Coin Metrics' State of the Network: Issue 147

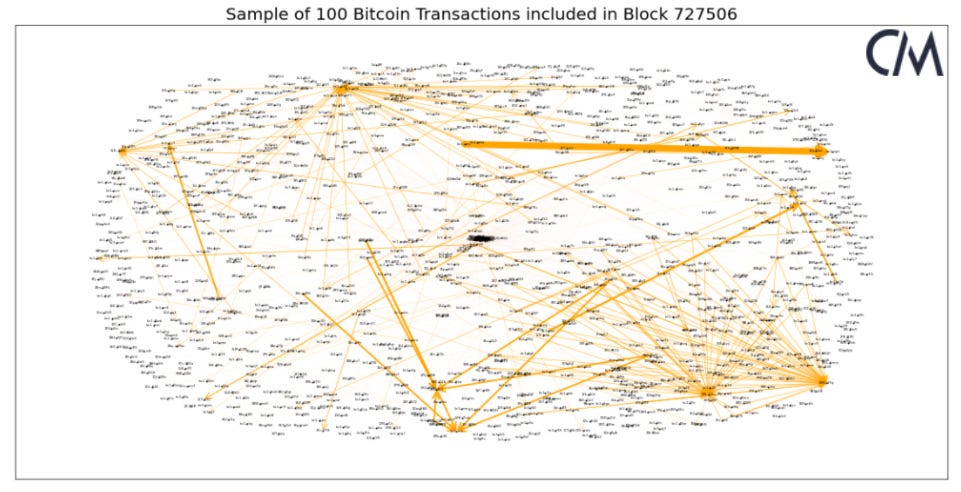

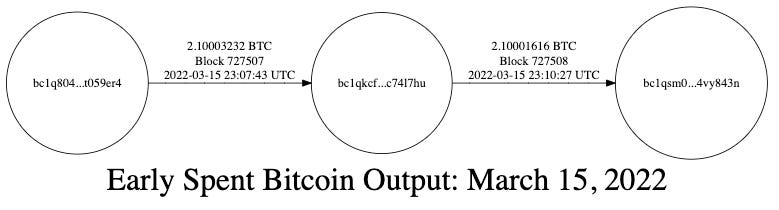

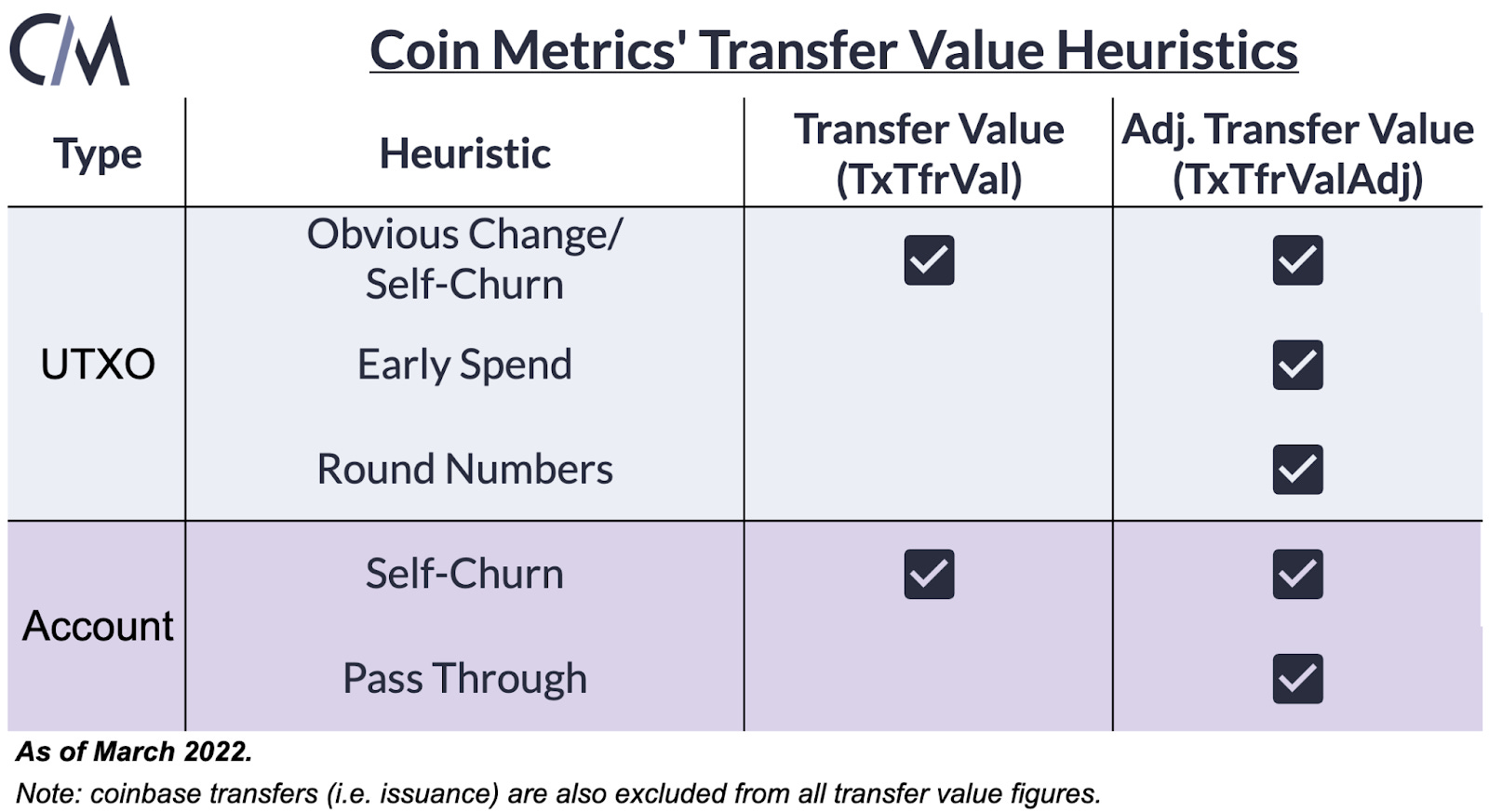

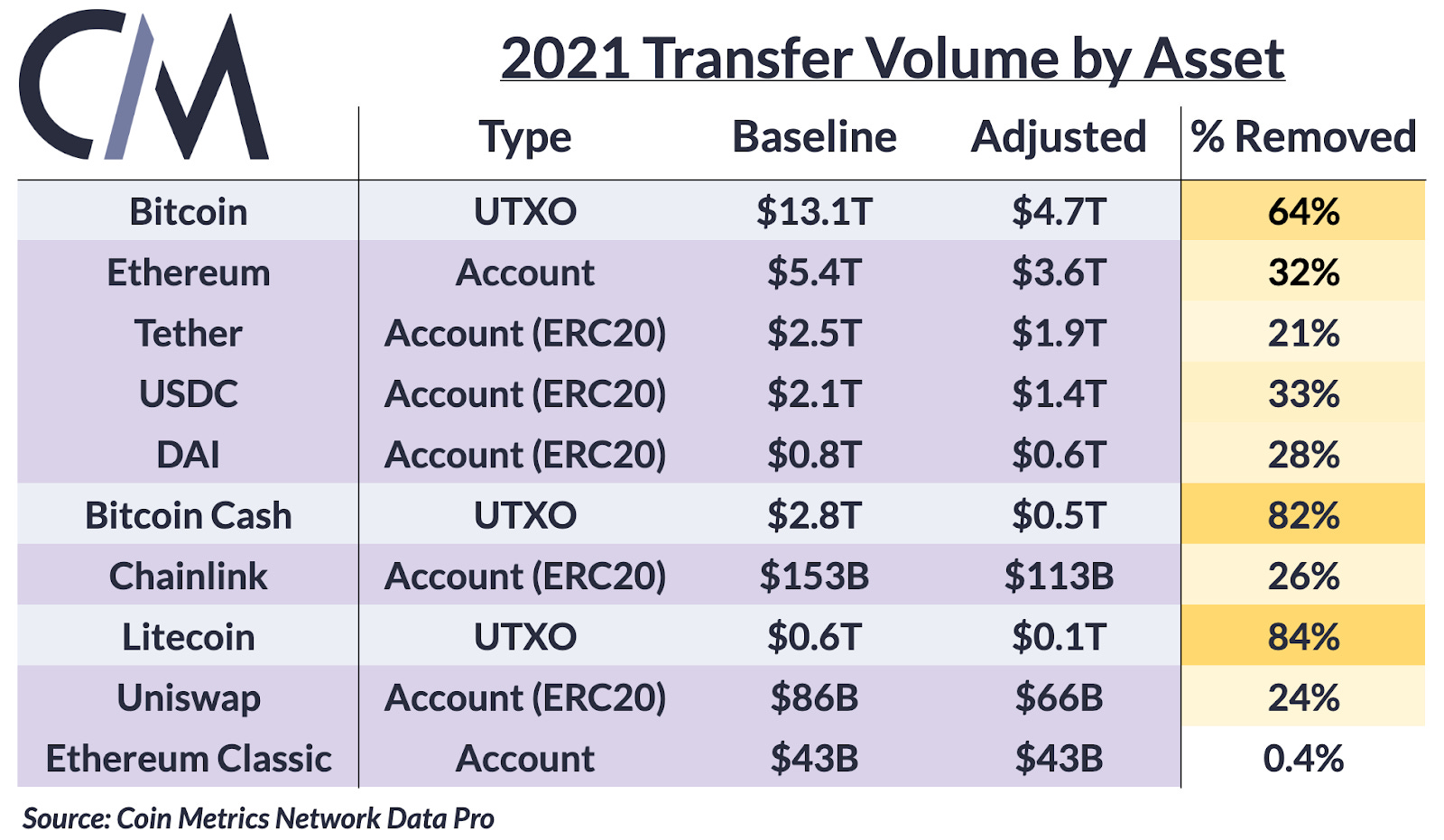

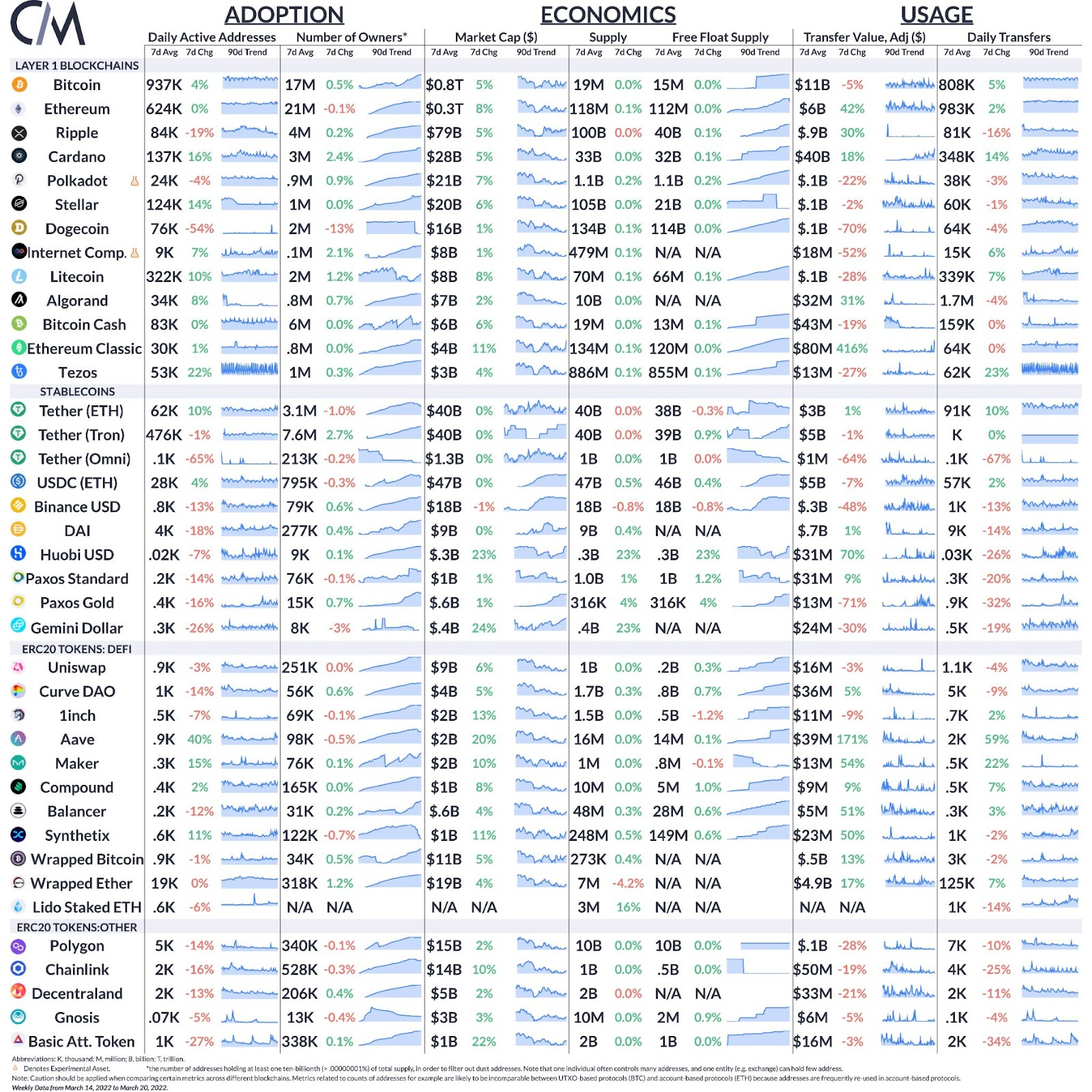

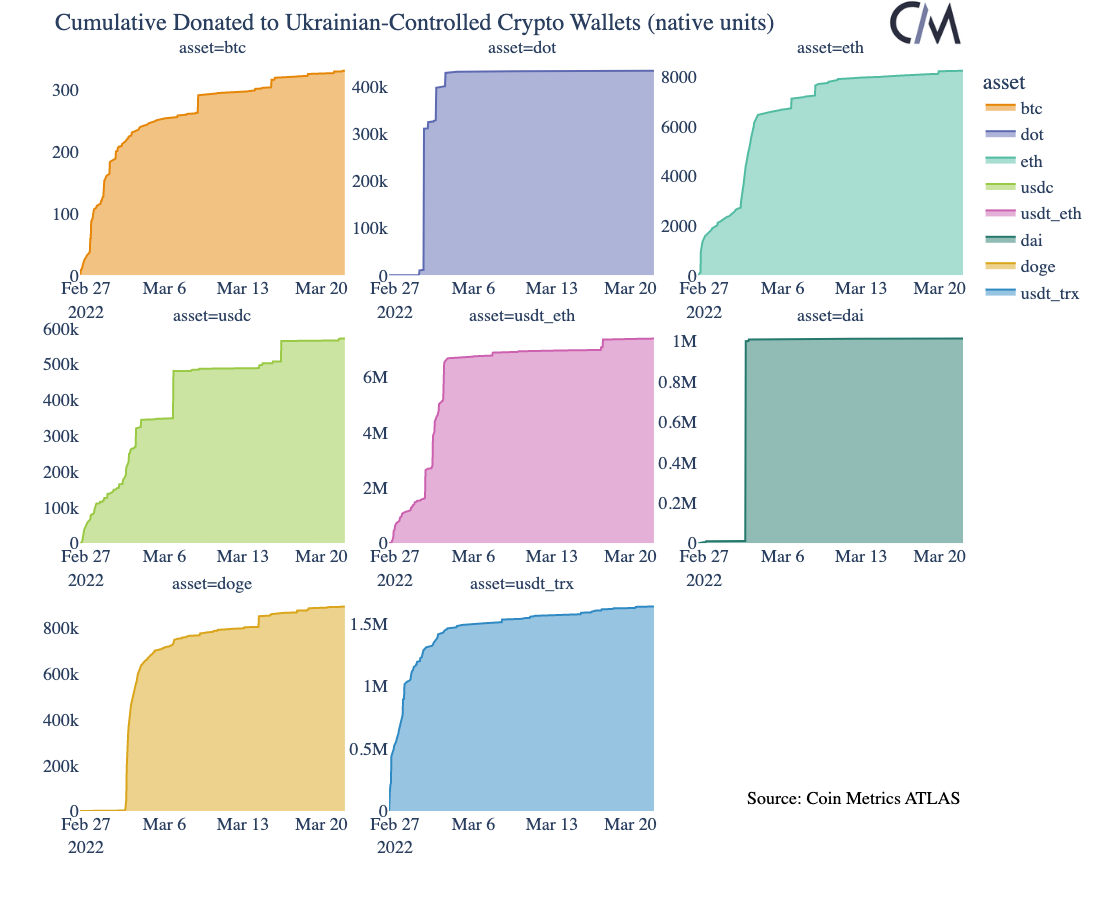

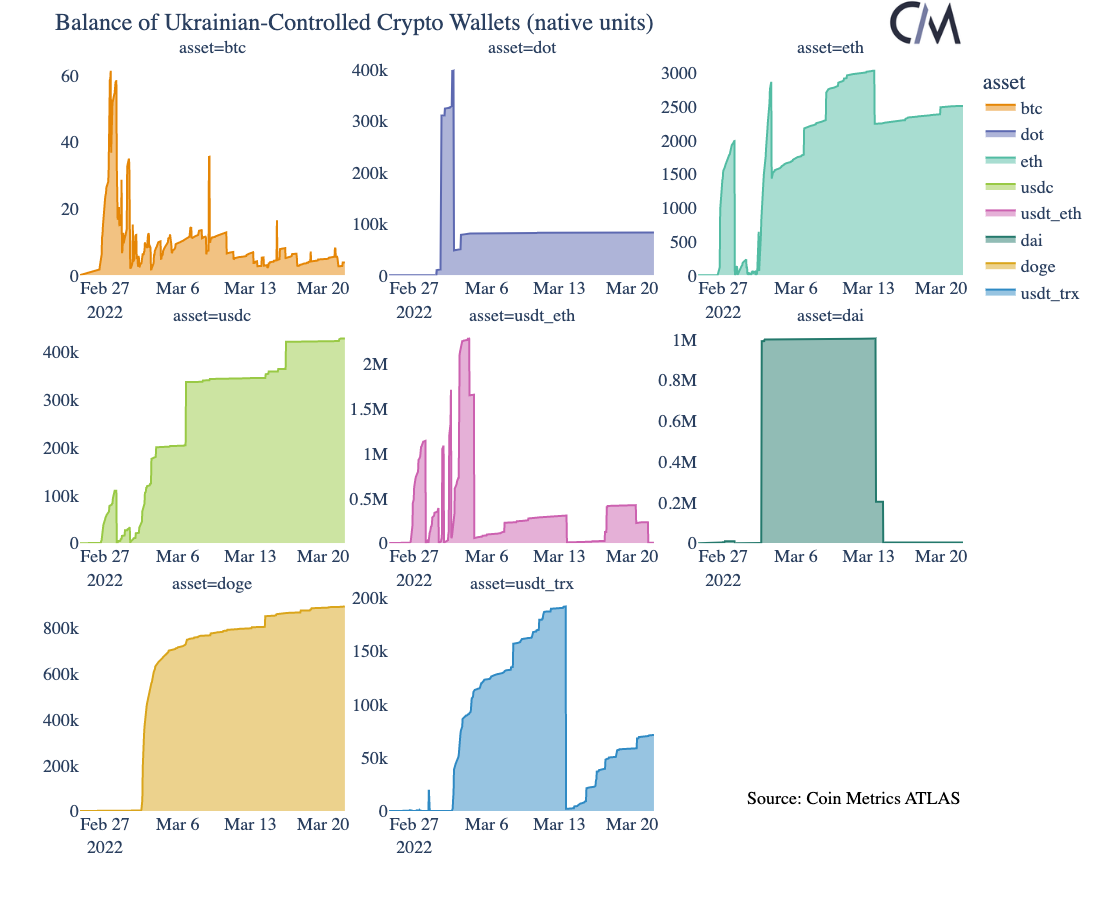

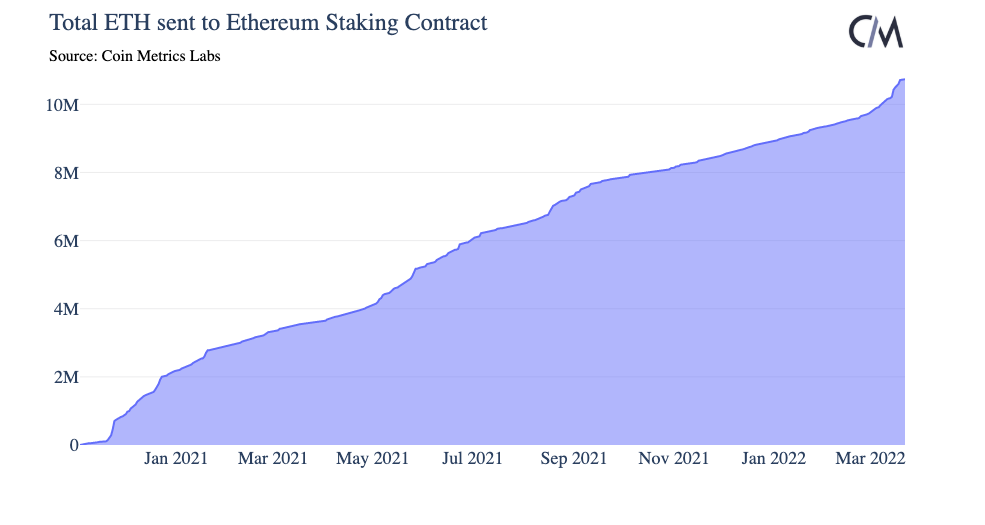

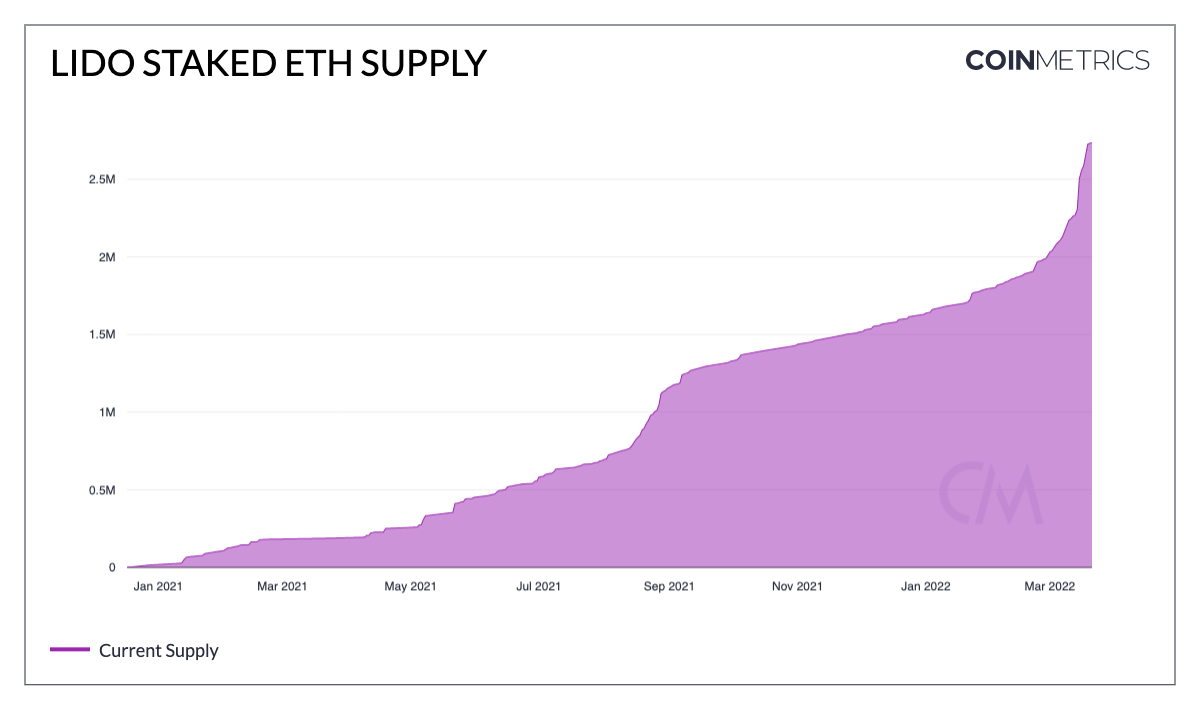

Get the best data-driven crypto insights and analysis every week: Coin Metrics is hiring Research Analysts, Data Scientists, and many other positions. Check out our open roles here. A Deep Dive Into Coin Metrics’ Transfer Value HeuristicsBy Kyle Waters and Nate Maddrey The following is an excerpt from an in-depth report covering the nuances of Coin Metrics’ adjusted blockchain