full. You had Alibaba in first place with Taobao and Tmall, Tencent-backed JD comfortably in second, and no room for a serious third place contender... until Pinduoduo made room with some good old fashioned low-end disruption. Pinduoduo realized that there was an enormous swath of customers who were either overserved or completely unserved by China’s existing ecommerce platforms. Specifically, while Taobao and JD served first and second-tier cities, those with populations over 3 million people and the bulk of the country’s GDP, there was no affordable option for people in third-tier cities and below, who made up the vast majority of China’s population.

People in these cities had less money but more time. Many had never shopped online, but they did use WeChat. While price is always a strong attack vector, it was a particularly strong attack vector when trying to reach these previously unserved groups. With more time on their hands than their fellow citizens in cities like Shanghai and Beijing, these buyers were willing to do things like, say, play games and tell their friends to buy with them in exchange for discounts. Starting at the low-end of the market forced Huang, Lei, and team to completely rethink what a mobile-first ecommerce app should look like and prioritize. The result is Pinduoduo. To learn what Pinduoduo does, whether and how its model could work in the west, recent developments at the company, the Bull and Bear cases, and PDD’s Metaverse potential (you didn’t think I’d write a piece without mentioning the Metaverse, right?):Thanks to Dan for editing and to Lillian for teaming up! How did you like this week’s Not Boring? Your feedback helps me make this great. Loved | Great | Good | Meh | Bad Thanks for reading and see you on Monday! Packy If you liked this post from Not Boring by Packy McCormick, why not share it? |

Older messages

Infinity Revenue, Infinity Possibilities

Monday, July 19, 2021

The Deceptively Cute Game Growing Faster Than Any Company in History

Introducing Not Boring Capital

Monday, July 12, 2021

Behind-the-Scenes of Raising a Fund to Invest in Companies with Stories to Tell

Unit21: No-Code, Much Power

Saturday, July 10, 2021

Meet the $300M Tiger-Backed Startup Empowering Operators One Vertical at a Time

Not Boring AMA

Monday, June 28, 2021

Peak of Hand-Drawn Graphics? How could Not Boring Fail? Biggest misses?

The Secret 3-Step Master Plan to Cure Healthcare

Thursday, June 24, 2021

NexHealth is Raising a $31 Million Series B to Fuel its Ambition

You Might Also Like

🔮 $320B investments by Meta, Amazon, & Google!

Friday, February 14, 2025

🧠 AI is exploding already!

✍🏼 Why founders are using Playbookz

Friday, February 14, 2025

Busy founders are using Playbookz build ultra profitable personal brands

Is AI going to help or hurt your SEO?

Friday, February 14, 2025

Everyone is talking about how AI is changing SEO, but what you should be asking is how you can change your SEO game with AI. Join me and my team on Tuesday, February 18, for a live webinar where we

Our marketing playbook revealed

Friday, February 14, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Cribbage Day, Reader... Don't get skunked! In today's

Connect one-on-one with programmatic marketing leaders

Friday, February 14, 2025

Enhanced networking at Digiday events

Outsmart Your SaaS Competitors with These SEO Strategies 🚀

Friday, February 14, 2025

SEO Tip #76

Temu and Shein's Dominance Is Over [Roundup]

Friday, February 14, 2025

Hey Reader, Is the removal of the de minimis threshold a win for e-commerce sellers? With Chinese marketplaces like Shein and Temu taking advantage of this threshold, does the removal mean consumers

"Agencies are dying."

Friday, February 14, 2025

What this means for your agency and how to navigate the shift ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Is GEO replacing SEO?

Friday, February 14, 2025

Generative Engine Optimization (GEO) is here, and Search Engine Optimization (SEO) is under threat. But what is GEO? What does it involve? And what is in store for businesses that rely on SEO to drive

🌁#87: Why DeepResearch Should Be Your New Hire

Friday, February 14, 2025

– this new agent from OpenAI is mind blowing and – I can't believe I say that – worth $200/month