Modern Treasury: The Quadrillion $ Quest

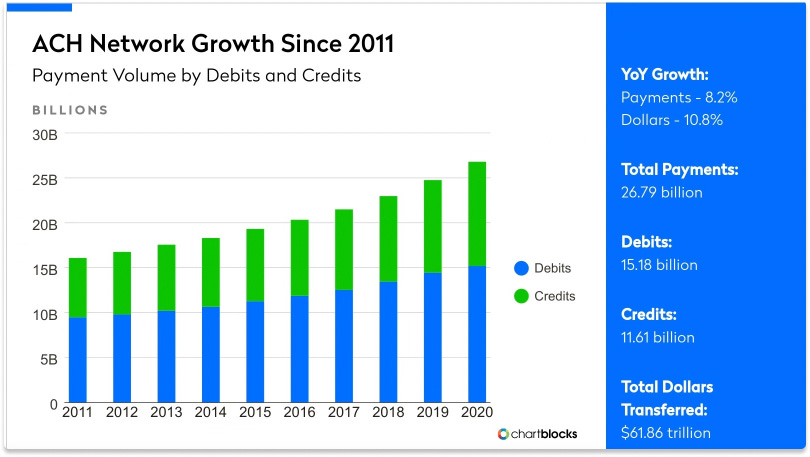

Modern Treasury: The Quadrillion $ QuestThe $2 billion, 3-year-old Startup Modernizing Money MovementWelcome to the 1,311 newly Not Boring people who have joined us since Monday! Join 85,240 smart, curious folks by subscribing here: 85,240 🎧 To get this essay straight in your ears: listen on Spotify or Apple Podcasts (shortly) Today’s Not Boring, the whole thing, is brought to you by… Modern Treasury Modern Treasury builds payment operations software to keep businesses’ money flowing. They’re building a world-class team to tackle a quadrillion dollar market. Join them: Hi friends 👋 , Happy Thursday! Today’s post is an Investment Memo x Sponsored Deep Dive (you can read more about my Sponsored Deep Dive selection and thought process here). Not Boring Capital recently invested in Modern Treasury at a $2 billion valuation, which is on the high-end of our range, particularly for a three-year-old company, so I wanted to walk through what makes the company special, why it’s in such a strong strategic position, and the massive opportunity it has in front of it. Let’s get to it. Modern Treasury: Quadrillion Dollar Quest“People forget. Software is a good business.” If valuations are any indication, people decidedly have not forgotten, but in the large and growing corner of the market in which Dimitri Dadiomov operates, software is a contrarian business model. Fintech companies normally want to touch the money so that they can earn interest on lending or interchange on spending. But maybe because both of Dimitri’s parents worked at Microsoft and he grew up appreciating the scale and ambition of businesses built purely on software, he, CPO Matt Marcus and CTO Sam Aarons decided to build a company that makes “software for fintech, but is not fintech.” That company is Modern Treasury. Instead of going after a specific vertical or customer, Modern Treasury builds horizontal software infrastructure for any company that moves money via bank transfers. It’s a data layer, not a money mover. Software for fintech, not a fintech. Building software for fintech instead of sitting in the flow of funds is one of two big, non-consensus decisions the company is built on. The other? Partner with the big banks instead of trying to take them down. Banks catch a lot of shit around these parts, but they sure do move a lot of money. In 2020, the ACH network handled $61.86 trillion in volume, $41.7 trillion of which were business to business payments. ACH operates in the US only. Even more money moves via wires. In August alone, $85.4 trillion flowed through FedWire, the Fed’s system through which banks send money to each other. CHIPS, the largest private USD clearing system, did $1.8 trillion in volume per day. There are more clearing systems besides those two, but those two alone do over $1 quadrillion in annual volume globally. For comparison, credit cards handle roughly $4 trillion in annual volume. But moving money with banks is not a modern experience. If you’ve sent an ACH or wire through a big bank recently, you kinda know what the experience is like for companies, too. The banks don’t give them some magical software to make all of this easy. Big banks don’t typically make magical software. So companies either hire people to handle all of their payment operations or build and maintain their own integrations with banks in order to automate everything as much as they can. Either way, they’re throwing valuable people at the problem. And pretty much every company has to do the same thing, figuring out integrations with the same banks, reconciling money the same way. “If everyone’s building the same thing and there’s no software company serving them, that’s a great recipe for a startup,” Matt told me. So the three co-founders started Modern Treasury to build APIs into the global banking system. They do the hard work of integrating with banks and creating high-quality software building blocks, and give customers like Gusto, BlockFi, Equi, Marqeta, and Pipe a clean API to handle their payment operations. Just three years old, it’s reconciling more than $2 billion every month. Last month, the company announced an $85 million Series C, led by Altimeter Capital with participation from Benchmark, Quiet Capital, and others (like Not Boring Capital). The valuation matches monthly reconciled volume: $2 billion. More important than volume or valuation, though, might be the valuable strategic position Modern Treasury is locking in. They’re building an almost perfect API-first business, and one that can leverage its position in the workflow into becoming the system of record for a company’s money. That’s Modern Treasury’s real goal, and its opportunity: to become the Salesforce for payments, with a modern twist. To understand it, we’ll cover:

