Not Boring by Packy McCormick - Is That a Family Office in Your Pocket?

Welcome to the 1,067 newly Not Boring people who have joined us since Monday! Join 65,504 smart, curious folks by subscribing here: 🎧 To get this essay straight in your ears: listen on Spotify or Apple Podcasts This week’s Not Boring, the whole thing, is brought to you by… Equi Equi puts a Family Office into the pocket of regular accredited investors. Read on to learn more. You can apply to be one of Equi’s 300 beta investors here: Hi friends 👋 , Happy Thursday! Today’s post is a kind that I’m writing more frequently on Thursdays: the Investment Memo x Sponsored Deep Dive crossover. I only write Sponsored Deep Dives about companies I’d want to invest in — the whole point is to expose you to some of the most exciting and innovative startups out there before anyone else does — and now that Not Boring Capital exists, I put my money where my mouth is whenever possible. You can read about how I select Sponsored Deep Dive subjects here, and increasingly, I plan to write them about portfolio cos. After learning more about Equi by writing this, I’ll be investing in the company, too. Speaking of portfolio companies… I’m launching the Not Boring Jobs Board, right here, right now. The board will feature open roles at Not Boring portfolio companies, and some other roles at fast-growing startups I think would be great places to work. To kick it off meta: I’m running the board on Pallet, a Not Boring portfolio company that’s getting an absurd amount of early traction, and my first featured role is… a Full-Stack Engineering role at Pallet itself. Calling it now: this will be a unicorn. And speaking of unicorns, Not Boring fav Ramp is hiring a Principal Product Designer. To apply, or to find yourself another Not Boring Job, go check out my Pallet. That leaves one challenge: what to do with the beaucoup bucks you make in your new dream job? Equi might be able to help… Let’s get to it. Is That a Family Office In Your Pocket?I am but a humble newsletter writer. I don’t have the power to command the stars. But my god have they aligned perfectly for this piece. When I first talked to Tory Reiss back in December, he was in the early stages of starting a new company. Since then, he and the company’s all-star team of co-founders raised a little money, went into the lab, and built. In June, he reached back out to tell me that it was almost ready, and asked if I could help explain what they’re doing. I said yes. We picked a date: July 29th. (That’s today.) We had no way of knowing then that today was going to be Robinhood’s first day of trading as a public company. Nor did we know that Titan was going to announce a $58M a16z-led Series B valuing the company at a $450M valuation last week. And even with all of the world’s crystal balls at our disposal we could never have guessed that a tweet about capital allocators, of all things, was going to take Twitter by storm. Those three events are relevant because Equi is a bit of the combination of the three, with a little extra sauce on top.