transfer volume. Access the full report here. In 2021, more value was transferred across Bitcoin and Ethereum in dollar terms than ever before, with both networks settling amounts measured in the trillions. As crypto adoption accelerates, more and more eyes are now turning to blockchain data to understand their growing economic significance. Raw transfer figures are exactly measurable because public blockchains are distributed and open databases that allow anyone, anywhere, to access the entire history of transactions and amounts transferred between users. Flow of bitcoin in 100 sample transactions extracted from Bitcoin block 727506, data compiled from Coin Metrics’ ATLAS. However, using blockchain data for economic analysis is a fragile exercise. Raw data is rife with noise and opportunity for misinterpretation. Coin Metrics was founded out of this exact need for high quality, carefully-curated crypto data. Some of CM’s earliest research (c. 2018) outlined the arduous task of estimating on-chain volume. Today, Coin Metrics approaches this task by applying a series of rules or “heuristics” to the raw data, informed by leading industry research and our own fundamental understanding of blockchain data. These rules ultimately help us siphon out noise and better determine the significance of burgeoning public blockchain economies. We currently offer our adjusted transfer volume estimates across 116 unique assets to both community and pro CM users alike. The Difficulties of Blockchain DataIt is vital to understand the sources of difficulty in accurately gauging on-chain transfer