Not Boring by Packy McCormick - Rivian: The Most Remarkable Adventure

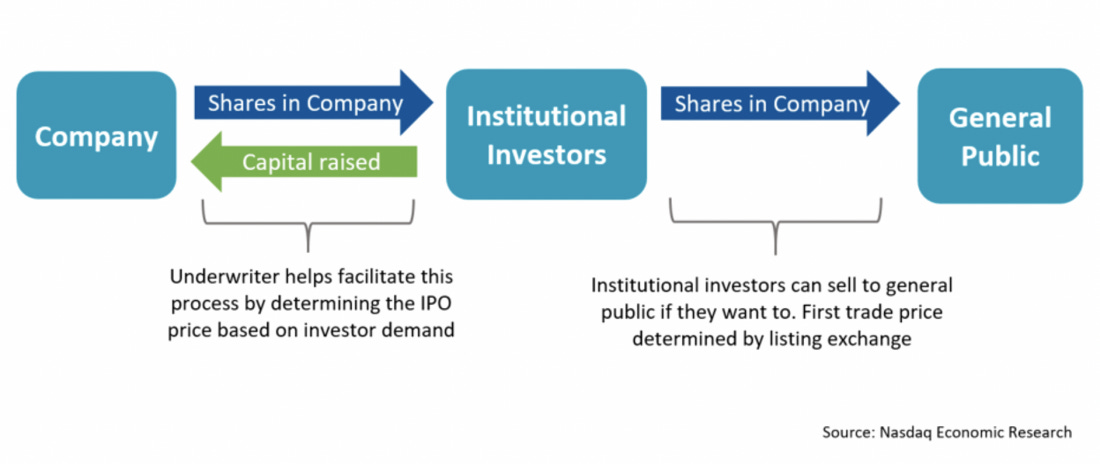

Rivian: The Most Remarkable AdventureA Deep Dive Into the 12-year-old, Amazon-backed, EV Adventure CompanyWelcome to the 552 newly Not Boring people who have joined us since Monday! Join 83,196 smart, curious folks by subscribing here: 🎧 To get this essay straight in your ears: listen on Spotify or Apple Podcasts (shortly) Hi Friends 👋, Happy Thursday! This is a unique one over here at Not Boring: it’s a Sponsored Deep Dive (you can read more about my Sponsored Deep Dive selection and thought process here), but it’s not sponsored by the company I’m writing about. I’m writing about Rivian’s IPO, but the piece is sponsored by SoFi. Before we get to the piece itself, I want to say a few words about why I’m writing it. SoFi is the only place regular retail investors can buy IPO shares of Rivian at the same time as the institutions. Retail investors getting IPO access is a new phenomenon, so we need new resources. A typical Initial Public Offering follows the same pattern:

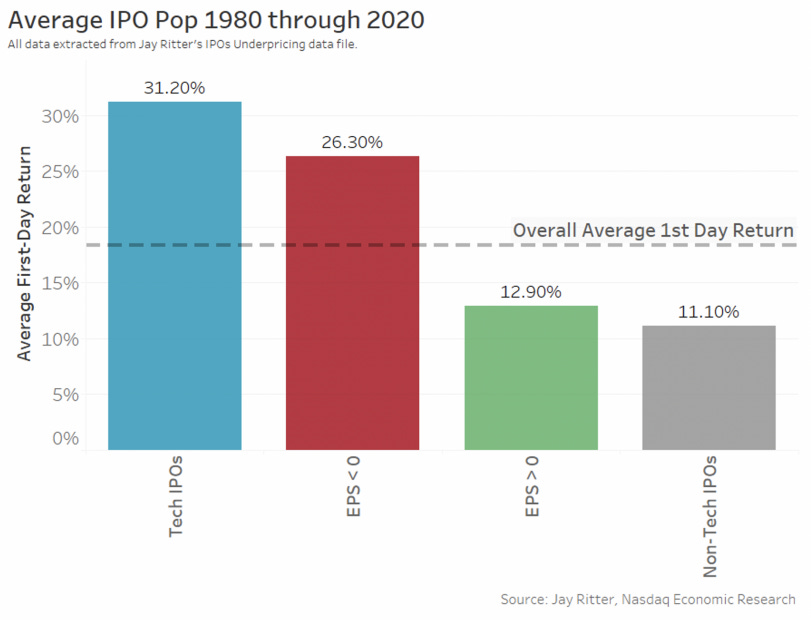

Nasdaq laid it out clearly in this graphic: The problem is, if you’re a retail investor, you’re probably going to pay significantly more than the institutions and HNW individuals. That’s a big part of the IPO pop: the difference between the price at which the institutions buy and where the stock closes its first day of trading. According to Nasdaq’s Jay Ritter, the average IPO pop from 1980 to 2020 was 18.4%. It was even higher for tech companies -- 31.2%! If you follow Benchmark’s Bill Gurley on Twitter, you know that he thinks the IPO pop, and the whole IPO process, is bad for companies. It means tech companies earn 30% less cash than they could for selling the same number of shares directly to the market. It’s also bad for retail investors, like us. It means that we can pay a 20-30% premium to the prices that well-connected institutions paid just hours earlier! (This should go without saying, but not all IPOs pop! Some crash. DYOR.) The trade that the companies were making was that they believed that these large institutional buyers would support the offering and hold the stock, giving them sturdy investor bases who would stick with the company and support its price in the public markets. The traditional IPO model was built for a different time, when private companies were less well-known to investors, and when retail investors were less active direct market participants. Now, software is eating the markets, and retail is getting involved. And the IPO process is changing, too. When Rivian, which makes electric trucks and SUVs, goes public next week, two groups will be able to invest in the companies IPO shares at the listing price in addition to the usual suspects:

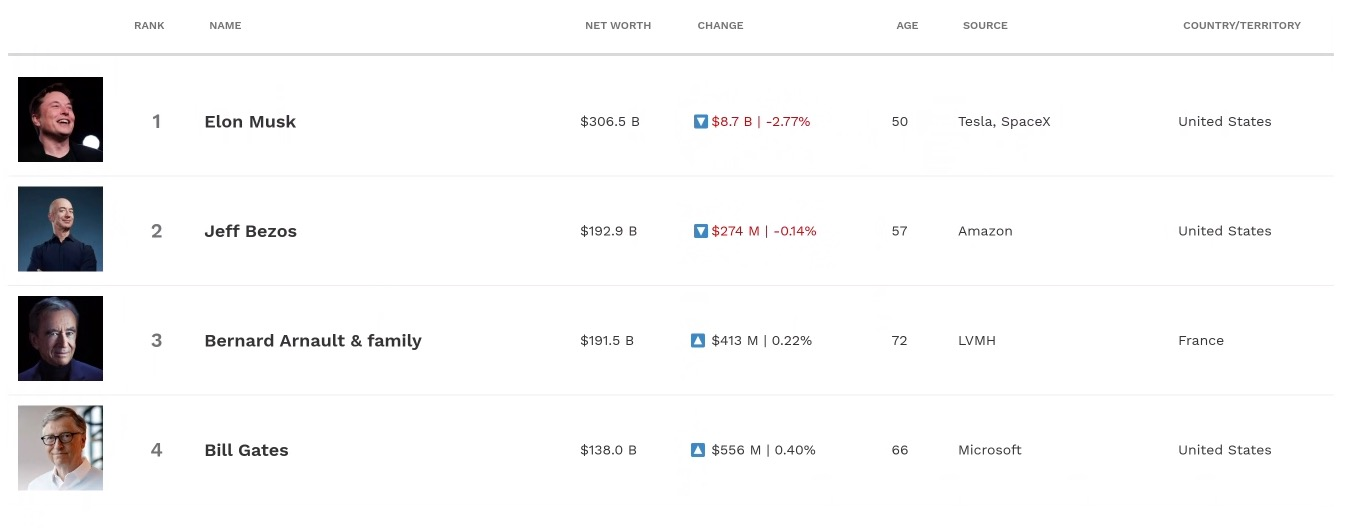

That’s why we’re here today. I partnered with SoFi to give my take on Rivian and the company’s IPO. Institutions and HNW individuals have access to sell-side research reports; you’re stuck with me. Rivian’s IPO will be one of the biggest and most hotly-anticipated of the year. SoFi will have no trouble finding buyers to fill its allocation. But this is the very early innings of a transition in which retail investors will hopefully get more and more access to IPO shares in the best deals. Companies are often nervous about retail investors, though. They’re worried we’re less likely to hold shares and more likely to sell on a pop. In order for retail to get more direct access, we need to not fuck it up. That means understanding what we’re buying, or not, and why. Knowledge makes the diamond hands. So today, we’ll explain the Rivian thesis and some risks so you’re ready. Disclaimer: This is not investment advice. I am not a registered investment adviser. We don’t know where Rivian will price. You should do your own research. This is just a starting point. Let’s get to it. Rivian: The Most Remarkable AdventureI’ll tell you this about Rivian’s R1S SUV and R1T pickup truck: they drive. It shouldn’t need to be said, but thanks to Nikola Motors, it does. Last year, in the face of growing skepticism over whether or not its Nikola One truck actually worked, Nikola released this promotional video, “Nikola One In Motion”:  Looks cool. Great music. Inspiring. The truck was, as promised, in motion. Just one problem. According to Hindenburg Research, “the video was an elaborate ruse—Nikola had the truck towed to the top of a hill on a remote stretch of road and simply filmed it rolling down the hill.” Nikola was a black eye on the electric vehicle (EV) space. Rivian is a bright spot. Not only does Rivian’s R1T drive, it drives really well. Kelly Blue Book gushed, “Not only is it a new kind of pickup truck, it is an excellent pickup truck.” MotorTrend was even more glowing, calling the 2022 Rivian R1T, “The Most Remarkable Pickup We’ve Ever Driven.” Rivian’s mission is to keep the world adventurous forever, which it’s doing by creating downright sexy electric pickup trucks and SUVs capable of handling rugged terrain and jumping from 0-60 in 3 seconds. After twelve long and winding years, the company is expected to go public next week. It’s planning to raise roughly $8 billion by selling 135 million shares at a price between $57-62 per share, which would represent a fully diluted market capitalization ((expected shares outstanding + options) * share price) of $55 - 60 billion, down from the $80 billion that’s been rumored since the company released its S-1 in the beginning of October. That would put it right in line with Lucid Motors, which shot up to a $63 billion market cap after it announced that it would be making the first deliveries of its $169k Air last weekend. Lucid is currently valued at a little over $59 billion. Rivian also just announced that it made its first deliveries of its R1T pickup trucks in October, the first of its three models to come to market. Its R1S SUV is expected to hit the streets in December, and its EDV delivery van, of which Amazon has ordered 100,000 through 2025, is scheduled to start delivering your packages in 2022. As of Halloween, Rivian has 55,400 pre-orders for the R1T and R1S. Then there’s Tesla. The 800 lb gorilla in the EV space has delivered 627,350 cars this year through the end of Q3. It’s run by Elon Musk, the first person in the history of the world to be worth more than $300 billion, a record he broke last week after Tesla broke a $1 trillion market cap for the first time. He makes Bill Gates look poor. A week later, Tesla is worth $1.16 trillion. It’s added more than two Rivians to its market cap in single-digit days. The EV market is hot. Many would argue it’s overheated. People have been screaming that Tesla is overvalued since I originally bought (and sold) TSLA in 2013. They’ve probably been right the entire time, and they’ve lost money practically the entire time. Elon has burned the shorts. People have learned not to bet against Elon, and the other EV companies have been beneficiaries. Remember Nikola? The one whose founder was forced to resign and charged with securities fraud? Even Nikola is worth $5 billion. The EV industry is the double-beneficiary of the government’s largesse: first, because the government offers tax incentives and subsidies to support the manufacturing and purchase of green vehicles, and second, because low rates and a tireless money printer have propelled the prices of growth stocks. That’s the backdrop against which Rivian is entering the market. It’s perfect timing for a company and a founder who have taken 12 years to reach this point. Rivian has no revenue; that’s been well-covered in the press around the IPO. It expects to lose $1.2 billion in Q3 this year as it begins delivering pickup trucks. It will need to spend roughly $5 billion to bring on its next production facility. It’s facing chip shortages that could lengthen delivery delays, and well-funded incumbents who are going all-in on electric trucks. It has no revenue. And yet, it will go public at a nearly $60 billion valuation. That seems outlandish on its face. But the company actually has a path to upside from there. It’s entering an electric pickup truck and SUV market that is temporarily wide-open. More than 70% of cars sold in the US are pickups and SUVs. The reviews for the R1T have been universally slobbery. And in a market in which companies are valued on a multiple of projected 2025 sales, it has a feasible path to growing into its valuation… if it does everything right. It’s worth digging in. Like any company, there’s a price at which it makes sense to buy Rivian, and a price at which it doesn’t. That’s not for me to decide for you -- this isn’t investment advice -- but we’ll cover some of the things you’ll need to make up your own mind:

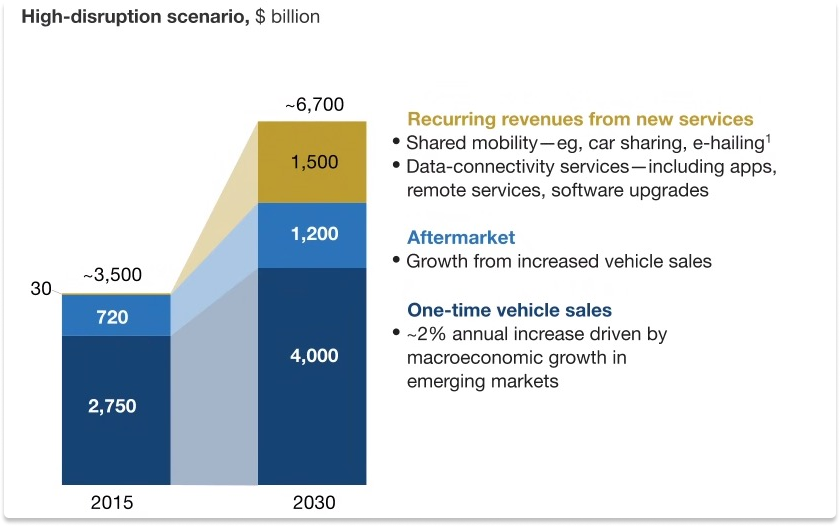

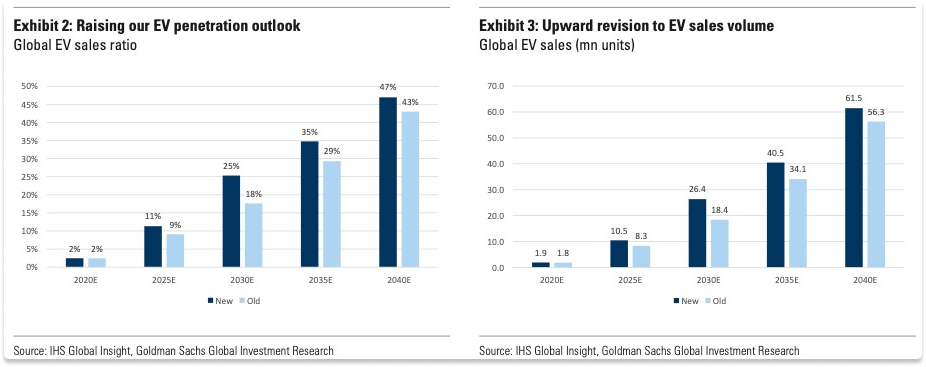

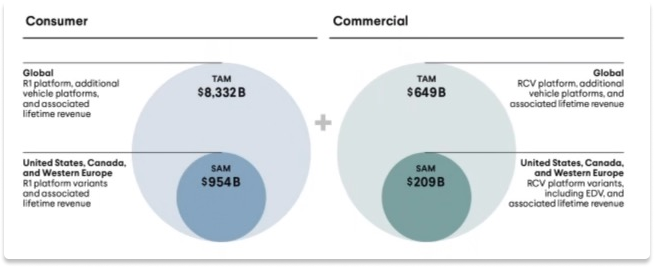

Ladies and gentlemen, start your engines. Setting the StageWe’ll get to the story of Rivian and all of the juicy details of the EV market in a minute, I promise, but before we do, it’s worth making sure that we’re all on the same page. There are a few facts that will be important to keep in mind and some simple factors that will contribute to Rivian’s value. First, the facts. The global automotive market is massive. McKinsey estimates that by 2030, there will be $4 trillion in annual vehicle sales, plus the potential for an additional $2.7 trillion in aftermarket and recurring revenue. Light trucks are the biggest chunk of the auto market in the US. In 2020, the light truck category -- pickups, vans, and SUVs -- represented 72% of US sales, and IHS Markit expects that share to grow to 78% by 2025. EV penetration will reach nearly half of all cars sold globally by 2040. Goldman Sachs recently revised its EV penetration and sales estimates upwards significantly, thanks in large part to stricter environmental regulations in the EU and the Biden Administration’s plan to support EVs. They forecast that EVs will make up 11% of global sales by 2025, 25% by 2030, 35% by 2035, and 47% by 2040. By 2030, Goldman projects that 26.4 million EVs will be sold worldwide each year, up 8 million, or 43%, from its previous projections. Putting it all together, it seems like a pretty great time to be selling electric light trucks (and services attached to them). Rivian itself views its market opportunity as all consumer vehicles, not just electric ones or light trucks. In the S-1, it calculates its consumer TAM as all of the cars sold in a year globally, multiplied by its average selling price plus the $67,900 in additional lifetime revenue from selling services, for a total of $8.3 trillion. It’s serviceable addressable market (SAM) is the same thing, just limited by the total number of cars sold in its bear-term markets: US, Canada, and Western Europe. That’s a very aggressive definition of TAM, but no matter how you slice it, the market it large enough to support multiple hundred-billion+ dollar companies. To learn what’s been going on in the EV Market, what Rivian is building, what the reviewers are saying, and how to evaluate Rivian…How did you like this week’s Not Boring? Your feedback helps me make this great. Loved | Great | Good | Meh | Bad Thanks for reading and see you on Thursday, Packy If you liked this post from Not Boring by Packy McCormick, why not share it? |

