The Pomp Letter - Perception Becomes Reality

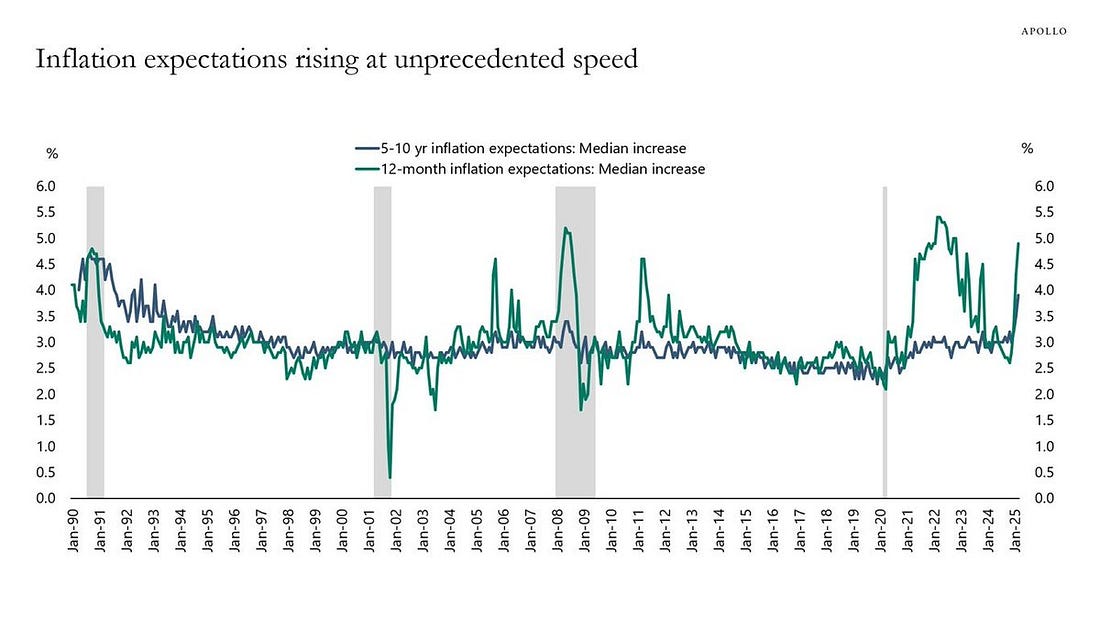

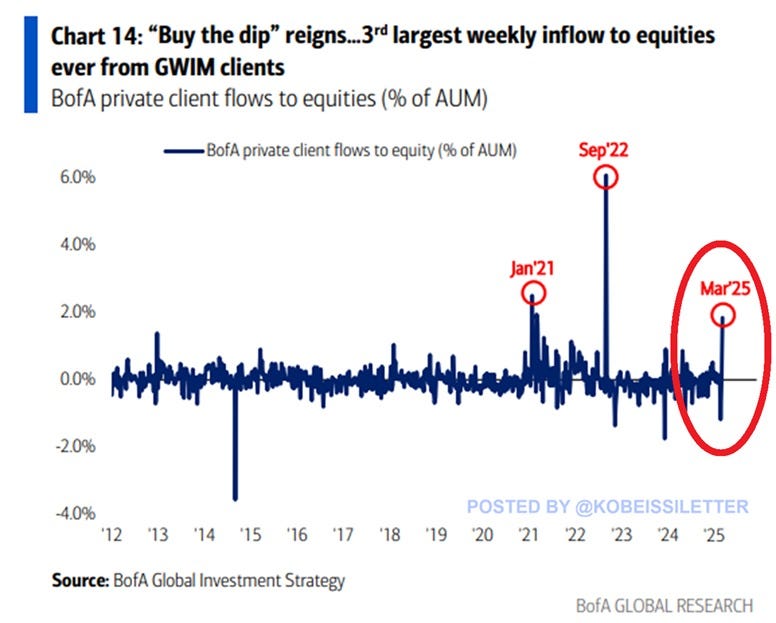

To investors, Perception is reality. At least that is how markets work in the short-term. Benjamin Graham said it best when he said “In the short run, the market is a voting machine but in the long run, it is a weighing machine.” We can see this playing out in real time. New polls over the weekend suggest that perception from the population is significantly different than mainstream media coverage would suggest. I don’t care what your political party affiliation is. Capital allocators have to do their best to seek truth, regardless of where it takes you. It is hard to do. It can be uncomfortable, especially when truth runs counter to your political preferences. It is a necessary process and skill though if you want to make money. Opinions about political parties is only one part of the current story. We are also seeing perception becoming reality in the economy. Mike Zaccardi points out a recent Apollo report claiming consumer inflation expectations have risen at an unprecedented rate. Americans believe inflation is going to come back. This is the case even though inflation is likely crashing under 2% right now. At some point, if business owners and consumers begin acting like inflation is coming, then odds of inflation rising increase because these individuals start hiking prices and allocating their capital in anticipation of the incoming inflation. Perception drives action. Action drives outcomes. This is how perception becomes reality. One area where you can explicitly see perception being acted on is high net worth individuals buying the stock market dip. Adam Kobeissi writes in The Kobeissi Letter:

If you think inflation is coming back, then what do you do? You get out of cash and you start buying investment assets as fast as you possibly can. Apollo is telling us inflation expectations are surging. Stocks are simultaneously falling, which created the perfect entry point for wealthy investors to deploy their cash and position themselves for future potential inflation. Here is the interesting part though — I don’t believe inflation is going to come roaring back. In fact, I think the opposite is happening. We are seeing a disinflationary period that suggests the Federal Reserve should be cutting interest rates, rather than holding them steady. Truflation is reporting the real time inflation number at 1.68% as of yesterday. That is a slight increase from 1.35% inflation that was reported last week by Truflation, but it is still substantially lower than the latest government inflation reading of 2.8%. While professional investors are debating inflation metrics and whether to buy stocks or not, the administration is fully focused on improving the economic situation for the working class. Treasury Secretary Scott Bessent posted publicly yesterday the following:

A few data points that suggest this is working include gas prices hitting a 4-year low and egg prices dropping more than 25% in recent weeks. These welcomed developments for millions of Americans don’t tell the whole story, but they definitely signal financial relief is on the way for a large portion of the population. A key challenge for investors in this environment is to stay on top of the day-to-day or week-to-week changes. Tariffs are on, then they are off. Inflation was high, now it is low. Things can change at a rapid pace. There is value in understanding what is happening in the world, but the secret is to not allow these changes to affect your portfolio or decision-making. Buy great assets. Hold them for a very long time. The short term gyrations are noise. Those who can ignore the chaos and uncertainty while holding resilient assets will do just fine. Hope you all have a great start to your week. I’ll talk to everyone tomorrow. - Anthony Pompliano Founder & CEO, Professional Capital Management Chaos in Stocks & Bitcoin Explained By Jordi Visser Jordi Visser is a macro investor with over 30 years of Wall Street experience. He also writes a Substack called “VisserLabs” and puts out investing YouTube videos. In this conversation we discuss Trump’s economic plan, tariffs, tax proposals, Trump vs Powell, inflation, gold, stocks, and the relationships and uncertainty from the Trump admin. Enjoy! Podcast Sponsors

You are receiving The Pomp Letter because you either signed up or you attended one of the events that I spoke at. Feel free to unsubscribe if you aren't finding this valuable. Nothing in this email is intended to serve as financial advice. Do your own research. You're currently a free subscriber to The Pomp Letter. For the full experience, upgrade your subscription. |

Older messages

Inflation May Be Much Lower Than You Think...

Tuesday, March 11, 2025

To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Is The Trump Administration Crashing The Market On Purpose?

Monday, March 10, 2025

Listen now (4 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

We Finally Have A Strategic Bitcoin Reserve

Friday, March 7, 2025

Listen now (4 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Maybe We Are Getting A Bitcoin-Only Strategic Reserve After All

Wednesday, March 5, 2025

Listen now (3 mins) | Today's letter is brought to you by Osprey Funds! ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

The Age of Economic Chaos

Tuesday, March 4, 2025

Listen now (7 mins) | To investors, ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

You Might Also Like

The *other* men's college basketball tournaments are a disaster

Tuesday, March 18, 2025

A perfectly good thing appears to have been burned down...for no good reason

2x signup rate (study)

Tuesday, March 18, 2025

Launching a product? I'm helping startups build better products and reach product-market fit. To do that, we've built ProductMix and you should use it: https://rockethub.com/deal/productmix

📓The new digital playbook

Tuesday, March 18, 2025

A sr manager shares her proven digital strategy View in browser MastersInMarketing-logo-email Prep your Bookmark clickin' finger; you're gonna want to come back to today's post again and

Perverse incentive

Tuesday, March 18, 2025

Does Penn have the will – or the wherewithal – to make ESPN Bet a success? ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

🔔Opening Bell Daily: US vs. World

Tuesday, March 18, 2025

Wall Street is mixed on whether to buy the dip as the stock market tumbles.

'Just don't say DEI': Brands sit out advertising around Black History Month, other heritage months this year

Tuesday, March 18, 2025

Brand clients have either paused marketing around days geared toward honoring historically marginalized communities or tweaked language away from anything that could be deemed DEI. March 12, 2025

The Early Bird 🪱

Tuesday, March 18, 2025

When to post in 2025.

The Gift of a True Apology

Tuesday, March 18, 2025

"Apologizing is central to everything we hold dear."

Publishers, take this social media survey for a $5 gift card

Tuesday, March 18, 2025

Survey: How are you using paid social media?

Huge data security deals drive infosec

Tuesday, March 18, 2025

VC interest flows into irrigation tech; health focus spurs growth in food, beverages; PE's aim is to retain female talent Read online | Don't want to receive these emails? Manage your