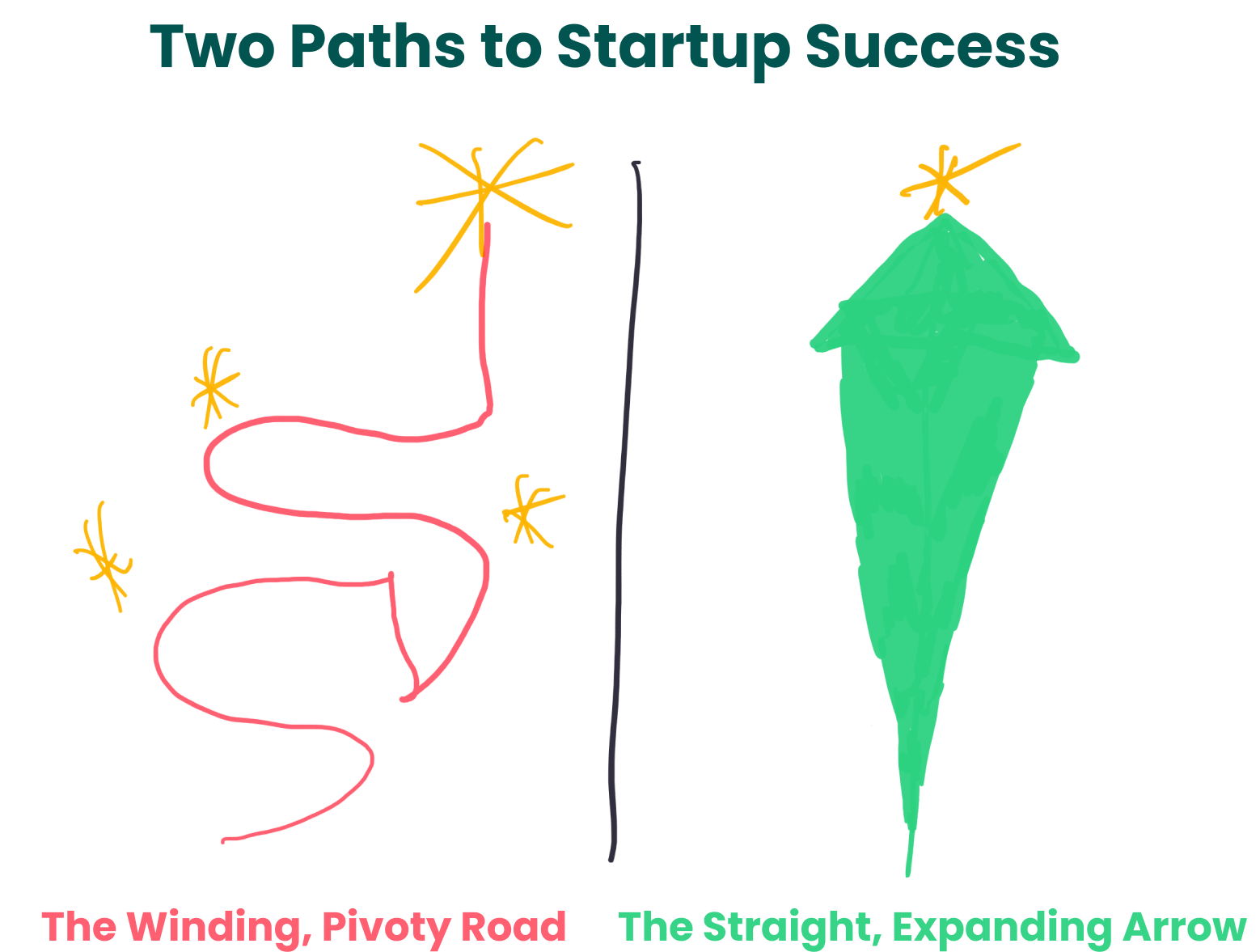

Let’s meet the Moderns. Meet Modern TreasurySuccessful startups take many paths. Some emerge victorious from a series of twists, trials, and pivots, like Discord. Others follow a straight line towards their North Star vision, realizing along the way that the opportunity was even bigger than they expected. Modern Treasury is in this fortunate second camp. Its three co-founders knew the problem they wanted to solve from the beginning; they just didn’t realize quite how big the opportunity would be. Dimitri, Matt, and Sam met at LendingHome where they built a mortgage marketplace that moved a lot of money to and from a lot of different people. They were responsible for the company’s payment operations, which included funding loans, collecting monthly payments, initiating investor deposits, handling transfers, and then reconciling all of it. They had to hire people and build tools to connect to their banks, manage all of the money going out in the form of loans and coming back in monthly repayments, and reconcile their books. And still, their payment operations didn’t move at the speed a tech company should. When they looked around for companies doing it smarter who they could copy, they realized that everyone was doing the same thing they were. Even bigger companies were just throwing people at the problem and building in-house. As entrepreneurs do, they decided they needed to build a solution. They applied to Y Combinator, got accepted, and got to work. Fun fact: their application didn’t say Modern Treasury; it said Turnkey Treasury. When enough people asked them why they were building a treasury for turkeys, they searched domain names and snagged moderntreasury.com for $7. Coming out of YC, the rafter (that’s a group of turkeys) wrote a post in August 2018, Introducing Modern Treasury, that clearly laid out the problem they were planning to tackle:

They also gave a clear, concise value proposition as it stood at the time:

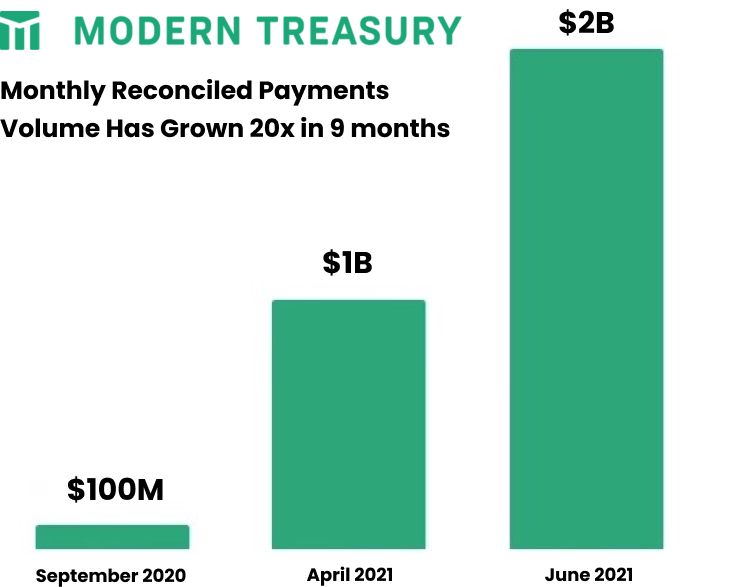

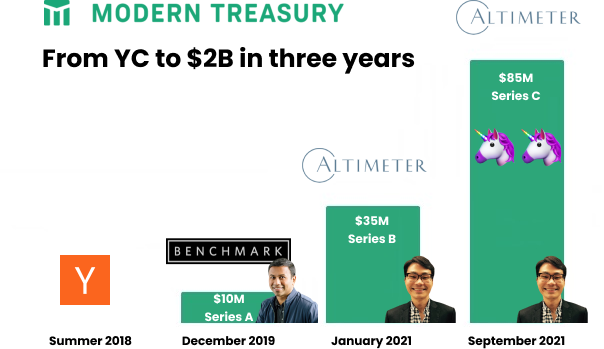

Three years later, Modern Treasury is holding true to the original vision, but the scope has expanded quite a bit. Today, it gives companies one API into banks to send wires, ACH, and real-time payments, automatically reconciles payments, and lets companies do continuous accounting instead of letting it all pile up until month end. It even built its own Ledger product that can be used to track… anything, from money to points and assets in video games. It powers the on- and off-ramps for large crypto companies like BlockFi, and just built support for wallets and real-time payment via the Signet Network. And it is growing at an unfathomable clip. Last September, the company handled $100 million in monthly reconciled payment volume (RPV). This June, just 9 months later, it eclipsed the $2 billion RPV mark, food for 20x growth. Of course, there are caveats. Reconciled payments volume isn’t a standard metric, the growth comes off of a small early base, and some very big companies are accountable for a lot of the jump, but still, it’s impressive. And investors have been impressed. After raising its seed from YC in summer 2018, Modern Treasury raised a $10M Series A from Benchmark in December 2019 and partner Chetan Puttagunta joined the board, which in the B2B software world is like getting Michael Jordan to join your team. In 2021, Altimeter’s Ram Woo led a $35M Series B in January and an $85M Series C in September, in which Benchmark, Quiet Capital, and little old Not Boring Capital participated. When insiders do back-to-back rounds that quickly, at a big valuation step-up, that is typically a very strong signal. A $2 billion valuation on $2 billion in monthly reconciled volume is aggressive, but these are smart investors. Blaming a hot market for high prices is lazy. What are they seeing? To learn why investors are so excited about Modern Treasury, what payment operations is, why Modern Treasury’s API-first system of record strategy is smart, and what its really big opportunity is… How did you like this week’s Not Boring? Your feedback helps me make this great. Loved | Great | Good | Meh | Bad Thanks for reading and see you on Thursday, Packy If you liked this post from Not Boring by Packy McCormick, why not share it? |

Older messages

Discord: Imagine a Place