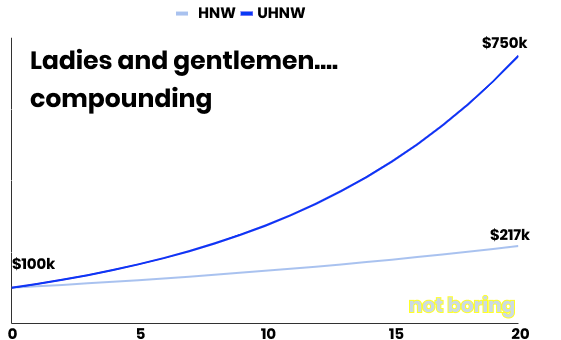

Equi takes pieces from all three, and combines them into something better: a tech-powered family office in your pocket. (Note: when I use the term Equi throughout the piece, I’m referring to both Equi’s investment advisor and Equi’s tech platform, which are two separate entities with different functions, but y’all don’t want to read the version that calls them different things throughout, so just know it.) Here’s the thing. The way that institutional investors and Ultra-High Net Worth individuals (UHNW or the .000001%) invest is very different from the way you or I invest, even if “you” are a High Net Worth (HNW or the 1%) individual. And it’s certainly not because the institutions don’t have the ability to invest the way that retail investors do… they have a broader universe of options available to them than we do, and they mix and match those options into portfolios with better risk-adjusted returns. The biggest difference between how they invest and how we invest? Alternative investments. Institutions and UHNW individuals, who often invest out of their own family offices, have on average roughly 50% of their portfolios in alternative investments like hedge funds, private credit, volatility, private real estate, crypto-backed lending, and more. Even HNW investors have closer to 6% on average in alternatives. That creates an enormous disparity in returns over the long-term. The average HNW investor has generated annualized returns of 2.5-5.4% over the past 20 years. The average UHNW investor has averaged 8.8-12.4% returns over the same period. That’s because diversifying with alternatives can increase returns and decrease volatility in a portfolio, which makes a big impact on how a portfolio grows. Throw compounding into the mix and the difference is enormous. After 20 years, $100k invested becomes $217k for the HNW investor, and $750k for the UHNW investor! The gap widens practically on its own. But before you get too envious, here’s another thing to know: a lot of the institutions aren’t actually great at allocating… They have access to alternative investments, but their process is often incredibly manual. They know a guy who knows a guy who runs a fund. References check out. Performance has been pretty good. If, per the tweet, MIT only allocates to the top 5%, they’re ahead of the curve. Definitionally, some institutions are allocating to the bottom 95%. Even most of the institutions allocating to the top 5% aren’t quantitatively structuring a portfolio of non-correlated managers. A small handful of alt-focused Fund of Funds do this, but they're nearly impossible to access and manage the money of a few ultra-rich clients. Equi’s value proposition is simple: it’s taking the best of the family office model, improving it by making data-driven investment decisions, and offering it to the (HNW, for now) people. Equi combines tech with smart humans to build the modern family office, like if Betterment and a top-tier quant alt-focused fund of funds had a baby. Although this is a Sponsored Deep Dive, it’s not meant to sell you on Equi specifically. For now, for regulatory and administrative reasons, the company’s investment arm can only let in 300 accredited investors, and their average investor is investing over $1.2m on the platform (although if that sounds like something you might be interested in, you can apply here, fill in Not Boring as the referral source, and I’ll badger the team to let you in). For perspective, to mimic a portfolio like the one they’ve assembled you would actually need well over $90m. Long term they aim to drive minimums lower so these investments become accessible to everyone. When I asked Equi’s co-founders their dream outcome for the piece, no one said “more customers.” Their answers were consistent:

So this piece will be about Equi, of course, but it’s also about a topic about which I’ve been banging the drum for nearly as long as I’ve been writing this newsletter: diversification across uncorrelated assets creates better risk-adjusted returns. Whether or not you invest through the Equi platform, you should be thinking about adding uncorrelated assets to your portfolio. In a bull market, YOLO trading on Robinhood has worked stunningly well. To deliver returns that compound over decades, you may need a slightly more sophisticated approach. Today, we’ll cover that and more:

A lot of what makes Equi tick under the hood is complex. I couldn’t build the portfolio that Equi offers. But the ideas it’s based on are pretty straightforward. It starts with understanding why the traditional portfolio structure no longer works. Re-Building a Modern PortfolioQuick: what’s the best way to structure your investment portfolio? For the past few decades, the answer has been easy: the 60/40 portfolio. Put 60% in equities, 40% in bonds and call it a day. That approach is easy to understand. 60% of your money should appreciate and grow, and 40% should generate income. Buy some index funds, buy some treasuries, call it a day. It’s also, unfortunately, the wrong approach today. Why? There are a few reasons.