Older messages

Minimally Extractive Meta

Monday, November 1, 2021

Why Zuck Might Have to Actually Contribute to the Open, Interoperable Metaverse

Sc3nius

Monday, October 25, 2021

We're all gonna make it.

Playing Solo Games

Monday, October 18, 2021

Not Boring Capital: Fund I, Update II

The Model of Everything

Thursday, October 14, 2021

Not Boring Investment Memo on ScienceIO

Log in to Not Boring by Packy McCormick

Tuesday, October 5, 2021

Click here to log in

You Might Also Like

🔮 $320B investments by Meta, Amazon, & Google!

Friday, February 14, 2025

🧠 AI is exploding already!

✍🏼 Why founders are using Playbookz

Friday, February 14, 2025

Busy founders are using Playbookz build ultra profitable personal brands

Is AI going to help or hurt your SEO?

Friday, February 14, 2025

Everyone is talking about how AI is changing SEO, but what you should be asking is how you can change your SEO game with AI. Join me and my team on Tuesday, February 18, for a live webinar where we

Our marketing playbook revealed

Friday, February 14, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Cribbage Day, Reader... Don't get skunked! In today's

Connect one-on-one with programmatic marketing leaders

Friday, February 14, 2025

Enhanced networking at Digiday events

Outsmart Your SaaS Competitors with These SEO Strategies 🚀

Friday, February 14, 2025

SEO Tip #76

Temu and Shein's Dominance Is Over [Roundup]

Friday, February 14, 2025

Hey Reader, Is the removal of the de minimis threshold a win for e-commerce sellers? With Chinese marketplaces like Shein and Temu taking advantage of this threshold, does the removal mean consumers

"Agencies are dying."

Friday, February 14, 2025

What this means for your agency and how to navigate the shift ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Is GEO replacing SEO?

Friday, February 14, 2025

Generative Engine Optimization (GEO) is here, and Search Engine Optimization (SEO) is under threat. But what is GEO? What does it involve? And what is in store for businesses that rely on SEO to drive

🌁#87: Why DeepResearch Should Be Your New Hire

Friday, February 14, 2025

– this new agent from OpenAI is mind blowing and – I can't believe I say that – worth $200/month