Monday, November 8, 2021

A Not Boring x The Generalist Collab on the Internet's New Home

Rivian: The Most Remarkable Adventure

Thursday, November 4, 2021

A Deep Dive Into the 12-year-old, Amazon-backed, EV Adventure Company

Minimally Extractive Meta

Monday, November 1, 2021

Why Zuck Might Have to Actually Contribute to the Open, Interoperable Metaverse

Sc3nius

Monday, October 25, 2021

We're all gonna make it.

Playing Solo Games

Monday, October 18, 2021

Not Boring Capital: Fund I, Update II

You Might Also Like

🔮 $320B investments by Meta, Amazon, & Google!

Friday, February 14, 2025

🧠 AI is exploding already!

✍🏼 Why founders are using Playbookz

Friday, February 14, 2025

Busy founders are using Playbookz build ultra profitable personal brands

Is AI going to help or hurt your SEO?

Friday, February 14, 2025

Everyone is talking about how AI is changing SEO, but what you should be asking is how you can change your SEO game with AI. Join me and my team on Tuesday, February 18, for a live webinar where we

Our marketing playbook revealed

Friday, February 14, 2025

Today's Guide to the Marketing Jungle from Social Media Examiner... Presented by social-media-marketing-world-logo It's National Cribbage Day, Reader... Don't get skunked! In today's

Connect one-on-one with programmatic marketing leaders

Friday, February 14, 2025

Enhanced networking at Digiday events

Outsmart Your SaaS Competitors with These SEO Strategies 🚀

Friday, February 14, 2025

SEO Tip #76

Temu and Shein's Dominance Is Over [Roundup]

Friday, February 14, 2025

Hey Reader, Is the removal of the de minimis threshold a win for e-commerce sellers? With Chinese marketplaces like Shein and Temu taking advantage of this threshold, does the removal mean consumers

"Agencies are dying."

Friday, February 14, 2025

What this means for your agency and how to navigate the shift ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏ ͏

Is GEO replacing SEO?

Friday, February 14, 2025

Generative Engine Optimization (GEO) is here, and Search Engine Optimization (SEO) is under threat. But what is GEO? What does it involve? And what is in store for businesses that rely on SEO to drive

🌁#87: Why DeepResearch Should Be Your New Hire

Friday, February 14, 2025

– this new agent from OpenAI is mind blowing and – I can't believe I say that – worth $200/month