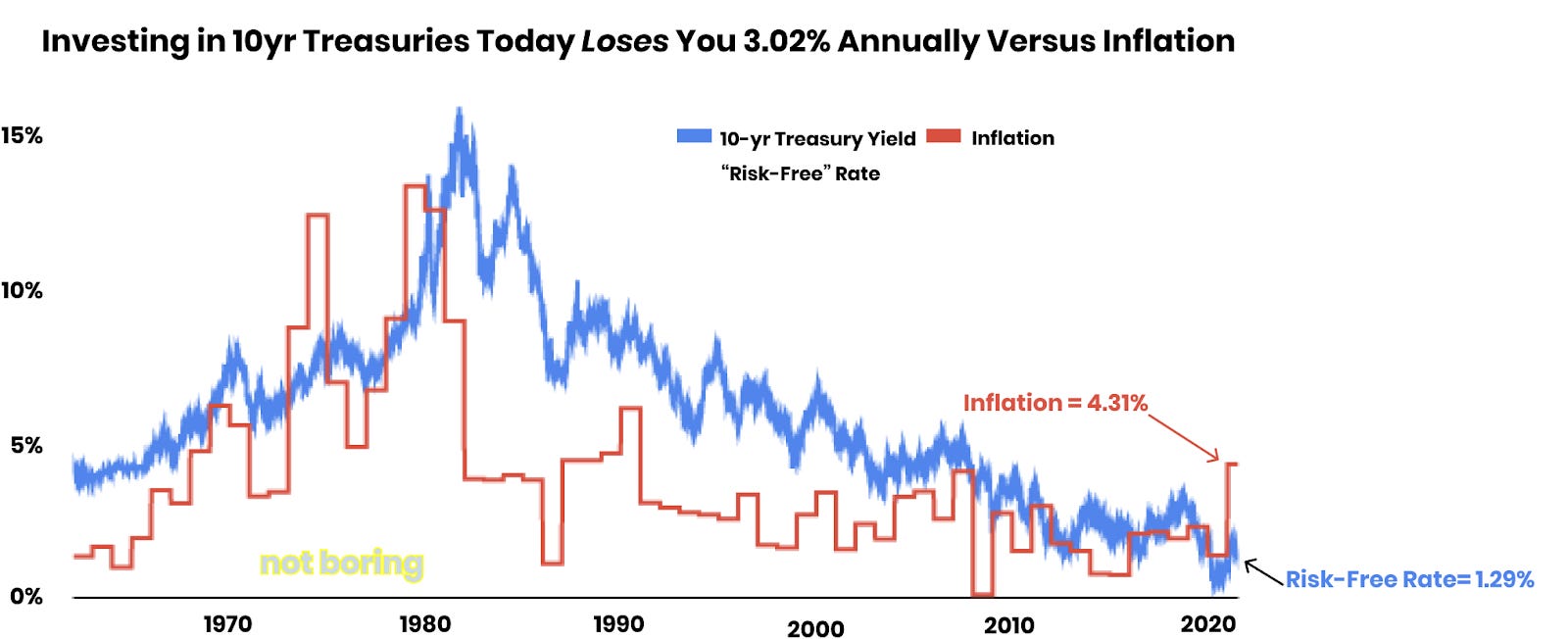

Let’s take each in turn. Interest Rates are Historically Low If you’ve been reading Not Boring, or watching the markets, or even turned on the news at some point over the past year, this one should not come as a surprise to you. Interest rates are historically low, which has driven up the price of growth assets and forced investors to look for returns in riskier assets. For most of recent history, investing in Treasuries was essentially free money. On the day I was born in 1987, the 10 Year Treasury yield, referred to as the “risk-free” rate because of the infinitesimally small chance that the US defaults on its debts, was 7.17%. Inflation that year averaged 4.43%. That meant that you could invest, with practically no risk, and have money with 2.74% more buying power the next year. Take a look at the historical chart of 10 Year Treasury yields versus inflation. Any time the blue line was higher than the red line, you could park your money in bonds and outpace inflation. It wasn’t sexy, and you weren’t going to outperform anyone by doing it, but money’s money.

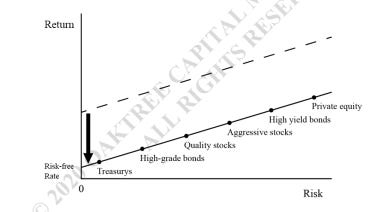

Since the Financial Crisis in 2009, that’s mostly flipped. Today, the risk-free rate is at 1.29% while inflation is at 4.31% (based on the Consumer Price Index, whether that’s accurately capturing real inflation is for another conversation). That means that if you invest in 10 Year Treasuries, your money buys 3% less every year. Oaktree’s Howard Marks wrote an excellent memo on this topic back in October titled Coming Into Focus. If you want to go deep, you should read the whole thing. The takeaway is that lower interest rates have a dramatic impact on every part of the market. When the risk-free rate is lower, returns on all other asset classes come down, too. To generate the same returns you were used to at a higher risk-free rate, you need to take on more risk. This is one of the reasons so much money has flowed into growth equities and venture capital since the Fed lowered rates in response to COVID. Long story short, bonds should not be 40% of your portfolio unless you have a strong thesis for why they should be. There’s alpha in the private markets if you pick the right managers and strategies. The difference between the 25th and 75th percentile managers in funds focused on traditional, publicly available assets like US Fixed Income or US Large Cap Equities is tiny. You’re probably better off avoiding paying the fees and just buying an index.