volume. They can be broken down into two buckets: adjustments needed for non-meaningful activity and adjustments arising from blockchain design. Non-meaningful activity comes in many different flavors but a general theme is that the owner of the asset does not change during the transfer. Some examples include mixers, centralized exchange wallet reshuffles, and pass throughs/obvious intermediaries. The other challenge arises from different blockchain design schemes. Today, there are two major blockchain design philosophies: unspent transaction output (UTXO) based and account-based. Given the structural differences between UTXO and Account-based blockchain design, different approaches must be applied to each. The table below summarizes the heuristics that Coin Metrics currently uses when calculating our base transfer value figure (TxTfrVal) and adjusted transfer value (TxTfrValAdj), for both native and USD denominated data. Evaluating Heuristic PerformanceWithout the ground truth, it’s impossible to exactly measure the performance of transfer value heuristics. However, there are methods to establish confidence in the results. Studying unadjusted total value transferred against adjusted totals by crypto asset yields valuable insight into the heuristics’ effectiveness. The table below shows the total value transferred in 2021 using our baseline metric and heuristic-adjusted total. The column to the far right shows the impact of adjustments, measured by the percentage of volume removed when moving from the baseline to adjusted figure. Continue reading the full report… Network Data InsightsSummary MetricsSource: Coin Metrics Network Data Pro Most major crypto assets bounced back over the last week with BTC and ETH market caps rising by 5% and 8%, respectively. BTC active addresses averaged 937K per day over the week, a 4% rise week-over-week. The two largest stablecoins on Ethereum saw increased on-chain activity last week. Daily active USDT (ETH) addresses rose 10% week-over-week while USDC active addresses increased 4%. Crypto Donations to UkraineThe charts below show the cumulative donated to and current balance of Ukrainian-government controlled crypto addresses as of Monday, March 21st. Network HighlightsThe total amount of ETH sent to the Ethereum staking contract accelerated past 10M on March 8th and is already more than half way to 11M ETH. In total, about 9% of all ETH supply is now locked in the staking contract. Much of the new ETH deposits have been completed using Lido which is a liquid staking protocol. Lido depositors receive staked ETH tokens (stETH) that represent their staking position. The supply of stETH is now over 2.5M, rising from 2M just at the beginning of March. Source: Coin Metrics’ Formula Builder The move to a proof-of-stake Ethereum also took one step closer last week with the successful testing of The Merge (move from a proof-of-work to proof-of-stake consensus) on the Kiln testnet. Weekly Summary VideoCheck out our weekly summary video for more on-chain highlights. Over 2M ETH has now been burnt since EIP-1559 was introduced to Ethereum in August 2021.   Coin Metrics UpdatesThis week’s updates from the Coin Metrics team:

As always, if you have any feedback or requests please let us know here. Subscribe and Past IssuesCoin Metrics’ State of the Network, is an unbiased, weekly view of the crypto market informed by our own network (on-chain) and market data. If you'd like to get State of the Network in your inbox, please subscribe here. You can see previous issues of State of the Network here. Check out the Coin Metrics Blog for more in depth research and analysis. © 2022 Coin Metrics Inc. All rights reserved. Redistribution is not permitted without consent. This newsletter does not constitute investment advice and is for informational purposes only and you should not make an investment decision on the basis of this information. The newsletter is provided “as is” and Coin Metrics will not be liable for any loss or damage resulting from information obtained from the newsletter. If you liked this post from Coin Metrics' State of the Network, why not share it? |

Older messages

Coin Metrics' State of the Network: Issue 146

Tuesday, March 15, 2022

Tuesday, March 15th, 2022

Coin Metrics' State of the Network: Issue 145

Tuesday, March 8, 2022

Tuesday, March 8th, 2022

Coin Metrics' State of the Network: Issue 144

Tuesday, March 1, 2022

Tuesday, March 1st, 2022

Coin Metrics' State of the Network: Issue 143

Wednesday, February 23, 2022

Wednesday, February 23th, 2022

Coin Metrics' State of the Network: Issue 142

Tuesday, February 15, 2022

Tuesday, February 15th, 2022

You Might Also Like

Central African Republic’s CAR memecoin raises scrutiny

Friday, February 14, 2025

Allegations of deepfake videos and opaque token distribution cast doubts on CAR's ambitious memecoin project. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

January CEX Data Report: Significant Declines in Trading Volume Across Major CEXs, Spot Down 25%, Derivatives Down…

Friday, February 14, 2025

According to data collected by the WuBlockchain team, spot trading volume on major central exchanges in January 2025 decreased by 25% compared to December 2024. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Previewing Coinbase Q4 2024 Earnings

Friday, February 14, 2025

Estimating Coinbase's Transaction and Subscriptions & Services Revenue in Q4 2024 ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

ADA outperforms Bitcoin as Grayscale seeks approval for first US Cardano ETF in SEC filing

Friday, February 14, 2025

Grayscale's Cardano ETF filing could reshape ADA's market position amid regulatory uncertainty ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

AI project trading tips: investment targets and position management

Friday, February 14, 2025

This interview delves into the investment trends, market landscape, and future opportunities within AI Agent projects. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

DeFi & L1L2 Weekly — 📈 Polymarket recorded a new high of 462.6k active users in Jan despite volume dip; Holesky a…

Friday, February 14, 2025

Polymarket recorded a new high of 462600 active users in January despite volume dip; Holesky and Sepolia testnets are scheduled to fork in Feb and Mar for Ethereum's Pectra upgrade. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Donald Trump taps crypto advocate a16z’s Brian Quintenz for CFTC leadership

Friday, February 14, 2025

Industry leaders back Brian Quintenz's nomination, highlighting his past efforts at the CFTC and potential to revamp crypto oversight. ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

⚡10 Tips to Make a Living Selling Info Products

Friday, February 14, 2025

PLUS: the best links, events, and jokes of the week → ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Interview with CryptoD: How He Made $17 Million Profit on TRUMP Coin

Friday, February 14, 2025

Author | WUblockchain, Foresight News ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