BUT, and this is one of the tropes that Tory wants to kill, that doesn’t mean that all hedge funds underperform the market after they take their fees. That’s become a popular narrative, and when you look at it in the aggregate, it looks true, but there is a huge variance in performance between top and bottom managers in private, alternative asset classes like Venture Capital, Real Estate, Growth Equity, Private Equity, Private Credit, and more. That means that you should be able to generate above-average risk-adjusted returns if you can pick, and allocate to, the best managers across a diversified portfolio of non-correlated strategies. To learn how alternatives are on the rise, how the Equi founders’ champagne problem turned into a mission to create generational wealth for as many people as possible, how Equi invests by allocating to the best managers, and how they plan to democratize access to private market investing… If you would like to apply to invest as one of Equi’s first 300 customers, you can right here: While they can’t guarantee anything, they will give Not Boring readers a special look. If you want to keep learning and go deeper down this rabbit hole, that’s what it’s all about! Sign up here to receive Equi’s emails and invites to Monthly Market Update Calls, and check out the Equi YouTube channel. It’s really excellent at explaining complex topics simply. How did you like this week’s Not Boring? Your feedback helps me make this great. Loved | Great | Good | Meh | Bad Thanks for reading and see you on Monday! Packy If you liked this post from Not Boring by Packy McCormick, why not share it? |

Older messages

Together, More Bull, More Bear, More Fun

Monday, July 26, 2021

Pinduoduo: A Chinese Characteristics x Not Boring Collab

Infinity Revenue, Infinity Possibilities

Monday, July 19, 2021

The Deceptively Cute Game Growing Faster Than Any Company in History

Introducing Not Boring Capital

Monday, July 12, 2021

Behind-the-Scenes of Raising a Fund to Invest in Companies with Stories to Tell

Unit21: No-Code, Much Power

Saturday, July 10, 2021

Meet the $300M Tiger-Backed Startup Empowering Operators One Vertical at a Time

Not Boring AMA

Monday, June 28, 2021

Peak of Hand-Drawn Graphics? How could Not Boring Fail? Biggest misses?

You Might Also Like

🔮 $320B investments by Meta, Amazon, & Google!

Friday, February 14, 2025

🧠 AI is exploding already!

✍🏼 Why founders are using Playbookz

Friday, February 14, 2025

Busy founders are using Playbookz build ultra profitable personal brands

Is AI going to help or hurt your SEO?

Friday, February 14, 2025

Everyone is talking about how AI is changing SEO, but what you should be asking is how you can change your SEO game with AI. Join me and my team on Tuesday, February 18, for a live webinar where we

Our marketing playbook revealed

Friday, February 14, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Cribbage Day, Reader... Don't get skunked! In today's

Connect one-on-one with programmatic marketing leaders

Friday, February 14, 2025

Enhanced networking at Digiday events

Outsmart Your SaaS Competitors with These SEO Strategies 🚀

Friday, February 14, 2025

SEO Tip #76

Temu and Shein's Dominance Is Over [Roundup]

Friday, February 14, 2025

Hey Reader, Is the removal of the de minimis threshold a win for e-commerce sellers? With Chinese marketplaces like Shein and Temu taking advantage of this threshold, does the removal mean consumers

"Agencies are dying."

Friday, February 14, 2025

What this means for your agency and how to navigate the shift ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Is GEO replacing SEO?

Friday, February 14, 2025

Generative Engine Optimization (GEO) is here, and Search Engine Optimization (SEO) is under threat. But what is GEO? What does it involve? And what is in store for businesses that rely on SEO to drive

🌁#87: Why DeepResearch Should Be Your New Hire

Friday, February 14, 2025

– this new agent from OpenAI is mind blowing and – I can't believe I say that – worth $200/month